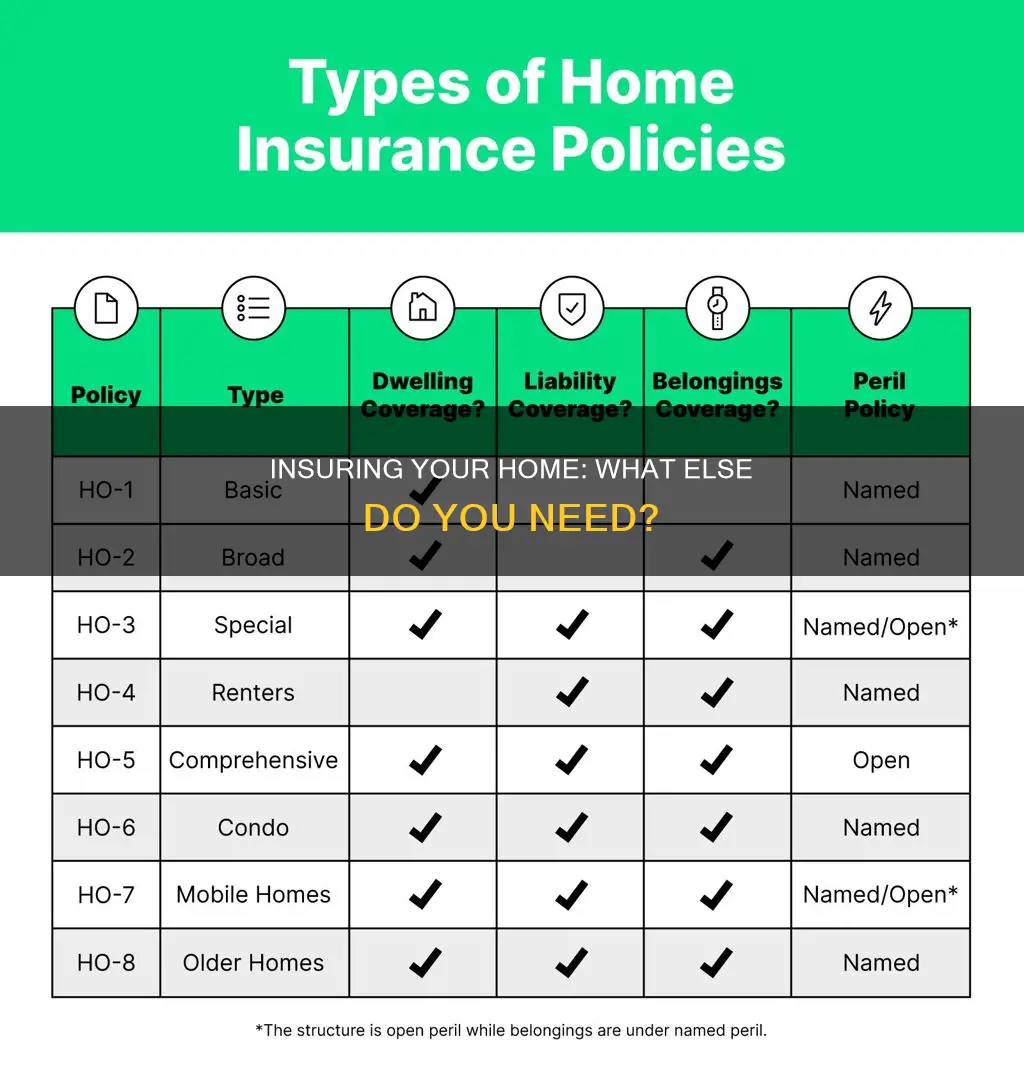

Homeowners insurance is a necessity. It protects your home and possessions against damage or theft. When buying a home, it's important to consider what additional insurance you may need on top of the standard coverage. Standard policies typically cover damage to the structure of your home and your personal belongings, as well as liability protection if someone is injured on your property. However, there are several optional add-ons and endorsements you may want to consider for more comprehensive coverage.

First, it's crucial to understand the limitations of your policy. Standard homeowners insurance usually covers specific perils such as fire, lightning, hail, and explosions. If you live in an area prone to flooding or earthquakes, you will need additional coverage. It's also important to ensure your policy limits are high enough to cover the cost of rebuilding your home, as the price you paid for your home may not reflect the rebuilding cost.

Next, consider your possessions. Most homeowners insurance policies provide coverage for personal belongings, typically ranging from 50% to 70% of the insurance on your dwelling. However, if you own high-priced possessions such as fine art, antiques, or jewellery, you may want to purchase additional coverage or a separate policy.

Additionally, review your liability coverage. The liability portion of homeowners insurance covers you against lawsuits for bodily injury or property damage caused by you, your family members, or pets. While most policies provide a minimum of $100,000 worth of coverage, experts recommend having at least $300,000 to $500,000, especially if you have a lot of assets that could be targeted in a lawsuit.

Furthermore, consider additional living expense (ALE) coverage. This reimburses you for temporary living costs, such as hotel stays and restaurant meals, if you are unable to live in your home due to covered disasters. Many policies provide coverage for about 20% of the insurance on your house, but some offer unlimited coverage for a limited time.

Finally, don't forget about optional endorsements. These are additions to your standard policy that provide extra coverage or adjust terms for specific items or situations. Common endorsements include increased coverage limits, protection for items not covered in the base policy, and coverage for particular risks such as earthquake or flood insurance.

In conclusion, while standard homeowners insurance provides a solid foundation of protection, it's important to assess your individual needs and consider adding extra coverage to ensure you're fully protected.

What You'll Learn

Earthquake insurance

- Structural damage to your residence.

- Damage to personal property.

- Replacement of your home if it is destroyed.

- Temporary living expenses if you are displaced.

The cost of earthquake insurance varies depending on several factors, including:

- Your deductible: Earthquake insurance deductibles tend to range from 10% to 25% of your coverage limit.

- Location of your home: If your home is in a high-risk area, you will likely pay more for earthquake insurance.

- Age of your home: Older homes without upgraded safety features may result in higher premiums.

- Number of stories in your home: Multi-story homes typically cost more to insure against earthquakes.

- Rebuilding cost: Higher rebuilding costs will likely lead to higher insurance premiums.

Annual earthquake insurance premiums can range from $800 to $5,000, and policy deductibles can be as high as 10% to 25% of your coverage limit.

How to get earthquake insurance:

To obtain earthquake insurance, start by inquiring with your current homeowners insurance company, as they may offer earthquake coverage options or refer you to another provider. You can also find a licensed earthquake insurance provider through your state's department of insurance.

Understanding the 10 Ordinances of Home Insurance

You may want to see also

Flood insurance

Most homeowners insurance does not cover flood damage, so it is important to purchase a separate policy. The National Flood Insurance Program (NFIP) is a federally subsidized program available to any property owner, including homeowners, renters, and condominium owners and associations, whether or not the property is in a floodplain. The Federal Emergency Management Agency (FEMA) administers the NFIP and offers Flood Insurance Rate Maps (FIRMs) to help determine the amount of flood risk and if flood insurance is required.

A flood insurance policy typically covers you if groundwater rises and floods your home. The core parts of your home, like the foundation and the systems that keep it running, are usually covered, as well as built-in appliances like refrigerators, dishwashers, and stoves. The NFIP offers $250,000 in coverage for your home's structure and $100,000 for belongings. Carpeting and personal property are generally covered, too, unless they're in the basement.

Even if you don't live in a high-risk flood area, it is still recommended to purchase flood insurance. More than 25% of flood insurance claims come from outside high-risk areas, and just one inch of water in an average home can cause more than $25,000 in damage. Flood insurance is affordable and can be purchased through the NFIP or a private insurance agent.

The Roadside Companion: Unraveling Farmers Truck Insurance Exchange

You may want to see also

Sewer and water backup endorsement

Sewer backups occur due to various reasons, including aging sewers, combined pipelines, tree roots, and sanitary main blockages. The number of reported sewer backups is increasing at a rate of around 3% annually, and the country's 500,000-plus miles of sewer lines are around thirty years old on average.

Water backup coverage typically includes damage to the sewer line running from your house to the city's main sewer line, the cost of removing standing sewage from your house, and repairing any damage caused by it. It's important to note that this coverage is different from flood insurance, which is a separate type of insurance not included in standard homeowners insurance policies.

The cost of water backup coverage is relatively affordable, with prices ranging from as little as $30 a year to up to $70 annually for $5,000 of coverage, and $25 to $35 for each additional $5,000 in coverage.

When deciding on coverage amounts, it's essential to consider the cost of replacing everything that's at risk of being damaged in a worst-case drain backup or sump pump overflow scenario. This includes the cost of replacing your flooring, furniture, personal belongings, and any other items that could be damaged.

While water backup coverage offers valuable protection, it's important to understand its limitations. It typically does not cover repairs or replacement of a broken sump pump, flood damage resulting from surface water or overflow of a body of water, or maintenance issues and negligence.

To summarize, sewer and water backup endorsement is a crucial additional insurance coverage for homeowners, especially considering the increasing frequency of sewer backup incidents and the potential for costly repairs and damage to personal property.

Farmers Insurance's Approach to Pitbulls: Understanding the Policy and Pitfalls

You may want to see also

Windstorm add-on

Windstorm insurance is a type of property insurance that covers your home if it is damaged by wind or hail. It is typically offered as an add-on to your home insurance or as a separate wind-only policy. This type of insurance is especially important for those living in areas prone to hurricanes, tornadoes, and strong thunderstorms, such as Florida, Texas, and Louisiana.

In most cases, homeowners insurance will automatically cover wind damage. However, if you live in a high-risk area, you may need to purchase a separate policy or add windstorm insurance as an endorsement to your existing policy. Windstorm insurance can be expensive, with rates varying depending on factors such as the age of your home, the likelihood of damage in your area, and whether you have taken any damage-mitigating measures.

When purchasing windstorm insurance, it is important to review your policy carefully. Some policies include a “named storm” deductible, which means that a traditional flat deductible applies to general wind damage, but a percentage-based deductible is used if a storm has been given a name, such as a hurricane or tropical storm. It is also important to understand the coverage limits and exclusions of your policy.

To file a windstorm insurance claim, review your policy and applicable deductible levels, document any damage with photos or videos, and schedule repairs as needed. It is recommended to file your claim promptly and keep a record of all communication with your insurance company.

Overall, windstorm insurance can provide valuable protection for your home and belongings in the event of wind or hail damage. If you live in an area prone to windstorms, be sure to review your insurance coverage and consider adding windstorm insurance if necessary.

Screen Enclosure Insurance: Attached to House?

You may want to see also

Identity theft endorsement

Identity theft insurance typically covers the costs associated with the recovery process after your identity has been stolen, including:

- Fees for case managers or identity restoration specialists.

- Legal fees for civil judgments, court hearings, and attorneys.

- Costs of replacing important identifying documents, such as your driver's license or Social Security card.

- Lost wages associated with identity theft.

- Costs to place fraud alerts on your credit reports.

- Fees charged by your bank or other lenders as a result of fraudulent financial activity.

It's important to note that identity theft insurance usually does not cover stolen money or direct financial losses from fraudulent purchases and other unauthorized use of credit accounts. Federal law generally protects you from liability in cases of financial fraud associated with identity theft.

The cost of identity theft insurance varies depending on the company and the services offered, ranging from as little as $25 per year to more than $30 per month. When purchasing homeowners insurance, many providers offer optional identity theft coverage for as little as $10 per month or less as an add-on to your existing policy.

In addition to financial protection, some insurers also offer credit remediation and restoration services. These services can help streamline the recovery process by connecting you with professionals who will work directly with your creditors, credit bureaus, and financial institutions. Credit monitoring services are also available, which can detect fraud and alert you to any suspicious activity on your credit report.

When considering identity theft insurance, it's important to assess your risk factors. For example, individuals who work remotely, conduct business online, have valuable assets, or rarely check their credit reports may be more vulnerable to identity theft. Adding identity theft endorsement to your home insurance policy can provide valuable protection and peace of mind in the event of identity-related fraud.

Unraveling the Truth Behind Farmers Insurance Rates

You may want to see also

Frequently asked questions

Homeowners insurance typically offers a range of protections for your property and personal belongings. A standard homeowners insurance policy covers damage to your home's structure, personal belongings, and provides liability, medical payments, and additional living expense coverage.

Optional homeowners insurance coverage is an addition to a standard policy that provides extra coverage or adjusts the terms for specific items or situations. Most commonly, endorsements increase coverage limits, extend protection to items not covered in the base policy, or add new coverage for particular risks.

Homeowners insurance doesn't cover flooding, earthquakes, typical wear and tear, and damage due to insufficient maintenance.