Auto insurance limits, also known as your coverage amount, refer to the maximum amount your insurer may pay out for a claim. Most auto insurance policies have different types of coverage with separate coverage limits. For example, liability coverage limits on car insurance are typically shown as three separate numbers: the maximum amount your insurer will pay for bodily injuries per person, the total amount your insurer will pay for bodily injuries per accident, and the maximum your insurer will pay for property damage per accident. Auto insurance limits vary by state and individual circumstances.

| Characteristics | Values |

|---|---|

| What are insurance limits? | The maximum amount an insurer will pay out for a claim |

| Insurance limit vs coverage amount | Insurance limit is also known as the coverage amount |

| Choosing your insurance limit | You can usually choose your auto liability coverage limit |

| Insurance limit and insurance rate | A higher coverage limit usually means a higher insurance rate |

| Different types of coverage | Most insurance policies, including auto insurance, have different types of coverages with separate coverage limits |

| Liability coverage | Liability coverage limits on car insurance are typically shown as three separate numbers: maximum payout per person, maximum payout per accident, and maximum payout for property damage |

| Comprehensive car insurance coverage | The insurance limit is often the actual cash value of your car |

| Collision car insurance coverage | The insurance limit is often the actual cash value of your car |

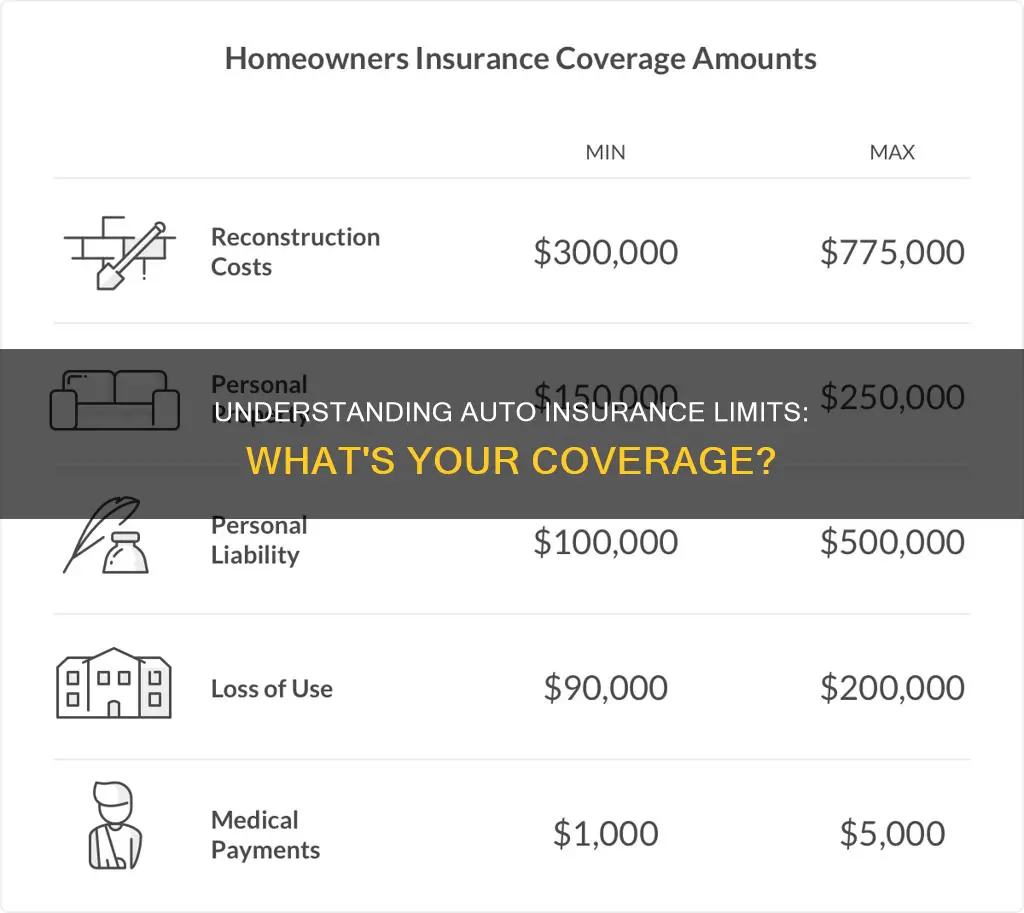

| Personal property coverage limit | Typically 50% of your dwelling limit, though this may be adjusted |

| Sub-limits | Homeowners policies may have additional coverage limits called sub-limits for specific items like jewelry and firearms |

What You'll Learn

Liability insurance limits

Liability insurance covers damage and injuries you cause to others in an accident. It is the main type of mandated coverage in auto insurance, and most states require a minimum limit for liability coverage.

Liability coverage limits on car insurance are typically shown as three separate numbers. For example, if you carry auto insurance with liability coverage limits of $50,000/$100,000/$30,000, those numbers are broken down as follows:

- $50,000: The maximum amount your insurer will pay for bodily injuries per person.

- $100,000: The total amount your insurer will pay for bodily injuries per accident.

- $30,000: The maximum your insurer will pay for property damage per accident, such as repairing the other driver's vehicle in an accident where you were at fault.

The minimum liability insurance requirements vary by state. For example, in California, the minimum liability insurance requirements are $15,000 for injury/death to one person, $30,000 for injury/death to more than one person, and $5,000 for damage to property. In Iowa, the minimum liability coverage is $20,000 of bodily injury to or death of one person in any one accident, $40,000 for two or more people, and $15,000 for damage to property.

While state minimums are a good starting point, they are usually not enough to cover all expenses in the event of a serious accident. You may want to consider purchasing higher liability limits to better protect your assets if you're responsible for someone else's injuries or damaged property. A good rule of thumb is to buy enough liability insurance to cover what you could lose in a lawsuit against you if you cause a car accident.

Auto Repair Shop Insurance: Navigating the Legal Maze

You may want to see also

Property damage coverage

You can choose to increase your property damage coverage limit to ensure you are adequately protected in the event of an accident. When deciding on the appropriate coverage amount, consider factors such as whether you own a home or other valuable assets, whether you frequently drive in high-traffic areas, and whether there are many expensive vehicles in your area.

It is important to remember that if the cost of damages exceeds your coverage limit, you will be responsible for the remaining amount. Therefore, it is advisable to choose the highest coverage limit you can comfortably afford to protect yourself financially and legally in the event of an at-fault accident.

Root Insurance: Beyond the Basics of Auto Coverage

You may want to see also

Medical payments coverage

MedPay limits typically range from $1,000 to $10,000, depending on the state and insurer. It's a good idea to have MedPay coverage equal to your health insurance deductible to cover out-of-pocket medical expenses. If you lack health insurance, consider a higher MedPay limit to manage medical bills.

Unlike health insurance, MedPay has no deductibles or co-payments. It also doesn't cover lost wages due to injury, and it won't help if you injure other drivers. However, it can be extremely useful for managing medical costs resulting from a collision.

When determining your MedPay coverage needs, consider the amount your health insurer will contribute to accident-related expenses. If it seems insufficient, MedPay can provide valuable additional protection. Remember, the more coverage you purchase, the higher your premium will be.

In summary, Medical Payments Coverage is an optional but valuable addition to your auto insurance, especially if you want peace of mind in covering potential medical expenses for yourself and your passengers after a car accident.

Join USAA Auto Insurance: Eligibility and Benefits

You may want to see also

Uninsured/underinsured motorist coverage

Uninsured motorist coverage comes into effect when you are hit by a driver who does not have any auto insurance. This coverage can help pay for medical expenses for you and your passengers, lost wages if you are unable to work due to injuries, and damage to your vehicle. It is important to note that this coverage does not pay anything to the uninsured driver who is at fault.

Underinsured motorist coverage, on the other hand, comes into play when you are hit by a driver who has some insurance but does not have enough coverage to pay for the damages or injuries they caused. This coverage can help fill the gap and ensure that you are adequately compensated for your medical expenses, lost wages, and vehicle repairs.

In some states, uninsured and underinsured motorist coverage may be separate, while in others, they are combined into a single coverage option. Additionally, there may be up to four different coverages within this category:

- Uninsured motorist bodily injury (UMBI): Covers medical expenses for you and your passengers if you are hit by an uninsured driver.

- Uninsured motorist property damage (UMPD): Covers damage to your vehicle caused by an uninsured driver.

- Underinsured motorist bodily injury (UIMBI): Covers medical expenses for you and your passengers if you are hit by a driver with insufficient insurance.

- Underinsured motorist property damage (UIMPD): Covers damage to your vehicle caused by a driver with insufficient insurance.

It is worth noting that uninsured/underinsured motorist coverage may not cover hit-and-run accidents in all states. In some cases, you may need collision coverage to ensure your vehicle is covered in such incidents.

When deciding on the amount of uninsured/underinsured motorist coverage to purchase, it is generally recommended to choose limits that match your liability insurance. For bodily injury coverage, consider selecting limits that align with your liability coverage. For property damage coverage, you can select a limit that reflects the value of your vehicle.

Auto Insurance: Can You Trust the Seller?

You may want to see also

Collision insurance coverage

Collision coverage can provide financial protection in the event of a single-vehicle accident or if you are found at fault in an accident with another driver. If you choose not to carry collision coverage and are involved in an accident, you will be responsible for the repair or replacement costs of your vehicle.

When deciding whether to purchase collision insurance, consider the value of your vehicle and your ability to pay for repairs or a replacement out of pocket. Collision insurance is particularly important for vehicles that are leased or financed, newer or more expensive vehicles, and older vehicles that still maintain good value relative to your deductible and monthly rate.

The amount of collision insurance coverage you select will depend on the value of your vehicle and your desired level of protection. A higher coverage limit will result in a higher insurance rate, but it can provide greater financial protection in the event of an accident.

In summary, collision insurance coverage can provide valuable protection for your vehicle in the event of a collision, helping to cover repair or replacement costs. It is an important consideration for vehicle owners, especially those with leased, financed, or newer vehicles, to ensure they are adequately protected in the event of an accident.

Transfer Vehicle Insurance: A Quick Guide

You may want to see also

Frequently asked questions

Auto insurance limits, also known as your coverage amount, refer to the maximum amount your insurer may pay out for a claim.

The main types of auto insurance coverage include liability insurance, uninsured or underinsured motorist coverage, personal injury protection, collision insurance, and comprehensive insurance.

The recommended amount of auto insurance coverage depends on factors such as state requirements, the value of your vehicle, and your financial situation. It's generally advised to have enough coverage to protect your assets and comply with state laws.

If your auto insurance claim exceeds your coverage limit, you may be responsible for any remaining expenses that aren't covered by your insurance policy.

To choose the right amount of auto insurance coverage, consider your state's minimum requirements, the value of your assets, the cost of repairs or replacement, and your ability to pay for damages out of pocket.