The average cost of car insurance varies depending on factors such as location, age, gender, driving history, and the type of vehicle. In the US, the monthly average cost of car insurance for full coverage is $194, while minimum coverage costs $53. The national average cost of car insurance is $64 per month for minimum coverage and $164 per month for full coverage. The cheapest car insurance companies are Auto-Owners, Erie, State Farm, and USAA. The cost of car insurance for an 18-year-old male is $461 per month, while for an 18-year-old female, it is $412 per month. The cost of car insurance also depends on the state, with Louisiana being the most expensive at $240 per month, and South Dakota being the cheapest at $29 per month.

What You'll Learn

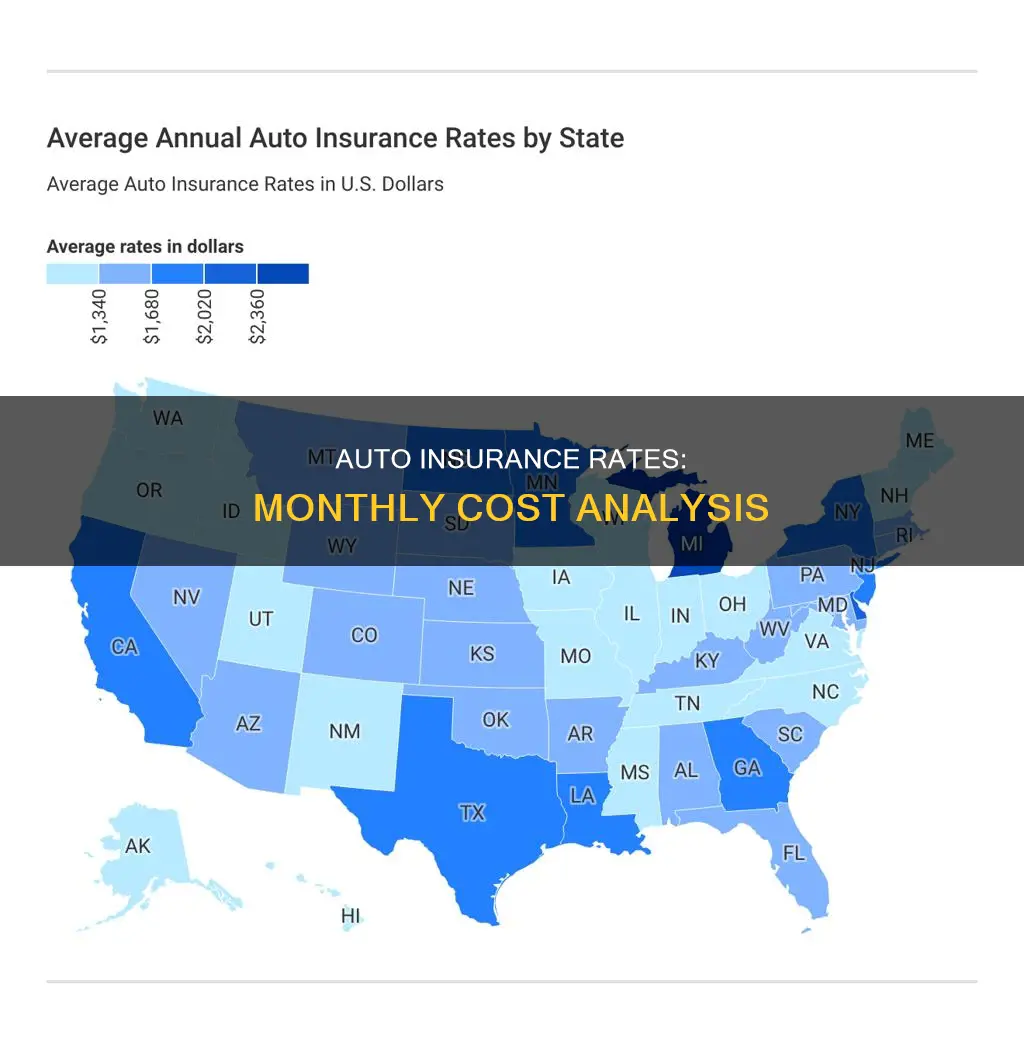

Average car insurance rates by state

The average cost of car insurance varies from state to state, with a number of factors influencing the price. The national average cost for car insurance is $2,118 per year, according to Forbes Advisor's analysis of full-coverage car insurance rates. However, the average cost of car insurance can vary from as much as $303 per year to $8,232 per year depending on the coverage you choose and where you live.

Factors Affecting Car Insurance Rates by State

Several factors determine the price of car insurance in each state, including:

- Minimum state car insurance coverage and limits: Some states require only liability coverage, while others mandate additional coverages such as uninsured motorist coverage, medical payments, or personal injury protection. States with more stringent coverage requirements tend to have higher insurance costs.

- Number of auto insurance claims: The frequency of car insurance claims in a state impacts rates. States with a higher number of claims, often due to severe weather events, urban congestion, or high crime rates, typically have higher insurance costs.

- Cost of car insurance claims: The cost of paying out claims varies by state, depending on factors such as car repair costs and medical expenses. States with higher claim costs will generally have higher insurance rates.

- Frequency of lawsuits: States with a higher rate of lawsuits related to car accidents tend to have more expensive insurance rates, as settlements can be larger.

- Population density: Urban states with higher population densities generally have more congested roads, leading to a higher frequency of accidents and insurance claims. As a result, insurance rates in these states tend to be higher.

States with the Highest Car Insurance Rates

The states with the most expensive car insurance rates include:

- New York

- Florida

- Louisiana

- Pennsylvania

- Maryland

Factors contributing to higher rates in these states include large urban areas, no-fault laws, a high number of lawsuits, and severe weather events.

States with the Lowest Car Insurance Rates

On the other hand, the states with the cheapest car insurance costs include:

- Idaho

- Vermont

- Ohio

- Maine

- Iowa

These states often have a large number of rural areas, milder weather, and competitive car insurance markets, all of which contribute to lower insurance rates.

Auto Insurance: Elderly Premiums and Expensive Coverage

You may want to see also

Average car insurance rates by company

The national average cost of car insurance in the US is $2,026 per year or $169 per month for full coverage, according to Forbes Advisor's 2024 analysis. The national average for state minimum coverage is $638 per year or $53 per month. However, car insurance rates vary across different companies.

USAA, Nationwide, Travelers and Geico are the cheapest car insurance companies for full coverage. USAA is only available to drivers with a military affiliation. The average cost of full coverage car insurance from these companies is as follows:

- USAA: $1,300 per year

- Nationwide: $1,300 per year

- Travelers: $1,300 per year

- Geico: $1,300 per year

For state minimum car insurance, USAA, Erie, Auto-Owners, Geico and Westfield are the cheapest options. The average cost of state minimum car insurance from these companies is as follows:

- USAA: $300 per year

- Erie: $600 per year

- Auto-Owners: $600 per year

- Geico: $600 per year

- Westfield: $600 per year

It is important to note that car insurance rates can vary based on various factors such as age, gender, driving record, credit score, vehicle type, and location. Additionally, the cost of car insurance can also differ from state to state due to factors like accident and claim frequency, the cost of labour and vehicle parts, vehicle theft frequency, and weather conditions.

Gap Insurance Tax in Florida

You may want to see also

Average car insurance rates by age

Age is one of the most important factors in determining your car insurance rate. While there are good drivers in every age group, younger drivers are generally more likely to have accidents or take risks on the road. Experienced drivers are less likely to have accident claims, which means they cost less to insure.

The average cost of car insurance varies by age, with younger and older drivers often paying more compared to those in middle age ranges. Rates are cheapest for drivers in their 40s, 50s, and 60s. The average car insurance cost for teens is high but decreases when they turn 20.

For example, a 16-year-old driver pays around $613 per month for full coverage car insurance. That's three times more than a 25-year-old driver pays for the same coverage. Rates are at their lowest for 60-year-old drivers, who pay $158 per month for full coverage insurance, on average. After age 60, rates begin to rise again.

How age affects car insurance rates

When you analyze average car insurance costs by age, you may notice a trend. Coverage starts out relatively expensive for teens and young adults. Over the years, premiums generally decrease as drivers gain more experience behind the wheel. But as drivers reach their senior years, premiums can creep back up. In general, this is due to risk factors associated with each age group.

Teens

Teens are considered some of the riskiest drivers to insure. Per mile driven, drivers aged 16 to 19 get into almost three times as many fatal car accidents as any other age group. Insurers frequently charge more to insure teen drivers to offset the higher costs associated with teen driving claims.

Adults

The cost of auto insurance coverage generally begins to drop by the time a driver reaches their early 20s. By age 25, drivers might notice a pretty significant reduction in their premiums. Throughout adulthood, provided that drivers have a history of safe driving and no insurance claims, premiums generally continue to drop as drivers gain more experience.

Seniors

Unfortunately, the downward trend of insurance premiums typically comes to an end as drivers reach their 70s. Aging-related factors like vision or hearing loss and slowed response time might make seniors more likely to get into accidents. However, while seniors may see their insurance premiums increase, they likely will not go back to paying the high rates of teen drivers, assuming their driving record is clean.

How to save on car insurance at different ages

Shopping around for car insurance before your policy renews is the best way to save money on car insurance. Getting quotes from at least three different insurers, comparing the same coverages, will ensure you have a clear understanding of what you’re getting for your money. Drop coverage you don’t need and increase your deductible if you can afford to pay more out of pocket in the event of a claim.

Regardless of age, you can trim costs by qualifying for car insurance discounts matching your driver profile. Here are a few different types of discounts for teens and senior drivers:

- Auto/home bundle discount

- Student-away discount

- Good student discount

- Married discount

- Driver training discount

- Senior defensive driver discount

- Low mileage discount

AAA Auto Insurance: Understanding Towing Coverage

You may want to see also

Average car insurance rates by gender

The cost of car insurance is influenced by a variety of factors, including age, gender, driving record, location, and vehicle type. While age is a significant factor, gender also plays a role in determining insurance rates, particularly for young drivers.

On average, male drivers pay higher insurance rates than female drivers. This is because men are generally considered to be riskier to insure due to a higher likelihood of being involved in accidents, speeding, and driving under the influence. The Insurance Institute for Highway Safety (IIHS) found that male drivers are 63% more likely to be involved in fatal crashes than female drivers. As a result, insurance companies charge men higher rates to account for the increased risk.

The gender gap in insurance rates is most pronounced among young drivers. For example, a 16-year-old male driver can expect to pay almost $500 more per year for insurance than a female driver of the same age. This difference narrows as drivers get older, with a $33 annual difference between 25-year-old male and female drivers. By the age of 30, the gap further closes, with women and men paying nearly equal rates.

However, it is important to note that not all states in the US allow insurers to use gender as a factor in determining insurance rates. States like California, Hawaii, Massachusetts, Michigan, Montana, North Carolina, and Pennsylvania have banned the use of gender in setting insurance rates. In these states, insurance companies must use other factors, such as driving record and years of experience, to calculate premiums.

While gender is a consideration, it is just one of many factors that influence car insurance rates. Other factors, such as age, driving history, location, and vehicle type, also play a significant role in determining insurance premiums.

Auto Liability Insurance: Protecting Passengers, Too

You may want to see also

Average car insurance rates by vehicle type

The type of vehicle you drive has a significant impact on your car insurance premium. The price and availability of parts, cost of labour, statistical likelihood of accidents, how much damage your vehicle could cause during an accident, and the vehicle's safety and crash prevention features could all influence how much you pay for coverage.

SUVs, Vans and Other Large Vehicles

While large vehicles like SUVs and vans can reduce the risk of damage to your vehicle or injuries to your passengers, they can cause more damage to other vehicles and their occupants, leading to higher liability costs.

Sports Cars

Vehicles built for speed and performance are at higher risk of causing accidents. Sports cars also tend to have higher costs for replacement parts.

Luxury Cars

As with sports cars, replacement parts for luxury vehicles are more expensive than for standard daily drivers. The high purchase price also leads to greater insurance premiums.

Electric Vehicles (EVs)

Parts and labour for these vehicles can be pricey, which means you'll pay higher premiums for full-coverage policies for hybrids and EVs.

Standard Sedans

Standard sedans are often the cheapest to insure due to low passenger capacity and low replacement costs.

- Electric Vehicles (EVs): $223

- Standard Sedans: $166

- Trucks: $158

- SUVs: $187

- Sports Cars: $225

- Luxury Cars: $212

West Auto Insurance: The Best Coverage for Your Car

You may want to see also

Frequently asked questions

The average monthly cost of car insurance in the U.S. is $194 for full coverage and $53 for minimum coverage.

Auto insurance rates are influenced by factors such as location, driving history, age, gender, vehicle type, and credit score.

To get cheaper auto insurance rates, you can compare quotes from multiple providers, bundle your insurance policies, improve your credit score, and take advantage of discounts offered by insurance companies.