Auto insurance coverage is an important aspect of vehicle ownership, offering financial protection in the event of accidents, theft, or damage. While the specific coverage requirements vary across different states in the US, there are some standard coverages that are typically recommended or mandated by law. Understanding what constitutes reasonable auto insurance coverage can help vehicle owners make informed decisions about their policies.

In the US, auto insurance coverage requirements are determined by each state, with minimum liability coverage being the standard across most states. This typically includes bodily injury liability, which covers medical expenses for injured individuals, and property damage liability, which covers damage to another person's vehicle or property. While these minimum requirements are necessary to drive legally, they often provide insufficient protection in the event of a costly accident. As such, it is generally recommended to opt for higher liability limits and consider additional coverages for enhanced financial security.

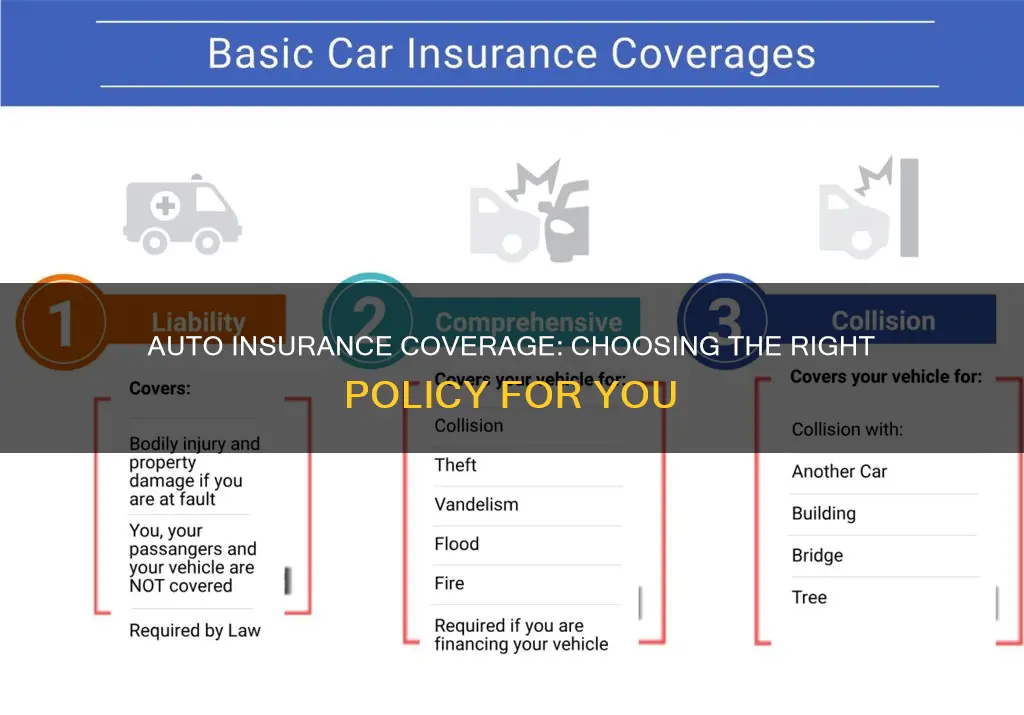

In addition to the state-mandated minimum liability coverage, there are several other types of auto insurance coverages that individuals may consider, depending on their specific needs and circumstances. These can include comprehensive coverage, which protects against non-collision damages such as theft, fire, or natural disasters; collision coverage, which pays for repairs to the policyholder's vehicle in the event of a collision; and uninsured/underinsured motorist coverage, which offers protection if the other driver involved in an accident has insufficient or no insurance.

When determining reasonable auto insurance coverage, individuals should carefully consider their state's minimum requirements, their financial situation, and the value of their vehicle. It is generally advisable to opt for higher liability limits and include additional coverages, such as comprehensive and collision, to ensure adequate protection. While the cost of insurance is an important consideration, skimping on coverage could lead to being underinsured when filing a claim. Therefore, individuals should strive to purchase the maximum coverage they can comfortably afford to ensure they are prepared for most scenarios.

What You'll Learn

Liability insurance

The cost of liability insurance depends on various factors, including the amount of coverage you select. The coverage limits are usually expressed as three numbers, such as 25/50/10, indicating the maximum coverage for bodily injury per person, bodily injury per accident, and property damage per accident, respectively. While the state minimum coverage may be sufficient for some drivers, it is generally recommended to opt for higher liability limits to ensure adequate protection in the event of a costly accident.

It is important to note that liability insurance does not cover damages to your own property or injuries you sustain in an accident. To protect yourself in such cases, you may need additional coverages such as personal injury protection, uninsured/underinsured motorist coverage, or collision and comprehensive insurance, depending on your state's requirements and your personal needs.

Auto Insurance and Credit Score: What's the Connection?

You may want to see also

Collision insurance

When deciding whether to purchase collision insurance, consider the value of your car. If you have a newer, more expensive vehicle, or an older car that still holds significant value, collision insurance can provide valuable protection. Additionally, if you are leasing or financing your vehicle, collision insurance is usually recommended to safeguard your investment.

In summary, collision insurance is a crucial component of auto insurance that offers financial protection in the event of a collision. While it tends to be costly, there are ways to reduce premiums, such as opting for a higher deductible. By assessing the value of your vehicle and your risk tolerance, you can make an informed decision about whether collision insurance is a reasonable addition to your auto insurance coverage.

Gap Insurance Tax in Texas

You may want to see also

Comprehensive insurance

The cost of comprehensive insurance will depend on factors such as the value of your vehicle, your deductible amount, and your financial circumstances. It is worth considering if you cannot afford to repair or replace your vehicle out of pocket or if you want peace of mind against any unforeseen events. However, if your vehicle's cash value is low and you have a high deductible, comprehensive insurance may not be necessary.

When deciding on comprehensive insurance, it is essential to understand what is not covered. For instance, if you are responsible for an accident or collide with an object such as a tree or building, you will need separate coverage. Additionally, comprehensive insurance does not include extended replacement coverage, which pays above your dwelling limit if your home is destroyed and rebuild costs exceed your limit.

Overall, comprehensive insurance is a valuable addition to your auto insurance policy if you want protection against unforeseen events that are outside of your control and are not caused by collisions. It provides peace of mind and financial protection in the event of theft, vandalism, severe weather, or accidents with animals.

Becoming an Auto Insurance Producer: Steps to Independence

You may want to see also

Uninsured/underinsured motorist insurance

Uninsured motorist coverage, often referred to as UM or UMBI, is a type of auto insurance that covers your medical expenses if you or your passengers are injured in an accident caused by an uninsured driver. This includes drivers without any liability insurance, hit-and-run drivers, or drivers whose insurance company denies coverage or goes out of business. Uninsured motorist coverage also extends to cover lost wages if you are unable to work due to the accident and can provide compensation for pain and suffering. It is important to note that this coverage is for your benefit and not for the uninsured driver.

Underinsured motorist insurance, or UIM, is similar but separate coverage. It is designed to cover medical bills and other expenses for you and your passengers if the at-fault driver does not have sufficient liability insurance to cover the costs. UIM coverage is particularly useful when the other driver's insurance is insufficient to cover your medical bills.

In some states, you can also purchase uninsured motorist property damage coverage (UMPD). This type of coverage pays for any damage to your vehicle caused by an uninsured driver. However, it is worth noting that collision coverage, which is optional and available in all states, can also cover vehicle damage, regardless of the other driver's insurance status.

The amount of uninsured/underinsured motorist coverage you need will depend on your state's requirements. Some states mandate this coverage, while others allow you to reject it in writing or do not offer it at all. If your state requires it, you must purchase at least the minimum amount, which is typically set to match your liability coverage limits. For example, if your liability limits are $100,000 for injury to one person and $300,000 per accident, your UM coverage would be 100/300.

The cost of uninsured motorist coverage varies, but on average, it costs around $136 per year, according to Forbes Advisor's analysis. It is important to remember that you cannot purchase only uninsured motorist coverage. It needs to be added to a basic auto insurance liability policy.

Short-Term Auto Insurance: One-Month Policies

You may want to see also

Personal injury protection

In addition to medical bills, PIP coverage can help pay for health insurance deductibles and lost wages resulting from time taken off work due to injuries. It can also help cover the cost of hiring temporary workers if you are self-employed. In the unfortunate event of a fatality, PIP insurance can assist with funeral, burial, or cremation expenses, as well as provide financial support to surviving dependents by replacing lost income. Furthermore, PIP coverage can help pay for necessary services that the injured party would typically perform, such as childcare and housecleaning.

The requirements for PIP coverage vary from state to state. In some states, such as Texas, PIP insurance is not mandatory, but a waiver must be signed if the coverage is declined. In other states with no-fault insurance laws, all drivers are required to purchase PIP coverage as part of their auto policies.

The amount of PIP coverage can vary, and it is recommended to review the specific requirements and options in your state. For example, in Texas, insurance companies are mandated to offer a minimum of $2,500 of PIP insurance, with the option to increase coverage to $5,000 or $10,000 for additional financial protection. It is important to note that PIP coverage typically has a time limit, such as three years from the date of the accident, for filing claims.

Insuring Friends: Auto Insurance Add-Ons

You may want to see also

Frequently asked questions

A common car insurance deductible is $500, but you can raise or lower your deductible to fit your budget. Lower deductibles often result in higher premiums, while higher deductibles can reduce premiums.

Most drivers should have at least three types of car insurance: liability, comprehensive, and collision. Liability insurance covers things like medical or repair costs for other people if you cause an accident. Comprehensive coverage protects you from things like theft or damage from a fire, a storm, a natural disaster, or even a piano falling on your car. Collision insurance covers the cost to repair or replace your car if you’re in an accident with another vehicle or object.

Nearly every state requires liability insurance for property damage and injury to other drivers, but the minimum coverage amounts vary from state to state. Some states require drivers to carry personal injury protection (PIP) insurance, which covers medical expenses for insured drivers and passengers, regardless of who’s at fault. MedPay, which covers medical expenses for insured drivers, their families, and passengers, is another type of mandatory insurance in some states. Uninsured/underinsured motorist coverage, which protects you in the event that the other driver doesn't have insurance or doesn't have enough, is also mandatory in many states.