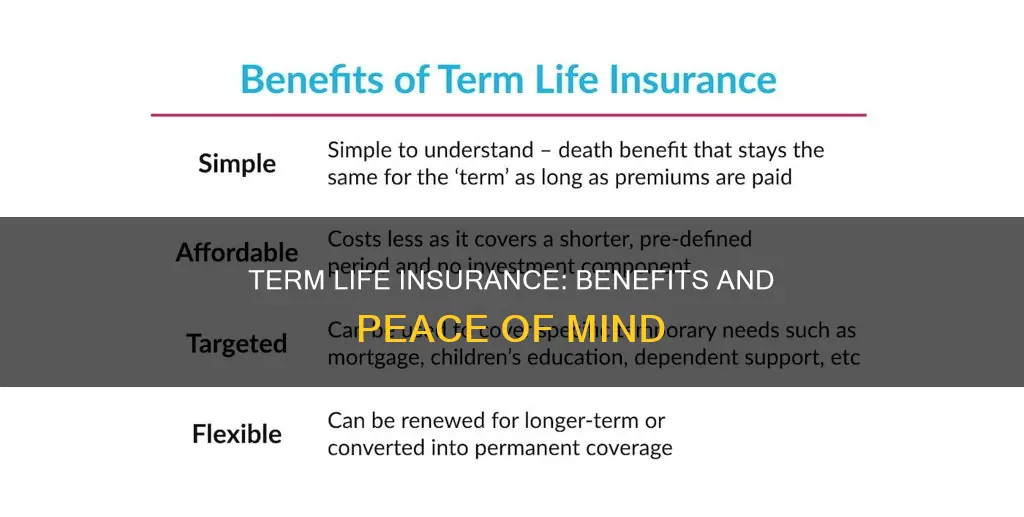

Term life insurance is a type of insurance that provides coverage for a specific period, often 10 to 30 years. It is generally the most affordable option for those seeking life insurance, as it offers a death benefit for a restricted time and doesn't have a cash value component like permanent insurance. Term life insurance is ideal for people who want substantial coverage at a low cost and is particularly attractive to young people with children, as it provides affordable financial protection during key life stages, such as raising a family or paying off a mortgage. It can also be used to pay off debts upon the insured's death, such as student loans or a mortgage. Additionally, term life insurance offers flexible payment and policy options, and there is no penalty for cancelling. However, it is important to note that term life insurance only offers temporary coverage and does not build cash value, which may be a disadvantage for those with permanent life insurance needs.

| Characteristics | Values |

|---|---|

| Affordability | Cheaper than other types of life insurance |

| Flexibility | Can be customised to meet specific needs |

| Coverage | Provides financial protection for a specific period, often 10 to 30 years |

| Death benefit | Pays out a tax-free lump sum to beneficiaries |

| No cash value | Doesn't accumulate cash value, so no return on investment |

| Convertibility | Can be converted to permanent life insurance |

| Renewable | Can be renewed at the end of the term, but at a higher rate |

| Accessibility | More accessible for those on a tight budget |

What You'll Learn

Term life insurance is affordable

The affordability of term life insurance makes it an attractive option for those on a tight budget, such as young couples or families with growing children. It provides them with the financial protection they need during critical life stages without breaking the bank. Additionally, term life insurance offers flexible payment and policy options, allowing individuals to choose how long they need coverage and how often they want to pay premiums. This further contributes to its affordability.

The cost of term life insurance also depends on factors such as age, health, lifestyle, and coverage amount. Generally, the younger and healthier an individual is, the lower their premium will be. This makes term life insurance a good option for those who are young and healthy as they can lock in lower rates for a longer period.

In summary, term life insurance is affordable because it is designed for temporary coverage, lacks a cash value component, and offers flexible payment and policy options. Its cost also depends on factors such as age and health, making it a budget-friendly option for younger and healthier individuals.

Life Insurance and Social Security: What's the Connection?

You may want to see also

It offers flexible payment and policy options

Term life insurance offers flexible payment and policy options. You can choose to pay your premiums monthly, quarterly, semi-annually, or annually. Most insurers will charge a processing fee if you don't pay once a year, so you may be able to save money by paying annually. This flexibility allows you to choose the payment option that best suits your financial situation and preferences.

In addition to flexible payment options, term life insurance also provides a range of policy options to meet different needs. You can select the length of coverage you require, typically ranging from one year to 30 years, with some companies offering longer terms of up to 40 years. This flexibility allows you to customize your policy based on your specific financial obligations and goals.

Another advantage of term life insurance is the ability to convert your term policy into permanent life insurance, such as whole life or universal life insurance. This conversion option provides flexibility if your needs change over time or if you develop health issues that make it difficult to obtain a new policy. You can also choose to renew your term policy at the end of the term, although the premiums may increase due to your age or changes in your health.

The flexibility of term life insurance makes it a popular choice for individuals and families seeking affordable and customizable coverage that can be tailored to their unique circumstances.

Essential Life Insurance: Cash Surrender Value Explained

You may want to see also

It has no cash value

Term life insurance is a type of insurance that guarantees a death benefit to the insured's beneficiaries if the insured person dies during the specified term. It is a popular option for those seeking coverage for a specific period, often 10 to 30 years. One of the key advantages of term life insurance is its affordability. It is generally the cheapest way to buy life insurance, as it provides coverage for a restricted time and doesn't have a cash value component like permanent insurance. This means that there is no savings account associated with term life insurance policies, and if the policy is cancelled, no money is returned. This is in contrast to permanent life insurance, which provides a surrender value based on the cash savings account if the policy is cancelled.

The absence of a cash value component in term life insurance policies has several implications. Firstly, it means that there is no opportunity to borrow or withdraw money from the policy. This is unlike permanent life insurance, where policyholders can borrow against the cash value or even withdraw it for financial needs. Secondly, term life insurance policies do not offer any return on investment. If the insured outlives the policy term, they do not receive any payout or benefit. This is because the premiums paid are solely allocated to the death benefit, ensuring that beneficiaries receive a substantial sum if the insured passes away during the specified term.

The lack of a cash value component in term life insurance also affects the cost of the policy. Since there is no investment or savings element, the premiums for term life insurance are generally lower than those for permanent life insurance. This makes term life insurance a more budget-friendly option, especially for those with temporary financial needs. It is important to note that term life insurance policies typically have a lower age cap than permanent life insurance, and the availability of longer terms may be limited for older individuals.

While the absence of a cash value component may be seen as a disadvantage by some, it is a key feature that contributes to the affordability and accessibility of term life insurance. It allows individuals and families to obtain substantial coverage at a lower cost, providing peace of mind and financial protection during critical life stages, such as raising a family or paying off a mortgage.

Life Insurance: Owner's Rights to Remaining Balance Explained

You may want to see also

It provides a tax-free death benefit

Term life insurance provides a tax-free death benefit to the beneficiaries of the insured. This means that the beneficiaries will receive the full amount of the death benefit, without any deductions for taxes. This can be extremely valuable for the beneficiaries, as it provides them with financial support during a difficult time.

The death benefit can be used to cover a variety of expenses, such as funeral costs, medical bills, and other final expenses. It can also be used to replace lost income, providing financial stability for the family of the insured. This is especially important for families with young children or for those with a mortgage or significant debt.

The tax-free nature of the death benefit is a significant advantage of term life insurance. It ensures that the full benefit amount is available to the beneficiaries, without any reduction due to taxes. This can make a big difference in the financial well-being of the beneficiaries and can help them to cope with the loss of their loved one.

In addition, the death benefit can also be used to fund college or continued education for surviving spouses or children. It can also be used to pay off debts, such as student loans or mortgages, ensuring that the family is not burdened with these financial obligations.

Overall, the tax-free death benefit provided by term life insurance is a valuable feature that can provide significant financial support to the beneficiaries of the insured during a difficult time. It is an important consideration when deciding whether to purchase term life insurance and can provide much-needed financial stability and peace of mind for loved ones.

NCAA Player Insurance: What's Covered for Life?

You may want to see also

It can be renewed or converted to permanent life insurance

Term life insurance is a type of insurance that provides coverage for a specific period, often 10 to 30 years. It is a popular option for individuals who require coverage during certain stages of their lives, such as raising a family or paying off a mortgage. Once the term expires, the policyholder has a few options: they can either renew the policy for another term, convert it to permanent coverage, or let the policy lapse.

Converting term life insurance to permanent life insurance, also known as whole life or universal life insurance, offers several benefits. Permanent life insurance provides coverage for the insured's entire life, rather than a fixed term. This means that as long as the premiums are paid, the policy will remain active, and beneficiaries will receive a death benefit regardless of when the insured person passes away. Permanent life insurance also accumulates cash value over time, which can be borrowed against or withdrawn. This cash value grows tax-free, providing additional financial flexibility.

Another advantage of converting to permanent life insurance is that it may be easier to obtain compared to purchasing a new policy. As health conditions change over time, it may become more challenging to qualify for a new policy. By converting an existing term policy, the policyholder avoids the need to go through the underwriting process again and can secure continued coverage despite any health issues that may have arisen.

When converting term life insurance to permanent coverage, policyholders have the flexibility to choose when and how much of their coverage they want to convert. This allows them to adjust their insurance plans according to their changing needs and circumstances. For example, if a policyholder initially had a $500,000 term policy and decides to convert it to permanent coverage, they can choose to convert only a portion, such as $200,000, and keep the remaining $300,000 as term insurance.

Converting term life insurance to permanent life insurance is a valuable option for individuals who anticipate their long-term needs may change. It provides the security of knowing that they can extend their coverage in the future without having to commit to a long-term policy upfront. The conversion feature allows policyholders to make adjustments as their financial responsibilities evolve, ensuring that their insurance plans remain aligned with their priorities.

Life Insurance: Personal Property Protection or Separate Policy?

You may want to see also

Frequently asked questions

Term life insurance is a good option for those who want to secure affordable, temporary financial protection that matches their coverage needs during critical financial responsibilities, such as raising a family or paying off a mortgage. It is also a good option for young families on a budget, as it is generally less expensive than permanent life insurance.

When you buy a term life insurance policy, the insurance company determines the premium based on the policy's value, age, gender, and health. If you die during the policy term, the insurer will pay the policy's face value to your beneficiaries. The term life insurance death benefit can be a vital financial support, helping to cover significant expenses like mortgages, education costs, or other financial needs that your family might face in your absence.

Term life insurance offers a tax-free death benefit, flexible payment and policy options, and no penalty for canceling. The proceeds can also be paid to the beneficiary without delay and are not subject to federal income taxes or included in the probate estate.