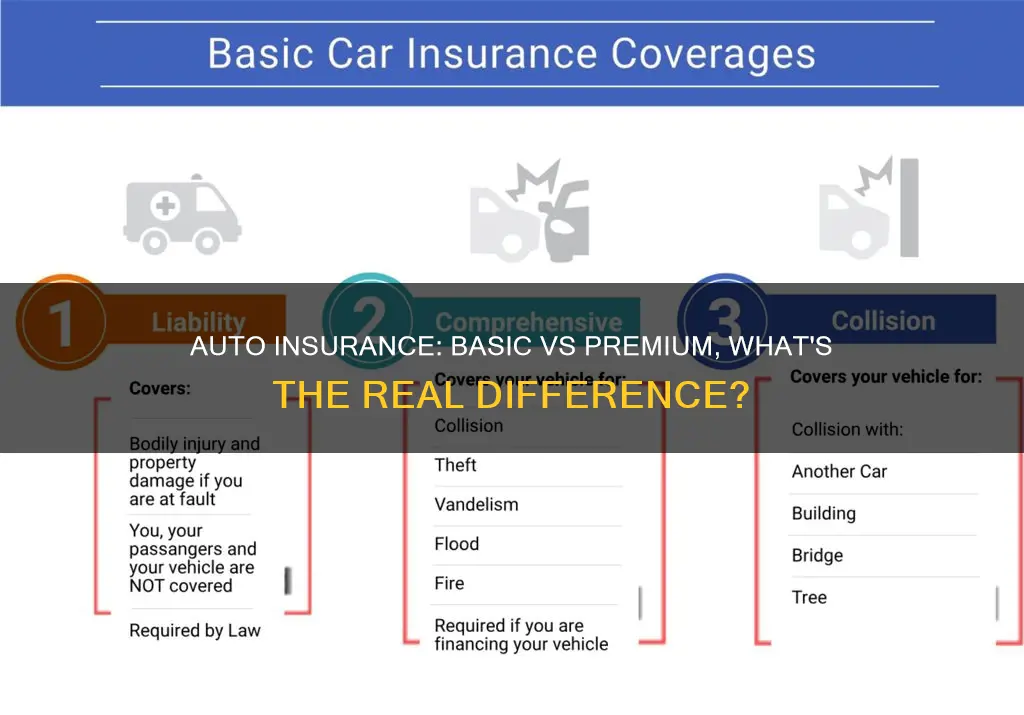

Auto insurance premiums are the payments made to an insurance company in exchange for coverage. The cost of these premiums is determined by a variety of factors, including age, location, driving record, and the type of car being insured. Basic and premium auto insurance policies differ primarily in the amount of coverage provided and the associated costs. Basic auto insurance typically provides minimum liability coverage, while premium auto insurance offers more comprehensive protection, including collision and comprehensive coverage, at a higher cost.

| Characteristics | Values |

|---|---|

| Premium Amount | Based on factors such as age, gender, location, driving record, type of car, and coverage selected. |

| Payment Frequency | Monthly, every six months, or annually. |

| Coverage | Basic insurance typically covers liability and collision. Premium insurance may include add-ons like roadside assistance, gap insurance, rental car reimbursement, etc. |

| Cost | Premium insurance typically costs more due to the additional coverages and higher limits. |

| Deductible | Basic insurance may have a higher deductible, while premium insurance often offers lower deductibles. |

What You'll Learn

Premium payment frequency

The frequency of premium payments for auto insurance varies depending on the insurance company and the policyholder's preference. The most common options are monthly, twice a year, or annually. Some insurance companies may also offer quarterly payments. Policyholders can typically choose how often they would like to make payments, and paying a larger amount upfront may result in a discount.

In some cases, policyholders may be required to pay the entire premium upfront, especially if they are deemed to be at-risk drivers. This could be due to a history of lapsed insurance coverage or the requirement to file an SR-22 form. By collecting the full premium upfront, insurance companies reduce the risk associated with insuring at-risk drivers.

It is worth noting that the premium payment frequency does not usually affect the total amount of the premium. The premium amount is typically determined based on factors such as the policyholder's age, driving record, location, type of vehicle, and the selected coverage options.

Addressing Auto Insurance: Understanding the Insured Address Change Process

You may want to see also

Premium calculation

The premium is the amount you pay for your auto insurance, and it is calculated based on various factors. These factors include your personal details, the type of car you drive, your driving history, and the type of coverage you choose.

Personal Details

Your age, gender, and location are all factors that influence your premium. Teenagers and senior drivers are considered higher-risk, so they tend to pay higher premiums than middle-aged drivers. Men also tend to pay more than women, as they are statistically more likely to be involved in accidents. Additionally, if you live in a densely populated city, your premium is likely to be higher due to the increased risk of collisions, theft, and other issues.

Type of Car

The type of car you drive also plays a significant role in determining your premium. If you drive an expensive, new, or luxury car, your premium will likely be higher because it costs more to repair or replace these vehicles. On the other hand, safety features and anti-theft technology can help lower your premium.

Driving History

Your driving record is another critical factor in calculating your premium. At-fault accidents, speeding tickets, and other incidents on your record will typically increase your premium. Insurance companies view these as indicators of risky driving behaviour. Conversely, if you have a clean driving record, you will generally pay a lower premium.

Type of Coverage

The type and amount of coverage you choose will also impact your premium. If you select additional coverages, such as roadside assistance, your premium will increase. Higher coverage limits will also result in a higher premium. Conversely, if you choose a higher deductible, your premium will usually be lower.

Other Factors

There are also other factors that can influence your premium, such as your credit score and the number of drivers on your policy. A higher credit score can lead to a lower premium, as it indicates financial responsibility. Additionally, adding more drivers to your policy, especially young or inexperienced drivers, can increase your premium.

In summary, auto insurance premiums are calculated based on a combination of factors related to your personal profile, driving history, vehicle characteristics, and chosen coverage options.

Agreed Value Auto Insurance: Your Choice, Your Terms

You may want to see also

Premium changes

Firstly, the type of coverage and the amount of insurance are significant factors in determining premium prices. For instance, higher liability limits and higher levels of collision and comprehensive coverage will result in more expensive premiums.

Secondly, personal factors such as age, gender, and credit history are considered. Teenagers and senior drivers are often deemed higher-risk, resulting in higher premiums. Men also tend to pay more than women, as they are statistically more likely to be involved in accidents.

Thirdly, the car being insured is a major factor. Expensive, high-performance, or brand-new cars will have higher premiums due to the higher cost of repairs or replacements. On the other hand, safety features and anti-theft technology can help lower premiums.

Fourthly, location plays a role in determining premium prices. Urban areas with higher congestion, accident rates, and crime rates will result in higher premiums.

Lastly, driving record and claims history are important. At-fault accidents, speeding tickets, and multiple claims indicate a risky driver, leading to higher premiums. However, these incidents are usually only considered for three to five years, after which rates may decrease again with improved driving.

It is worth noting that insurance companies use their own unique formulas to calculate premiums, and shopping around for insurance is often the best way to find affordable premiums.

Gap Insurance: UK Car Protection

You may want to see also

Policy cancellation

To cancel your policy, contact your insurance provider or agent. Most companies accept cancellation requests over the phone, while some may require a signed cancellation letter or form. You can also mail, fax, or email a letter stating your intention to cancel and the effective date of cancellation. Be sure to review your policy for any cancellation fees, refund policies, or notice requirements. Some companies may charge a cancellation fee, and you may have to pay a fee if you prepaid your premiums.

It is important to follow the correct cancellation procedure to avoid unnecessary fees and penalties. Ask your insurance provider about any specific requirements, such as a cancellation letter or notice period. Once your cancellation request is processed, you will receive a confirmation of cancellation and a refund of any prepaid premiums, minus any applicable fees.

Keep in mind that cancelling your auto insurance policy is different from letting it lapse. If you simply stop paying your premiums, your insurance company will continue to insure your vehicle and charge you for coverage until the policy is officially cancelled. This can result in unnecessary charges and create issues when trying to obtain coverage in the future. Therefore, it is always best to proactively cancel your policy by following the proper procedures.

Renewing Vehicle Insurance: Saudi Arabia Guide

You may want to see also

Premium affordability

The affordability of insurance premiums depends on a variety of factors, which differ depending on the type of insurance. However, there are some common factors across most types of insurance, such as the age of the insured.

Auto Insurance

The cost of auto insurance premiums is influenced by a range of factors, including:

- Your driving record: The fewer incidents on your record, the less you typically pay. New drivers tend to pay higher premiums because they haven't yet established a driving history.

- Your age and demographics: Teenagers and senior drivers are considered higher-risk and generally pay higher premiums than middle-aged drivers.

- Your location: If you live in a densely populated city, there's a greater risk of collisions, theft, and other harm, which could result in higher insurance rates.

- Your car: If you drive an expensive car, your premium could be higher due to the cost of repairs or replacement. On the other hand, safety technology and anti-theft features can help lower your premium.

- Your mileage: Driving frequently and for long periods is often associated with higher premiums.

- Your coverage and deductible: The more coverages you carry and the higher your coverage limits, the higher your premium will be. Conversely, a higher deductible leads to a lower premium.

- Other drivers on your policy: Adding drivers to your policy will impact your rates, as insurers assess the overall risk of accidents and claims, including the individual risk level of all listed drivers.

Home Insurance

Home insurance premiums are influenced by factors such as:

- The location of the home.

- The age of the policyholder.

- The claim history of the policyholder.

- The type of coverage being purchased.

Life Insurance

For life insurance, the major factors influencing premium affordability include:

- The insured's risk of mortality.

- The interest the insurer expects to earn by investing the premium.

- The expenses the insurer will incur.

- The age at which coverage begins.

- The policyholder's health.

Health Insurance

The Affordable Care Act (ACA) of 2010 established several rules that regulate how insurance companies can set premiums for policies offered through the ACA Health Insurance Marketplace. The five major factors that insurers can use to set rates are:

- Age.

- Category of insurance plan.

- Geographic location.

- Tobacco use.

- Whether the enrollment covers an individual or a family.

Safeco's Auto Insurance Claim Cancellation Policy: What You Need to Know

You may want to see also

Frequently asked questions

A car insurance premium is the amount of money you pay to your insurance company in exchange for a policy. Premiums are usually paid either monthly, every six months, or annually.

The cost of a car insurance premium is determined by a variety of factors, including the type of coverage, the area in which you live, your driving record, your age, your gender, your credit score, and the type of car you drive.

A basic auto insurance policy typically provides liability coverage only, which helps protect you financially if you're at fault in an accident. A premium auto insurance policy, also known as full coverage, includes liability coverage as well as comprehensive and collision coverage, which can help pay for repairs to your own vehicle.

There are several ways to save money on your car insurance premium. You can shop around and compare quotes from different insurance providers, choose a higher deductible, or take advantage of discounts offered by insurance companies, such as for bundling policies or being a good student.