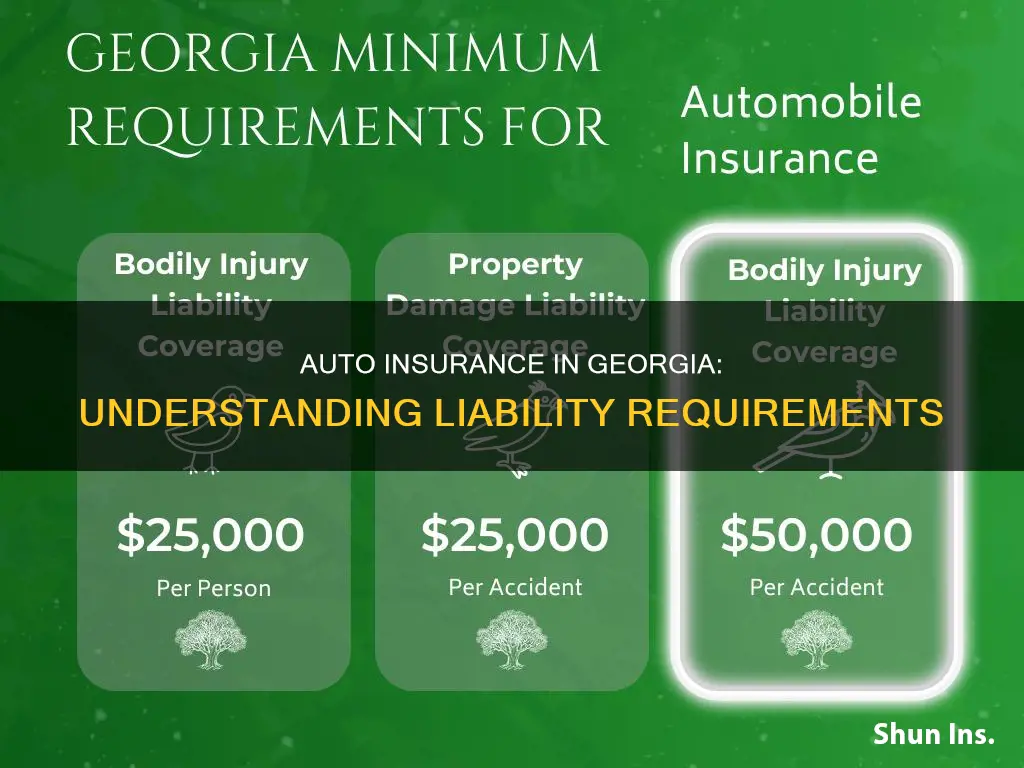

In Georgia, drivers are required by law to carry liability insurance that meets the state's minimum limits. This means that drivers must have a minimum of $25,000 in bodily injury liability coverage per person and $50,000 per accident, as well as $25,000 in property damage liability coverage per accident. These minimum limits are intended to provide a basic level of protection for those involved in car accidents. Liability insurance helps cover the costs of damage or injuries caused by motorists and protects both the policyholder and other road users. While Georgia requires drivers to have liability insurance, it is important to note that this type of insurance does not cover the policyholder's property or any injuries to themselves or their passengers in the event of an accident.

| Characteristics | Values |

|---|---|

| Bodily Injury Liability Coverage | $25,000 per person and $50,000 per incident |

| Property Damage Liability Coverage | $25,000 per incident |

| Uninsured Motorist Coverage | Optional |

| Collision Coverage | Optional |

| Comprehensive Coverage | Optional |

What You'll Learn

Bodily injury liability coverage

In Georgia, drivers are legally required to have a minimum of $25,000 of bodily injury liability coverage per person and $50,000 per incident. This type of insurance covers the medical expenses of those injured in an accident where you are at fault. It can also cover legal fees if you are sued for damages.

While the minimum coverage in Georgia is $25,000 per person and $50,000 per incident, it is important to note that this may not be sufficient in all cases. If the injured person's damages exceed your insurance coverage, they have the right to collect the excess amount from your personal assets. Therefore, it may be wise to consider purchasing additional coverage to protect yourself financially.

Bodily injury liability insurance is a critical component of your auto insurance policy and is required in most states, including Georgia. It helps to ensure that you can financially cover the costs associated with injuring someone else in a car accident. By understanding the requirements and protections provided by this type of insurance, you can make informed decisions about your coverage and be prepared in the event of an accident.

To summarise, bodily injury liability coverage is an essential aspect of auto insurance, providing financial protection and peace of mind in the event of an accident. While the minimum requirements in Georgia offer a basic level of protection, it is worth considering higher coverage limits to ensure you are adequately covered.

Hartford Auto Insurance: What You Need to Know

You may want to see also

Property damage liability coverage

It is important to note that if the cost of damages exceeds the amount of your coverage, you are responsible for the remaining cost. Therefore, it is recommended to consider raising your coverage limit, especially if you own a home or other expensive items, frequently travel in high-traffic areas, or live in an area with many expensive vehicles. You can also purchase an umbrella insurance policy, which provides additional coverage on top of your normal car insurance.

When choosing a property damage liability coverage limit, it is essential to consider your specific circumstances and the potential risks involved. By selecting an appropriate coverage limit, you can ensure that you are adequately protected in the event of an accident. Additionally, reviewing your policy and understanding your coverage limits is crucial to knowing what is covered and what your responsibilities are in the event of an accident.

In Georgia, liability insurance is required by law for all drivers. The minimum limits of liability insurance are set to provide a basic level of protection for individuals involved in car accidents. In addition to property damage liability coverage, Georgia law also requires bodily injury liability coverage with minimum limits of $25,000 per person and $50,000 per incident. These liability coverages ensure that drivers can financially cover the costs associated with accidents, including medical expenses, lost income, vehicle repair costs, and legal fees resulting from a court judgment.

TN Health Insurance: Understanding Auto Accident Coverage

You may want to see also

Uninsured/underinsured motorist coverage

In Georgia, approximately 12% of drivers lack liability insurance, which can lead to significant financial challenges if they cause an accident. Uninsured/underinsured motorist coverage fills this gap by providing protection when the at-fault driver has insufficient or no insurance. This coverage typically includes two types: bodily injury and property damage.

Bodily injury coverage addresses medical expenses, pain and suffering, and lost wages for both the policyholder and their passengers. It is mandated in Georgia at a minimum of $25,000 per person and $50,000 per accident, ensuring that injured parties can receive compensation for their medical costs and other related expenses.

Property damage coverage, on the other hand, focuses on damages to the insured's vehicle and other personal property, such as their house, fence, or items like cell phones and laptops. This type of coverage is also required in Georgia, with a minimum limit of $25,000 per accident.

It is important to note that drivers have the option to choose higher coverage limits, providing additional financial protection in case of an accident. On the other hand, if drivers prefer not to have uninsured/underinsured motorist coverage, they must explicitly reject it in writing.

It is worth noting that uninsured motorist coverage also applies when the uninsured driver cannot be located but their identity is known. In such cases, the law requires substantial diligence in attempting to locate the driver through methods like service by publication.

To summarise, uninsured/underinsured motorist coverage in Georgia is a valuable safeguard against financial hardships that may arise from accidents involving uninsured or underinsured drivers. It ensures that individuals can receive compensation for medical expenses, lost wages, and property damage, providing peace of mind and a sense of security on the road.

Vehicle Insurance: Comprehensive Coverage Explained

You may want to see also

Personal injury protection (PIP)

PIP insurance covers the various expenses caused by the injuries you or your passengers suffer in a car accident. This includes doctor's appointments, lost wages, replacement services (such as hiring a nanny), and funeral and burial services. It is important to note that PIP insurance does not cover pain and suffering damages or non-injury expenses like vehicle repairs.

One of the main advantages of PIP insurance is that it provides compensation regardless of fault. In Georgia, if you are found to be more than 50% at fault for an accident, you cannot recover any damages in a liability claim. PIP insurance, however, will cover your injury expenses even if you are at fault. This can provide valuable protection and reduce the risk of facing a lawsuit if you are liable for an accident.

Another benefit of PIP insurance is that it helps to protect your personal assets. Without PIP insurance, you would have to pay all your medical bills and other injury-related costs out of pocket. With PIP insurance, these expenses are covered up to the limits of your policy. If your medical bills exceed your PIP policy's limits, you may be able to use your health insurance before paying out of pocket.

It is worth noting that Georgia has a statute of limitations for personal injury cases. According to O.C.G.A. § 9-3-33, you have two years from the date of the accident to file a lawsuit against the at-fault driver. Consulting with a car accident lawyer can help ensure that your claim is filed within this timeframe.

Get Your Maryland Auto Insurance License: A Step-by-Step Guide

You may want to see also

Medical payments coverage

MedPay coverage can be useful if the person who caused the accident was uninsured or if their insurance company disputes their liability or delays payment. MedPay can also help with co-pays, coinsurance, and deductibles if your health insurance only partially covers your medical expenses from a car accident. Additionally, MedPay usually provides coverage regardless of fault, so it can help pay your medical bills if you were at fault in the accident.

MedPay benefits can vary depending on the terms of your insurance policy. In general, MedPay covers the medical bills of the policyholder, passengers in the covered car, and someone driving the vehicle with the owner's permission. It is important to note that MedPay does not provide benefits to people in other vehicles involved in the accident.

MedPay coverage may also extend beyond the vehicle. For example, if you have MedPay coverage on your car and are hit by another vehicle while walking or riding a bike, your MedPay coverage can help cover some of your medical bills, up to the limits of your policy.

MedPay typically reimburses expenses up to the coverage limit. For example, if you have $5,000 in MedPay coverage and your out-of-pocket medical expenses are $3,500, your MedPay will reimburse you for the $3,500 you paid. Additionally, if you have unpaid medical bills, your MedPay insurer may send the payment directly to the healthcare provider instead of to you.

In the unfortunate event of a fatal accident, MedPay coverage can also help cover funeral expenses for the eligible person, up to the limits of the MedPay coverage. However, it is important to review the specific terms of your policy to understand the extent of coverage provided.

According to Georgia law, medical payments coverage must cover expenses for services received within three years of the accident, although insurance companies can specify a longer time period.

Pausing Auto Insurance: Is It Possible?

You may want to see also

Frequently asked questions

The minimum liability insurance requirement in Georgia is $25,000 per person for bodily injury, $50,000 per incident, and $25,000 per incident for property damage.

Liability insurance in Georgia covers the medical expenses and property damage of the other driver in an accident where you are at fault. It also covers lost income if the other driver is unable to work due to their injuries.

Yes, it is mandatory to have liability insurance in Georgia. All drivers are required by law to carry at least the minimum amount of auto insurance to ensure they can be financially responsible for any damage or harm caused on the road.

Driving without auto insurance in Georgia is considered a misdemeanor. If convicted, you may face a fine of between $200 and $1,000, up to 12 months in jail, or both. Additionally, your vehicle's registration may be suspended, and you will be required to pay a reinstatement fine.