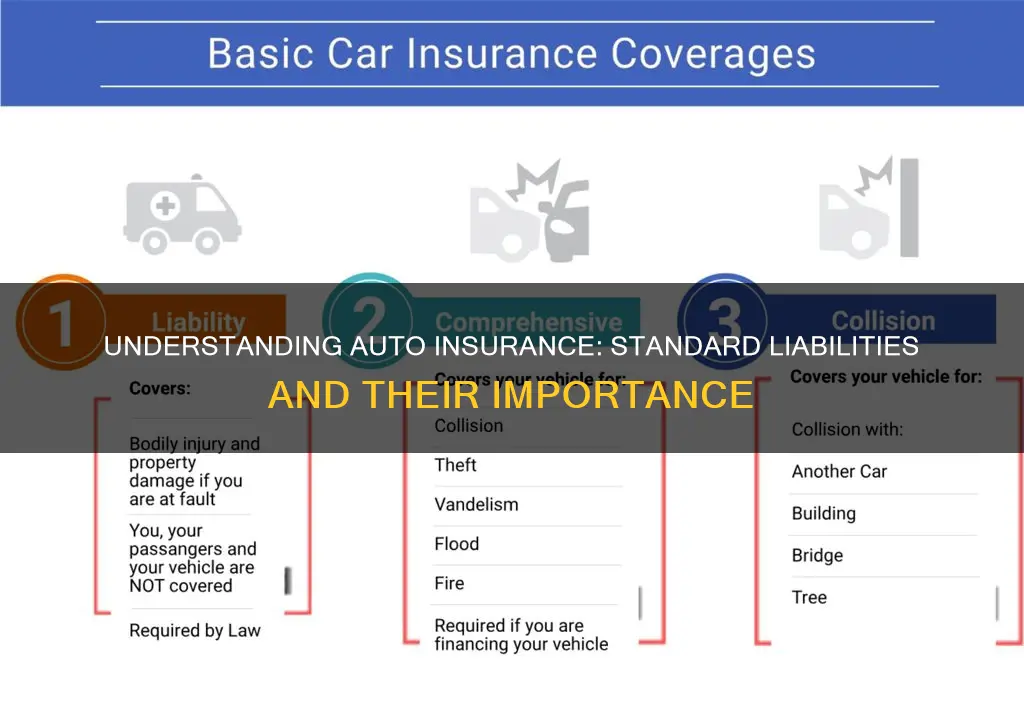

Car insurance is a legal requirement in almost every state, with the exception of New Hampshire and Virginia. The minimum amount of insurance required by law is liability insurance, which covers damage and injuries caused to others in an accident. However, this is often not enough to cover the costs of a serious accident, and it is recommended that drivers carry more than the state minimum. The recommended coverage is $100,000 per person and $300,000 per accident in bodily injury liability, and $100,000 per accident in property damage liability. This is often written as 100/300/100.

| Characteristics | Values |

|---|---|

| Bodily injury liability per person | $25,000 |

| Bodily injury liability per accident | $50,000 |

| Property damage liability per accident | $25,000 |

| Bodily injury liability per person (high coverage) | $100,000 |

| Bodily injury liability per accident (high coverage) | $300,000 |

| Property damage liability per accident (high coverage) | $100,000 |

What You'll Learn

Bodily injury liability

When purchasing bodily injury liability insurance, it is important to consider not just the minimum requirements in your state, but also how much coverage you would need to fully protect yourself in the event of a serious accident. Experts recommend purchasing coverage of at least $100,000 per person and $300,000 per accident, and ideally enough to cover your net worth. This is because, if you are sued for medical costs that exceed your coverage limits, you could be held financially responsible for the remaining amount, which could put your savings, house, and other assets at risk.

Mercury Auto Insurance: Accident Rate Impact on Premiums

You may want to see also

Property damage liability

When choosing the amount of property damage liability coverage, consider factors such as whether you own a home or other expensive items, whether you travel in high-traffic areas, and whether there are many expensive vehicles in your area. If you answered yes to any of these questions, you may want to consider increasing your coverage limit. Additionally, keep in mind that if the cost of damages exceeds your coverage limit, you will be responsible for the remaining amount.

Youth Auto Insurance Discounts: Unlocking Affordable Coverage

You may want to see also

Personal injury protection

PIP covers medical expenses for you and your passengers after a car accident. This includes reasonable medical costs such as surgeries, X-rays, dental or eye treatments, prosthetic devices, and professional nursing care. It also covers rehabilitation therapy and can help pay for your health insurance deductible.

In addition to medical expenses, PIP can cover lost wages if you are unable to work due to your injuries. This benefit also applies if you are self-employed and need to hire temporary workers.

PIP can also provide financial support for funeral, burial, or cremation expenses if a covered individual passes away in an auto accident. It can help replace lost income for surviving dependents and pay for services such as childcare and house cleaning that the injured person would normally perform.

It's important to note that PIP doesn't cover everything. It will not cover the injuries of other drivers in a collision or any injuries sustained while committing a crime, such as fleeing the police. Additionally, injuries sustained while receiving payment for driving, such as ridesharing, may not be covered by PIP.

State Requirements for PIP

State car insurance requirements vary across the United States. In states with no-fault insurance laws, all drivers must purchase PIP as part of their auto policies. These states include Florida, Hawaii, Kansas, Kentucky, Massachusetts, Michigan, Minnesota, New Jersey, New York, North Dakota, Pennsylvania, and Utah.

Some at-fault states also require PIP coverage, including Arkansas, Delaware, Maryland, Oregon, Texas, and Washington. In these states, the insurance company of the at-fault driver is responsible for paying for injuries up to the policy limits.

There are also states where PIP is optional, including South Carolina and Virginia. In Texas, for example, insurers are required to offer a minimum of $2,500 in PIP coverage, but you can increase this amount for additional financial protection.

When considering PIP coverage, it's essential to review your state's requirements and regulations.

U.S.A.A. vs Geico: Competitive Auto Insurance Rates

You may want to see also

Medical payments coverage

MedPay limits typically range from $1,000 to $10,000, and it is generally recommended to carry coverage equal to your health insurance deductible. If you do not have health insurance, consider a higher MedPay limit to cover potential medical bills.

While MedPay is not offered in every state, states that do not offer it typically have personal injury protection (PIP) coverage available instead. PIP is similar to MedPay but also covers lost wages, funeral expenses, and other costs. If you have a choice between the two, PIP is often a better option due to its expanded coverages.

Safco's Auto Insurance: Who's Covered and Who's Not?

You may want to see also

Uninsured/underinsured motorist coverage

Uninsured motorist coverage will pay for your injuries, your passengers' injuries, and damage to your vehicle if you are hit by a driver with no insurance. This coverage usually includes uninsured motorist bodily injury (UMBI) and uninsured motorist property damage (UMPD). UMBI covers medical bills for you and your passengers, while UMPD covers damage to your vehicle.

Underinsured motorist coverage comes into play when you are hit by a driver who doesn't have enough insurance to cover the damages or injuries they caused. It typically includes underinsured motorist bodily injury (UIMBI) and underinsured motorist property damage (UIMPD). Similar to UMBI and UMPD, UIMBI and UIMPD cover medical bills and vehicle damage, respectively.

The limits for uninsured/underinsured motorist coverage are usually set at the same level as your liability coverage limits. For example, if your liability coverage is $50,000 per person and $100,000 per accident, you would choose the same limits for your uninsured/underinsured motorist coverage. This ensures that you have an equal amount of protection when you are at fault and when you are hit by someone else.

In some states, uninsured/underinsured motorist coverage is mandatory, while in others it is optional. Even if it is not required in your state, it is strongly recommended to have this coverage to protect yourself financially in the event of an accident with an uninsured or underinsured driver. Without this coverage, you could end up paying for medical bills or vehicle repairs out of your own pocket.

When deciding how much uninsured/underinsured motorist coverage to purchase, consider the value of your vehicle and the amount of coverage you need to protect yourself and your assets. It is generally recommended to have enough liability coverage to protect your net worth, which includes the value of your home, vehicles, savings, and investments, minus any debts.

In summary, uninsured/underinsured motorist coverage is an important component of auto insurance that can provide financial protection in the event of an accident with an uninsured or underinsured driver. It is mandatory in some states and highly recommended in others. By having this coverage, you can have peace of mind knowing that you are protected in case of an accident.

Auto Windshield Insurance: What's the Deductible Deal?

You may want to see also

Frequently asked questions

The minimum amount of auto insurance you need is your state's required liability coverage. This covers the cost of injuries and damages you cause in an accident. The most common minimum liability limits are $25,000 per person and $50,000 per accident for bodily injury, and $25,000 for property damage. However, these limits vary by state.

It is recommended to have liability coverage of at least $100,000 per person and $300,000 per accident for bodily injury, and $100,000 for property damage. This will provide better financial protection in the event of a serious accident.

Liability insurance covers the cost of injuries and property damage caused to others in an accident that you are at fault for. It includes bodily injury liability, which covers medical costs, and property damage liability, which covers the cost of repairing or replacing damaged property.

In addition to liability insurance, you may need other types of coverage, such as comprehensive and collision insurance, depending on your state's requirements and your personal situation. Comprehensive insurance covers damage to your vehicle from events like theft, vandalism, or natural disasters, while collision insurance covers damage to your vehicle in an accident with another vehicle or object.

The cost of liability insurance varies depending on factors such as your state, age, driving record, and the type of vehicle you drive. The national average cost of minimum coverage, which typically includes liability insurance, is $493 per year.