Vehicle insurance, also known as car insurance, motor insurance, or auto insurance, is a financial protection plan for cars, trucks, motorcycles, and other road vehicles. The age of a vehicle affects its insurance rates since older cars are less expensive to replace and have depreciated value. Various factors, including vehicle age, safety features, and anti-theft systems, influence car insurance rates. While older cars are generally cheaper to insure, specific classic or collector cars may be exceptions.

| Characteristics | Values |

|---|---|

| Purpose | Provide financial protection against physical damage, bodily injury, and liability resulting from traffic collisions. |

| Coverage | Damage to third-party vehicles, other third-party property, and the insured vehicle. |

| Types | Third-party insurance, comprehensive insurance, third-party property damage insurance, etc. |

| Factors Affecting Premiums | Vehicle's make, model, and year; driver's age, gender, driving history, profession, etc. |

| Claims | Recorded in the Claims and Underwriting Exchange (CUE) in the UK; insurers usually ask about claims made in the last 3-5 years. |

What You'll Learn

- Vehicle insurance is compulsory in many places, but the specific terms vary by region

- Older cars are typically cheaper to insure as they are less valuable

- Newer vehicles may qualify for a new car insurance discount

- The cost of car insurance drops slowly as a car gets older

- Comprehensive insurance is usually recommended for newer cars

Vehicle insurance is compulsory in many places, but the specific terms vary by region

Vehicle insurance, also known as car insurance, motor insurance, or auto insurance, is compulsory in many places. However, the specific terms vary by region.

In the United States, auto insurance requirements vary from state to state. Most states require a motor vehicle owner to carry some minimum level of liability insurance. States that do not require vehicle insurance include Virginia, New Hampshire, and Mississippi. Virginia, however, requires residents to pay an annual fee of $500 per vehicle if they choose not to buy liability insurance. In New Jersey, it is illegal to operate a motor vehicle without liability insurance coverage. In North Carolina, drivers must hold liability insurance before a license can be issued.

In the European Union, vehicle insurance is also compulsory and has minimum coverage requirements. These include a minimum of €1,000,000 of cover per victim or €5,000,000 per claim in the case of personal injury, and €1,000,000 per claim in the case of damage to property.

In the United Kingdom, the Road Traffic Act 1988 requires motorists to be insured against liability for injuries to others and damage to others' property.

In Australia, every state has its own Compulsory Third-Party (CTP) insurance scheme, which covers personal injury liability in a vehicle crash.

In Canada, basic auto insurance is mandatory throughout the country, with each province's government determining the minimum required coverage.

In India, auto insurance is compulsory for all new vehicles, whether for commercial or personal use.

The specific terms of vehicle insurance can vary significantly depending on the region, with factors such as the degree of coverage, the cost of premiums, and the enforcement of insurance requirements all differing across jurisdictions.

Mercury Insurance: Who's Driving?

You may want to see also

Older cars are typically cheaper to insure as they are less valuable

The age of a vehicle is a significant factor in determining auto insurance rates. Older cars are generally cheaper to insure than newer cars because they are less valuable, and thus cost less for insurance companies to replace in the event of a total loss. The value of a car constantly depreciates, and this process begins as soon as the car is driven off the lot.

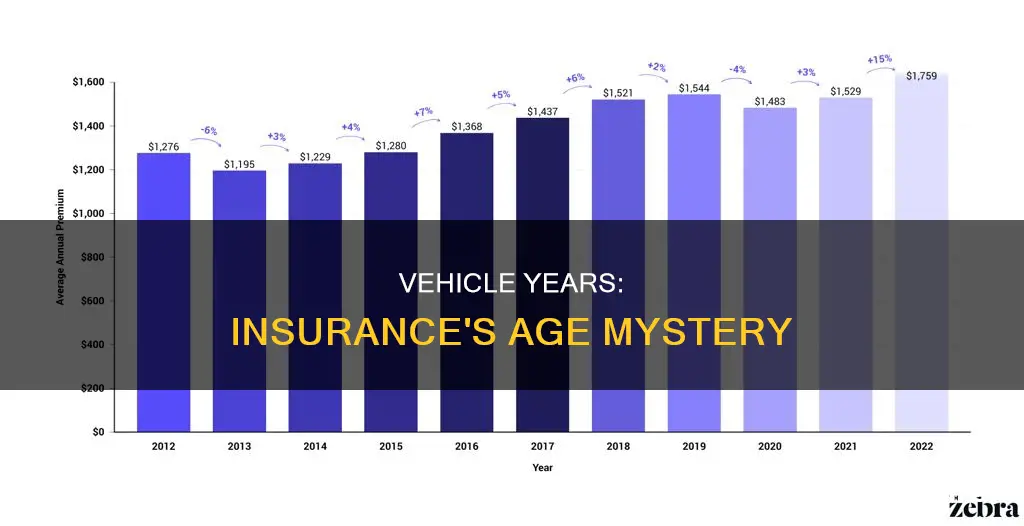

The cost of insurance drops slowly as a car gets older. For example, a new Honda Civic costs around $154 a month to insure, while a 2012 model averages $112 a month. After a car is one year old, insurance costs drop by around 10%. The savings really start to kick in after a car is three to five years old, which is often when financing ends. Once a car is ten years old, it is usually a better deal to switch from full coverage to liability-only insurance.

However, there are exceptions to the rule that older cars are cheaper to insure. If an older car is a popular model with thieves, has hard-to-find replacement parts, or is a luxury or high-end sports car, it could cost more to insure than a newer car of a different make and model. For example, the Honda Civic is the most likely car to see higher insurance prices, despite being cheaper to insure than newer cars. Additionally, if an older car lacks safety features or is prone to theft or damage, insurers may charge higher premiums.

GEICO: Salvage Vehicle Insurance

You may want to see also

Newer vehicles may qualify for a new car insurance discount

Newer Vehicles and Insurance Discounts

The age of a vehicle is a significant factor in determining auto insurance rates. Newer vehicles tend to be more expensive to insure because they are worth more and haven't depreciated yet. However, newer vehicles may also qualify for a new car insurance discount, which can help offset the higher insurance costs.

New Car Discounts

A new car discount is typically awarded to policyholders whose vehicles are no older than three years from the current model year. This discount is applied to collision and comprehensive insurance coverage, which covers damage to your car in an accident. The amount of the discount varies by insurer, but it generally falls between 5% and 20% of the total auto policy premium. Some companies, like GEICO, offer discounts of up to 15% for new vehicles.

Factors Affecting Discounts

It's important to note that different insurers have different definitions of what constitutes a "new" vehicle. For example, Nationwide considers a new car to be two years old or newer, while Progressive extends the discount to cars three years old or newer. Additionally, eligibility requirements vary, and some insurers may limit the discount to specific vehicle models, such as sedans over SUVs, or certain coverage options. A clean driving record may also be required to qualify for the discount.

Advantages of New Car Discounts

New car discounts offer two main benefits. Firstly, they provide cost savings, helping to offset the higher insurance premiums associated with newer vehicles. Secondly, they allow policyholders to take advantage of additional coverage options that may not be available for older vehicles, such as guaranteed asset protection (GAP) insurance, which covers the difference between the total amount owed on a car loan and the vehicle's actual cash value if it is declared a total loss after an accident.

Qualifying for a New Car Discount

To qualify for a new car discount, the vehicle typically needs to be in the name of the policyholder and added to their insurance policy. The specific age requirements vary by insurer, but it is generally two or three years from the current model year. Additionally, the type of vehicle may be a factor, with some insurers restricting the discount to certain makes, models, or states. It's recommended to contact your insurance company to understand their specific requirements and eligibility criteria for new car discounts.

Gov Website Checks Your Car Insurance

You may want to see also

The cost of car insurance drops slowly as a car gets older

Vehicle age is one of the factors that affect car insurance rates. Older cars are generally less expensive to insure because they are less valuable, and the potential insurance payouts after an accident are lower. The cost of car insurance drops slowly as a car gets older, but the value of the car drops quickly. For example, a 10-year-old car may be worth $6,000, but the annual cost of insuring it could be $2,000, representing 35% of the car's value. This proportion increases over time, and after 15 years, the cost of insurance may exceed the value of the car.

The age of a car also affects the availability of insurance coverage options. Collision and comprehensive coverage may become limited for older cars, and the cost of full coverage insurance may approach or exceed the value of the vehicle. As a result, it is generally recommended to switch to liability-only insurance for cars that are about 10 years old. This can lower the insurance bill significantly, but the owner will have to pay for repairs or a replacement car out of pocket in case of an accident.

Older cars tend to have higher repair costs due to the scarcity of parts, and they may also lack advanced safety and anti-theft features, increasing the risk of accidents, injuries, and theft. These factors contribute to higher insurance premiums for older vehicles. Additionally, the insurance premium is determined by spreading the risk associated with the car evenly over its expected life, which results in higher premiums for older cars.

To save money on insurance for older cars, it is recommended to adjust the deductible, as higher deductibles lead to lower premiums. Discounts for safe driving, bundling policies, and installing safety features may also be available. Usage-based insurance programs can be beneficial for older cars that are driven less frequently. Shopping around and comparing quotes from different insurance carriers can also help in finding the best coverage at a lower price.

Insuring Old Vehicles: Is It Worth It?

You may want to see also

Comprehensive insurance is usually recommended for newer cars

The age of a vehicle is a significant factor in determining auto insurance rates. Older cars are generally less expensive to insure because they are less valuable and cost less to replace. On the other hand, newer vehicles may qualify for discounts and are often equipped with safety and anti-theft features that can lead to cheaper insurance rates.

Comprehensive insurance is an optional coverage that reimburses you for damage to your car from non-collision events, such as fires, vandalism, natural disasters, or theft. It is typically recommended for newer cars for several reasons. Firstly, comprehensive insurance covers a variety of unexpected events that are beyond the control of the driver. This includes weather events, falling objects, car theft, and vandalism. While these events can happen to any vehicle, newer cars tend to have a higher value, and comprehensive insurance can provide financial protection in case of such incidents.

Another reason comprehensive insurance is suggested for newer cars is the requirement by lenders and leasing companies. If you finance or lease a new car, comprehensive insurance is usually mandated to protect the lender's or leasing company's investment. This ensures that they can recoup their losses in case of theft or damage to the vehicle.

Additionally, comprehensive insurance can provide peace of mind for owners of newer cars. If you cannot afford to repair or replace your new car in the event of unforeseen damage, comprehensive insurance can offer financial security. It is worth noting that comprehensive insurance becomes less useful as your car ages and loses value. At that point, you may want to reconsider this coverage if you have sufficient funds to cover potential repair or replacement costs.

When deciding whether to opt for comprehensive insurance for your newer car, it is essential to weigh the benefits against the costs. Consider factors such as the value of your car, the likelihood of extreme weather events or theft in your area, and your ability to cover unexpected repair or replacement expenses.

Salvage Vehicle: Insurance Reporting

You may want to see also

Frequently asked questions

Vehicle insurance, also known as car insurance, motor insurance, or auto insurance, is insurance for cars, trucks, motorcycles, and other road vehicles. Its primary use is to provide financial protection against physical damage or bodily injury resulting from traffic collisions and against liability that could also arise from incidents in a vehicle.

The different types of vehicle insurance include third-party insurance, third-party, fire, and theft insurance, and comprehensive insurance. Third-party insurance is mandatory in many places and covers only personal injury liability in a vehicle crash. Third-party, fire, and theft insurance covers damage to third-party property and vehicles, as well as fire and theft of the insured vehicle. Comprehensive insurance covers damage to the insured vehicle and third-party vehicles, as well as injury or death of third parties.

Older cars are typically less expensive to insure because they are less valuable and have depreciated in value. Newer vehicles may qualify for a new car auto insurance discount if they are equipped with safety and anti-theft features. However, new cars are generally worth more and therefore cost more to insure.

Technically, car insurance claims never disappear from your record. They are added to the Claims and Underwriting Exchange (CUE), which is a database of all the car insurance claims made in the UK. However, insurance companies usually only ask about claims made in the last 3-10 years, with 5 years being the most common timeframe.