There are many options available when it comes to auto insurance, and the best option for you will depend on your personal circumstances.

When choosing an auto insurance provider, it's important to consider factors such as cost, coverage, customer satisfaction, and availability in your state. It's also worth looking into discounts that you may be eligible for, such as those for bundling policies, safe driving, or insuring multiple vehicles.

- Travelers: Best overall, best for accident forgiveness, and best for affordability.

- State Farm: Best for customer satisfaction and best for bundling.

- Erie: Best for customer satisfaction, best for liability-only insurance, and best for having few customer complaints.

- USAA: Best for military members and veterans.

- Nationwide: Best for pay-per-mile coverage.

- Geico: Best for discounts and best for high-risk drivers.

- American Family: Best for your budget.

- Progressive: Best for accident forgiveness.

- Auto-Owners: Best for financial strength.

- NJM: Best for having few customer complaints.

- Amica: Best for discounts.

| Characteristics | Values |

|---|---|

| Company | Travelers, State Farm, Erie, USAA, Nationwide, Geico, Liberty Mutual, American Family, Progressive, Country Financial |

| Availability | 43, 50, 12, 50, 46, 50, 50, 19, 26, 10 |

| Customer Satisfaction | Below average, high, high, high, average, average, below average, high, average, high, high |

| Affordability | Affordable, low overall rates, affordable, affordable, affordable, affordable, affordable, affordable, affordable, affordable |

| Discounts | Yes, yes, yes, yes, yes, yes, yes, yes, yes |

| Add-ons | Yes, yes, yes, yes, yes, yes, yes, yes, yes, yes |

What You'll Learn

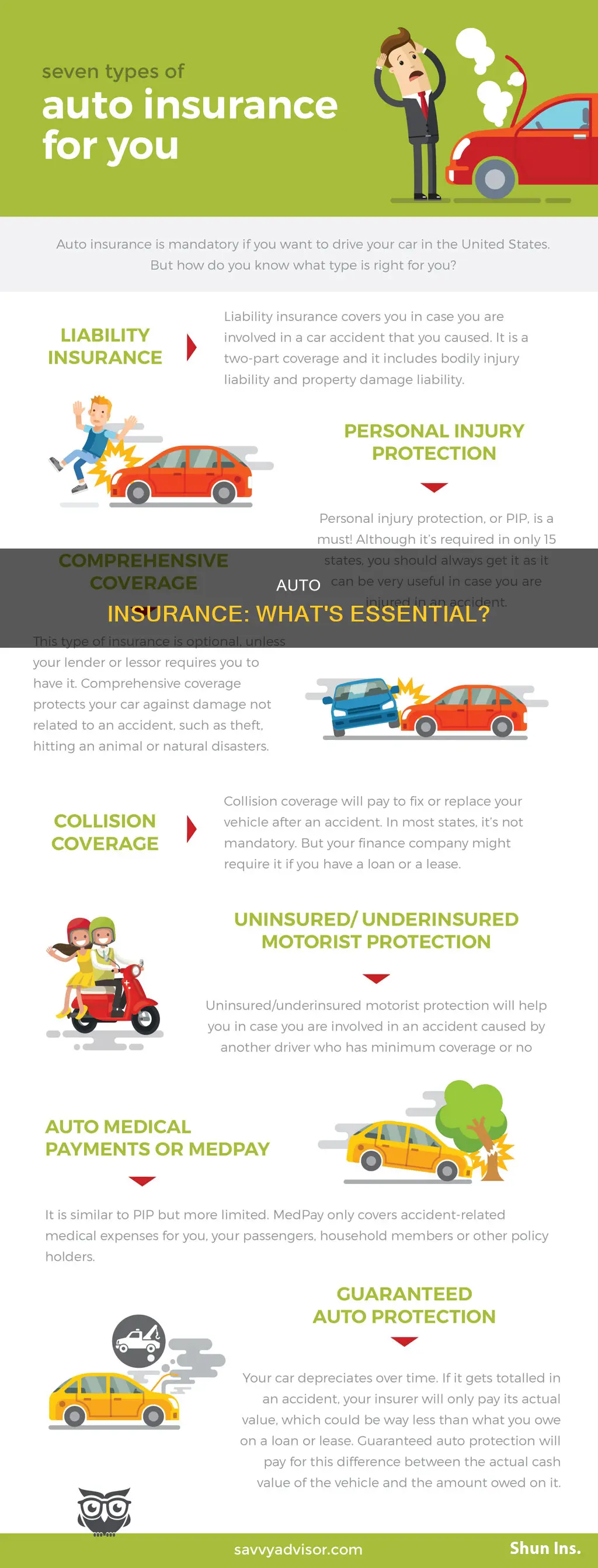

Liability insurance

Bodily Injury (BI) Liability

If you are at fault in an accident, this will cover the medical bills for those injured during the accident. It will also cover the loss of income that resulted from injuries received, as well as costs associated with pain and suffering.

Property Damage (PD) Liability

This covers the costs to repair or replace items damaged in the accident. That can include damage to other vehicles and other types of property, like homes, fencing, and storefronts.

Understanding Liability Limits

All liability auto insurance policies have limits, or how much an insurer will pay out on a claim. Liability coverage limits are divided into three categories: bodily injury per person, bodily injury per accident, and property damage per accident. When looking at an auto insurance policy, you may see coverage limits listed as three numbers separated by a forward slash. For instance, a 25/50/25 liability policy includes $25,000 in bodily injury coverage per person, $50,000 in bodily injury per accident, and $25,000 in property damage per accident. Many insurers also offer combined single-limit policies, where your liability limit is a single amount, such as $300,000.

What's Not Covered by Liability Insurance

Lower Vehicle Insurance: Discounts and Deductibles

You may want to see also

Comprehensive insurance

When deciding whether to get comprehensive insurance, consider the value of your car, your financial circumstances, and your personal preferences. If your vehicle has a high cash value or you cannot afford to repair or replace it out of pocket, comprehensive insurance could be a worthwhile investment.

Auto Insurance: Water Damage Covered?

You may want to see also

Collision insurance

When deciding on the amount of your deductible, consider the cost of your car and its potential corresponding repairs, as well as your willingness to pay for repairs under the amount of the deductible. A higher collision deductible means you will cover more of the cost of repairs when they arise, which in turn lowers your monthly premium.

Saskatchewan Vehicle Insurance GST Status

You may want to see also

Medical payments coverage

MedPay covers expenses such as hospital visits, nursing services, ambulance and EMT fees, health insurance deductibles and co-pays, surgery, X-rays, and dental procedures. Limits typically range from $1,000 to $10,000, and it's generally a good idea to carry coverage equal to your health insurance deductible. If you don't have health insurance, you should consider carrying a higher MedPay limit.

MedPay is especially useful if you're not sure you could afford to pay your medical bills after a car accident, or if you want to cover your out-of-pocket costs if you do have health insurance. It can also help pay for medical treatment if you're injured as a passenger in a friend's car, if you or your family members injure your passengers in a car accident, or if you're hit by a car while walking. However, it won't cover lost wages if you're forced to miss work due to a car accident.

Uninsured: What Now?

You may want to see also

Personal injury protection

PIP has two parts:

- Medical expense coverage: This covers the cost of treatment received from hospitals, doctors, and other medical providers, as well as any medical equipment that may be needed to treat injuries.

- Additional PIP coverage: This provides reimbursement for certain other expenses incurred due to injuries, such as lost wages, and the cost of hiring someone to take care of your home or family.

In some states, such as New Jersey, personal injury protection is mandatory for all drivers. Requirements for PIP coverage vary from state to state, so it's important to check the specific regulations in your state.

PIP coverage may overlap with other insurance policies, such as health insurance or medical pay auto insurance. However, PIP is specifically designed to cover car accident injuries, and it can pay for medical bills and other losses even if other forms of insurance deny coverage.

When selecting a PIP policy, it's important to consider the limits and deductibles of your other insurance policies, as well as the requirements and limitations of PIP coverage in your state.

Switching Auto Insurance: A Quick Guide

You may want to see also

Frequently asked questions

The minimum insurance requirements vary by state. For example, in California, drivers are required to have $15,000 bodily injury liability per person, $30,000 total bodily injury liability per accident, and $5,000 property damage liability per accident. In contrast, in Massachusetts, the minimum requirements are $25,000/$50,000/$25,000, respectively.

The type of car insurance you should get depends on your personal circumstances and preferences. If you want the most affordable option, consider getting minimum coverage car insurance, which includes only the minimum insurance required to drive in your state. If you want more financial protection, consider getting full coverage insurance, which typically includes your state's minimum requirements, plus comprehensive and collision insurance.

The amount of car insurance you need depends on your unique circumstances. However, as a general rule of thumb, you should have enough liability coverage to protect your assets in case you are liable in an accident. You can calculate your net worth by subtracting your debts from the value of your home, vehicles, savings, and investments. Then, make sure your liability coverage is sufficient to cover this amount.

To find the best price on car insurance, get quotes from multiple insurance companies and compare the rates and coverage offered. You may also be able to save money by bundling your auto insurance with another policy, such as homeowners or renters insurance. Additionally, look for discounts that you may be eligible for, such as good driver discounts or multi-policy discounts.