To accept insurance at a private practice, there are several forms and applications that need to be completed. The first step is to obtain liability insurance, which is a private practice must. Then, you need to get your National Provider Identity (NPI) number, which is a HIPAA-protected way to identify yourself when filing an insurance claim. Next, you need to fill out an application to join an insurance provider panel and get credentialed. This can be a grueling process and usually takes several months. Once you are credentialed, you can fill out the CAQH (Council for Affordable Quality Healthcare) form, which will allow you to become an in-network provider. After that, you can start setting up insurance billing for your clients by adding their demographic and insurance information. This includes their legal name, sex, insurance member ID card number, and more. Finally, you can start creating and submitting insurance claims, which will require information such as diagnosis codes and appointment dates.

| Characteristics | Values |

|---|---|

| Application | CAQH (Council for Affordable Quality Healthcare) |

| Application Requirements | Basic information (name, address, contact, etc.), education and training, specialties and board certifications, practice location information, hospital affiliation information, malpractice insurance information, work history and references, and disclosure and malpractice history |

| Application Timeframe | Several months |

| Application Renewal | Every 90 days |

| Insurance Company Requirements | Must be an in-network provider, must be credentialed |

What You'll Learn

National Provider Identity (NPI)

The National Provider Identifier (NPI) is a unique 10-digit identification number issued to healthcare providers in the United States by the Centers for Medicare and Medicaid Services (CMS). The NPI is used to identify healthcare providers in standard transactions, such as healthcare claims and prescriptions. It is also used by health plans and healthcare clearinghouses in their internal files and to coordinate benefits with other health plans. The NPI is mandatory for all individual HIPAA-covered healthcare providers or organizations, including physicians, pharmacists, dentists, and chiropractors, and must be used in all HIPAA standard transactions.

The NPI is designed to be an intelligence-free numeric identifier, meaning the numbers do not carry any additional information about the healthcare provider, such as their medical specialty or state of residence. This helps to protect the privacy and security of the provider's information.

To obtain an NPI, healthcare providers can apply through the National Plan and Provider Enumeration System (NPPES) website. The application process is relatively quick and easy, and there is no cost to obtain an NPI. The NPI remains permanent and does not change if the provider changes practices or work settings.

The NPI plays a crucial role in streamlining administrative and financial transactions in the healthcare industry and is an essential component of the healthcare provider's identification when interacting with insurance companies.

Mawista Insurance: Private or Public? Understanding Your Coverage

You may want to see also

Council for Affordable Quality Healthcare (CAQH) form

The Council for Affordable Quality Healthcare (CAQH) form is an important step in the process of becoming credentialled by insurance companies and becoming an in-network provider. The CAQH is a non-profit organisation that was first incorporated under the name Coalition for Affordable, Quality Healthcare, Inc., and later renamed the Council for Affordable Quality Healthcare, Inc. It was formed by some of the nation's largest health insurance companies to create a forum for healthcare industry stakeholders to discuss administrative burdens for physicians, patients, and payers.

The CAQH form is a comprehensive application that collects and maintains all the information needed for credentialing by insurance companies. It is a lengthy form that requires basic information such as name, address, contact information, education, training, specialties, board certifications, practice location, hospital affiliation, malpractice insurance, work history, references, and disclosure and malpractice history. It is recommended to gather all the required information before starting the form, as it can be time-consuming and burdensome.

The CAQH form is free to fill out and submit, and it simplifies the process of applying to multiple insurance companies separately. After completing the form, you will be asked to select the insurance companies you want to share your information with, and they will have access to your CAQH form to begin the credentialing process. It's important to note that credentialing can take several months, and CAQH will contact you every 90 days to confirm that the information provided in your form is still valid.

Once credentialled by an insurance company, it is essential to familiarise yourself with the coverage offered by each company, as they may vary in terms of the number of sessions covered per year and other benefits. Additionally, it is beneficial to implement systems for creating and submitting insurance claims, such as using an EHR platform for CMS 1500 claims.

Private MD Labs: Insurance Billing and Your Privacy

You may want to see also

Liability insurance

If you are a mental health private practice owner, you need professional liability insurance to prevent you from being a target for legal actions/claims or licensing board complaints. This is also known as mental health malpractice insurance and it protects your practice from the financial burdens that may occur due to liabilities associated with practicing and providing patient care, such as patient claims or board complaints.

There are a few liability limits options to choose from, based on your needs, and you can add CPH TOP™ coverage, which includes General Liability (also known as "Slip and Fall" or "Premises Liability Coverage").

When selecting an insurance provider, there are many factors to consider, including the amount of coverage, the scope of services provided, and the type of coverage (e.g., in-person, virtual care, or both).

ConnectiCare Private Insurance: What You Need to Know

You may want to see also

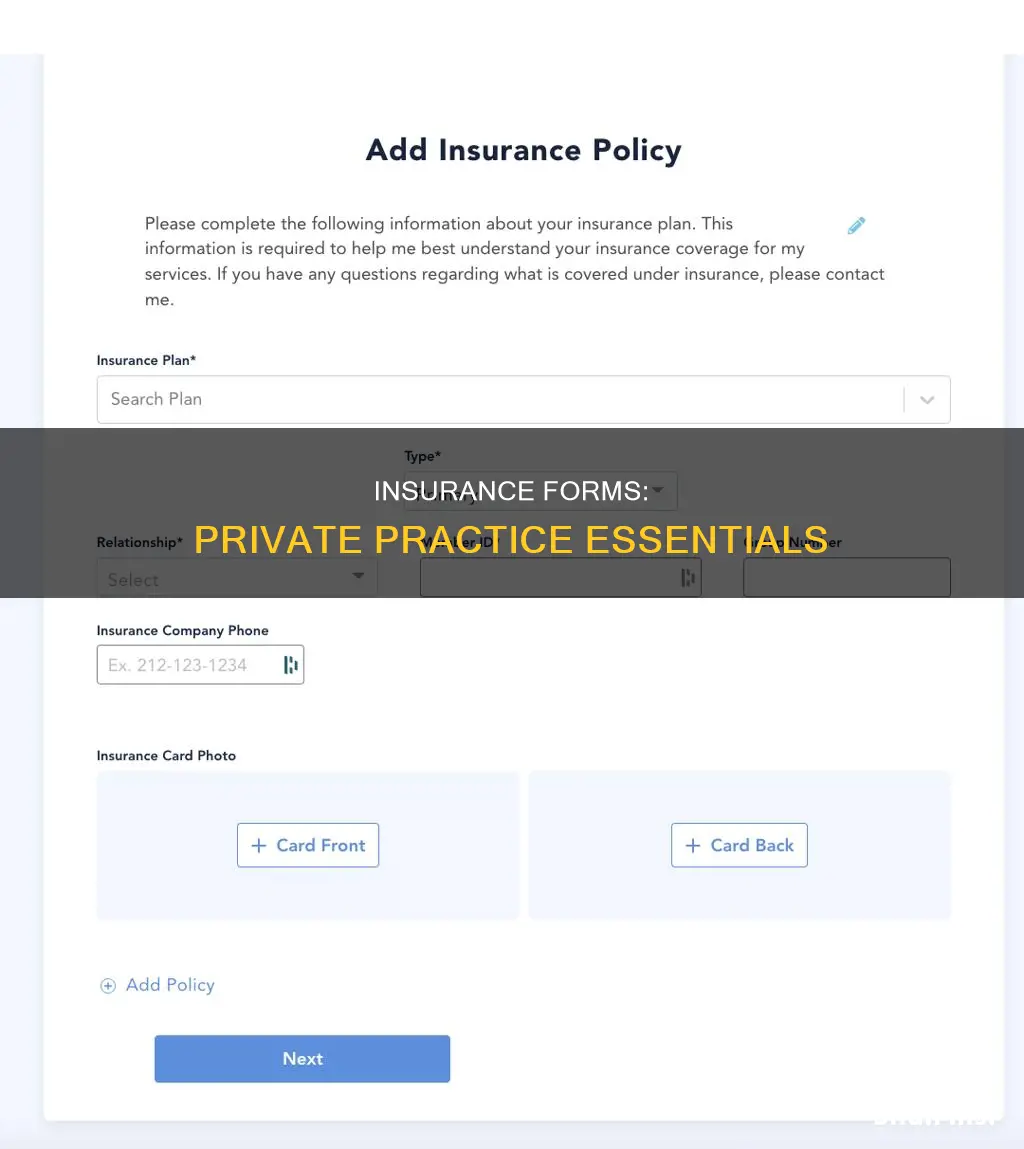

Client's demographic and insurance information

To submit claims for a client, you must first enter their demographic and insurance information. This information must be entered correctly to minimise claim rejections.

The following demographic information is required:

- Legal first name and legal last name

- Name as shown on the insurance member ID card

- Sex as shown on the insurance policy

The following insurance information is required:

- Primary insurance information, including the insurance payer and member information

- If the client is under someone else's plan, such as a parent or spouse, select the correct relationship and enter the primary insured's information

- Secondary insurance information (if applicable)

- Annual deductible (if applicable)

- Effective start and end dates of the insurance plan

- A copy of the front and back of the insurance member ID card

It is recommended that you verify benefits and eligibility before your first appointment with a client and again at the start of a new year to avoid claim denials and unexpected client balances due to a change in coverage.

Understanding Private Party Value and Insurance Claims

You may want to see also

Payment information and adjustment reason codes

- PR: Claim Adjustment Group Code, indicating internal adjustments within the X12 standard.

- CO: Contractual Obligation, representing adjustments due to contractual agreements.

- PI: Payer Initiated Reductions, signifying reductions made by the payer.

- PT: Patient Responsibility, denoting patient-related adjustments.

When submitting a claim, it's crucial to include the correct procedure and revenue codes, as well as ensure consistency with the modifier, place of service, patient's age, gender, provider type, and diagnosis. Any inconsistencies can lead to claim denials or adjustments.

Additionally, it's important to be aware of specific scenarios that may require the use of adjustment reason codes, such as denials, partial payments, and contractual agreements. Keeping accurate and timely records is essential to facilitate efficient processing and minimise errors.

To streamline the billing process and ensure compliance with insurance requirements, it's recommended to familiarise yourself with the full list of payment information and adjustment reason codes relevant to your specific situation and jurisdiction.

Haven's Private Hire Insurance: London's Best Coverage

You may want to see also

Frequently asked questions

To get credentialed, you must fill out an application to join an insurance provider panel. After that, you will probably have to fill out an application with the Council for Affordable Quality Healthcare (CAQH) to become verified.

The CAQH (Council for Affordable Quality Healthcare) form is an application that can be used and sent to each insurance company. This application is free.

The CAQH form will require your basic information such as your name, address, contact, etc. It will also ask for your education and training, specialties and board certifications, practice location information, hospital affiliation information, malpractice insurance information, work history and references, and disclosure and malpractice history.

After filling out the CAQH form, you will be asked to select which insurance companies you would like to share this information with. These companies will then have access to your CAQH form and the credentialing process will begin.

The credentialing process can take several months, so it is recommended to begin the process as soon as you decide to accept insurance.