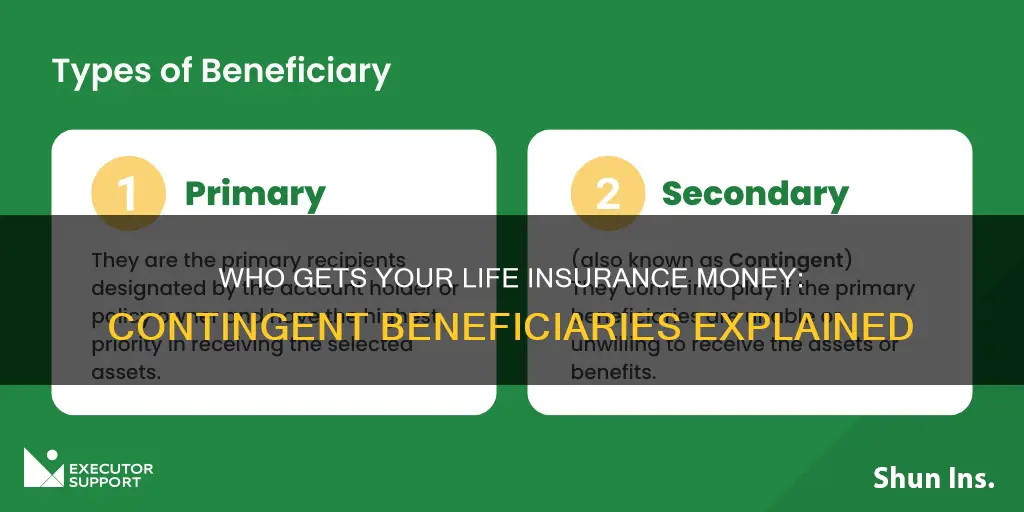

A contingent beneficiary, also known as a secondary beneficiary, is a backup recipient of the benefits outlined in a will, trust, or insurance contract. They are entitled to the benefits only if the primary beneficiary has died, cannot be located, or refuses the inheritance. When purchasing life insurance, you will be asked to designate at least one primary beneficiary, and it is also recommended that you name at least one contingent beneficiary. This ensures that your assets go to the desired person or entity and helps your loved ones avoid unnecessary time and expenses related to probate.

| Characteristics | Values |

|---|---|

| Role | Backup to the primary beneficiary in a life insurance policy |

| Receives payout when | Primary beneficiary has also passed away, can't be located, is ineligible, or refuses the benefit |

| Number | One or more |

| Type of entity | Person, organisation, business, charity, trust, or the insured's estate |

| Designation | Not required but highly recommended |

What You'll Learn

Who can be a contingent beneficiary?

A contingent beneficiary is a backup beneficiary that will benefit from your policy if the primary beneficiary cannot receive the payout. When you apply for a life insurance policy, you will be asked to name your primary beneficiary. The primary beneficiary will collect the death benefit if you pass away while your plan is still active.

You can name any person, organization, or business as your contingent beneficiary. However, if you name a child, you'll need to designate a trustee to manage the estate on their behalf until they turn 18.

You can also establish criteria around your contingent beneficiary's inheritance. For example, you could name your child as the secondary beneficiary of your life insurance payout, but only after they finish college.

You can have as many contingent beneficiaries as you want, as long as their portions of the estate add up to 100%. You could split your estate evenly between two children, give 60% of your estate to your child and 40% to another relative, or divide your assets between several philanthropic organizations.

Life Insurance Activation: Instant or Not?

You may want to see also

How many contingent beneficiaries can you have?

When you purchase a life insurance policy, one of the most important steps is choosing your beneficiaries. A beneficiary is the person or entity you designate to receive the death benefit from your life insurance policy. You can name multiple beneficiaries and even assign specific percentages of the death benefit you want each beneficiary to receive. In addition to primary beneficiaries, you can also name what's known as a contingent beneficiary or secondary beneficiary.

So, how many contingent beneficiaries can you have? There is no set limit to how many contingent beneficiaries you can name. You can name as many secondary beneficiaries as you'd like. However, it's important to consider that, in practice, it may be more practical to limit the number to ensure efficient distribution of the death benefit and avoid potential conflicts or disputes among your chosen beneficiaries. It is also crucial to carefully consider your relationships and beneficiaries' needs when making these decisions.

While there may be no legal limit to the number of contingent beneficiaries, insurance companies may have their own internal guidelines or restrictions. It is always a good idea to check with your insurance provider to understand any specific requirements or recommendations they may have. Some companies may have forms or processes that could influence how you structure your beneficiary designations. Understanding these details can help ensure a smooth process for your beneficiaries should they ever need to make a claim.

In conclusion, while you can technically name an unlimited number of contingent beneficiaries, it is wise to be thoughtful and strategic in your approach. Consider the relationships and needs of those involved, and don't hesitate to consult with professionals, such as financial advisors or legal experts, to ensure your wishes are carried out effectively and efficiently. Remember, the goal is to provide peace of mind and financial security for your loved ones, so taking the time to plan carefully is always time well spent.

Bank of America: Life Insurance for Account Holders?

You may want to see also

When does a contingent beneficiary receive the payout?

A contingent beneficiary will receive the payout when the primary beneficiary is unable to accept the death benefit. This could be because the primary beneficiary has passed away, cannot be located, or is no longer eligible to receive the benefit, such as in the case of a divorce. The contingent beneficiary is a backup to ensure that the death benefit goes to the right person or organisation.

In the case of life insurance, the primary beneficiary is typically a spouse or adult child. However, if they are unable to accept the payout for any reason, the contingent beneficiary will receive the benefit. This could be another family member, such as a child or parent, or it could be a charitable organisation.

It is important to name a contingent beneficiary when purchasing life insurance, as this ensures that the benefit goes to the intended recipient and is not subject to probate or estate taxes. Without a contingent beneficiary in place, the benefit may be paid to the estate, which can lead to delays, additional fees, and family disputes.

The number of contingent beneficiaries and the percentage of the payout they receive can be specified by the policyholder. It is also possible to change the contingent beneficiary at any time, although this should be reviewed regularly, especially after significant life events.

Uncover Credit Life Insurance: Check Your Policy Status

You may want to see also

What happens if there is no contingent beneficiary?

If there is no contingent beneficiary, the death benefit will be paid to the policyholder's estate instead of the people or organisations they would have selected. This means that the payout will be subject to estate taxes and will have to go through probate court, where a judge will determine the recipient. This process can take months or even years to complete, and the estate must settle administrative fees, taxes, and any outstanding debts before the heirs receive anything. As a result, the heirs may ultimately receive less than the policy's original death benefit, and it will take longer for them to receive it.

Additionally, once the benefit is paid to the estate, it can be seized by creditors. Therefore, it is recommended that policyholders regularly review and update their primary and contingent beneficiaries to avoid this scenario.

Life Insurance and Drug Testing: Guardian's Policy Explained

You may want to see also

How to choose a contingent beneficiary?

Choosing a contingent beneficiary is an important step in ensuring that your life insurance benefits are received by the right people, even if your primary beneficiary is unable to accept the payout. You can name any person, organisation, or business as a contingent beneficiary, giving you flexibility in tailoring your wishes. Here are some factors to consider when selecting a contingent beneficiary:

Dependents

Do you have dependents who would need financial support if something happened to you? Consider who would care for them and manage any financial responsibilities.

Adults vs Minors

Naming adults as beneficiaries is straightforward, but naming minors requires additional steps. You will need to create a trust or custodial account to manage the funds until they reach adulthood.

Financial Responsibilities

Think about who would be responsible for your financial obligations, such as debts, mortgage, or dependents, if your primary beneficiary cannot fulfil this role.

Organisations

If you have charitable causes or organisations that are close to your heart, you may want to consider naming them as contingent beneficiaries. This ensures that your money will go towards a meaningful cause if your primary beneficiary is unavailable.

Regular Review

Life changes such as marriage, the birth of a child, divorce, or the death of a loved one are all reasons to review and update your life insurance policy and beneficiary designations. Regularly reviewing your policy ensures that your wishes are up to date and that the right people will receive the benefits when the time comes.

Understanding Bonus Calculation Methods in Life Insurance Policies

You may want to see also

Frequently asked questions

A contingent beneficiary, or secondary beneficiary, serves as a backup to the primary beneficiaries named on your life insurance policy. If your primary beneficiaries are unable to accept the payout for any reason, the contingent beneficiary will receive it.

A contingent beneficiary can be any person, organisation, business, estate, charity or trust.

You can have as many contingent beneficiaries as you like, as long as their portions of the estate add up to 100%.

Yes, you can change your contingent beneficiary at any time, unless you have made an irrevocable beneficiary designation or are subject to certain community-property state laws.