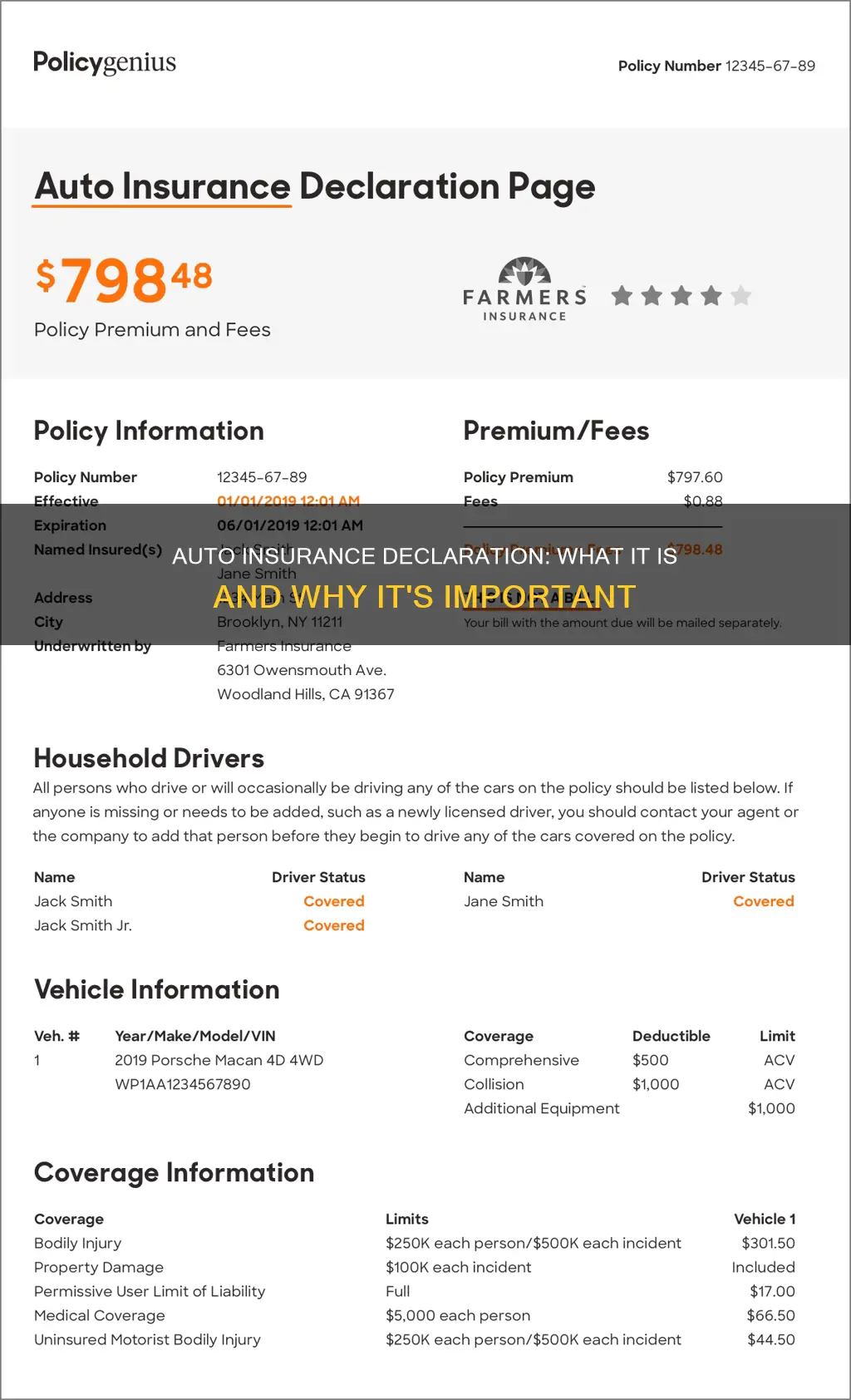

A declaration of auto insurance, also known as a dec page, is a detailed summary of your car insurance policy. It is a crucial document that outlines the specifics of your insurance coverage, including essential information such as the policy number, effective dates, coverage types, policy limits, and personal details of the insured individuals. This declaration page serves as a concise reference point, summarising the key aspects of your insurance policy and providing a clear understanding of your coverage. It is typically found at the beginning of your insurance paperwork, making it easily accessible for reference or verification purposes.

| Characteristics | Values |

|---|---|

| Policy Information | Effective dates, policy number, types of coverage, policy limits, personal information about the insured, driving history |

| Vehicle Information | VIN, year, make, model, mileage |

| Insured Information | Name, address, lender (loss payee) |

What You'll Learn

Policy number, effective dates, coverage types, limits, and personal information

An auto insurance declaration page provides a summary of your policy information. It includes the following:

Policy Number

The declaration page will include the policy number, which is a reference number that can be used to identify your specific insurance policy.

Effective Dates

The page will outline the policy period, including the date the coverage goes into effect and the expiration date. This is important to know when you need to renew your policy.

Coverage Types

The declaration page outlines the types of coverage you have selected for your policy. This includes different types of car insurance, such as liability, collision, comprehensive, or gap insurance. It also includes any additional coverages you have selected, such as uninsured motorist coverage or personal injury protection.

Limits

The declaration page will list the coverage limits you have chosen for each type of insurance. These are the maximum amounts your insurer will pay out for a covered claim. For example, you may see per-person and per-accident limits for bodily injury liability.

Personal Information

The declaration page includes personal information about the individuals who are insured. This includes the names of all insured drivers, including the policyholder and any additional drivers covered under the same policy. It may also include personal information such as your name, address, and driving history.

Full Coverage Auto Insurance in Indiana: Understanding Levels

You may want to see also

Vehicle information: VIN, year, make, model, mileage, and driving history

A declaration page in an auto insurance policy includes detailed information about the vehicle being insured. This is to ensure that the insurance company has all the necessary information about the car, and that the car is correctly identified. This information is also used to determine the insurance rates and coverage.

The Vehicle Identification Number (VIN) is a unique, 17-digit code used to identify a specific vehicle. It is like a car's social security number, with each digit and letter in the code referencing specific features of the vehicle, such as its make and model, country of origin, and year of production. The VIN can be found in several places, including the dashboard on the driver's side, a sticker on the driver's door or door jamb, the vehicle's title, insurance documents, and registration.

The year, make, and model of the vehicle are also included in the declaration. This information is important as it helps determine the value of the car, the cost of repairs, and the insurance rates. The year of production can be identified through the VIN, but the declaration page specifies the make and model as well for clarity and ease of reference.

The vehicle's mileage is another important piece of information in the declaration. This is because vehicles with higher mileage tend to have higher maintenance costs and may be more likely to break down. The mileage can also impact the value of the vehicle and the insurance rates.

Finally, the declaration page includes information about the driving history of the insured individual. This includes details about any accidents, claims, or traffic violations. This information is used to assess the risk associated with insuring the driver and can impact the insurance rates and coverage.

Auto Insurance and Dog Bites: What You Need to Know

You may want to see also

Loss payees and lienholders

A loss payee is a person or entity with a legally secured insurable interest in another's property. This is usually a financial institution, such as a bank, that loaned money to buy a car. The car is the collateral. When there is a total loss, the lender is paid before anyone else. The loss payee is the party to whom the claim from a loss is to be paid. They are the primary recipient of any kind of reimbursement and are most often used in the property-casualty insurance industry.

A lienholder, also known as a lienor, is defined as the party that holds a lien on your car until your loan is paid in full. The lienholder for a car loan is often a financial firm, such as a bank or credit union, though private parties can also act as lienholders. A lienholder may require you to carry specific auto insurance coverages until the loan on your vehicle is paid in full, such as comprehensive and collision coverage. A lienholder may also be considered a loss payee and will require that it be listed on the insurance policy as part of the loan agreement.

In many cases, the loss payee and lienholder are the same. The loss payee or lienholder is named on your insurance policy because if the car is a total loss, some portion of the claim payout belongs to them. The main difference is that the loss payee doesn't have to have an ownership stake in the property. They have an insurable interest in it. A lienholder owns the property until the loan is paid off.

Chevy Gap Insurance: Contact and Claims

You may want to see also

Excluded drivers

An insurance declaration page is a summary of your policy information. It includes personal information about the individuals who are insured, what types of coverage you have, and the policy's limits. One of the items listed on a declaration page is "Excluded drivers, if any".

An excluded driver is a person in your household who has been explicitly excluded from coverage under your car insurance policy. Their name will show as "excluded" on your policy, and they won't be insured to drive any vehicles on your policy. Not all states allow policyholders to exclude household members from coverage.

When you exclude a driver from your policy, they may not drive your car under any circumstances—even in an emergency. On the other hand, when you remove a driver from your policy, they are usually still covered if they drive your car, as long as they have your permission.

There are times when you might want to exclude a driver from your car insurance policy. For example, if a driver has multiple accidents or violations on their motor vehicle report that negatively impact the cost of your insurance, excluding them from your policy could lower your car insurance rate. Including all household members on your auto insurance provides the most financial protection, but excluding high-risk drivers who live under your roof may make sense. Drivers with a history of DUIs, at-fault accidents, and moving violations typically pay more for insurance than people with clean driving records. Excluding a risky driver from your policy may help you save on auto insurance.

You may also want to exclude elderly relatives or roommates who no longer drive because it isn't safe for them to get behind the wheel, and household members with medical conditions that may make driving risky. However, one group of people you shouldn't exclude from your coverage is teen and young adult children who are away at college. It can be tempting to exclude them to save money because it typically costs more to insure this age group than more experienced drivers. However, they should remain on your policy if they drive your car when they're home from school—even if it's only occasionally.

Auto Insurance in Las Vegas: What's the Cost?

You may want to see also

Discounts and surcharges

An insurance declaration page is a summary of your insurance policy, including policy numbers, effective dates, types of coverage, and personal information about the insured. It also includes details about the insured property, such as the vehicle's year, make, model, and mileage.

Regarding discounts and surcharges, auto insurance companies offer various options to help lower your insurance premium:

Discounts

- Multi-policy or bundling discounts: Insuring multiple types of policies (e.g., auto and homeowners insurance) or multiple cars on a single policy with the same company can result in significant savings, often advertised as 10-25% off.

- Safe driver/good driver discounts: Maintaining a clean driving record without tickets or accidents for three to five years can lead to discounts, with some companies offering up to 10% off liability and collision rates.

- Student discounts: Young drivers who are full-time students with good grades (B average or 3.0 GPA) can qualify for savings, typically ranging from 5-25%.

- Away-from-home student discounts: If your child leaves their car at home while attending college more than 100 miles away, you can expect a discount of up to 25% on your liability coverage.

- Senior/mature driver discounts: Drivers above a certain age (typically 55 or 65) may qualify for discounts, with some companies offering 5-10% off their basic liability and physical damage coverage.

- Early signing/renewal discounts: Signing up for or renewing your policy before it expires can result in savings of 3-10% on your total policy cost.

- Paid-in-full reduction: Paying your six-month or annual rate upfront can get you a discount of around 5-10%.

- Electronic billing/autopay: Opting for paperless billing and automatic payments can lead to savings of 5-10%, or a flat amount like $30 off.

- Low mileage and usage-based discounts: Driving fewer miles annually (typically below 7,500-15,000 miles) and allowing your driving to be monitored through apps or devices can result in discounts of up to 20% or even 40%.

- Defensive driving course discounts: Completing an approved defensive driving course can lead to a discount of 10-15% on liability, collision, and personal injury or medical payments coverages.

- Anti-lock brakes and other safety features: Having factory-installed safety features like anti-lock brakes, airbags, and passive restraint systems can result in discounts of 5-10% on collision and personal injury protection coverages.

- Anti-theft devices: Installing anti-theft devices, alarm systems, or vehicle tracking systems can lead to discounts of 5-15% on comprehensive coverage.

- Daytime running lights: Having daytime running lights can get you a discount of around 3% on your entire car insurance rate.

- Telematics/Usage-Based Insurance (UBI): Participating in UBI programs, where driving behaviour is monitored, can lead to discounts of up to 30-40%, depending on the company.

Surcharges

Surcharges are additional charges applied to your insurance premium due to certain factors or risks. These can include:

- Traffic violations or accidents: Tickets, accidents, or major incidents on your driving record can result in surcharges, increasing your premium.

- High-risk driving behaviour: Aggressive driving, frequent sudden stops, or speeding can lead to higher rates, especially if monitored through UBI programs.

- Vehicle age and condition: Older vehicles or those without certain safety features may have higher premiums due to increased risk.

- Location and garaging address: The location where the vehicle is kept and driven can impact the premium, with urban areas or regions with higher accident rates potentially resulting in surcharges.

- Driver age: Youthful or inexperienced drivers are considered higher-risk and often face higher premiums until they gain more driving experience.

Suspending Allstate Auto Insurance: A Step-by-Step Guide

You may want to see also

Frequently asked questions

A declaration of auto insurance, also known as a "dec page", is a detailed summary of your car insurance policy. It includes basic policy information such as the effective dates, policy term, named insured, address, and coverage details.

The declaration of auto insurance typically includes the following information:

- Policy number and effective dates

- Types of coverage and policy limits

- Personal information about the insured individuals

- Vehicle information such as VIN, year, make, model, and mileage

- Driving history and accident record

- Information about any loss payees or lienholders

A declaration of auto insurance is important because it provides a summary of your car insurance coverage and policy details. It serves as proof of insurance and can be used when registering your vehicle or filing a claim. It is also useful when comparing insurance products or switching insurers.