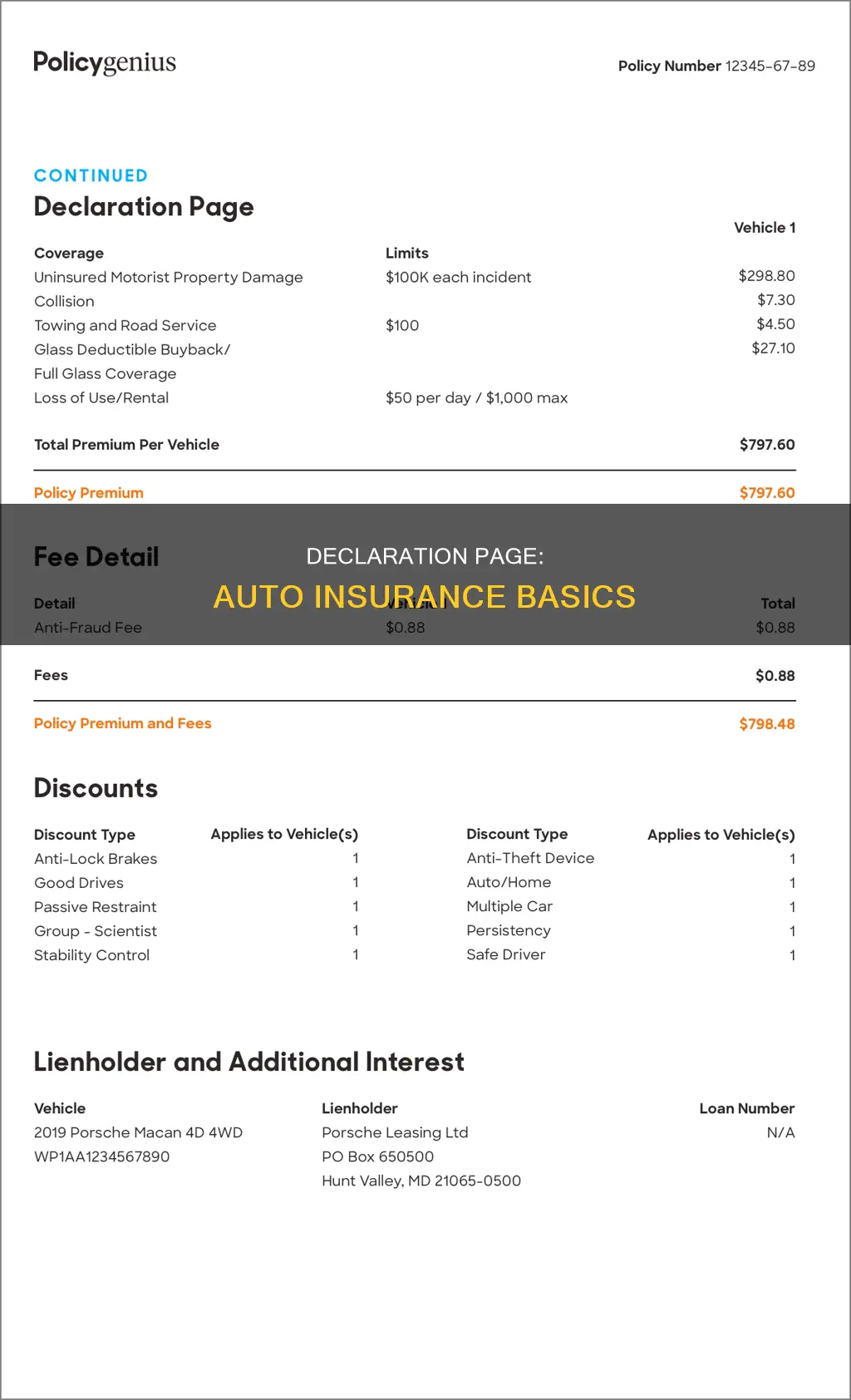

An auto insurance declarations page is a document that provides a summary of your car insurance policy. It includes details such as the coverage, limits, and deductibles of your policy, as well as information about the insured drivers and vehicles. This page serves as a quick reference guide to your policy and can be useful if you need to understand your coverage when your insurance agent is unavailable. It is typically sent to you by your insurance company after you purchase your policy and can be accessed online or through their website or app.

| Characteristics | Values |

|---|---|

| Purpose | To provide a summary of your auto insurance policy |

| Coverage | Details of what the policy covers, including types of coverage and coverage limits |

| Policy Details | Policy number, effective date, expiration date, agent information, policyholder details, covered drivers, vehicle details, deductibles, policy period, loss payee, and any discounts |

| Cost | How much your car insurance costs and how often you pay |

| Policyholders | Names of all insured drivers, including the policyholder and any additional drivers |

| Vehicles | Year, make, model, vehicle identification number (VIN), and average mileage of covered vehicles |

What You'll Learn

What is a declaration page for car insurance?

A car insurance declaration page is a summary of your auto insurance policy. It is typically attached to the front of your policy and contains basic details such as how much your car insurance costs, the type of coverage your policy contains, and how much coverage you have purchased. It also includes the coverage limits, your premium, and how frequently you pay it.

The declaration page will list your policy number and term period, as well as information about the make and model of your car. It will also contain the names of all insured drivers, including the policyholder and any additional drivers covered under the same policy.

The declaration page can be useful if you need to know what is covered by your policy and your insurance agent is not available. It can also be helpful if you want to get quotes from other companies to compare to your current policy. It is recommended that everyone who has car insurance keep a copy of their auto declaration page easily accessible.

You can usually find the declaration page attached to the front of your car insurance policy. If you don't have it, you can call your car insurance company to request a copy, access it online through your insurance company's website or app, or download it from your insurance company's online portal or mobile app.

Gap Insurance: Lender's Letter Explained

You may want to see also

What does an auto declaration page contain?

An auto declaration page, also known as a "dec page", is a summary of your auto insurance policy. It is typically attached to the front of your policy and includes important information about your policy, such as cost and coverage types and amounts. It is usually one or two pages long and includes the following:

- Policy number and term period

- Information about how much coverage you purchased and the coverage limits

- Information about your premiums, deductibles, and how frequently you pay them

- The make, model, and vehicle identification number of your car, and its lienholder (if you lease)

- The names of all insured drivers, including the policyholder and any additional drivers covered under the same policy

- All cars covered by your auto insurance policy, identified by make, model, year, and VIN

- The types of coverage you are paying for and their limits and deductibles

- A breakdown of how much you pay for each coverage type and vehicle, and any discounts you qualify for

- Agent information: contact information for your insurance agent (if you have one)

- Policyholder details: your name, address, and phone number

- Policy period: the expiration date for your coverage

IDV: Vehicle Insurance's Claim Value

You may want to see also

Who needs an auto declaration page?

An auto declaration page is a summary of your auto insurance policy. It is usually attached to the front of your policy, or can be found online. It includes important information about your car insurance policy, such as:

- The make and model of covered cars

- Coverage amounts and limits

- Insurance agent or company contact information

- Policy period

- Drivers

- Vehicles

- Loss payees

- Premium

- Coverages

- Limits

- Deductibles

- Discounts

Anyone who has car insurance should keep a copy of their auto declaration page easily accessible. This is so that you can refer to it if you have an accident or other incident and your insurance agent is not available. It can also be useful when it comes to renewing your policy, as you can review and assess your coverage and make any necessary changes. For example, if you've paid off your auto loan, you'll want to make sure that your lender is no longer listed on your policy.

You may also need your auto declaration page if you're buying a car and need to provide proof of insurance. It can also be useful when shopping around for a new insurer, as you can use it to help you compare car insurance quotes.

Insuring Yourself to Drive Hospital Vehicles

You may want to see also

How do you get an insurance declaration page?

An insurance declaration page is a summary of your policy, so it's important to know how to get hold of it.

Your insurance company will usually send your insurance policy declaration page automatically as soon as you sign up for auto or home insurance. You'll find it at the beginning of your policy documents, which you may receive by email, fax, or regular mail. It's also becoming more common for insurers to make your declaration page available online through a web portal or mobile app.

If you can't find your declaration page, you can easily get one from your insurance provider by calling an agent or contacting the company’s customer service team.

If you have a copy of your insurance policy forms, the declaration page will be at the front of the document. It will usually contain a heading that says “Declarations Page” or something similar.

Once you get a new copy, keep one easily accessible in case you have to file a claim. Some agents recommend having a second copy that you keep somewhere outside your home in case important documents get damaged. Consider scanning the document and saving it digitally.

Uninsured Motor Vehicle Insurance: What's Covered?

You may want to see also

What if the information on the declaration page is wrong?

It is important to review your declaration page carefully as soon as you receive it to make sure all the listed information is accurate. If you find that the information on your declaration page is incorrect, you should contact your insurance company immediately. If you need to make changes to your policy due to something like a name change or a new vehicle, contact your insurance company to update your policy information and a new declarations page should be issued.

Having a copy of your declarations page, whether physical or electronic, is useful when you need to attain basic information about your policy quickly. It can serve as a quick reference to your policy if you need to know what is covered and your insurance agent isn't available. It can also be helpful if you want to get quotes from other companies to compare to your current policy.

You should keep a copy of your auto declarations page easily accessible so you can refer to it if you have an accident or other covered incident and your insurance agent isn't available. The declarations page could help you figure out what damages should be covered and what limits will apply so you can decide whether to file a claim.

It is also useful to have your declarations page handy when it comes time to renew your policy so you can review and assess your coverage to see if you should make any changes. For example, if you've paid off your auto loan, you'll want to make sure that your lender is no longer listed on your policy. Or maybe you want to reduce or increase your coverage limits for your comprehensive coverage based on your vehicle's current value.

Teacher Credit Gap Insurance: Refundable?

You may want to see also

Frequently asked questions

A declaration page for car insurance, also known as a "dec page", provides a summary of your policy. It includes details on the coverage, limits, and deductibles you've purchased. It also includes information about the policyholder, covered drivers, and the vehicle(s) covered under the policy.

An insurance declaration page includes the policy number, policy effective date, agent information, policyholder details, covered drivers, vehicle details (year, make, model, Vehicle Identification Number (VIN), and average mileage), coverage details, policy period, loss payee, and any applicable discounts.

After purchasing a car insurance policy, your insurer will typically send you a declaration page via mail, email, or fax. You may also be able to access it online through your insurance company's website or app, or by contacting your insurer to request a copy.

While a declaration page can serve as proof of insurance in many cases, it is not the same as an insurance card, which is typically used as proof of insurance when pulled over by law enforcement. A certificate of insurance may be required when showing proof of auto insurance to the Department of Motor Vehicles or your lender.