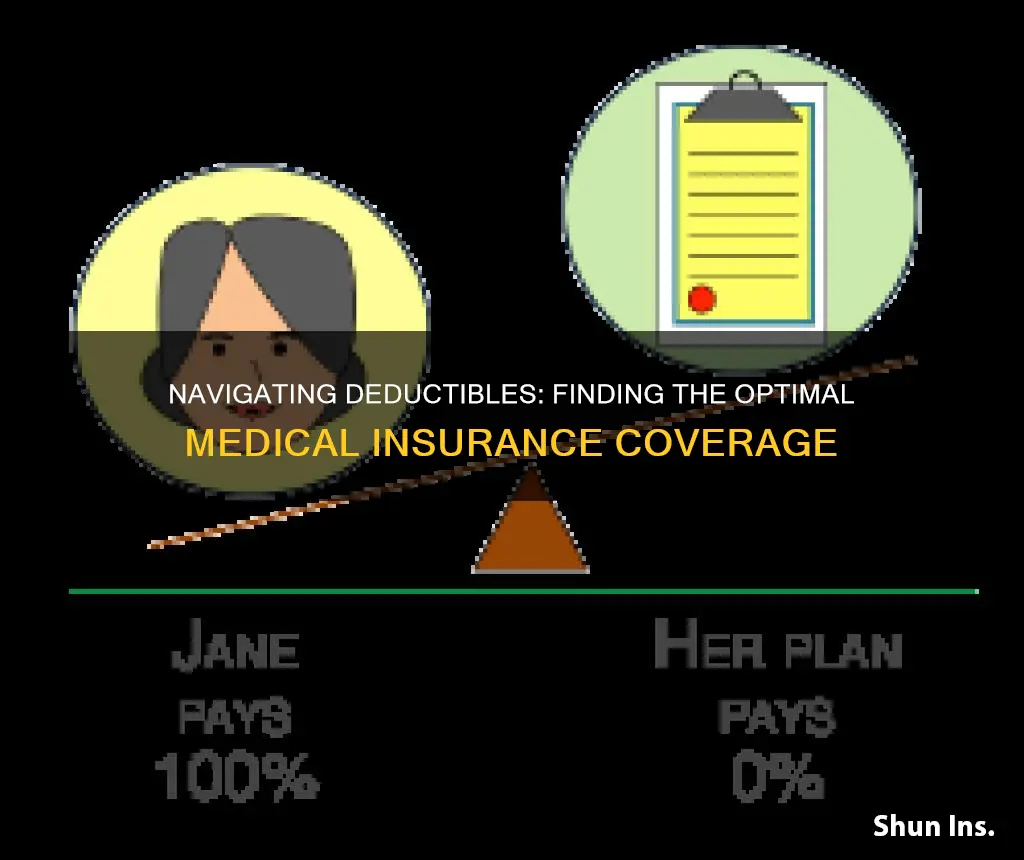

A health insurance deductible is the amount you pay before your insurance kicks in. The higher the deductible, the lower your premium, and vice versa. Low deductibles are best when an illness or injury requires extensive medical care. High-deductible plans offer more manageable premiums and access to HSAs.

| Characteristics | Values |

|---|---|

| Individual yearly deductible | $5,101 |

| Family yearly deductible | $10,310 |

| Average deductible for marketplace plans for medical and prescription drugs | $7,481 for Bronze plans |

| Average deductible for marketplace plans for medical and prescription drugs | $4,890 for Silver plans |

| Average deductible for marketplace plans for medical and prescription drugs | $1,650 for Gold plans |

| Average deductible for marketplace plans for medical and prescription drugs | $45 for Platinum plans |

| Individual deductible | Amount that the insured individual must pay out-of-pocket before their insurance coverage begins to share the costs of medical expenses |

| Family deductible | Type of deductible that applies to family health insurance plans, providing coverage for the entire family |

| Deductible | Run the scale from $0 to $8000 individual |

| Deductible | Can go up to $16,000 |

What You'll Learn

Deductibles range from $0 to $8000

A health insurance deductible is the amount you pay before your insurance kicks in. For example, if you have a $1000 deductible, and you need a $1000 MRI procedure and a $2000 surgery, you will pay $1000 out-of-pocket for the MRI, and then $0 for the surgery. A health plan with a lower deductible generally carries a higher monthly payment, and vice versa. If you prefer to pay a higher amount monthly for the security and predictability of low out-of-pocket expenses for high-cost medical care, you may want a low deductible in your healthcare plan. This can be a good option if you have a chronic health condition or high risk of sports injuries.

Deductibles run the scale from $0 to $8000 individual and can go up. They sure can, in my profession I have seen plans with deductibles of 16,000, and a MOOP of 16,050.

The average individual yearly deductible was $5,101 during the Open Enrollment Period in 2024. For families, it had an average deductible of $10,310. In 2023, the Kaiser Family Foundation (KFF) reported that the average deductible for marketplace plans for medical and prescription drugs is $7,481 for Bronze plans, $4,890 for Silver plans, $1,650 for Gold plans, and $45 for Platinum plans.

Low deductibles are best when an illness or injury requires extensive medical care. High-deductible plans offer more manageable premiums and access to HSAs. HSAs offer a trio of tax benefits and can be a source of retirement income.

If you're enrolling in your employer's health insurance plan for the first time or updating your existing coverage, it pays to be prepared. You might wonder if it makes more sense to go with a high or low deductible health insurance plan. Like most benefits-related questions, there is no one-size-fits-all answer to that question—it just depends on your individual needs.

Vanderbilt Medical Insurance: Unlocking Coverage Options for Comprehensive Care

You may want to see also

High-deductible plans offer more manageable premiums

A health insurance deductible is the amount you pay before your insurance kicks in. For example, if you have a $1000 deductible, and you need a $1000 MRI procedure and a $2000 surgery, you will pay $1000 out-of-pocket for the MRI, and then $0 for the surgery. A health plan with a lower deductible generally carries a higher monthly payment, and vice versa. If you prefer to pay a higher amount monthly for the security and predictability of low out-of-pocket expenses for high-cost medical care, you may want a low deductible in your healthcare plan. This can be a good option if you have a chronic health condition or high risk of sports injuries.

The higher the deductible, the lower your premium, and vice-versa. The average individual yearly deductible was $5,101 during the Open Enrollment Period in 2024. For families, it had an average deductible of $10,310. In 2023, the Kaiser Family Foundation (KFF) reported that the average deductible for marketplace plans for medical and prescription drugs is $7,481 for Bronze plans, $4,890 for Silver plans, $1,650 for Gold plans, and $45 for Platinum plans.

Deductibles run the scale from $0 to $8000 individual (I've seen) and I assume they can go up. They sure can, in my profession, I have seen plans with deductibles of 16,000, and a MOOP of 16,050. Provider sees that people have HDHPs and will ask for their full fee (allowable amount per insurance) before service, usually, so that tends to get paid. But yes, any coinsurance an HDHP or non-HDHP has has a chance to go to collections.

Medical Insurance Reimbursement: Taxable Benefits or Tax-Free Perks?

You may want to see also

Lower deductibles carry higher monthly payments

A health insurance deductible is the amount you pay before your insurance kicks in. For example, if you have a $1000 deductible, and you need a $1000 MRI procedure and a $2000 surgery, you will pay $1000 out-of-pocket for the MRI, and then $0 for the surgery. A health plan with a lower deductible generally carries a higher monthly payment, and vice versa. If you prefer to pay a higher amount monthly for the security and predictability of low out-of-pocket expenses for high-cost medical care, you may want a low deductible in your healthcare plan. This can be a good option if you have a chronic health condition or high risk of sports injuries.

Low deductibles are best when an illness or injury requires extensive medical care. High-deductible plans offer more manageable premiums and access to HSAs. HSAs offer a trio of tax benefits and can be a source of retirement income. If you're enrolling in your employer's health insurance plan for the first time or updating your existing coverage, it pays to be prepared. You might wonder if it makes more sense to go with a high or low deductible health insurance plan. Like most benefits-related questions, there is no one-size-fits-all answer to that question—it just depends on your individual needs.

The average individual yearly deductible was $5,101 during the Open Enrollment Period in 2024. For families, it had an average deductible of $10,310. In 2023, the Kaiser Family Foundation (KFF) reported that the average deductible for marketplace plans for medical and prescription drugs is $7,481 for Bronze plans, $4,890 for Silver plans, $1,650 for Gold plans, and $45 for Platinum plans. Deductibles run the scale from $0 to $8000 individual and I assume they can go up. They sure can, in my profession, I have seen plans with deductibles of 16,000, and a MOOP of 16,050.

Understanding Your Rights: Can You Cancel Health Insurance?

You may want to see also

Deductibles affect premium and coverage

A health insurance deductible is the amount you pay before your insurance kicks in. For example, if you have a $1000 deductible, and you need a $1000 MRI procedure and a $2000 surgery, you will pay $1000 out-of-pocket for the MRI, and then $0 for the surgery. A health plan with a lower deductible generally carries a higher monthly payment, and vice versa. If you prefer to pay a higher amount monthly for the security and predictability of low out-of-pocket expenses for high-cost medical care, you may want a low deductible in your healthcare plan. This can be a good option if you have a chronic health condition or high risk of sports injuries.

Deductibles run the scale from $0 to $8000 individual (I've seen) and I assume they can go up. They sure can, in my profession I have seen plans with deductibles of 16,000, and a MOOP of 16,050.

Low deductibles are best when an illness or injury requires extensive medical care. High-deductible plans offer more manageable premiums and access to HSAs. HSAs offer a trio of tax benefits and can be a source of retirement income.

The higher the deductible, the lower your premium, and vice-versa. The average individual yearly deductible was $5,101 during the Open Enrollment Period in 2024. For families, it had an average deductible of $10,310. In 2023, the Kaiser Family Foundation (KFF) reported that the average deductible for marketplace plans for medical and prescription drugs is $7,481 for Bronze plans, $4,890 for Silver plans, $1,650 for Gold plans, and $45 for Platinum plans.

Medical debt is common, but not necessarily from HDHPs. With the HDHP, many have 0%, 10% or 20% after the deductible and many HDHPs have an Out of Pocket Max not too far off from the deductible itself. Provider see that people have HDHPs and will ask for their full fee (allowable amount per insurance) before service, usually, so that tends to get paid. But yes, any coinsurance an HDHP or non-HDHP has has a chance to go to collections.

Unraveling Insurance Coverage: Medical Spa Treatment and Reimbursement

You may want to see also

Deductibles vary by insurance plan

A health insurance deductible is the amount you pay before your insurance kicks in. For example, if you have a $1000 deductible, and you need a $1000 MRI procedure and a $2000 surgery, you will pay $1000 out-of-pocket for the MRI, and then $0 for the surgery. A health plan with a lower deductible generally carries a higher monthly payment, and vice versa. If you prefer to pay a higher amount monthly for the security and predictability of low out-of-pocket expenses for high-cost medical care, you may want a low deductible in your healthcare plan. This can be a good option if you have a chronic health condition or high risk of sports injuries.

Deductibles run the scale from $0 to $8000 individual and I assume they can go up. They sure can, in my profession, I have seen plans with deductibles of 16,000, and a MOOP of 16,050.

The average individual yearly deductible was $5,101 during the Open Enrollment Period in 2024. For families, it had an average deductible of $10,310. In 2023, the Kaiser Family Foundation (KFF) reported that the average deductible for marketplace plans for medical and prescription drugs is $7,481 for

Low deductibles are best when an illness or injury requires extensive medical care. High-deductible plans offer more manageable premiums and access to HSAs. HSAs offer a trio of tax benefits and can be a source of retirement income.

Like most benefits-related questions, there is no one-size-fits-all answer to that question—it just depends on your individual needs. A health insurance deductible is the amount of money you must pay toward medical expenses each year before your health insurance plan begins to cover eligible costs.

Navigating ADHD Medication Access: Tips for the Uninsured

You may want to see also

Frequently asked questions

A deductible is the amount you pay before your insurance kicks in.

A good deductible depends on your individual needs. The average individual yearly deductible was $5,101 during the Open Enrollment Period in 2024. Deductibles can range from $0 to $8000 and even higher.

A low deductible is best when an illness or injury requires extensive medical care. A high deductible offers more manageable premiums and access to HSAs.

The individual deductible applies to individual health insurance plans, providing coverage for one person. The family deductible applies to family health insurance plans, providing coverage for the entire family.