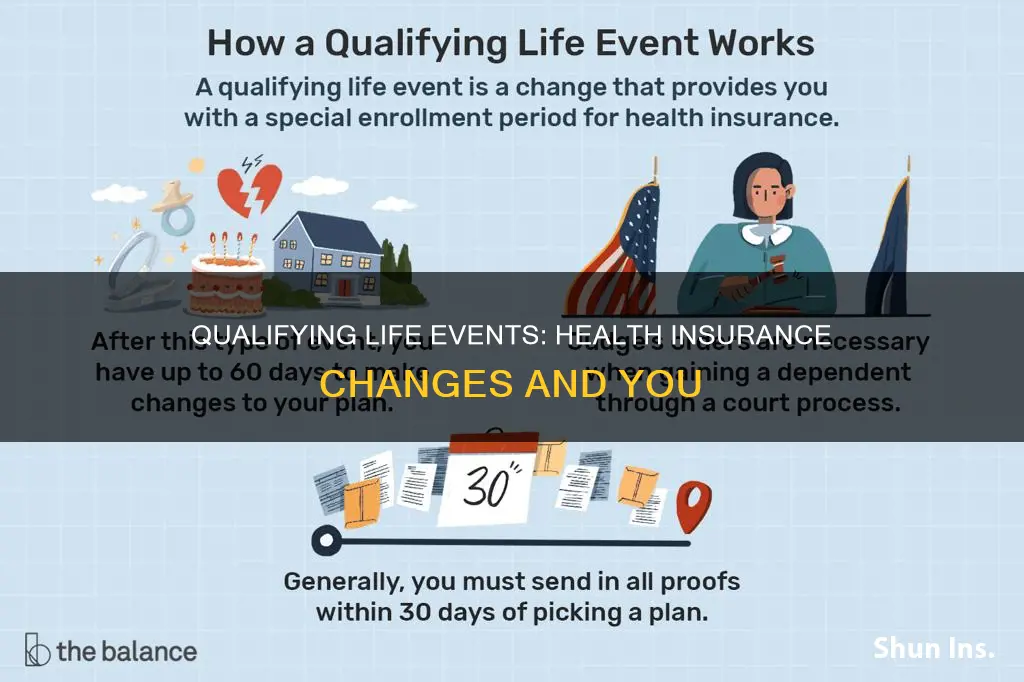

A qualifying life event is a significant change in your life situation that may impact your health insurance coverage and make it necessary to enroll in a new plan. These events allow you to qualify for a Special Enrollment Period (SEP), enabling you to purchase health insurance outside of the regular annual open enrollment period. Examples of qualifying life events include losing your health coverage, changes in your household or residence, having or adopting a baby, and changes in income or citizenship status. It's important to note that the specific qualifying events may vary depending on the type of health insurance plan and location.

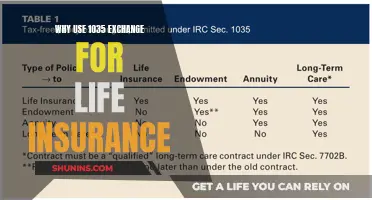

| Characteristics | Values |

|---|---|

| Definition | A life-changing situation that can impact you and your health insurance |

| Time period | A Special Enrollment Period (SEP) of 60 days before or after a qualifying life event |

| Types of events | Loss of health coverage, changes in household, changes in residence, other qualifying events |

| Loss of health coverage | Losing existing health coverage, losing eligibility for Medicare/Medicaid/CHIP, turning 26 and losing coverage through a parent's plan |

| Changes in household | Getting married or divorced, having a baby or adopting a child |

| Changes in residence | Moving to a different zip code, county, or state; moving to or from a place of education or work |

| Other qualifying events | Changes in income, gaining U.S. citizenship, leaving incarceration, starting or ending AmeriCorps service |

What You'll Learn

Loss of health coverage

Losing health coverage is one of the four basic types of qualifying life events (QLE) that can make you eligible for a Special Enrollment Period (SEP). This allows you to enrol in a health insurance plan outside of the annual Open Enrollment Period.

Types of Loss of Health Coverage

- Losing job-based coverage: If you lose coverage through your employer or a family member's company, you may qualify for an SEP. However, you won't qualify if you voluntarily dropped the coverage or lost it due to non-payment of premiums.

- Losing COBRA coverage: If you're losing COBRA continuation coverage because the coverage ended or your former employer stopped contributions, causing you to pay the full insurance cost, you qualify for an SEP. But, if you end COBRA early and pay the full cost yourself, or lose coverage due to non-payment of premiums, you won't qualify.

- Losing individual health coverage: If you lose your individual health coverage, you may qualify for an SEP if your insurance carrier stops offering your plan, you lose eligibility for student health coverage, your plan area no longer covers your place of residence, or you choose not to renew your plan mid-year. You won't qualify if you voluntarily drop your coverage or lose it due to non-payment of premiums or failure to provide required documentation.

- Losing eligibility for Medicaid or CHIP: Losing eligibility for Medicaid or the Children's Health Insurance Program (CHIP) can qualify you for an SEP. This could be due to changes in household income, pregnancy-related changes, or your child ageing out of CHIP.

- Losing eligibility for Medicare: Losing eligibility for Medicare Part A can qualify you for an SEP. However, losing Medicare Parts B, C, or D alone does not qualify you. You also won't qualify if you lose Medicare Part A due to non-payment of premiums.

- Losing coverage through family circumstances: Losing health coverage through a family member, such as a parent or spouse, qualifies you for an SEP. This could include turning 26 and losing dependent status, a family member's employer cutting dependent coverage, divorce or legal separation, or the death of a family member. You won't qualify if you voluntarily drop your dependent coverage or if neither you nor your family member pays the required premiums.

What to Do After a Qualifying Life Event

If you experience a qualifying life event, you typically have 60 days before or after the event to choose and enrol in a new health insurance policy. In some cases, you may need to provide documentation of your qualifying life event within 30 days of choosing a policy. This could include notices from your previous insurer or employer. Your new coverage will generally begin on the first day of the month after you select your new policy.

Life Insurance: UPS' Employee Benefits and Coverage Options

You may want to see also

Changes in household

Marriage, Divorce, and Legal Separation

When an individual gets married, divorced, or legally separated, the size of their household changes, and their health insurance coverage must be adjusted to reflect this. Marriage allows for a 60-day window to change coverage, including adding a spouse to an employer-sponsored health plan. Divorce or legal separation may result in the loss of existing coverage, especially if the spouse who does not hold the policy loses access to their partner's insurance. In this case, they may be able to purchase an individual plan through a Special Enrollment Period (SEP).

Parenthood

Having a baby, adopting a child, or receiving a foster child are all considered qualifying life events. In these cases, a new dependent is added to an individual's health insurance, and the size of their household changes. Typically, parents have a 60-day window from a baby's birth or a child's adoption to enrol the child in their health insurance plan. It is important to note that getting pregnant does not qualify for an SEP in most states, but prenatal care is usually covered by existing insurance.

Death of a Policyholder

The death of the primary policyholder in a family is a qualifying life event. This may result in the loss of existing coverage for family members, triggering a Special Enrollment Period.

Other Household Changes

Other changes in household circumstances that may qualify for an SEP include a child ageing out of their parent's health insurance plan at 26 or a spouse quitting their job and losing their insurance coverage.

Globe Insurance: Term Life Insurance Options and Availability

You may want to see also

Changes in residence

Types of Moves that Qualify for a SEP

- Moving to a different zip code, county, or state that changes your health plan area.

- For students, moving to or from school.

- For seasonal workers, moving to or from a work location.

- Moving in or out of a shelter or transitional housing.

- Moving to the U.S. from a U.S. territory or foreign country.

- Moving to a new area where your current coverage is not available.

- Moving to an area where your current coverage is available, but there are new plans to consider.

Documentation for Changes in Residence

When enrolling in a new plan due to a change in residence, you may be required to provide documentation of your move. This could include:

- Proof of residency from new and old addresses.

- New rental agreements, deeds, or mortgages.

- A driver's license or state identification card with your new address.

- Official school documentation, including enrollment or housing information.

- A letter from your employer confirming that you relocated for work.

- A green card, education certificate, or visa if you moved to the U.S. from another country.

DFAS: Life Insurance and Annuities for Survivors

You may want to see also

Other qualifying events

A qualifying life event (QLE) is a life-changing situation that can impact you and your health insurance. Experiencing a significant life change may allow you to change your health plan outside of the annual enrollment period (also called open enrollment).

There are several other qualifying events that may allow you to qualify for a Special Enrollment Period (SEP). These include:

- Changes in income: Changes in your income that affect the coverage you qualify for may be considered a qualifying life event. This could include an increase or decrease in household income that impacts your eligibility for certain health plans.

- Gaining membership in a federally recognized tribe or becoming a shareholder in an Alaska Native Claims Settlement Act (ANCSA) Corporation: If you gain membership in a federally recognized tribe or become a shareholder in an ANCSA Corporation, you may be eligible for a Special Enrollment Period.

- Becoming a U.S. citizen: If you recently became a U.S. citizen, this could be considered a qualifying life event, allowing you to enroll in a health plan outside of the annual enrollment period.

- Leaving incarceration: If you have recently been released from jail or prison, this may be considered a qualifying life event, and you may be eligible for a Special Enrollment Period.

- AmeriCorps service: If you are an AmeriCorps member starting or ending your service, this could be considered a qualifying life event, allowing you to make changes to your health plan outside of the annual enrollment period.

It's important to note that the specific rules and requirements for qualifying life events may vary depending on your location and health insurance provider. Be sure to check with your insurance provider or local regulations for the most accurate and up-to-date information.

Personal Lines Insurance: Does It Cover Life Insurance?

You may want to see also

Special Enrollment Periods

A Special Enrollment Period (SEP) is a time outside the yearly Open Enrollment Period when you can sign up for health insurance. You qualify for an SEP if you've had certain life events, known as Qualifying Life Events (QLEs), or if your household income is below a certain amount.

There are four basic types of qualifying life events:

Loss of Health Coverage

- Losing existing health coverage, including job-based, individual, and student plans

- Losing eligibility for Medicare, Medicaid, or CHIP

- Turning 26 and losing coverage through a parent's plan

Changes in Household

- Getting married or divorced

- Having a baby or adopting a child

Changes in Residence

- Moving to a different ZIP code or county

- Moving to or from the place you attend school (if you're a student)

- Moving to or from the place you both live and work (if you're a seasonal worker)

- Moving to or from a shelter or other transitional housing

Other Qualifying Events

- Changes in your income that affect the coverage you qualify for

- Gaining membership in a federally recognized tribe or status as an Alaska Native Claims Settlement Act (ANCSA) Corporation shareholder

- Becoming a U.S. citizen

- Leaving incarceration (jail or prison)

- AmeriCorps members starting or ending their service

Retired Military: What Life Insurance Benefits Are Available?

You may want to see also

Frequently asked questions

A qualifying life event is a life-changing situation that can impact you and your health insurance. Experiencing a significant life change may allow you to change your health plan outside of the annual enrollment period (also called open enrollment).

Qualifying life events include, but are not limited to, having or adopting a baby, the death of someone who shares your health plan, moving to a new area, earning U.S. citizenship, a shift in employment status, and loss of health insurance.

If you experience a qualifying life event, you qualify for a Special Enrollment Period. This means you can enroll in a health plan outside of the annual enrollment period.

You typically have up to 60 days following a qualifying life event to enroll in a health plan.

The documentation required depends on the type of qualifying life event. Common documents include birth certificates, adoption records, marriage licenses, divorce paperwork, and proof of address, such as a lease or rental agreement.