Deciding on a reasonable auto insurance deductible is a subjective judgment that depends on several factors. A deductible is the amount you pay out of pocket when making a claim, with the insurance company covering the remaining costs. The most common deductible amount is $500, but it can range from $100 to over $2,000. A higher deductible typically results in lower insurance premiums, but it also means you'll pay more if an accident occurs. When choosing a deductible, it's essential to consider your emergency fund, car value, risk tolerance, and ability to cover potential costs. It's a balance between keeping premiums low and ensuring you can afford the deductible if needed.

| Characteristics | Values |

|---|---|

| What is a deductible? | The amount you pay out of pocket when you make a claim. |

| When do you pay a deductible? | When you make a claim under your collision or comprehensive coverage, uninsured or underinsured motorist coverage, or personal injury protection. |

| When is a deductible not required? | When another driver is at fault; when you have a vanishing deductible; when you have a collision deductible waiver; when you have full-glass coverage. |

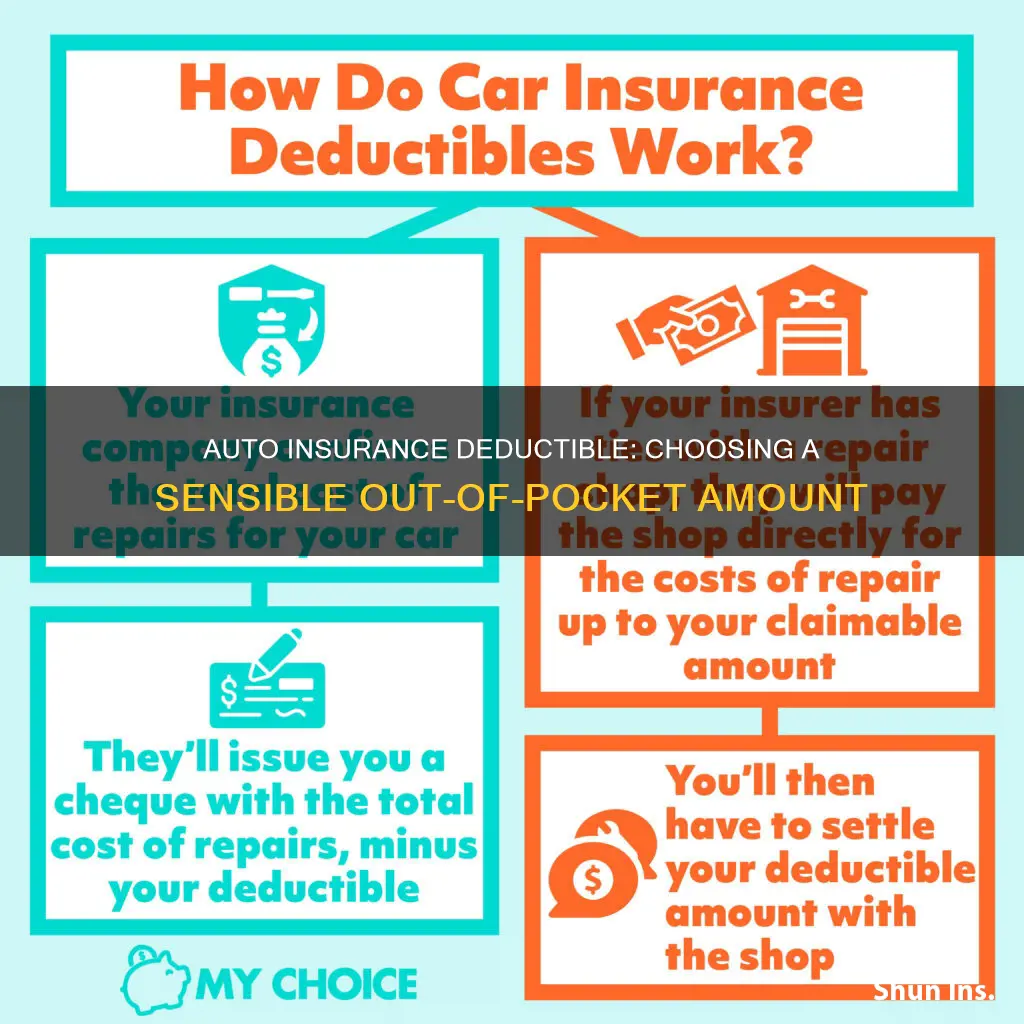

| How does a deductible work? | You pay the deductible to the auto repair shop after they complete the repairs. The insurer will then deduct your portion from the total they send to the repair shop. |

| How does the deductible affect your premium? | A higher deductible results in lower premiums, and vice versa. |

| How to choose a deductible? | Consider how much you can afford to pay out of pocket, your lender's requirements, your accident history, and how often you drive. |

What You'll Learn

A deductible is the amount you pay out-of-pocket when you make a claim

A car insurance deductible is the amount of money you pay out-of-pocket for an accident before your insurance company pays the rest. The average car insurance deductible is $500, with most drivers choosing this option. However, deductibles can range from $100 to over $2,000.

When you buy car insurance, you'll have to make several choices about your insurer and optional coverages. You'll also have to choose your insurance deductible, which can be challenging. Should you try to save money by picking a higher deductible or feel more secure by going with a lower one?

- Your deductible is the portion of the costs you'll pay for a covered claim. It's important to weigh your car's value, your emergency fund, and the costs of coverage when making this decision.

- Choosing a higher deductible may help you save money on premiums, but this means you'll have to pay more out of pocket after an accident. On the other hand, a lower deductible means higher monthly payments.

- Deductibles are used as a way to share the risk between the policyholder and the insurance company. If you didn't have a deductible, you could technically have as many accidents as you wanted at the insurance company's expense. By paying a deductible, you also have a stake in any claims you make.

- Not every type of car insurance uses a deductible. Liability insurance, for example, never uses a deductible. This type of insurance helps cover damages you cause to another person or their property in an accident.

- Collision insurance and comprehensive insurance typically have deductibles. Collision insurance covers accidents, regardless of who is at fault, while comprehensive insurance covers non-collision situations such as hail damage or theft.

- Personal injury protection (PIP) often has a deductible as well. PIP helps cover medical expenses for you and your passengers and is required in some states.

- The right deductible for you depends on several factors, including your driving history, your emergency fund, and your ability to withstand financial loss.

- If you have a good driving record and a high tolerance for risk, you may opt for a higher deductible to save on premiums. Conversely, if you have a history of accidents or want more peace of mind, a lower deductible may be preferable.

- It's important to choose a deductible that you can afford to pay out of pocket in the event of an accident. If you can't afford a high deductible, the financial consequences could be serious.

- Consider your vehicle's value when choosing your deductible. If your car is worth less, you may not want a high deductible because the cost of repairs might not justify the higher deductible.

- Your state laws, dealership requirements, and waivers may also influence your deductible. Some states have minimum deductible requirements, and dealerships may specify a maximum deductible for leased or financed cars.

In summary, a car insurance deductible is the amount you pay out-of-pocket when you make a claim. The choice between a higher or lower deductible depends on your financial situation, risk tolerance, and driving history. By understanding how deductibles work and carefully considering your options, you can make an informed decision about the right deductible for your needs.

Auto Insurance Holder: Understanding Certification and Its Benefits

You may want to see also

A higher deductible means lower monthly payments

When it comes to auto insurance, a deductible is the amount you pay out of pocket when you make a claim. Typically, you have a choice between a low and high deductible, and this choice has implications for your monthly insurance payments. Opting for a higher deductible means you'll pay less each month for your coverage, but there's a trade-off: you'll need to pay more if you ever need to file a claim.

Let's break down how this works. When you choose a higher deductible, you're taking on more financial responsibility in the event of a claim. For example, if you have a $1,000 deductible and end up in an accident that causes $4,000 worth of damage to your car, you'll need to pay that $1,000 deductible before your insurance company steps in to cover the remaining $3,000.

Now, how does this impact your monthly payments? When you have a higher deductible, your insurance company sees you as a lower risk. As a result, they reward you with lower monthly premiums. This is because the insurance company knows that if you have a higher deductible, you're less likely to file a claim for every little incident. They're sharing the risk with you, and you both benefit from fewer claims being made.

The relationship between deductibles and monthly payments can be seen clearly when comparing different deductible levels. For instance, a 34-year-old man with a $50 deductible for comprehensive and collision coverage might pay around $776 per year. However, if he increases his deductible to $250, he'll save about 29% annually, bringing his premium down to $554. If he goes even higher and chooses a $1,000 deductible, his premium could be more than halved, resulting in a yearly savings of $338, or 56%.

While a higher deductible leads to lower monthly payments, it's important to carefully consider this decision. A higher deductible means you'll need to pay more if you ever need to make a claim. Therefore, it's crucial to assess your budget and risk tolerance when deciding on your deductible amount.

Canceling Auto Insurance Early: Options?

You may want to see also

A lower deductible means higher monthly payments

When it comes to auto insurance, a deductible is the amount of money you pay out of pocket for an accident before your insurance company covers the rest. The relationship between the deductible and premium is such that a lower deductible means higher monthly payments. This is because a lower deductible means you have more coverage from your insurance company and pay less out of pocket in the event of a claim.

For example, let's say your policy includes $5,000 in coverage. With a low deductible of $500, your insurance company covers you for $4,500. On the other hand, if you opt for a higher deductible of $1,000, your insurance company will only cover $4,000. As a result, you will have to pay more in monthly premiums to balance out the increased coverage provided by a lower deductible.

It's worth noting that the impact of raising your deductible on your premium may vary depending on other factors such as your vehicle's value, driving record, location, and claims frequency. Additionally, choosing a deductible should also take into account your ability to pay a higher amount in the event of an accident. While a higher deductible may lead to lower premiums, it also means you will have to pay more out of pocket if an accident occurs. Therefore, it is essential to carefully consider your financial situation and comfort level with risk when deciding on the deductible amount.

Effective Strategies for Filing Complaints Against Safeco Auto Insurance

You may want to see also

A deductible is usually a specific dollar amount

A car insurance deductible is the amount of money you pay out of pocket for an accident before your insurance company pays the rest. Deductibles are usually a specific dollar amount, chosen and agreed upon by the policyholder when purchasing an insurance policy. Typically, deductibles range from $100 to $2,000, with $500 being the most common deductible.

When you file a claim, your insurance company will subtract the cost of the deductible from your claim payout. For example, if your mechanic bills $3,000 in repairs and you have a $500 deductible, your insurer will write a check for $2,500 to cover it.

The amount of your deductible is deducted from the insurance payout you receive. You cover the deductible out of your pocket, and the insurer pays for the remainder of your covered losses, up to your policy limits. For instance, if you cause $5,000 of damage to your car in a covered accident and have a $250 deductible, you’d pay $250, and your insurance would cover the remaining $4,750.

It's important to note that not every type of car insurance uses a deductible. Liability insurance, for example, never uses a deductible. This type of insurance helps cover damages you cause to another person or their property in an accident, regardless of fault.

When choosing a deductible, it's essential to consider your financial situation, the value of your vehicle, your emergency fund, and the likelihood of filing a claim. A higher deductible will result in lower premiums, but it also means you'll pay more out of pocket in the event of an accident. On the other hand, a lower deductible will increase your monthly insurance payments but provide more coverage and security in the event of a claim.

Smart Savings: Defensive Driving Insurance Discounts

You may want to see also

Liability coverage usually doesn't have a deductible

When it comes to auto insurance, a deductible is the amount you pay out of pocket when you make a claim. Typically, a deductible is a specific dollar amount, but it can also be a percentage of the total amount of insurance on the policy. For example, if you have a deductible of $1,000 and the cost to repair your car after an accident is $4,000, you will have to pay the $1,000 deductible, and your insurance company will cover the remaining $3,000.

Liability coverage, however, usually doesn't have a deductible. This type of insurance covers damages you cause to another person or their property in an accident, and it is required by most states to legally drive your vehicle. Liability coverage includes property damage coverage, which pays for repairs to the other driver's vehicle, rental vehicles, damage to buildings or other structures, damage to personal property, and legal fees if you're sued for property damage. It also includes bodily injury coverage, which provides payment for medical expenses, rehabilitation, and legal costs for individuals injured in an accident.

While liability coverage doesn't typically have a deductible, other types of auto insurance coverage do. Collision coverage, which pays to repair your car after an accident with another vehicle or structure, usually has a deductible ranging from $100 to $1,000. Comprehensive coverage, which covers damage from non-collision situations like hail damage or theft, typically has a similar deductible range. Personal injury protection (PIP), which is required in 13 states, often has a deductible ranging from $100 to $2,500, although some states like Utah don't allow deductibles for this type of coverage.

The relationship between the deductible and premium is important to consider. A lower deductible generally means higher monthly insurance payments, as your insurance company provides more coverage. On the other hand, a higher deductible results in a reduced insurance premium. For example, if you have a deductible of $500, your insurance company covers you for $4,500 on a policy line of $5,000. But if your deductible is $1,000, the coverage provided by the insurance company decreases to $4,000.

When choosing your auto insurance deductible, it's essential to weigh various factors, including your vehicle's value, your emergency fund, your risk tolerance, and your driving history. While a higher deductible may lower your premium, it's crucial to ensure that you can afford the higher out-of-pocket expenses in the event of an accident.

Stated Amount Auto Insurance: Understanding Your Coverage

You may want to see also

Frequently asked questions

A car insurance deductible is the amount of money you pay out of pocket for a claim before your insurance company pays the rest.

A good car insurance deductible is one that you can afford to pay if your vehicle is unexpectedly damaged. It's based on your risk tolerance and the amount you can afford to pay out of pocket if you file an insurance claim.

The average car insurance deductible is $500. However, it can range from $100 to over $2,000.

Choosing a higher deductible will lower your insurance premium, and selecting a lower deductible will result in a higher premium. This is because the deductible represents the portion of financial responsibility that your insurance company has to bear in the event of a claim.