Life insurance is one of the best ways to protect your loved ones financially. When you take out a life insurance policy, you must name a beneficiary (or multiple beneficiaries) who will receive the death benefit if you pass away while the policy is active. A primary beneficiary is the person or entity who is first in line to receive the death benefit. However, if the primary beneficiary dies before or simultaneously with the policyholder, the death benefit goes to the secondary beneficiary, also known as the contingent beneficiary. This is a crucial step in the process of purchasing life insurance, as it ensures that your loved ones receive the benefit as intended.

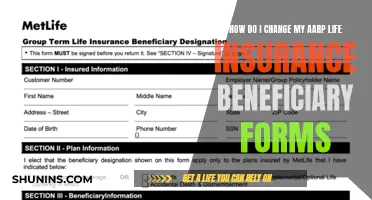

| Characteristics | Values |

|---|---|

| Purpose | To ensure the death benefit payout goes to the people you want to protect |

| Who can be a beneficiary | Any person or entity (e.g. a charity) |

| Number of beneficiaries | One or more |

| Types of beneficiaries | Primary, secondary, tertiary, etc. |

| Designation | Revocable or irrevocable |

| Allocation | Doesn't have to be even; can be by dollar amount or percentage |

What You'll Learn

What is a primary beneficiary?

A primary beneficiary is the person or entity who is first in line to receive benefits in a will, trust, retirement account, life insurance policy, or annuity upon the account holder's death. An individual can name multiple primary beneficiaries and stipulate how distributions would be allocated. For example, a parent with a $100,000 life insurance policy can name their son and daughter as the primary beneficiaries, but also decide how to distribute the assets. This means the daughter can receive $60,000, and the son can get $40,000 upon the policyholder's death. Each can also receive equal 50% portions of $50,000 should the parent make that clear in the insurance policy.

The primary beneficiary is typically the spouse, children, or other family members of the deceased. However, there is no requirement to name a family member as a life insurance beneficiary; anyone can be designated. For instance, if no one is financially dependent on the deceased, they might consider a favourite charity as the beneficiary of their death benefit. By designating the organisation of their choice as their primary life insurance beneficiary, they ensure the payout will be donated to them upon their death.

It is important to keep beneficiary designations up to date as life changes (marriage, children, divorce, etc.). While it is not mandatory to name a beneficiary, it is usually the reason people buy life insurance in the first place—to provide a benefit to the people they care about.

If the primary beneficiary is no longer alive or able to collect, a contingent beneficiary may also be named.

Whole Life Insurance: Maximizing Benefits for You and Your Family

You may want to see also

What is a contingent beneficiary?

A contingent beneficiary, also referred to as a secondary beneficiary, is a person or institution chosen by the policyholder to receive the death benefit or payout from their insurance policy, retirement account, or another financial account, in the event that the primary beneficiary is unable to accept the benefit. This may be because the primary beneficiary has died, can't be located, or chooses not to accept the assets.

The contingent beneficiary acts as a backup to ensure that the benefit is received by someone the policyholder intends it for, and to avoid legal proceedings that could cost the beneficiary time and money. The number of contingent beneficiaries is up to the policyholder, who can also choose how much of the benefit each beneficiary will receive.

While it is not required to name a contingent beneficiary, it is highly recommended to ensure that assets go where intended.

Make Money by Selling Term Life Insurance?

You may want to see also

Who can be a beneficiary?

When choosing a life insurance policy beneficiary, you can name more than one person or entity to receive the benefits. You can choose to name one specific person, a trust, or multiple people as beneficiaries.

Some common beneficiaries for life insurance plans are spouses, family members, business colleagues, charities, and trusts.

Technically, anyone can be named as a beneficiary, but there are some things to consider:

- Spouse: People who are married with children still living at home commonly designate their spouse as the only primary beneficiary. If you live in a state with common property laws, you may need your spouse's consent to name anyone else as the primary beneficiary.

- Other family members: It is not uncommon to divide the proceeds among a spouse and any adult children. You can also consider allocating a share to other family members, such as a parent who is financially dependent on you or a sibling with special needs.

- Friends: Friends can be designated as beneficiaries, but since friendships can change over the years, it may be a good idea to designate them as revocable beneficiaries.

- People with whom you have a financial relationship: If someone co-signed your mortgage or business loan, or helped pay for your education, they can be designated as beneficiaries to help ensure your financial obligations are met.

- Minors: Minors cannot legally manage their money. If you want to name minor children as beneficiaries, the life insurance company may require that you also name a legal guardian for them.

- Your estate: You can choose to leave the entire policy proceeds to your estate, where it will be distributed after probate by your Executor according to the terms of your will.

- A trust: A trust is an entity that can hold assets over time, with a Trustee that you designate to distribute funds according to the conditions you set.

- A charity: A charity or church can be named as a primary or contingent beneficiary.

It is important to note that you don't have to choose just one person to inherit your death benefit. You can include multiple beneficiaries at each level and elect a percentage that you'd like each to receive.

Life Insurance: Who's Missing Out and Where?

You may want to see also

What happens if you don't name a beneficiary?

If you don't name a beneficiary, it may be unclear who is entitled to the funds, which can delay the benefit payment. The money will likely be paid to your estate or held in probate. This means that your loved ones may not receive the death benefit payout for years.

Probate is a legal process where a court determines how your assets, including life insurance policies, are distributed if you have not specified your wishes. This process can be lengthy, complicated, and costly. Court fees and legal costs can reduce the death benefit payout.

In the case of retirement accounts like a 401(k), if you die without a beneficiary, your assets will likely be held in probate. For most life insurance policies, there is a default order of payment if no beneficiary is named. The death benefit will be paid to the owner of the policy if they are different from the insured person and still alive, or to the owner's estate. For group insurance policies, the order typically starts with your spouse, then your children, then your parents, and then your estate.

If there is no default order specified in your policy, the payout may be paid to your estate or held in probate. This can cause conflict among loved ones and result in legal disputes. Therefore, it is important to name your beneficiaries when you get a life insurance policy.

Life Insurance Cash Value: Safe from Government Seizure?

You may want to see also

How to choose a beneficiary?

Choosing a beneficiary for your life insurance is a crucial step in purchasing your policy. Here are some detailed and instructive guidelines on how to choose a beneficiary:

Understand the role of a beneficiary

Firstly, it is important to understand who a beneficiary is and their role. A beneficiary is the person or entity that you legally designate to receive the benefits from your life insurance policy or other financial products. This person will receive the death benefit payout after your passing, so it is a significant decision that requires careful consideration.

Consider your relationships and priorities

Think about your relationships and who you want to benefit from the financial safety net you are creating. This could be a spouse, children, siblings, or other family members. Consider if anyone relies on you financially, such as aging parents or a close friend. If you have minor children, you may also want to set up a trust and name it as the beneficiary to manage assets for them until they reach legal adulthood.

Primary and contingent beneficiaries

You will need to choose a primary beneficiary, who is your first choice to receive the payout. It is also a good idea to name a secondary or contingent beneficiary, who will receive the payout if your primary beneficiary passes away, or if you both die at the same time. This ensures your wishes are respected, and your payout goes to the right person or entity.

Multiple beneficiaries

You can also choose multiple beneficiaries and decide how you want the money to be split between them, usually by percentage. This allows you to spread the benefits across several people or organisations, such as charities.

Revocable vs irrevocable beneficiaries

When setting up your policy, you will also need to decide between revocable and irrevocable beneficiaries. A revocable beneficiary offers flexibility as you can change your choice at any time, but an irrevocable beneficiary cannot be changed without their agreement, providing more guaranteed financial protection.

Keep your beneficiary designations up to date

Remember to review and update your beneficiary designations as your life changes, such as marriage, divorce, having children, or experiencing the death of a loved one. This will ensure that your life insurance policy remains relevant to your current circumstances and priorities.

Check state laws and insurance company requirements

Finally, be sure to check with your insurance company and your state for any specific requirements or restrictions on beneficiaries. For example, some states may require you to list your spouse as your primary beneficiary.

Your Doctor, Your Life Insurance Exam: Is it Possible?

You may want to see also

Frequently asked questions

A second beneficiary in life insurance is also known as a contingent or secondary beneficiary. They are the person or entity that will receive the death benefit payout if the primary beneficiary passes away before, or at the same time as, the policyholder.

Choosing a second beneficiary can give you peace of mind, as it ensures your life insurance payout will be used as intended. It can also help to avoid legal proceedings if there is no living primary beneficiary, which could cost your loved ones additional time and money.

Choosing a second beneficiary is a personal decision. You may want to consider someone who is financially dependent on you, or who will bear certain expenses upon your death. It is important to keep your beneficiary designations up to date and to provide as much information as possible, including their full legal name, address, date of birth, and Social Security number.