An active vehicle insurance declaration, also known as a dec page, is a document that summarises the key aspects of your car insurance policy. It outlines essential details such as insured names, policy numbers, vehicle data, coverage limits, and cost. The purpose of this document is to provide a concise overview of your coverage, clarifying specifics for both the insured individual and any third parties. It is typically sent to the policyholder by the insurance company via email, post, or through an online portal.

| Characteristics | Values |

|---|---|

| Purpose | To provide a summary of your auto policy |

| Coverage | Insured parties, vehicles, coverage limits, cost and policy duration |

| Accessibility | Available online or through mailed copies from the insurer |

| Use cases | Reviewing policy details, filing a claim, renewing or changing a policy |

| Proof of insurance | Not sufficient proof of insurance for traffic stops or vehicle registration |

What You'll Learn

What is a car insurance declaration page?

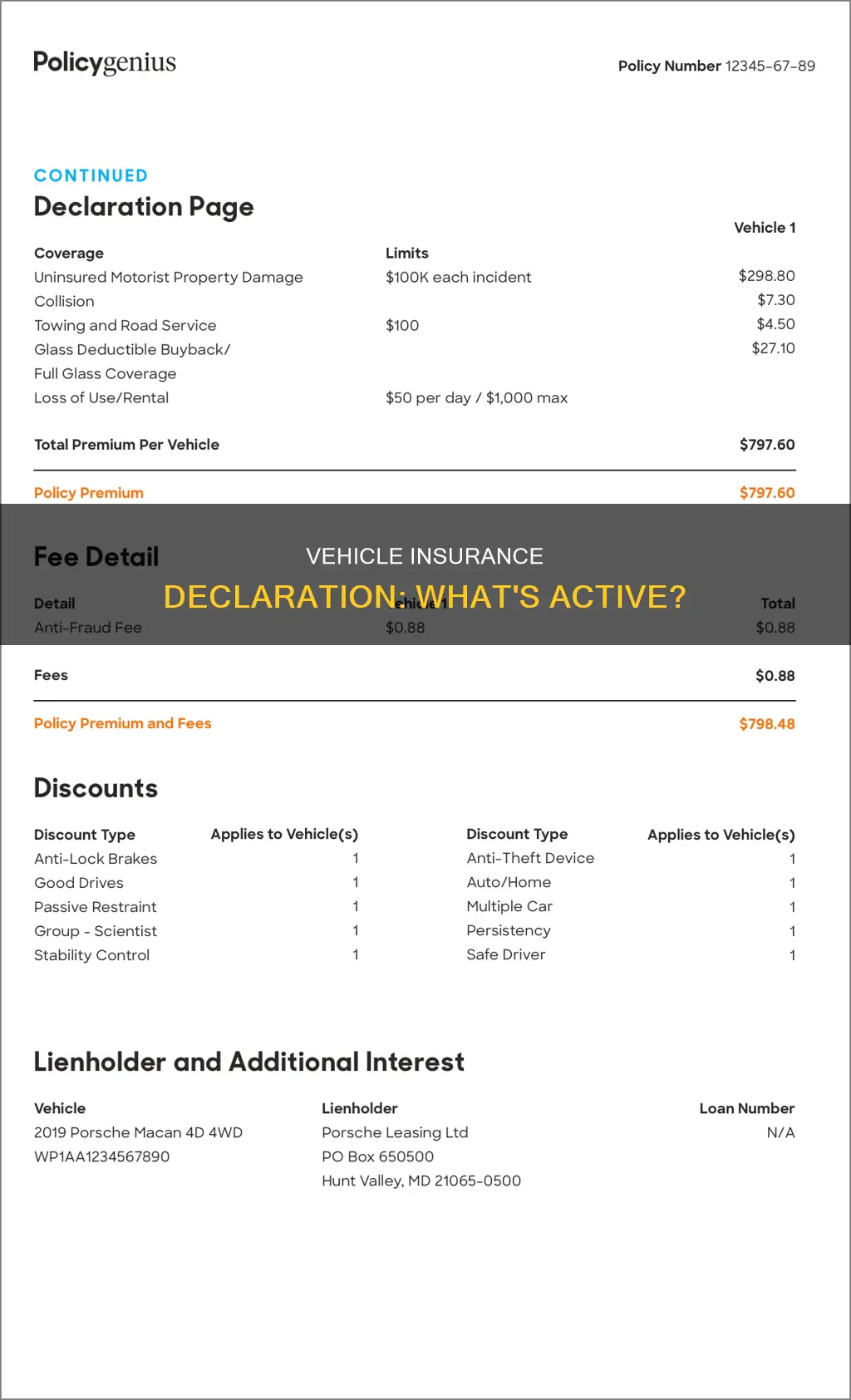

A car insurance declaration page is a summary of your auto insurance policy, usually covering one or two pages. It provides a concise summary of vital policy information, including policy periods and numbers, insured drivers, covered vehicles, and elected coverages.

The declaration page may be a stand-alone document or the beginning of your entire auto insurance policy. It is often sent to you via email, fax, or regular mail by your insurance company as soon as you buy your policy. Many insurers also allow you to access your declaration page online.

- Policy number, the date coverage goes into effect, and the expiration date.

- Agent's name and contact information.

- Names of all insured drivers, including the policyholder and any additional drivers.

- All cars covered by the policy, identified by make, model, year, and Vehicle Identification Number (VIN).

- Types of coverage, including specific limits for each coverage type, such as per-person and per-accident limits for bodily injury liability, and limits on additional coverage types such as uninsured motorist coverage or personal injury protection.

- Deductible amounts for comprehensive car insurance coverage and auto collision coverage, if added to the policy.

- A breakdown of the premium, showing how much you are paying for each coverage type and vehicle, along with any applicable discounts.

While the declaration page provides a helpful summary of your policy, it is not typically used as proof of insurance. For that, you would need to carry a physical or digital insurance card in your vehicle.

Vehicle Insurance: Am I Covered?

You may want to see also

What does it include?

An active vehicle insurance declaration, also known as a "dec page", is a summary of your auto insurance policy. It includes a lot of important information, such as:

- Policyholder's name: The name of the main individual or entity the insurance policy covers.

- Policy number: The unique identification number of your insurance policy.

- Policy term: Your insurance coverage's effective dates and duration.

- Vehicle details: Information about the insured vehicle(s), such as make, model, and Vehicle Identification Number (VIN).

- Coverage types and limits: The types of coverage included in the policy (like liability, collision, and comprehensive) and the maximum amounts your insurer will pay out for different types of claims.

- Premiums: The cost you pay for your insurance policy, which can be broken down by coverage type and vehicle.

- Discounts: Any discounts you get from your insurer, which may include things like safe driving, bundling multiple policies, or installing security features in your car.

- Deductibles: The amount you must pay out-of-pocket before your insurance coverage kicks in.

- Excluded drivers: Individuals not covered by the policy.

- Endorsements: Optional coverages like roadside assistance or rental reimbursement.

- Agent information: Contact information for your insurance agent, if you have one.

- Policy period: The expiration date for your coverage, typically six or 12 months from the start date.

- Lender information: If you lease your car or have an auto loan, the name and contact information of the lender.

The dec page is usually found at the beginning of your policy documents or in a prominent place on insurance websites and apps. It is meant to give you a concise overview of your coverage and can be useful for understanding your policy, comparing insurance options, and filing claims. However, it is not typically accepted as proof of insurance.

Vehicle Insurance: MID Registration

You may want to see also

When do you need to use it?

You should use your vehicle insurance declaration when you:

- First buy your policy: Check that everything is correct, including your name, address, coverage types, limits, deductibles, and premium amounts.

- Need a reminder of what coverage you have: The declaration page provides a concise summary of your policy, including the types of coverage, limits, deductibles, and costs.

- Shop around for a new policy: You can use your current declaration page to compare coverage and costs with quotes from other insurance providers.

- Need to file a claim: Your declaration page provides crucial information, such as your policy number, coverage details, deductibles, and contact information for your insurer.

- Renew or change your policy: Refer to your declaration page to understand your current coverage and costs before making any changes or renewing your policy.

- Are in an accident: If you're involved in an accident, your declaration page can be presented to law enforcement or other parties as a comprehensive summary of your insurance coverage. However, it is not considered proof of insurance, and you should carry a physical or digital insurance card for that purpose.

Leased Vehicles: Gap Insurance Essential?

You may want to see also

Where do you find it?

An auto insurance declaration page is usually sent to you by your insurance company via email, fax, or regular mail as soon as you buy your policy. Many insurers also allow you to access your declaration page online, either through a web portal or a mobile app. You can also contact your insurance agent to request a copy of your declaration page if you need an extra copy or lose the original.

When you first purchase a car insurance policy, your provider will either mail or email you a copy of your policy documents, including the declarations page. If you have an online account with your insurance company, you should be able to log in and download a copy of your declarations page directly from their website.

Total Loss Insurance: What's Covered?

You may want to see also

Can you use it as proof of coverage?

An active vehicle insurance declaration, also known as a declarations page, dec page, or insurance ID card, is a document that outlines the key details of your insurance policy. It is a concise summary of your policy, displaying insured parties, vehicles, coverage limits, cost, and policy duration. It is usually provided by your insurer in the form of a printed or electronic card.

Now, can you use it as proof of coverage? Well, it depends. While the declarations page provides detailed information about your insurance policy, it is not always accepted as the sole proof of insurance. In most states, you can use a digital or physical copy of your insurance card or declarations page as proof of coverage when requested by law enforcement, the DMV, or other entities. However, some states, like New Mexico, may require a physical copy, and it's always a good idea to carry one in your vehicle.

Additionally, when dealing with certain entities, such as lenders or the Department of Motor Vehicles, they may require additional documentation like a certificate of insurance, which is similar to the declarations page but excludes specific details. Therefore, while your active vehicle insurance declaration can be useful as a form of proof of coverage in certain situations, it is essential to always carry your insurance card and be aware of the specific requirements of the state you are in or the entity requesting the proof of coverage.

Unlicensed Vehicles: Need Insurance?

You may want to see also

Frequently asked questions

An active vehicle insurance declaration is a document that outlines the key details of your insurance policy. It includes information such as the policyholder's name, policy number, policy term, vehicle details, coverage limits, premiums, and deductibles. It serves as a quick reference guide and provides a concise summary of your coverage.

An active vehicle insurance declaration includes the policyholder's name, policy number, term of the policy, vehicle details such as make, model, and Vehicle Identification Number (VIN), coverage types and limits, premiums and discounts received, and deductibles. It also includes the contact information of the insurance company or agent.

An active vehicle insurance declaration is important as it provides a comprehensive summary of your car insurance policy. It helps you understand your coverage, limits, and deductibles, and can be useful when filing a claim or reviewing your policy. It also serves as proof of insurance in certain cases.

You should refer to your active vehicle insurance declaration when reviewing your policy, comparing insurance offers, or filing an insurance claim. It can help you identify your policy number, determine your coverage and deductibles, and check for additional insured or excluded drivers.

Your insurance company will typically send you the active vehicle insurance declaration via email, regular mail, or through an online portal when you purchase or renew your policy. You can also access it by logging into the insurance company's website or mobile app, or by contacting your insurer or agent directly.