An auto insurance declaration page is a summary of your car insurance policy, providing a concise overview of vital policy information. This document is typically sent to the policyholder by the insurance company via email, fax, or regular mail after purchasing or renewing a policy. It includes essential details such as the policy number, effective date, expiration date, insured drivers, covered vehicles, and elected coverages. The declaration page also outlines the types of coverage, their limits, deductibles, and the associated costs. It is a useful reference for understanding your coverage, comparing quotes, and filing claims. However, it is not considered proof of insurance in most cases.

| Characteristics | Values |

|---|---|

| Purpose | To provide a summary of your auto insurance policy |

| Information | Policy number, effective date, agent information, policyholder details, covered drivers, vehicle details, coverage details, policy period, loss payee, discounts |

| Format | Physical copy or online |

| Use Cases | Quick reference, getting quotes from other companies, understanding coverage, filing a claim |

| Not Suitable For | Proof of insurance for law enforcement or the DMV |

What You'll Learn

What is an auto insurance declaration page?

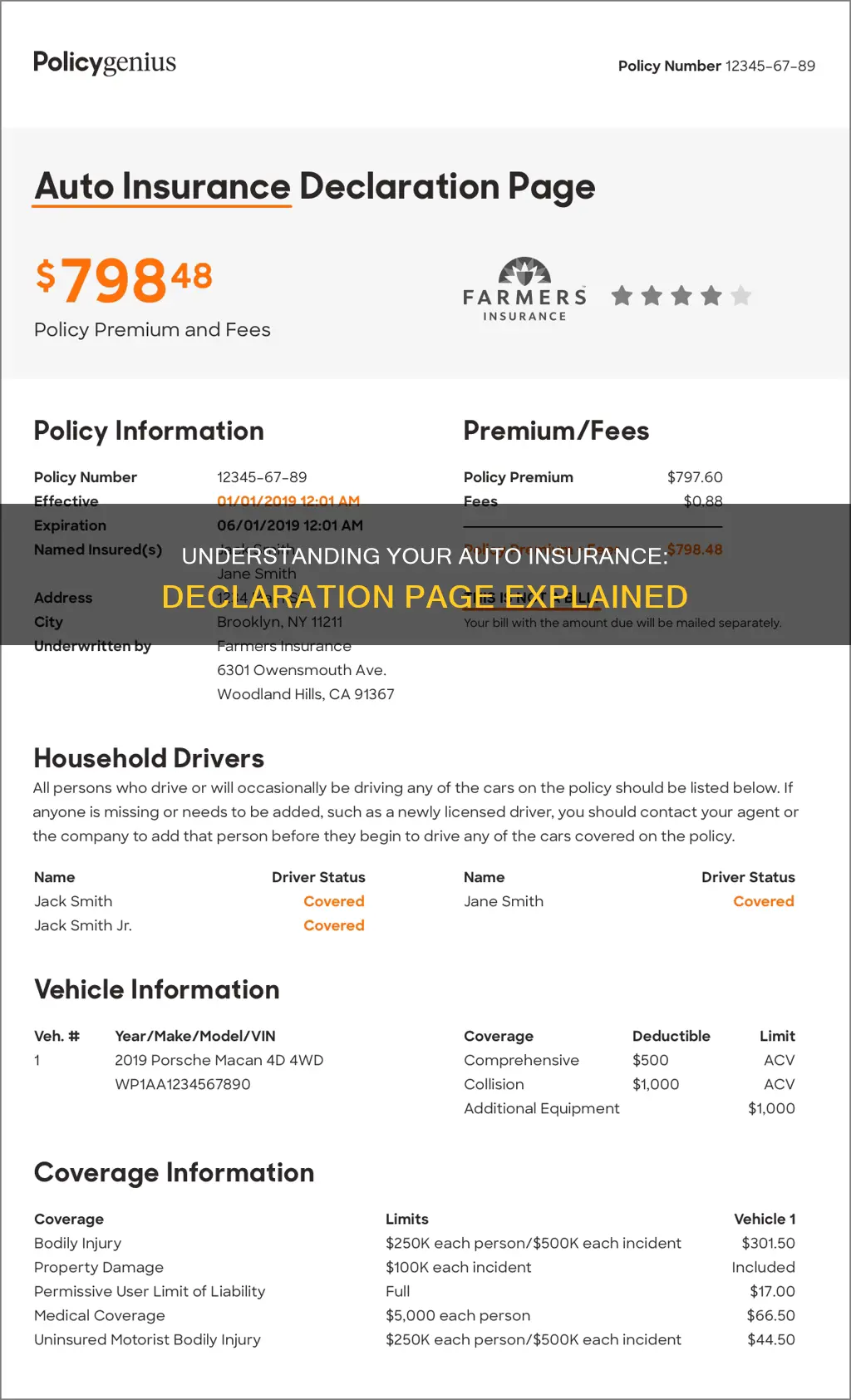

An auto insurance declaration page is a document that provides a summary of your car insurance policy. It includes key details such as the policy number, the date coverage starts and ends, the insured drivers, the vehicles covered, and the types of coverage. It also outlines the limits and deductibles of the policy, as well as any discounts that are applied. The declaration page is typically sent to the policyholder by the insurance company after the purchase of the policy. It serves as a quick reference guide for the policyholder to understand their coverage and can be useful when filing a claim or comparing policies.

The auto insurance declaration page is usually a two- to five-page document that summarises the vital information about the policy. It includes the policy number, which is needed when filing an insurance claim or contacting the insurer for support. The page also lists the policy effective date, which is when the coverage begins, and the expiration date, which is typically six or twelve months from the start date.

The declaration page also includes the agent's information, such as their name and contact details, if the policy was purchased through an agent. Additionally, it lists the names of all the insured drivers, including the policyholder and any additional drivers covered under the same policy.

All the vehicles covered by the policy are also listed on the declaration page, along with their make, model, year, and Vehicle Identification Number (VIN). If there are different types and amounts of coverage for each vehicle, the declaration page helps to clarify these details.

The declaration page also outlines the coverage limits, which are the maximum amounts the insurer will pay for a covered claim. It also includes any deductibles, which are the out-of-pocket amounts the policyholder must pay when filing a claim. The page may also break down the premium, showing how much is being paid for each coverage type and vehicle.

Overall, the auto insurance declaration page is a comprehensive summary of the policy, providing important details about the coverage, insured drivers, vehicles, and costs. It is a useful reference for policyholders to understand their insurance coverage and their rights in the event of an accident or incident.

Auto Insurance: Who's Covered and Who's Not?

You may want to see also

What does an auto insurance declaration page contain?

An auto insurance declaration page, also known as a "dec page", provides a summary of your car insurance policy. It contains all the key details of your insurance policy, including the following:

- Policy number and effective date: The unique number attached to your policy, which is required when filing an insurance claim, along with the date the policy comes into effect and coverage begins.

- Agent information: Contact details for your insurance agent, if you have one.

- Policyholder details: The name, address, and phone number of the policyholder.

- Covered drivers: A list of any drivers officially covered under the policy and any drivers that are excluded.

- Vehicle details: Information about the covered vehicle(s), including the year, make, model, vehicle identification number (VIN), and average mileage.

- Coverage details: The types of coverage included in the policy, such as accident forgiveness, along with coverage limits, deductibles, and policy add-ons.

- Policy period: The expiration date for your coverage, typically six or twelve months from the start date.

- Loss payee: Any party with a vested interest in the vehicle, such as the lender if the vehicle is leased or financed.

- Discounts: Details of any insurer discounts applied to the policy.

- Policy cost: A breakdown of how much you are paying for each coverage type and vehicle, including any discounts.

The declaration page is usually two to five pages long and serves as a quick reference guide to your policy. It is not typically used as proof of insurance, but it can be useful for understanding your coverage and comparing it to other policies.

Your Driving Record and Auto Insurance: What's the Connection?

You may want to see also

Who needs an auto insurance declaration page?

An auto insurance declaration page is a summary of your auto insurance policy. It is usually the first page or pages of your policy document. It is also known as a "dec page".

Anyone with car insurance should keep a copy of their auto insurance declaration page easily accessible. This is so that you can refer to it if you have an accident or other incident and your insurance agent isn't available. The declaration page could help you figure out what damages should be covered and what limits will apply, so you can decide whether to file a claim.

It's also useful to have your declaration page to hand when it's time to renew your policy, so you can review and assess your coverage. For example, if you've paid off your auto loan, you'll want to make sure your lender is no longer listed on your policy. Or you may want to increase or decrease your coverage limits depending on your vehicle's current value. You can also use it to compare your current policy details to quotes from other insurers.

Your insurance company will usually send your insurance policy declaration page automatically as soon as you sign up for auto insurance. You'll find it at the beginning of your policy documents, which you may receive by email, fax, or regular mail. It's also becoming more common for insurers to make your declaration page available online through a web portal.

Auto Insurance: Adding Your Child as a Driver

You may want to see also

How do you get an auto insurance declaration page?

An auto insurance declaration page is a summary of your car insurance policy, including the types of coverage, the cost of each, and the total premium. It also includes details of the insured drivers and vehicles, as well as the policy number, period, and any discounts applied. This document is useful for quickly checking the details of your policy and is often the first page of your insurance policy document. It is not, however, proof of insurance.

When you first purchase a car insurance policy, your insurance company will send you a copy of your policy with the declaration page attached to the front. This is usually sent via mail, but may also be sent via email or fax. If you bought your policy online, you may be able to print a declaration page directly from your insurer's website.

You should receive a new declaration page each time you renew or make changes to your policy. If you lose your declaration page, you can request a replacement from your insurer. Some companies also allow you to access your declaration page online through a web portal or app.

Hawaii Auto Liability Insurance: Victim's Coverage Explained

You may want to see also

When should you use an auto insurance declaration page?

An auto insurance declaration page is a summary of your auto policy, usually one or two pages long. It is a useful document to refer to when you need to quickly understand the key aspects of your insurance policy.

When You First Buy Your Policy

When you first buy your auto insurance policy, you should refer to the declaration page to ensure that all the information is correct. Details such as your name, address, vehicle information, policy details, and discounts should be checked for accuracy.

When You Need to Verify Your Coverage

If you need a reminder of what coverage you have, the declaration page will outline the types of coverage, the limits, and the deductibles. It will also list the vehicles and drivers covered by the policy.

When Shopping for a New Policy

When comparing quotes from different insurance companies, the declaration page can be a handy reference to understand your current policy details, coverage limits, and premiums. This will help you make informed decisions when considering alternative policies.

When Filing a Claim

In the event of an accident or incident, you can refer to the declaration page to understand what damages are covered and what limits apply. This information will help you decide whether to file a claim.

It is important to note that the auto insurance declaration page is not proof of insurance. For that, you will need to keep your auto insurance ID card with you, either physically or digitally.

Beneficiary Basics: Vehicle Insurance

You may want to see also

Frequently asked questions

An auto insurance declaration page is a summary of your auto insurance policy. It includes details such as the policy number, the date coverage starts, the expiration date, the insured drivers, the covered vehicles, and the types of coverage.

An auto insurance declaration page includes the policyholder's name and vehicle information, such as the make, model, and vehicle identification number (VIN). It also includes the insurer's or agency's contact information, lender information, policy details, premium, and any discounts.

Anyone who has car insurance should keep a copy of their auto insurance declaration page easily accessible. This document can be useful if you need to understand what your policy covers, get quotes from other companies, or file a claim.

When you purchase or make changes to an auto insurance policy, your insurance company will typically send you a copy of your declaration page via email, fax, or regular mail. You may also be able to access it through your insurance company's website or mobile app.

No, an auto insurance declaration page is not the same as proof of insurance. While it provides information about your coverage and policy details, it is not meant to be used as proof of insurance. For that, you will need an insurance card or a certificate of insurance.