IPA medical insurance, short for Independent Practice Association medical insurance, is a type of health coverage designed specifically for healthcare professionals. It provides a comprehensive benefits package tailored to the unique needs of doctors, dentists, and other medical practitioners. This insurance offers a range of features, including coverage for medical malpractice, professional liability, and various healthcare services, ensuring that healthcare providers can focus on patient care without the added stress of financial concerns.

What You'll Learn

- Coverage: Comprehensive health insurance covering medical expenses and treatments

- Benefits: Includes hospitalization, doctor visits, and prescription drug coverage

- Network: Access to a network of healthcare providers and specialists

- Premiums: Regular payments made by the insured to the insurance company

- Exclusions: Specific treatments or services not covered by the policy

Coverage: Comprehensive health insurance covering medical expenses and treatments

Comprehensive health insurance, often referred to as 'IPA Medical Insurance', is a type of coverage that provides extensive protection for individuals and families. This insurance plan is designed to cover a wide range of medical expenses and treatments, ensuring that policyholders can access necessary healthcare services without incurring significant financial burdens. Here's a detailed breakdown of what this coverage entails:

Medical Expenses: This insurance policy typically covers a broad spectrum of medical costs. It includes expenses related to doctor visits, hospital stays, emergency room visits, and various medical procedures. From routine check-ups and vaccinations to more complex surgeries and treatments, comprehensive health insurance aims to cover it all. Policyholders can seek medical attention without worrying about the financial implications, as the insurance provider will often negotiate rates with healthcare providers to ensure affordable access.

Prescription Drugs: One of the critical aspects of comprehensive health insurance is the coverage of prescription medications. This coverage ensures that individuals have access to necessary medications, whether it's for managing chronic conditions or treating acute illnesses. Many plans offer a formulary, which is a list of covered drugs, and may provide different tiers of coverage for generic, preferred brand, and non-preferred brand medications. This structure encourages the use of cost-effective drugs while still providing access to essential medications.

Preventive Care and Wellness: Comprehensive health insurance also emphasizes preventive care and wellness programs. This includes coverage for routine screenings, vaccinations, and health maintenance services. By promoting preventive care, the insurance aims to detect potential health issues early, which can lead to better outcomes and potentially lower costs in the long run. Additionally, wellness programs may offer incentives or discounts for policyholders who participate in health-enhancing activities or meet specific health goals.

Inpatient and Outpatient Services: The coverage extends to both inpatient and outpatient services. Inpatient care, which involves hospital stays, is typically covered for various medical conditions and surgeries. Outpatient services, such as doctor's visits, laboratory tests, and minor procedures, are also included. This comprehensive approach ensures that individuals can receive the necessary care, whether it requires an overnight stay in a hospital or a quick visit to a specialist.

Specialist Referrals and Second Opinions: Another advantage of comprehensive health insurance is the coverage for specialist referrals and second opinions. If a primary care physician refers a patient to a specialist, the insurance will often cover the associated costs. Additionally, seeking a second opinion for complex medical decisions is also typically included, ensuring that policyholders have access to diverse medical perspectives and the best possible treatment options.

Understanding the coverage provided by comprehensive health insurance is essential for individuals and families to make informed decisions about their healthcare. This type of insurance plays a crucial role in ensuring that medical expenses do not become a financial burden, allowing policyholders to focus on their health and well-being.

Northern Nevada Medical Group: Insurance Coverage Explained

You may want to see also

Benefits: Includes hospitalization, doctor visits, and prescription drug coverage

When considering your healthcare options, understanding the benefits of IPA medical insurance is crucial. This type of insurance plan offers comprehensive coverage, ensuring that your medical needs are met with a range of essential services. Here's a breakdown of the key advantages:

Hospitalization coverage is a cornerstone of IPA insurance. It provides financial protection during extended hospital stays, which can be costly without insurance. This coverage ensures that you're not burdened with unexpected medical bills, allowing you to focus on your recovery. Whether it's a routine procedure or a complex surgery, having this benefit can provide peace of mind, knowing that your hospital expenses are covered.

Regular doctor visits are an integral part of maintaining good health. IPA medical insurance recognizes this and includes coverage for these visits. This means you can access primary care services, annual check-ups, and consultations with specialists without incurring significant out-of-pocket expenses. Regular check-ups are essential for disease prevention and early detection, making this benefit a valuable asset for your long-term well-being.

Prescription drug coverage is another critical aspect of IPA insurance. Managing chronic conditions or recovering from illnesses often requires medication. With this coverage, you can access the medications you need at a reduced cost. It ensures that you can adhere to your prescribed treatment plan without financial barriers, promoting better health outcomes.

In summary, IPA medical insurance provides a comprehensive safety net for your healthcare needs. It covers essential services like hospitalization, doctor visits, and prescription drugs, ensuring that you receive the care you need when you need it. Understanding these benefits can help you make informed decisions about your insurance coverage, ultimately leading to a healthier and more secure future.

Private Insurance vs. Medicaid: Unlocking the Best Healthcare Option

You may want to see also

Network: Access to a network of healthcare providers and specialists

When it comes to understanding IPA medical insurance, one of the key aspects is the network of healthcare providers and specialists that members have access to. This network is a crucial component of the insurance plan, as it determines the level of care and support available to policyholders.

The IPA (Independent Practice Association) model often involves a carefully curated network of healthcare professionals who have agreed to provide services to the insurance plan's members. This network is typically made up of doctors, specialists, hospitals, and other medical facilities. The primary goal is to ensure that members have convenient and timely access to quality healthcare.

With an IPA insurance plan, members are generally encouraged to use the in-network providers to ensure cost-effectiveness. In-network healthcare professionals have agreed to accept the insurance company's set rates, which often results in lower out-of-pocket expenses for the insured. When a member visits an in-network doctor or specialist, the insurance company typically covers a significant portion of the costs, making it more affordable for the individual.

Access to a wide network of specialists is particularly beneficial as it allows members to receive specialized care without extensive research or referrals. Whether it's a cardiologist, neurologist, or oncologist, having a network of specialists ensures that members can quickly find and consult experts in their respective fields. This is especially important for individuals with chronic conditions or those requiring complex medical treatments.

Additionally, IPA plans often provide tools and resources to help members navigate the network effectively. This may include online directories, member portals, or dedicated customer support teams that can assist with finding in-network providers and scheduling appointments. By streamlining access to the network, IPA insurance aims to improve the overall patient experience and ensure that members receive the care they need efficiently.

Navigating Medical Releases: Weighing Risks and Benefits for Insurance Adjusters

You may want to see also

Premiums: Regular payments made by the insured to the insurance company

When it comes to IPA medical insurance, understanding the concept of premiums is essential. Premiums are a fundamental aspect of any insurance policy, representing the regular payments made by the insured individual or entity to the insurance company. These payments are typically made on a periodic basis, such as monthly, quarterly, or annually, and are a crucial component of the insurance contract.

In the context of IPA (Individual Practice Association) medical insurance, premiums are often structured to cover the costs associated with potential medical expenses. The insured individual agrees to pay a certain amount regularly to the insurance provider, ensuring that they have access to healthcare services when needed. These premiums are calculated based on various factors, including the individual's age, health status, chosen coverage level, and the specific terms of the IPA insurance plan.

The amount of the premium can vary significantly depending on the insurance company and the specific plan selected. Generally, higher coverage limits and more comprehensive benefits will result in higher premiums. For instance, a plan with extensive coverage for specialized treatments or a higher annual deductible might require a more substantial premium payment. It is important for individuals to carefully review the premium structure and understand the value they receive in exchange for these regular payments.

Regular premium payments are a commitment to the insurance company, ensuring that the insured party has access to the promised benefits. These payments also contribute to the overall stability and sustainability of the insurance provider's operations. By understanding the premium structure and its implications, individuals can make informed decisions when choosing an IPA medical insurance plan that aligns with their financial capabilities and healthcare needs.

In summary, premiums are a vital aspect of IPA medical insurance, representing the insured individual's regular financial contribution to the insurance company. These payments facilitate access to healthcare services and are a key factor in the overall insurance experience. It is essential for policyholders to be aware of premium amounts, payment schedules, and the value derived from their insurance coverage.

Unraveling Health Insurance's Past: Coverage for Medical Bills

You may want to see also

Exclusions: Specific treatments or services not covered by the policy

When considering an IPA (Individual Practice Association) medical insurance plan, it's crucial to understand the specific treatments and services that may not be covered under the policy. These exclusions are designed to manage costs and ensure that the insurance provider can financially support the plan's other benefits. Here's a detailed breakdown of what you need to know:

Preventive Care and Routine Check-ups: IPA medical insurance often provides comprehensive coverage for preventive care, which includes regular check-ups, vaccinations, and screenings. However, it's important to note that this coverage might not extend to routine physical examinations or annual health assessments that are considered standard and necessary by the insurance provider. These routine services may be excluded to encourage members to seek medical attention only when necessary.

Cosmetic and Elective Procedures: Treatments primarily aimed at improving appearance or enhancing physical appearance are often excluded. This category includes cosmetic surgeries, non-essential cosmetic dental procedures, and elective cosmetic treatments. For example, a procedure to change the shape of your nose or a non-essential dental implant might not be covered.

Substance Abuse and Mental Health Services: While mental health coverage varies, many IPA policies exclude treatment for substance abuse, including drug and alcohol rehabilitation. Additionally, specific mental health services, such as routine therapy sessions or certain types of psychiatric care, may also be excluded. It's essential to review the policy to understand the extent of coverage for these services.

Chronic Disease Management: Management of chronic conditions like diabetes or hypertension might have specific exclusions. For instance, routine monitoring and management of these conditions could be covered, but specialized treatments or medications might not be included. Understanding these exclusions is vital for individuals with chronic illnesses to ensure they receive the necessary care.

Alternative and Complementary Treatments: Services like acupuncture, homeopathic medicine, or other alternative therapies might not be covered. These treatments are often considered experimental or not supported by mainstream medical evidence. It's advisable to verify the coverage for any complementary or alternative medicine you intend to use.

Being aware of these exclusions is essential for IPA medical insurance policyholders to manage their expectations and healthcare costs effectively. Reviewing the policy's details and seeking clarification from the insurance provider can help individuals make informed decisions about their healthcare choices.

Unraveling the Mystery: Medical Insurance and Service Dogs

You may want to see also

Frequently asked questions

IPA, or Independent Practice Association, medical insurance refers to a type of health insurance plan offered by a group of independent physicians and surgeons. These plans are designed to provide coverage for medical services and treatments, often with a focus on a specific region or network of healthcare providers. IPA insurance aims to offer a more personalized and flexible approach to healthcare compared to traditional insurance models.

IPA insurance operates by contracting with a network of healthcare professionals, including doctors, specialists, and hospitals. When an IPA member requires medical care, they typically choose a primary care physician (PCP) from the network. The PCP then coordinates and manages the member's healthcare needs, referring them to specialists or other healthcare providers within the network when necessary. IPA plans often have negotiated rates with providers, ensuring members receive quality care at discounted rates.

IPA insurance offers several advantages, including:

- Personalized Care: Members have a dedicated PCP who gets to know their medical history and preferences, providing more tailored healthcare.

- Lower Costs: Negotiated rates with providers can result in reduced out-of-pocket expenses for members.

- Access to a Network: Members have access to a wide range of healthcare services within the IPA network, ensuring convenience and continuity of care.

- Coordination of Care: The IPA model promotes better coordination between different healthcare providers, reducing the chances of medical errors and improving overall patient outcomes.

While IPA insurance has its advantages, there are a few potential drawbacks to consider:

- Limited Out-of-Network Coverage: IPA plans often provide better coverage and rates for in-network providers, so out-of-network care may be more expensive or not covered at all.

- Network Restrictions: Members are typically restricted to using healthcare providers within the IPA network, which might limit their choice of doctors or specialists.

- Higher Premiums: Due to the personalized and coordinated care model, IPA insurance plans may have higher monthly premiums compared to some other insurance options.

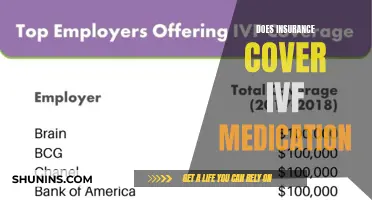

IPA medical insurance is often designed for specific groups, such as:

- Employers: Companies can offer IPA plans to their employees as part of a comprehensive benefits package.

- Professional Associations: Medical associations or societies can provide IPA insurance to their members.

- Individual Members: Some IPA organizations also offer individual plans to those who meet their eligibility criteria.