The approximate rate for teen auto insurance varies depending on several factors, including the teen's age, gender, driving history, and location. On average, teens pay around $445 per month or $5,340 per year for car insurance. This rate is higher compared to older, more experienced drivers due to teens having a higher risk of accidents. The lack of driving experience among teens leads to insurance companies charging higher rates to cover the increased risk.

The cost of adding a teen to an existing policy can range from $250 to $740 per month, depending on the insurance company and specific circumstances. The gender of the teen also plays a role, with male teens generally having higher insurance rates than female teens due to higher accident and violation rates.

To find the best rates, it is recommended to shop around and compare quotes from multiple insurance companies. Additionally, taking advantage of discounts, such as good student discounts and safe driving programs, can help mitigate the cost of teen auto insurance.

| Characteristics | Values |

|---|---|

| Average monthly cost of insurance for teens | $445 |

| Average yearly cost of insurance for teens | $5,340 |

| Average monthly cost of insurance for teens on their parents' policy | $299 |

| Average yearly cost of insurance for teens on their parents' policy | $3,594 |

| Average monthly cost of insurance for teens on their own policy | $730 |

| Average yearly cost of insurance for teens on their own policy | $8,765 |

| Average cost of insurance for a 16-year-old male on their parents' policy | $350 |

| Average cost of insurance for a 16-year-old female on their parents' policy | $325 |

| Average cost of insurance for a 16-year-old male on their own policy | $628 |

| Average cost of insurance for a 16-year-old female on their own policy | $563 |

| Average cost of insurance for a 17-year-old male on their parents' policy | $323 |

| Average cost of insurance for a 17-year-old female on their parents' policy | $300 |

What You'll Learn

Discounts for good grades and driver training

Auto insurance for teens is typically more expensive than for older, more experienced drivers. However, there are ways to save money on auto insurance for teens, and one of the easiest ways to do so is by taking advantage of good student discounts and driver training discounts.

Good Student Discounts

Many auto insurance companies offer good student discounts for teens and young drivers who maintain solid grades in school. These discounts can offer significant savings on car insurance premiums. The criteria for earning a good student discount vary between car insurance companies, but most insurers require you to have at least a B average or a 3.0 GPA while enrolled in high school or as a full-time college student. Be sure to check with your auto insurance company to confirm its specific criteria and whether or not you meet the standards.

Examples of auto insurance companies that offer good student discounts include State Farm, Geico, and USAA. State Farm offers a discount of up to 25% for students with good grades, and this discount can last until the student turns 25. Geico offers a good student discount of up to 15% off the potential car insurance cost. USAA also offers a good student discount for full-time students with a B average or higher, but it is only available to active military members, veterans, and their families.

Driver Training Discounts

Driver training discounts are another way to save money on auto insurance for teens. Some car insurance providers offer discounts to student drivers if they take an approved driver's education or driver training course. These courses teach new drivers safe driving techniques and help them become better, safer drivers.

For example, State Farm offers a driver training discount if all operators of the vehicle under the age of 21 complete an approved driver education course. GEICO also encourages taking defensive driving courses and offers a discount for those who complete an approved course. The eligibility rules and requirements for defensive driving discounts vary by state, but they typically include age requirements and specify that the course must be completed voluntarily.

In addition to good student discounts and driver training discounts, there are other ways to save on auto insurance for teens, such as multi-car discounts, vehicle safety features discounts, and loyalty discounts. By combining these discounts, teens and their families can significantly reduce the cost of auto insurance.

Understanding Auto Insurance Claims: How Long Till Payout?

You may want to see also

Gender and age impact on insurance rates

The cost of car insurance for teens is influenced by several factors, including age, gender, driving history, and location. While age is a significant factor, with younger drivers paying higher premiums due to their lack of experience and higher accident risk, gender also plays a role in determining insurance rates.

In most states, insurance companies are allowed to consider gender when setting car insurance rates. On average, women tend to pay slightly less for car insurance than men, but the difference is often minor, with adult drivers typically seeing a price difference of less than 1% between the genders. However, younger male and female drivers will see a bigger gender gap in insurance costs, with teenage boys paying the most out of all teens. This is because insurers have found that boys and young men are more likely to be involved in car accidents and engage in riskier driving behaviours, such as speeding and driving under the influence.

It's important to note that some states in the US prohibit the use of gender as a factor in determining insurance rates, including California, Hawaii, Massachusetts, Montana, Pennsylvania, North Carolina, and Michigan. In these states, insurance companies are not allowed to consider gender when setting insurance premiums.

While age and gender can impact insurance rates, it's worth mentioning that other factors, such as driving record, type of car, location, and credit history, also play a significant role in determining insurance premiums.

Auto Insurance Scoring: Unlocking the Calculation Mystery

You may want to see also

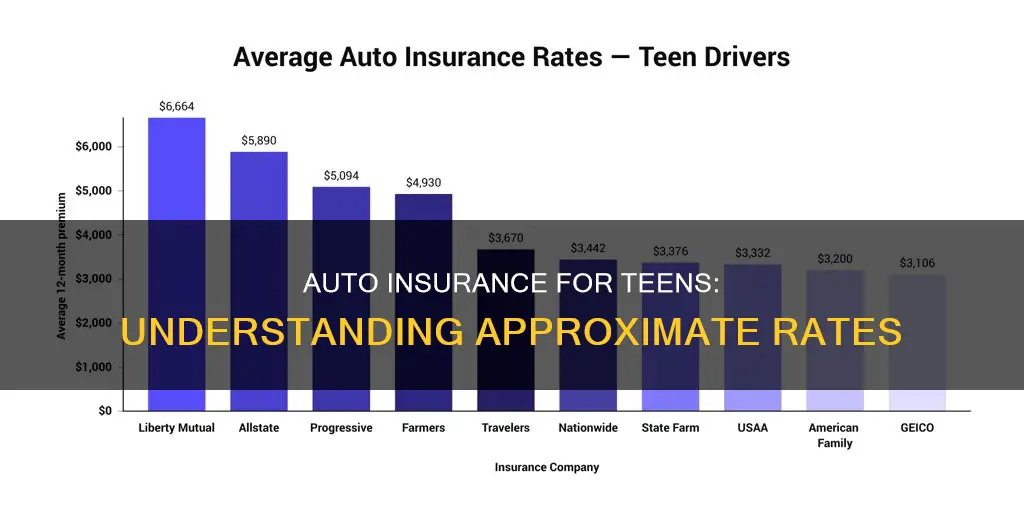

Cheapest insurance companies for teens

The cost of car insurance for teens varies depending on factors such as the driver's age, gender, location, and the vehicle they drive. Here is a list of some of the cheapest insurance companies for teens, along with their average annual or monthly rates:

- USAA: USAA is known for offering affordable rates for teens, with an average annual cost of around $1,289 to $1,554. USAA is only available to military servicemembers, veterans, and their families. They offer various discounts and coverage add-ons, including roadside assistance and accident forgiveness.

- Travelers: Travelers is another affordable option, with an average annual rate of about $1,249. They provide several discounts for young drivers, such as good student, driver training, and student-away-at-school discounts.

- Geico: Geico is one of the cheapest options for teens, with competitive rates and generous discounts. The average annual cost for a teen's minimum coverage policy is around $1,355. Geico also receives great ratings from both editors and customers.

- State Farm: State Farm is a widely available option, as it is the largest auto insurance company in the United States. They offer a range of specialty coverage types and discounts for teens, with an average annual rate of around $1,500.

- Mercury: Mercury Insurance is a great choice for teens in the 11 states where it operates. While they don't offer as many discounts, their base premiums are competitive, making them a good option for basic coverage.

- Grange: Grange Insurance offers favourable rates for teen drivers and receives positive reviews from consumers. They provide various types of auto insurance and 17 auto insurance discounts, but their coverage is only available in 13 states.

- Erie: Erie has some of the lowest rates for teens on their own policies and competitive rates for parents adding a teen. They also offer an app called YourTurn that encourages safe driving and can result in discounts. However, Erie is only available in 12 states and Washington, D.C.

- Progressive: Progressive offers low prices, attractive discounts, and varied coverage options. They have a teen driver discount for parents who add a driver under 18 to their policy.

- Nationwide: Nationwide has the lowest average rate for parents adding a teen driver to their policy. They also offer usage-based insurance, accident forgiveness, and gap insurance.

It's important to note that rates can vary based on individual circumstances, and it's always a good idea to shop around and compare quotes from multiple insurance companies to find the best deal for teen drivers.

Best Auto Insurance for Elderly Drivers: Safety and Savings

You may want to see also

Average insurance rates for teens by state

The cost of car insurance for teens varies by state, with some states being cheaper for teens than others. The average rate for full-coverage car insurance for a 16-year-old driver is $7,149, while a 17-year-old pays $5,954 annually. The younger the driver, the more expensive the car insurance. This is because younger drivers are more likely to get into car accidents than older drivers.

Connecticut, Louisiana, Nevada, and New York are some of the most expensive states for teen car insurance in the country. On the other hand, Massachusetts and Hawaii generally have the lowest average rates for teen drivers, likely because they don't allow age as a rating factor. New York, Florida, and Louisiana tend to have the highest average rates.

The average cost of adding a teen driver to a parent's insurance policy is $299 per month, or $3,594 annually. However, the cost can vary depending on the age and gender of the teen, with male teen drivers typically costing more to insure than female drivers. The average car insurance premium for an 18-year-old female is $413 per month, while a male pays $462 per month.

| Age & Gender | Average Monthly Cost |

|---|---|

| Male, 16 | $628 |

| Female, 16 | $563 |

| Male, 17 | $462 |

| Female, 17 | $413 |

Teens can save money on car insurance by staying on their parents' insurance policy, taking advantage of discounts for good students and safe driving, and choosing a vehicle with good safety features.

Categorizing Auto Insurance Expenses in Quickbooks: The Right Way

You may want to see also

Tips to save on teen insurance

Good Student Discounts

Most insurance companies offer discounts for students who maintain good grades. For instance, Allstate offers a good student discount to unmarried drivers under 25 years of age who have at least a B- average. State Farm also offers up to a 25% savings for students with good grades, up to age 25 or their last year of school.

Safe Driving Courses

Many insurance providers promote driver safety courses as a way to teach young, inexperienced drivers the rules of the road and offer discounts upon completion. Examples of carriers that reward drivers with a premium discount include Geico, State Farm, Allstate, and Travelers.

Distant Student Discounts

If your teen driver moves away from home to attend college and leaves their car behind, they might be eligible for a lower rate. Some insurance companies offer a distant student discount, while others offer an "away-at-school" driver status that can decrease your premium.

Choose a Safe and Affordable Car

The make and model of your vehicle can significantly impact insurance rates. A used sedan could be a more economical option than a new, sporty coupe. However, remember that older vehicles may lack safety features such as anti-theft devices and anti-lock braking systems, which might lead to a higher premium.

Take Advantage of Telematics

Telematics programs use in-car devices or phone apps to monitor driving habits and offer discounts for safe driving. However, under some insurers' programs, rates could increase if poor driving habits are detected.

Shop Around for Insurance

Comparison shopping is crucial to finding the best rates and coverage for teen drivers. Requesting quotes from multiple carriers allows for equal coverage comparisons to ensure your teen has adequate insurance at a competitive price.

Insuring Your New Ride

You may want to see also

Frequently asked questions

The average cost of auto insurance for teens varies depending on age, gender, location, and other factors. On average, teens pay around $445 per month or $5,340 per year for car insurance. The cost is higher for younger teens, with 16-year-olds paying an average of $7,149 per year, while the cost decreases to around $4,126 per year for 19-year-olds.

It is generally much cheaper to add a teen to a parent's existing policy than for the teen to have their own policy. For example, the average cost of adding a teen to a parent's policy is around $299 per month, while the cost of a separate teen policy is approximately $468 per month.

Several factors influence the cost of auto insurance for teens, including age, gender, driving history, type of vehicle, and the amount of coverage. Male teens generally pay more than female teens due to higher accident rates. The cost also varies by state, with location-specific factors such as weather, accident frequency, vehicle theft, and medical care costs impacting rates.

Yes, there are several discounts that can help reduce the cost of auto insurance for teens. These include good student discounts, driver training discounts, multi-vehicle discounts, and safe driving or telematics program discounts. Comparing rates from different insurance providers and taking advantage of applicable discounts can help teens and their parents find the most affordable coverage options.