Auto insurance is a requirement for vehicle owners, offering financial protection and legal compliance in the event of accidents or damages. When purchasing auto insurance, policyholders receive an insurance card as proof of coverage, but for a comprehensive overview of the policy, one must refer to the auto insurance declaration page. This document provides crucial information about the policy, including coverage amounts, deductibles, insured individuals, and applicable terms and conditions. It is important to know how to access this page, as it is essential for making informed decisions about insurance coverage, modifications, and claims. The process of locating the declaration page may vary depending on the insurance provider, but it typically involves logging into one's online account and navigating to the relevant section for policy documents. Understanding the auto insurance declaration page is a vital aspect of managing one's vehicle insurance coverage.

| Characteristics | Values |

|---|---|

| Purpose | To provide a comprehensive overview of your auto insurance policy |

| Coverage | Specifics such as the policy period, coverage amounts, deductibles, named insureds, and any applicable terms and conditions |

| Location | Depends on the insurance company; for example, State Farm policyholders can access it by logging into their online account, navigating to the “My Accounts” section, selecting their auto policy, and clicking on “View Policy Documents." |

What You'll Learn

What is an auto insurance declaration page?

An auto insurance declaration page is a detailed document that summarises your auto insurance policy. It is sometimes referred to as a "dec page". This document is important as it provides a clear overview of your policy details, including specific coverage details. It is a key component of an insurance policy and outlines the most important information about your personal insurance policy.

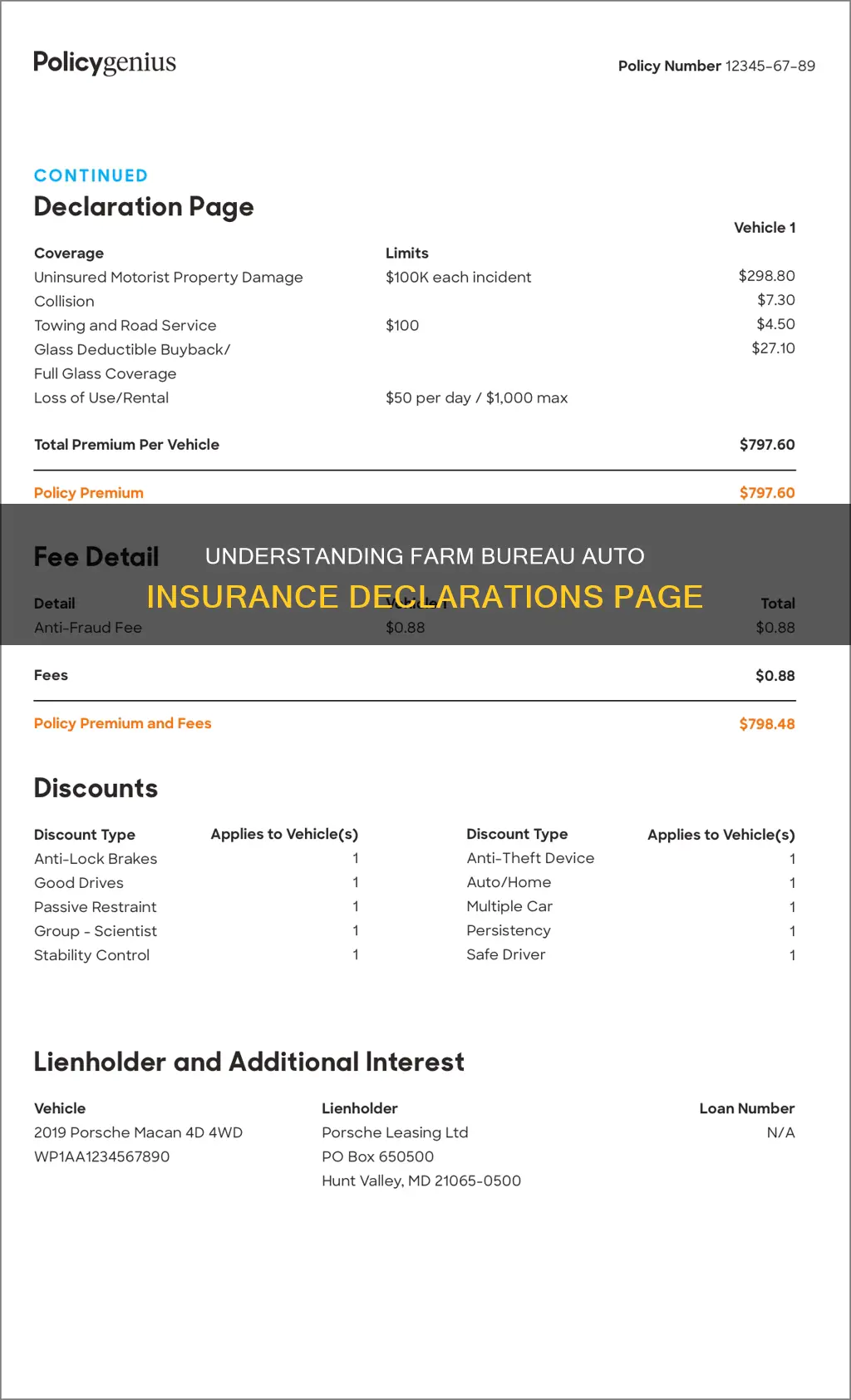

The declaration page includes information such as the policy period, coverage amounts, deductibles, named insureds, and any applicable terms and conditions. It also includes the policy number, the policy's term length, and information about the car, such as its year, make, model, and VIN. If you have leased or financed your vehicle, it may also include information about your lender.

The auto insurance declaration page is usually the first page of your auto insurance policy. It is not the same as proof of insurance, which is provided by your insurance card. The declaration page provides a more comprehensive overview of your auto insurance policy.

Understanding the auto insurance declaration page is crucial when making informed decisions about your insurance coverage, making changes to your policy, or filing a claim. It allows you to reference how much auto insurance you have, how much you are paying for it, and the specifics of your coverage.

Auto Insurance and Punitive Damages: What's the Verdict?

You may want to see also

What is included in an auto insurance declaration page?

An auto insurance declaration page, also known as a "dec page", is a summary of your auto policy, usually in one or two pages. It provides important information related to your policy, such as:

- The date coverage starts and ends.

- The vehicles covered, including the year, make, model, vehicle identification number (VIN) and average mileage.

- The types of coverage you're paying for, including collision insurance and liability insurance, and their limits and deductibles, if applicable.

- A breakdown of how much you pay for coverage, including any discounts you qualify for.

- The policy number, which you'll need when you file an insurance claim.

- Agent information: Contact information for your insurance agent (if you have one).

- Policyholder details: Your name, address and phone number.

- Covered drivers: A list of any drivers officially covered under the policy and any drivers that are excluded from coverage.

- Policy period: The expiration date for your coverage (typically six or 12 months from the start date).

- Loss payee: Any party with a vested interest in the vehicle, including the lender if you lease or finance your vehicle.

Your auto insurance declarations page is a useful reference if you need to know what is covered under your policy and your insurance agent isn't available. It can also be helpful if you want to get quotes from other companies to compare to your current policy.

Auto Insurance Card: Spouse's Name?

You may want to see also

How to find your auto insurance declaration page

An auto insurance declaration page is a summary of your auto insurance policy. It provides a concise overview of vital policy information, such as policy numbers, periods, insured drivers, covered vehicles, and the types and limits of your elected coverage. It also includes personal information, such as your name and address, and details about your vehicle, including its make, model, year, and Vehicle Identification Number (VIN).

- When you first purchase your auto insurance policy, your insurance company will typically send you the declaration page via email, fax, or regular mail. It is often included as the first page(s) of your insurance policy documents.

- Many insurance providers also offer online access to your declaration page through their website or mobile app. You can log in to your account and navigate to the documents section to find it.

- If you cannot locate your declaration page or need an additional copy, you can contact your insurance company directly. Give them a call or reach out to their customer support team to request a copy. They will be able to provide you with a new declaration page.

- If you have made any changes to your coverage or renewed your policy recently, your insurance provider should send you an updated declaration page reflecting those changes.

Keep in mind that the declaration page is not considered proof of insurance. For that, you will need to carry a physical insurance card or a digital copy in your vehicle. However, the declaration page serves as a useful reference for understanding your coverage, premiums, deductibles, and other important details of your auto insurance policy.

Vehicle Loans: Are They Insured?

You may want to see also

The difference between a declaration page and proof of insurance

An insurance declaration page is a document that outlines the provisions of an insurance policy. It includes information such as the coverage limits, the premium, listed discounts, the policyholder's name and address, policy endorsements, and limits for each coverage. It is a summary of the insurance policy and is typically the first page of the policy document. It is automatically generated by the insurance provider and sent to the policyholder when they purchase the policy.

Proof of insurance, on the other hand, is a more concise document that includes basic information such as the policy number, the name and address of the policyholder, and the effective dates of the policy. It is designed to be carried in the vehicle or on one's person and presented when needed, such as when a driver is pulled over for a traffic violation or when purchasing a home or car. It serves as evidence of insurance coverage and can be used to quickly exchange insurance information in the event of an accident.

While both documents are important to keep on file, they serve different purposes. The declaration page is primarily for the policyholder's benefit, providing a detailed summary of the policy and its coverages, limits, and costs. It is also used as a reference when comparing insurance policies or filing a claim. On the other hand, proof of insurance is intended to provide a snapshot of the policy's existence and can be used to validate and verify coverage to third parties, such as lenders or the Department of Motor Vehicles.

It is worth noting that, in some cases, a declaration page can also serve as proof of insurance when purchasing a car or home. However, it is generally recommended to carry a physical or digital insurance card as proof of insurance when driving, as the declaration page may contain more information than is necessary for verification purposes.

Vehicle Damage: What Insurance Covers?

You may want to see also

Why is the declaration page important?

The declaration page is important as it provides a comprehensive overview of your auto insurance policy. It is a detailed document that outlines various specifics, such as the policy period, coverage amounts, deductibles, named insureds, and applicable terms and conditions. This information is crucial for making informed decisions regarding your insurance coverage, any desired changes to your policy, or when filing a claim.

The declaration page is typically located at the front of your insurance packet and serves as a summary of your auto insurance policy. It includes essential details such as the policy number, effective dates, types of coverage, policy limits, and personal information about the insured individuals. For instance, if you are reviewing your auto insurance policy, the declaration page will provide specifics about the types of insurance covering your vehicle, including liability, collision, comprehensive, or gap insurance.

Furthermore, the declaration page is vital when applying for a mortgage with a lender. They require proof of homeowners insurance to proceed with their process. It is also beneficial to assess your declaration page when reviewing your policy to understand your coverages, limits, and deductibles. This information is essential for making informed decisions about your insurance coverage and ensuring you have adequate protection.

Additionally, the declaration page is important for understanding the financial aspects of your insurance policy. It explains how much your insurance costs and what you are getting for your payment. It includes information about your premiums, deductibles, and the factors that determine your premium amount, such as personal characteristics, driving history, and the type of vehicle you own.

In conclusion, the declaration page is a crucial document that provides a comprehensive summary of your auto insurance policy. It includes essential details about your coverage, financial obligations, and personal information. Understanding the information presented on the declaration page empowers you to make informed decisions about your insurance choices and ensures you have the necessary protection in place.

Insuring Vehicles: What About the Driver?

You may want to see also

Frequently asked questions

An auto insurance declaration page is a detailed document that provides important information about your policy. It includes specifics such as the policy period, coverage amounts, deductibles, named insureds, and any applicable terms and conditions.

An insurance card only provides basic information and does not outline the details of the policy. For a comprehensive overview of your auto insurance policy, refer to the auto insurance declaration page.

An auto insurance declaration page includes information about your policy's coverage types, coverage limits, deductible amounts, and the cost of the coverage options. It also includes your policy's term length, your policy number, and information about your car.