PLPD stands for public liability and property damage. In Colorado, drivers are required to have auto liability coverage, which includes bodily injury (BI) liability and property damage (PD) liability. The minimum car insurance limits for bodily injury liability are $25,000 per person and $50,000 per accident, while the minimum limit for property damage liability is $15,000 per accident.

| Characteristics | Values |

|---|---|

| Bodily Injury Liability (BI) | $25,000 per person and $50,000 per accident |

| Property Damage Liability (PD) | $15,000 per occurrence |

| Uninsured/Underinsured Motorist (UM/UIM) | $25,000 per person and $50,000 per accident |

| Collision Coverage | Not required by law but often required by banks |

| Comprehensive Coverage | Not required by law but often required by banks |

| Medical Payments Coverage (MPC) | $5,000 |

What You'll Learn

Bodily Injury Liability (BI)

When deciding on the amount of BI coverage to purchase, consider your financial situation, assets, and what you can afford. While the state minimum may be sufficient for some, others may want to opt for higher coverage limits for added protection. It's important to carefully weigh your risks and choose a coverage amount that provides adequate financial protection in the event of an accident.

In addition to BI coverage, Colorado drivers are also required to have property damage liability (PD) coverage, which covers damage to another person's property, such as their vehicle or other physical property. The minimum requirement for PD coverage in Colorado is $15,000 per accident.

While these are the mandatory minimum requirements, it's worth considering purchasing higher coverage limits or additional optional coverages to ensure you have sufficient financial protection in the event of a more serious accident.

Unraveling the Auto Insurance Quote Process: A Step-by-Step Guide

You may want to see also

Property Damage Liability (PD)

The minimum amount of PD coverage required in Colorado is $15,000 per accident. This means that if you are found to be at fault for an accident, your insurance company will cover the cost of repairing or replacing the damaged property up to a maximum of $15,000. If the cost of repairs exceeds this amount, you may be personally liable for the remaining expenses.

While the minimum PD coverage is $15,000, it is important to consider your individual needs and financial situation when deciding on the appropriate amount of coverage. If you live in an area with high property values or frequently drive in congested areas, you may want to consider purchasing additional PD coverage to protect yourself from potential financial liability.

PD insurance is an essential component of auto insurance in Colorado, helping to ensure that individuals are financially protected in the event of an accident. By understanding the requirements and options available, drivers can make informed decisions about their coverage and ensure they have adequate protection.

In addition to PD coverage, Colorado drivers are also required to carry bodily injury liability insurance, which covers injuries to other people in an accident. The minimum requirements for this coverage are $25,000 per person and $50,000 per accident. These minimums are set by the state, but it is recommended to consider higher coverage limits based on individual needs and financial situation.

Insured: Personal Auto Policy Add-On

You may want to see also

Uninsured/Underinsured Motorist (UM/UIM) Coverage

In Colorado, insurers are required by law to offer UM/UIM coverage with the same limits as the bodily injury liability coverage selected by the policyholder. This means that if you choose bodily injury liability coverage of $100,000 per person and $300,000 per occurrence, your UM/UIM coverage will match these limits. You can choose to waive UM/UIM coverage, but this must be done in writing.

UM/UIM coverage consists of two main components: uninsured motorist bodily injury (UMBI) and uninsured motorist property damage (UMPD). UMBI covers medical bills for both you and your passengers if you are hit by an uninsured driver, while UMPD covers damage to your vehicle.

In addition to the basic UM/UIM coverage, you can also opt for underinsured motorist bodily injury (UIMBI) and underinsured motorist property damage (UIMPD) coverage. UIMBI covers medical bills if you are hit by a driver whose insurance is insufficient, while UIMPD covers damage to your vehicle in such cases.

While UM/UIM coverage is not mandatory in all states, it is highly recommended for all drivers. In Colorado, it is a valuable addition to your auto insurance policy, providing financial protection in the event of an accident with an uninsured or underinsured driver.

Canceling Geico: A Quick Guide

You may want to see also

Collision Coverage

You can choose a deductible for this coverage—that is, the amount you must first pay out-of-pocket before the insurance company covers the rest. Collision coverage is usually required by lenders as a condition of vehicle financing.

While not mandatory, collision coverage is a valuable addition to your auto insurance policy, ensuring you are covered in the event of an accident that results in damage to your vehicle.

Maximizing Credit Card Rewards with Auto Insurance Purchases

You may want to see also

Comprehensive Coverage

- Vandalism to your car

- A tree falling on your vehicle

- Water damage from a flood or rain

- Windshield or other glass damage

Comprehensive insurance is a form of first-party insurance, which covers losses suffered by the policyholder. Although it is not required by law in Colorado, it may be a requirement to get a car loan.

The cost of adding comprehensive insurance to your auto insurance policy depends on a number of factors, including your driving history, the type of car you drive, and where you live. In general, adding comprehensive coverage to your policy will add around $600 to your annual premium. If you opt for a low deductible, the price can increase to around $900.

Comprehensive Auto Insurance: Windshield Warrior or Weak Spot?

You may want to see also

Frequently asked questions

The minimum coverage for passenger vehicles in Colorado is $25,000 for bodily injury or death to any one person in an accident, $50,000 for bodily injury or death to all persons in any one accident, and $15,000 for property damage in any one accident.

PLPD insurance, or Personal Liability and Property Damage insurance, covers bodily injury liability and property damage liability. This means that it covers injuries to other people and damage to other people's property in an accident.

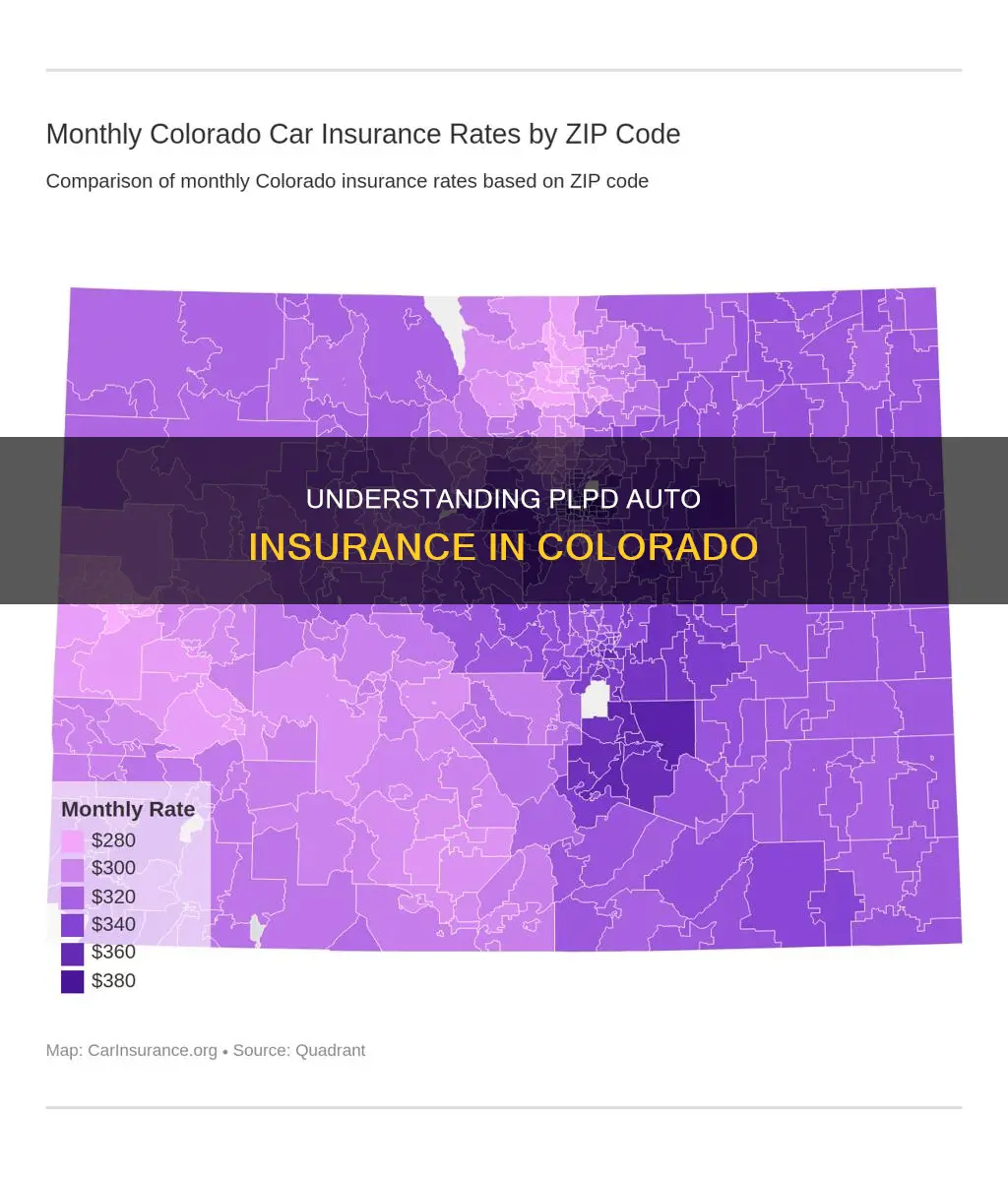

The average cost of car insurance in Colorado is $75 per month for a liability-only policy, which is the type of policy included in PLPD insurance. However, costs can vary depending on factors such as your age, driving record, and location.