Direct billing is a payment method for auto insurance that allows the insured to pay their premiums directly to the insurance company, rather than going through a middleman or broker. This means that the insured has a direct relationship with the insurance provider and can manage their policy and claims without a third-party intermediary. Direct billing offers several advantages, including streamlined payments, simplified policy management, and direct access to customer support from the insurer. This approach can also result in cost savings for the insured, as there are no broker fees or commissions. Understanding direct billing and its implications is essential for vehicle owners exploring insurance options and seeking efficient, cost-effective ways to manage their policies.

| Characteristics | Values |

|---|---|

| Definition | Direct billing is an arrangement between an auto insurance company and a repair shop that allows the shop to bill the insurance company directly for repairs, instead of the car owner paying upfront and then getting reimbursed. |

| Benefits | - Convenience for the car owner, as they don't need to pay upfront and wait for reimbursement - Peace of mind knowing that the repair shop has been pre-approved by the insurance company - Streamlined repair process |

| Eligibility | Car owners must have a valid insurance policy with the company offering direct billing and repairs must be related to a claim covered by the policy. |

| Process | 1. Car owner takes their vehicle to a pre-approved repair shop 2. Repair shop assesses the damage and provides an estimate to the insurance company 3. Insurance company approves the estimate and authorizes the repair 4. Repair shop bills the insurance company directly and repairs are carried out |

| Considerations | - Not all insurance companies offer direct billing - Car owners should verify that their insurance company has a direct billing arrangement with their preferred repair shop - Direct billing may not be available for all types of repairs or claims |

| Availability | Direct billing is typically offered by larger, national insurance companies and they often have networks of pre-approved repair shops that customers can choose from. |

| Customer Service | Direct billing can enhance customer satisfaction by providing a more convenient and streamlined repair process, reducing the financial burden on the customer, and offering peace of mind. |

| Claim Processing | The insurance company handles the billing process directly with the repair shop, which can speed up the claim settlement and reduce the hassle for the car owner. |

What You'll Learn

Direct Billing Process

Direct billing is an insurance industry term with a slightly different meaning depending on whether it is being used in the context of health insurance or property and casualty (general) insurance. This answer will focus on the direct billing process in both contexts.

In the context of health insurance, direct billing refers to the process of a healthcare provider billing an insurance company directly for services rendered to a policyholder. This saves the patient from having to complete all the necessary paperwork and file a health insurance claim themselves. The direct billing process in health insurance typically involves the following steps:

- The patient receives medical services from a healthcare provider.

- The healthcare provider directly bills the insurance company for the services rendered, providing relevant information such as the patient's policy details and the services provided.

- The insurance company processes the bill and reimburses the healthcare provider directly by the invoice payable date.

- The patient does not need to file any paperwork or pay upfront costs, and they are only responsible for any deductibles or co-pays specified in their insurance policy.

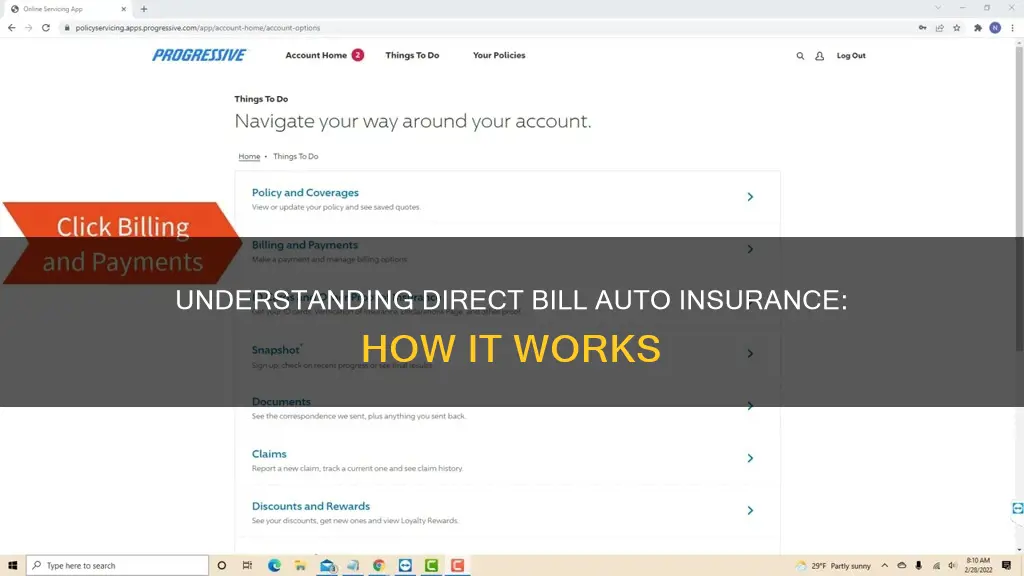

In property and casualty insurance, direct billing refers to the process of a policyholder paying premiums directly to the insurance company instead of paying through a brokerage, agency, or intermediary. This is in contrast to agency billing, where the intermediary who sold the policy collects premiums on behalf of the insurance company. Here is how the direct billing process typically works in this context:

- The insurance company or provider sends a premium invoice directly to the policyholder.

- The policyholder makes the payment directly to the insurance company, typically by the due date specified in the invoice.

- The insurance company receives and processes the payment, updating the policyholder's records accordingly.

It is important to note that the decision to use agency billing or direct billing in property and casualty insurance depends on various factors, including the size of the premiums involved and the nature of the client.

Renters: Get Auto Insurance Coverage with Ease

You may want to see also

Benefits of Direct Billing

Direct billing is a service that allows individuals to receive medical treatment without paying upfront. Instead, the medical provider directly bills and receives payment from the insurance company. This method has several benefits for both the patient and the healthcare provider.

Saves Time and Effort

Direct billing eliminates the need for patients to fill out forms, file claims, and make phone calls. It streamlines the process by reducing the amount of paperwork involved, making it less time-consuming and cumbersome for patients.

No Upfront Payment

One of the most significant advantages of direct billing is that patients do not have to worry about carrying cash or paying for medical expenses upfront. This is especially beneficial for unexpected or emergency medical treatments, where immediate payment may be required. With direct billing, patients can focus on their health without the added financial stress.

Faster Payment for Healthcare Providers

With direct billing, healthcare providers can directly bill the insurance company and receive payment by the invoice payable date. This ensures a timely and consistent revenue stream for the providers, improving their cash flow and financial stability.

Enhanced Patient Experience

Direct billing improves the overall patient experience by removing financial barriers and reducing the administrative burden. Patients do not have to worry about reimbursement claims and can instead direct their attention to their medical care and recovery. This simplifies the process, making it more accessible and patient-friendly.

Streamlined Insurance Claims

Direct billing speeds up the insurance claims process. The insurer settles the claim faster, the healthcare provider gets paid promptly, and the patient is spared the hassle of dealing with paperwork and reimbursement delays. This efficiency benefits all parties involved and fosters a positive relationship between insurers, healthcare providers, and patients.

Choosing the Right Auto Insurance: Key Considerations

You may want to see also

Eligibility Criteria

Direct Auto Insurance, founded in 1991 by William Adair, is a non-standard automobile insurance company headquartered in Nashville, Tennessee. The company offers flexible billing options and affordable rates for all drivers, regardless of their insurance history or coverage needs.

Direct Auto Insurance welcomes all drivers, including those considered "high-risk" or requiring SR-22 certification. The company does not refuse coverage based on credit score or driving history. This sets Direct Auto apart from other insurance companies that may deny coverage to individuals with bad credit or a history of accidents or violations.

Direct Auto serves 11 states: Alabama, Arkansas, Florida, Georgia, Louisiana, Mississippi, North Carolina, South Carolina, Tennessee, Texas, and Virginia. If you reside in one of these states, you are eligible to apply for coverage with Direct Auto Insurance.

The company offers a range of insurance products, including motorcycle insurance, individual term life insurance, accident medical expenses coverage, and commercial auto insurance. Each of these products has its own eligibility requirements, which are likely to include factors such as age, vehicle type, driving record, and state of residence.

For example, to be eligible for motorcycle insurance, you typically need to be at least 18 years old and have a valid motorcycle license. Commercial auto insurance eligibility may depend on factors such as the type of business, number of vehicles, and driving history of employees.

Direct Auto also provides various types of discounts, including a safe driver discount, good student discount, senior citizen discount, multi-product discount, prior coverage discount, and welcome back discount. To be eligible for these discounts, you must meet specific criteria, such as maintaining a clean driving record, being a student with good academic standing, or being a returning customer.

Additionally, Direct Auto offers term life insurance, which is likely to have eligibility criteria based on age, health status, and other risk factors.

It is important to note that eligibility criteria can vary across different insurance providers and states. Therefore, it is always advisable to review the specific requirements of Direct Auto Insurance and confirm your eligibility by contacting their customer service team or visiting their website.

Auto Insurance in Russia: What's the Law?

You may want to see also

Types of Repairs Covered

The types of repairs covered by auto insurance depend on the type of coverage you have. A standard car insurance policy typically includes up to five major types of coverage: medical payments and personal injury protection, liability coverage, uninsured/underinsured motorist coverage, collision coverage, and comprehensive coverage.

Medical Payments and Personal Injury Protection

This type of coverage helps pay for medical bills and lost wages resulting from an accident. It may also cover funeral costs.

Liability Coverage

Liability coverage is required in most states and covers property damage and injuries to other drivers in accidents that you cause. However, it does not cover repairs to your own vehicle.

Uninsured/Underinsured Motorist Coverage

This type of coverage helps pay for repairs and injuries if you are hit by an uninsured or underinsured driver.

Collision Coverage

Collision coverage protects you in the event of a collision with another car, a tree, a fence, or a guardrail, or if you damage your car by driving over a pothole. It covers repairs to your car regardless of who is at fault.

Comprehensive Coverage

Comprehensive coverage protects you from damages caused by incidents other than collisions, such as vandalism, theft, natural disasters, and other acts of nature. It also covers damage from hitting an animal or rodents chewing through your car's wiring.

In addition to these standard coverages, there are several add-ons available that can provide additional protection for repairs:

Mechanical Breakdown Insurance (MBI)

MBI helps cover the cost of repairs to parts and systems that are not typically covered by standard auto insurance policies. This includes repairs to key engine components and other essential parts in the event of a mechanical breakdown. However, MBI does not cover the replacement of wear-and-tear items like brake pads, spark plugs, filters, or tires. MBI is usually only available for newer cars with low mileage and may be subject to age and mileage limitations.

Extended Warranty Coverage

An extended warranty provides continued coverage for specific issues even after the manufacturer's warranty has expired. It may offer similar protection to MBI but tends to be cheaper and have a shorter time frame for eligibility. However, extended warranties may be more limited in the types of repairs they cover and typically do not cover normal wear and tear.

Roadside Assistance Coverage

Roadside assistance coverage can provide towing services, assistance with flat tires, and jump-starting dead batteries. It is available 24 hours a day, 7 days a week, and can be a useful addition to your policy if you do not already have a standalone roadside assistance policy.

Managing Risk: Strategies of Auto Insurance Companies

You may want to see also

Claim Settlement

When it comes to direct-billed auto insurance, the claim settlement process is generally streamlined and efficient. This is one of the key benefits of this type of insurance arrangement. Here's a step-by-step guide on how the claim settlement process typically works:

Step 1: Reporting the Incident

In the event of an accident or incident that requires you to make a claim, the first step is to report it to your insurance company as soon as possible. Most direct-bill auto insurance providers offer 24/7 claim reporting services, so you can reach out to them immediately. You will need to provide details about the incident, including the date, time, location, and the extent of any damage or injuries. It's helpful to have as much information as possible, including photos, witness statements, and police reports, if available.

Step 2: Assessment and Approval

Once the insurance company has received your claim report, they will assign a claims adjuster to your case. The adjuster will assess the damage and review your policy to determine what is covered and the extent of your benefits. This may involve inspecting your vehicle, reviewing repair estimates, and discussing the incident with you and any other parties involved. If your claim is approved, the adjuster will inform you of the next steps and outline the coverage provided by your policy.

Step 3: Repairs and Payments

If your vehicle needs repairs, you can take it to a repair shop of your choice or one recommended by your insurance company. Direct-bill insurance providers often have partnerships with trusted repair facilities, ensuring quality repairs. Once the repairs are completed, the insurance company will handle the payment directly with the repair shop, so you don't have to worry about upfront costs. If your vehicle is deemed a total loss, the insurance company will provide you with a settlement based on the actual cash value or agreed value of your car, depending on your policy.

Step 4: Additional Benefits

Direct-bill auto insurance providers often offer additional benefits to make the claim settlement process smoother. This may include rental car coverage while your vehicle is being repaired, so you can stay mobile. Some companies also offer 24/7 claims support, priority repair services, and guaranteed repairs, ensuring that the work meets certain quality standards.

Step 5: Finalizing the Claim

After the repairs are completed and all payments have been made, your insurance company will finalize your claim. They will provide you with a summary of the repairs, costs, and any deductions made based on your policy's terms and conditions. It's important to review this documentation carefully and ask any questions if there are aspects you don't understand.

Remember, the specific claim settlement process can vary slightly depending on your insurance provider and the details of your policy. Always review your policy documents to understand your coverage and the steps involved in making a claim.

Auto Insurance Premiums: Strategies to Combat Rising Costs

You may want to see also

Frequently asked questions

Direct bill auto insurance is a type of insurance where the policyholder pays the insurance company directly for their coverage, rather than going through a middleman or broker. This typically results in lower premiums and more streamlined billing.

With direct bill auto insurance, the policyholder typically sets up automatic payments from their bank account or credit card to the insurance company. The frequency of payments can vary, but monthly, quarterly, and annual payment plans are commonly offered.

One of the main benefits of direct bill auto insurance is cost savings. By cutting out the middleman, insurance companies can pass on the savings to the policyholder in the form of lower premiums. Additionally, direct billing can simplify the payment process, as policyholders only have to deal directly with the insurance company.

Signing up for direct bill auto insurance is typically straightforward. You can usually enroll when you first purchase your insurance policy, or you may be able to switch to direct billing at any time by contacting your insurance provider and setting up a payment method.

Yes, you should be able to change your payment method at any time. Contact your insurance provider to update your payment information or switch between payment methods (e.g., from credit card to bank withdrawal). It's important to keep your payment information up to date to avoid any interruptions in your coverage.