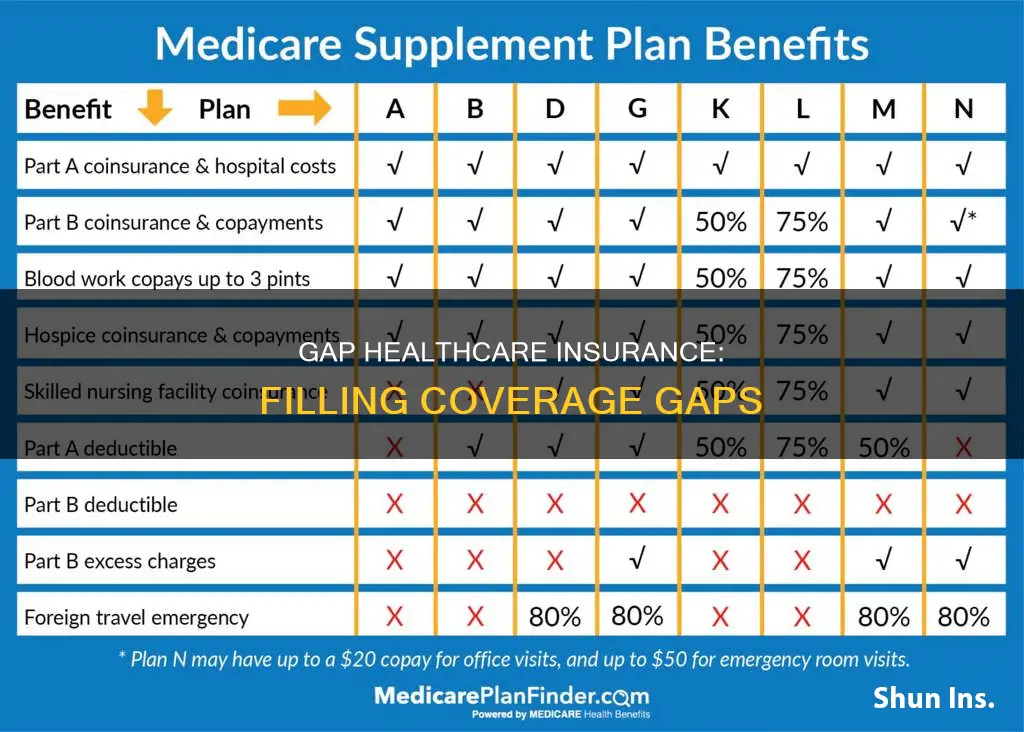

Gap health insurance is a type of supplemental coverage that helps people pay for various out-of-pocket medical expenses, such as deductibles, copays, and coinsurance. It is commonly purchased alongside a high-deductible health plan (HDHP) to protect against high out-of-pocket costs. Gap insurance is not a major medical plan and is not intended to meet the requirements of the Affordable Care Act (ACA). Instead, it serves as a supplementary policy to fill the gaps in primary health insurance coverage. This type of insurance is particularly useful for individuals with high medical costs before reaching their deductible or those in between jobs.

What You'll Learn

Gap insurance is a group supplemental health plan

Gap insurance is not considered a replacement for primary health insurance as it is not ACA-compliant. Instead, it is a supplementary policy that helps cover medical costs before the deductible is met. This can include medical deductibles, copayments, and doctor visits outside the provider network. It may also cover living expenses such as housing, food, and transportation.

The popularity of gap insurance has been rising due to the increasing cost of healthcare and the rise in insurance premiums and health coverage deductibles brought about by the Affordable Care Act. It is an attractive option for employers as it can save them 10-20% on their group medical premium, while also providing better coverage and reducing out-of-pocket expenses for employees.

For employees, the value of gap insurance depends on their situation. Those with extensive or ongoing medical issues and high out-of-pocket costs may benefit from a low-cost gap plan. On the other hand, healthy employees with no anticipated medical expenses may not find it as valuable.

Overall, gap insurance can provide peace of mind and financial protection for those with high healthcare costs or those who are between jobs and insurance plans.

Uninsured Vehicle? Here's What to Do

You may want to see also

It works alongside a high-deductible major medical plan

Gap health insurance is a group supplemental health plan that works in tandem with a high-deductible major medical plan. The IRS defines a High Deductible Health Plan (HDHP) as a plan with a minimum deductible of $1,300 for an individual and $2,600 for a family. This threshold has increased in recent years, in line with rising plan costs.

Gap insurance helps to pay for medical costs before the deductible is reached, hence the term "insurance on insurance". By raising the deductible on the major medical plan, the insured can make significant savings. Gap insurance is particularly useful for those with high medical costs who have not yet reached the deductible on their primary insurance, or for those between jobs.

The benefits of gap insurance include reducing overall out-of-pocket costs and improving access to healthcare. For employers, it can save up to 20% on group medical premiums. It is important to note that gap insurance is not a major medical plan and is not ACA-compliant. It is a supplementary policy, and as such, it covers a limited range of medical services, focusing on urgent rather than preventive care.

For employees, the value of gap insurance depends on their situation. Those with extensive or ongoing medical issues and high out-of-pocket costs may benefit from a low-cost gap plan. On the other hand, healthy employees with no expected medical expenses may not find it worthwhile. While employees will have to pay a monthly premium for gap insurance, their overall maximum out-of-pocket costs will be reduced. This is particularly relevant given the rising cost of healthcare, which may outpace salary increases.

Insuring Your New Financed Vehicle

You may want to see also

It helps pay for medical costs before reaching the deductible

Gap health insurance is a supplementary health insurance policy that is usually purchased alongside a high-deductible health plan (HDHP). It helps pay for medical costs before reaching the deductible on the primary insurance plan. This has led to people calling it "insurance on insurance".

The IRS defines a HDHP as a policy that has a deductible of at least $1,400 for an individual and $2,800 for a family, with total yearly out-of-pocket expenses (including deductibles, copayments, and coinsurance) of less than $7,000 for an individual or $14,000 for a family. HDHPs offer coverage only after this substantial yearly premium has been met. Gap health insurance policies allow you to receive coverage on medical expenses before your deductible has been met.

A medical gap insurance plan is simple in that it follows an employer’s major medical plan. It pays off the underlying major medical plan’s Explanation of Benefits (EOB) directly to the subscriber or provider. A gap plan pays the benefits described in the Schedule of Benefits up to a maximum benefit amount. These plans may have a supplemental deductible or coinsurance (out of pocket) which the subscriber must meet before plan reimbursement.

A gap plan can be particularly useful for employees with extensive or ongoing medical issues and high out-of-pocket costs. It can help to reduce their overall maximum out-of-pocket costs. This is especially beneficial when salaries may not be enough to cover the cost of the monthly health premium and the health insurance deductible.

For employers, a gap plan can save them 10-20% on their group medical premium. With a gap plan, a business can offer gap health insurance that keeps out-of-pocket expenses for employees down while spending less than they would if they had a higher-priced plan with a lower deductible.

Vehicle Damage: What Insurance Covers?

You may want to see also

It is not major medical insurance or ACA-compliant

Gap health insurance is not major medical insurance or ACA-compliant. This means that it is not a standalone, comprehensive health insurance plan and does not meet the standards set by the Affordable Care Act (ACA). Gap insurance is designed to be used alongside a high-deductible major medical plan to provide additional coverage for medical costs. It is important to distinguish that gap insurance is a supplementary policy, filling in the gaps of primary insurance plans.

As a supplementary form of insurance, gap health insurance has limited benefits. It is not meant to replace traditional health insurance but rather to enhance it. Gap insurance is often referred to as "insurance for your insurance" because it helps pay for medical expenses before reaching the deductible on the primary insurance plan. This can include deductibles, copayments, and doctor visits outside the provider network. It is important to note that gap insurance does not cover all types of medical expenses, and certain exclusions may apply.

The distinction between gap insurance and major medical insurance is crucial. Major medical insurance, as the name suggests, provides comprehensive coverage for a wide range of healthcare services and expenses. It is designed to be the primary form of health insurance and typically includes coverage for preventative care, doctor's visits, prescription drugs, hospital stays, and more. On the other hand, gap insurance is more limited in scope and focused on urgent or emergency care.

The fact that gap health insurance is not ACA-compliant is also significant. The ACA sets standards for health insurance plans to ensure they provide essential health benefits, protect consumers, and make coverage more affordable. However, gap insurance does not fall under these regulations and, therefore, may not offer the same level of consumer protection or comprehensive benefits as ACA-compliant plans. This non-compliance with the ACA also means that gap insurance cannot be purchased through the Health Insurance Marketplace and may have different enrolment periods.

While gap health insurance can provide valuable additional coverage, it is important to understand its limitations. It is not a substitute for major medical insurance but rather a supplementary option to help manage out-of-pocket expenses. Those considering gap insurance should carefully review the policy details, exclusions, and limitations to ensure it aligns with their specific needs and provides the desired level of coverage. Understanding the differences between gap insurance and major medical insurance is essential for making informed decisions about healthcare coverage.

Insurance Notes: Vehicle Contingency Disclosure

You may want to see also

It covers urgent care, critical illnesses and accidents

Gap health insurance is a supplementary health insurance policy that is usually purchased alongside a high-deductible health plan (HDHP). It is not a major medical plan and is not intended to meet the requirements of the Affordable Care Act (ACA). Instead, it is used in conjunction with a major medical plan that is compliant with the ACA.

Gap health insurance is focused on urgent care rather than preventive care. It covers critical illnesses and accidents, including things like a heart attack, stroke, or car accident where unplanned or emergency care is needed. Within those situations, gap insurance can cover several expenses, such as medical deductibles, copayments, and doctor visits outside the provider network. Depending on the policy, it could also cover living expenses such as housing, food, and transportation.

Gap health insurance plans include accident plans, critical illness plans, and hospital indemnity plans. They help employees manage their out-of-pocket expenses without draining their bank accounts. The premiums are paid to cover portions of out-of-pocket medical expenses under a group health insurance plan. Generally, an employer may pay (or allow employees to pay) for gap health insurance to supplement an HDHP.

Gap health insurance requires payment of an insurance premium or expense that you or your employees will cover regardless of actual medical utilization. With gap health insurance plans, you can extend healthcare coverage, offset out-of-pocket costs, and protect your employee's income.

Personal Vehicle Insurance: What You Need to Know

You may want to see also

Frequently asked questions

Gap health insurance is a group supplemental health insurance plan that works alongside a high-deductible major medical plan. It helps to cover the cost of medical care and fill the "gap" in health insurance coverage.

Gap health insurance covers unexpected high-expense medical services, such as surgeries related to heart attacks and strokes performed in hospitals. It also covers trips to the doctor's office, medical devices, treatments, and prescription medicine costs up to your out-of-pocket maximum.

Gap health insurance is ideal for those with high deductibles and high out-of-pocket medical costs. It is also beneficial for those who are in between jobs or health insurance plans, as well as those who cannot afford traditional health insurance plans.