Insurance driver schedules are an essential component of the insurance industry, particularly for companies that offer coverage for vehicles. These schedules outline the specific driving activities and responsibilities of a driver, providing a clear framework for insurance companies to assess risk and determine appropriate coverage. By detailing the driver's daily tasks, such as the types of vehicles driven, the duration of each trip, and the frequency of driving, insurance companies can tailor their policies to fit the driver's needs while ensuring fair and accurate risk assessment. This practice is crucial for both the insurance provider and the driver, as it helps manage expectations and ensures that the coverage is suitable for the driver's unique driving circumstances.

What You'll Learn

- Insurance Basics: Understanding insurance coverage and its purpose

- Driver Schedule: Documenting driving hours and rest periods

- Compliance: Adhering to regulations and industry standards

- Risk Assessment: Evaluating risks associated with driver schedules

- Claims Process: Handling insurance claims related to driver incidents

Insurance Basics: Understanding insurance coverage and its purpose

Insurance is a financial safeguard that provides protection against various risks and uncertainties in life. It is a contract between an individual or entity (the insured) and an insurance company, where the latter agrees to compensate the former for specified losses in exchange for a premium. Understanding the basics of insurance coverage is essential for anyone looking to protect themselves, their assets, and their loved ones.

The primary purpose of insurance is to manage risk. Life is full of unpredictable events, and insurance helps individuals and businesses mitigate the financial impact of these events. For example, health insurance covers medical expenses, providing financial protection against unexpected illnesses or injuries. Similarly, auto insurance safeguards against the financial consequences of car accidents, while home insurance protects against damage to one's property.

Insurance coverage is designed to offer financial protection and peace of mind. It typically includes various components, such as liability coverage, which protects the insured against claims made by others for bodily injury or property damage. For instance, if someone is injured in an accident caused by the insured, the insurance company will cover the medical expenses and legal fees. Other types of coverage include property coverage, which protects against damage to or loss of insured items, and personal injury protection, which covers medical expenses for the insured and their passengers.

When purchasing insurance, it's crucial to understand the terms and conditions of the policy. This includes knowing the coverage limits, exclusions, and any applicable deductibles. For instance, a health insurance policy might have a deductible, meaning the insured must pay a certain amount out-of-pocket before the insurance coverage kicks in. Additionally, understanding the claims process is essential, as it outlines the steps to take when a covered loss occurs.

In summary, insurance is a vital tool for managing risk and providing financial protection. It offers peace of mind by ensuring that individuals and businesses are prepared for unforeseen events. By understanding the basics of insurance coverage, including the different types of coverage, policy terms, and the claims process, one can make informed decisions when selecting and managing insurance policies. This knowledge empowers individuals to protect themselves and their assets effectively.

Automated Auto Insurance Payments: Afternoon Debit?

You may want to see also

Driver Schedule: Documenting driving hours and rest periods

A driver schedule is a crucial document for any driver, especially those in the transportation and logistics industry, as it outlines the specific hours and periods allocated for driving and rest. This schedule is essential for ensuring compliance with legal and safety regulations, as well as for effective fleet management and insurance purposes. When documenting driving hours and rest periods, there are several key elements to consider.

Firstly, it is important to record the start and end times of each driving shift. This includes any breaks taken during the shift and the duration of those breaks. For example, a driver might log a start time of 8 am and an end time of 4 pm, with a 30-minute break taken at 11 am. Accurate timekeeping is vital for insurance purposes, as it helps to establish a clear pattern of driving and rest, which can be used to assess risk and determine insurance premiums.

Rest periods are another critical aspect of a driver schedule. According to the regulations, drivers must be given adequate time to rest between shifts. This is to prevent fatigue and ensure road safety. The schedule should indicate the duration of rest periods, whether they are mandatory or optional, and any specific requirements for rest periods, such as a minimum of 10 hours off-duty time between shifts. For instance, a driver might be scheduled for a 12-hour rest period after a 10-hour driving shift, ensuring they have sufficient time to recover.

In addition to timekeeping, the driver schedule should also document the total driving hours per week or month. This is essential for insurance companies to assess the risk associated with the driver's workload. By providing a clear overview of driving hours, insurance providers can offer more accurate coverage and premiums. It also helps drivers and employers manage their schedules effectively, ensuring that no legal limits on driving hours are exceeded.

Furthermore, the schedule should include any special instructions or requirements related to driving and rest. This might include mandatory safety training sessions, vehicle maintenance checks, or specific driving conditions that need to be considered. For instance, a driver might be required to take a 30-minute break every two hours due to a particular route's challenging terrain. By documenting these details, the schedule becomes a comprehensive tool for managing driver operations and ensuring compliance with all relevant regulations.

In summary, a well-documented driver schedule is essential for drivers and their employers to manage their operations effectively while adhering to legal and safety standards. It provides a clear record of driving hours, rest periods, and any special requirements, which is vital for insurance purposes and overall fleet management. By maintaining accurate and detailed schedules, drivers can ensure they are operating within safe and legal boundaries.

Combining Auto and Motorcycle Insurance: Saving Tips

You may want to see also

Compliance: Adhering to regulations and industry standards

Compliance with regulations and industry standards is a critical aspect of the insurance industry, especially when it comes to driver schedules and related policies. This is because insurance companies are heavily regulated to ensure fair practices, protect consumers, and maintain the integrity of the market. Adhering to these standards is essential for maintaining the trust of customers and regulatory bodies alike.

In the context of driver schedules, compliance involves several key areas. Firstly, insurance companies must ensure that their policies and procedures are transparent and easily understandable to both drivers and customers. This includes clear communication about the terms and conditions of the driver's schedule, including any restrictions, payment methods, and performance expectations. For instance, a driver's schedule might specify the number of hours they are expected to work, the types of vehicles they can operate, and the geographic areas they are permitted to cover.

Secondly, compliance requires that insurance companies maintain accurate and up-to-date records of driver schedules. This includes documenting changes in schedules, any deviations from the agreed terms, and any performance issues. Such records are crucial for audit purposes and for ensuring that the company is meeting its regulatory obligations. For example, if a driver's schedule is altered due to a change in customer demand or a vehicle breakdown, the insurance company must document this change and ensure that it complies with the relevant regulations.

Furthermore, compliance also involves staying abreast of and implementing changes in regulations and industry standards. The insurance industry is subject to frequent changes in legislation and standards, which can impact driver schedules and related policies. For instance, new regulations might require additional training for drivers or impose stricter guidelines on vehicle maintenance. Insurance companies must be proactive in updating their policies and procedures to reflect these changes, ensuring that they remain compliant at all times.

In summary, compliance with regulations and industry standards is a multifaceted process that requires attention to detail, clear communication, and a proactive approach to staying informed about changes in the industry. By adhering to these standards, insurance companies can ensure that their driver schedules are fair, transparent, and in line with the expectations of both drivers and customers. This, in turn, helps to maintain the reputation and trustworthiness of the insurance company in the market.

Uber Vehicle Insurance: What You Need

You may want to see also

Risk Assessment: Evaluating risks associated with driver schedules

Driver schedules are a critical component of the insurance industry, especially for those involved in the transportation and logistics sector. When assessing the risks associated with driver schedules, it is essential to consider various factors that can impact the safety, efficiency, and overall performance of drivers. Here's an overview of the risk assessment process:

Risk Identification: Begin by identifying potential risks related to driver schedules. These risks can be categorized into several areas. Firstly, consider the impact of long working hours on driver fatigue. Insufficient rest and extended periods behind the wheel can lead to drowsiness, reduced reaction times, and impaired decision-making. This is a significant concern as it directly affects road safety. Secondly, evaluate the scheduling practices themselves. Inefficient scheduling may result in unrealistic deadlines, causing drivers to exceed legal speed limits or make risky maneuvers to meet time constraints. Another critical aspect is the driver's personal life and commitments. Unforeseen personal issues or family emergencies can disrupt schedules, leading to potential delays or missed deliveries.

Data Analysis: Gather and analyze relevant data to assess the risks. Collect historical data on driver performance, including accident records, traffic violations, and on-time delivery statistics. Identify patterns and trends that might indicate a higher risk associated with certain scheduling practices. For instance, are there more accidents during specific hours or on particular routes? Analyze driver logs and GPS data to understand driving patterns and identify any deviations from expected behavior. This data-driven approach provides valuable insights into the risks associated with different scheduling scenarios.

Risk Mitigation Strategies: Develop comprehensive strategies to mitigate the identified risks. Implement strict guidelines and regulations regarding working hours and rest periods to ensure drivers adhere to legal limits. Encourage the use of fatigue-monitoring systems and provide drivers with regular breaks to combat drowsiness. Optimize scheduling algorithms to create realistic and achievable schedules, allowing for flexibility and considering real-time traffic conditions. Additionally, establish a robust communication system where drivers can report personal issues promptly, enabling the company to adjust schedules accordingly and provide support when needed.

Regular Review and Adaptation: Risk assessment is an ongoing process. Regularly review and update driver schedules to adapt to changing circumstances. Seasonal variations, weather conditions, and unexpected events can impact risk levels. By continuously monitoring and evaluating, insurance companies can ensure that driver schedules remain safe and efficient. This iterative approach allows for quick risk mitigation and adaptation to evolving industry standards and regulations.

In summary, evaluating risks associated with driver schedules requires a thorough understanding of various factors influencing driver performance and safety. By identifying potential risks, analyzing data, and implementing effective mitigation strategies, insurance companies can ensure a safer and more efficient transportation system. This risk assessment process is vital for maintaining a competitive edge and providing reliable services in the insurance industry.

Vehicle Registration: Insurance or Not?

You may want to see also

Claims Process: Handling insurance claims related to driver incidents

The claims process for insurance related to driver incidents is a structured approach to managing and resolving claims efficiently. When a driver is involved in an accident, the first step is to ensure that all parties involved are safe and any immediate medical attention is provided. Once the situation is under control, the driver should immediately contact their insurance company to initiate the claims process. This initial contact is crucial as it sets the tone for the entire handling of the claim.

During the call, the insurance representative will gather essential details about the incident, including the date, time, location, and a description of the accident. They will also ask for personal information to verify the driver's identity and policy coverage. It is important to provide accurate and honest information at this stage to avoid any potential complications later. The representative will then guide the driver through the next steps, which typically involve filing a detailed claim report and providing supporting documents.

The claim report should include a comprehensive account of the incident, including witness statements (if available), police reports (if applicable), and any relevant photographs or videos. These documents help in reconstructing the events and establishing liability. The insurance company may also request additional information, such as vehicle maintenance records or driver's license details, to assess the claim thoroughly. Once the claim is filed, the insurance provider will assign a claims adjuster to handle the case.

The adjuster's role is to investigate the claim, assess the damages, and determine the appropriate compensation. They will review the provided documentation, conduct interviews, and may even arrange for vehicle inspections. It is essential for the driver to cooperate fully with the adjuster and provide any additional information requested. The adjuster will then make a decision regarding the claim's settlement, which could be in the form of repairs, replacements, or financial compensation.

If the claim is approved, the insurance company will facilitate the necessary repairs or provide the agreed-upon compensation. The driver should maintain records of all communication and correspondence related to the claim for future reference. In cases where the claim is denied or disputed, the driver has the right to appeal the decision and provide additional evidence to support their claim. This process ensures that all parties involved receive fair treatment and that the insurance company can manage its liabilities effectively.

Vehicle Adjuster: How to Start

You may want to see also

Frequently asked questions

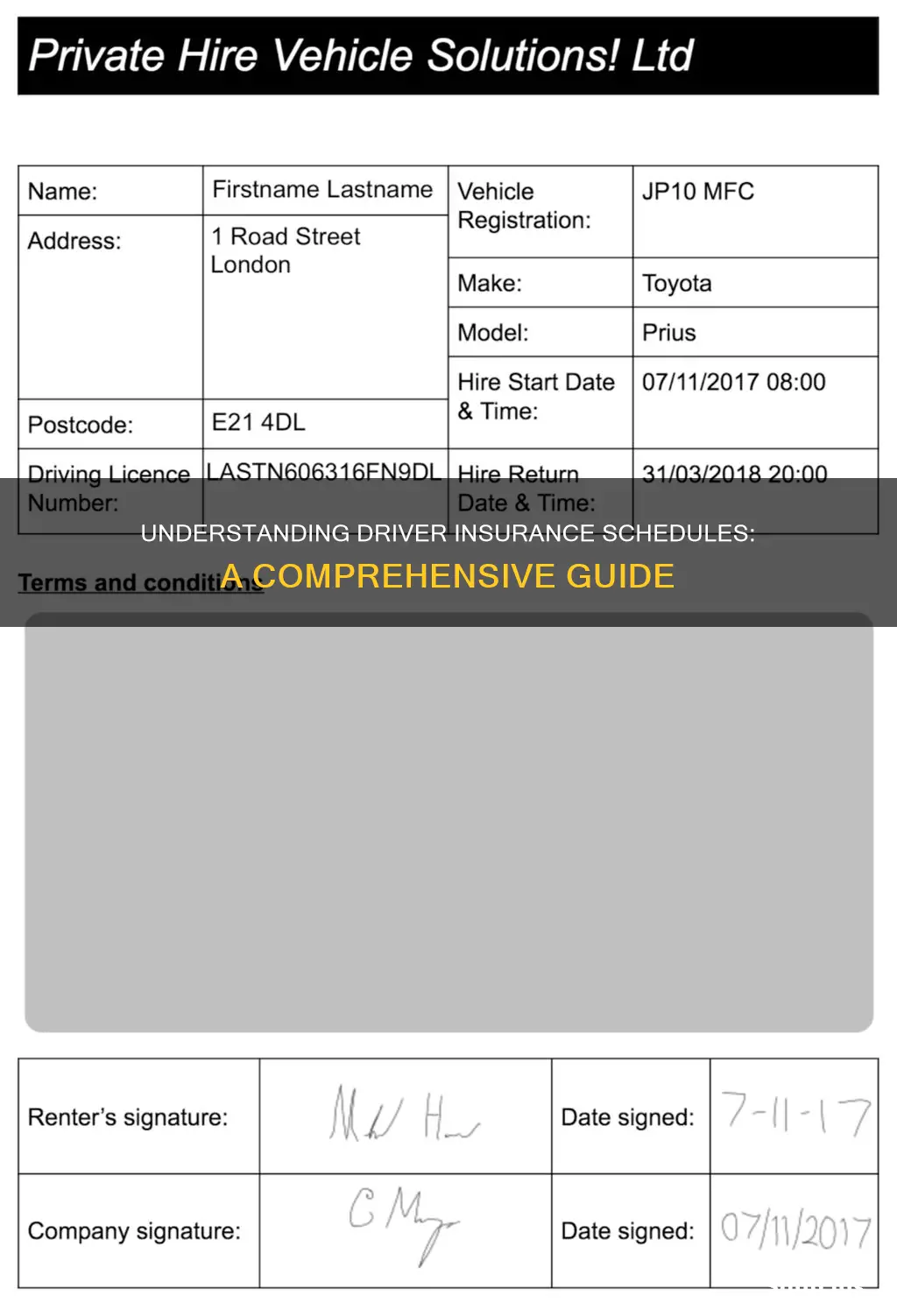

An insurance driver schedule, also known as a driver's duty or duty record, is a document that outlines the driving activities and responsibilities of a driver for an insurance company or a fleet management organization. It typically includes details such as the driver's start and end times, the routes they cover, the vehicles they operate, and any specific tasks or deliveries they are assigned.

This schedule is crucial for several reasons. Firstly, it helps insurance companies and fleet managers monitor and manage their drivers' activities, ensuring compliance with regulations and company policies. It also aids in risk assessment and claims management by providing a record of the driver's movements and potential exposure to risks. Additionally, it can be used for performance evaluation and training purposes.

The insurance driver schedule can vary depending on the organization's needs and the type of driving involved. It often includes sections for driver details, such as name, license number, and contact information. It then lists the driving duties, which may include pick-up and drop-off locations, delivery times, and any special instructions. Some schedules might also include breaks, rest periods, and any administrative tasks.

Absolutely. In the event of an accident or claim, the insurance driver schedule can provide valuable information. It helps investigators understand the driver's movements, potential factors contributing to the incident, and the sequence of events leading up to the accident. This documentation is essential for insurance companies to assess liability and process claims efficiently.