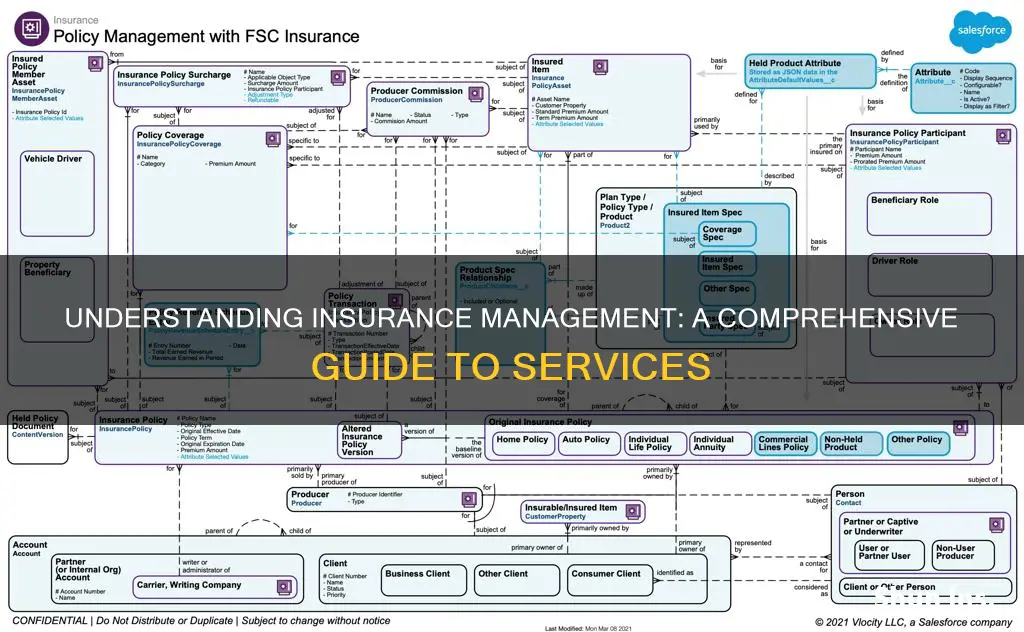

Insurance management services encompass a range of professional offerings designed to streamline and optimize the insurance process for individuals and businesses. These services typically involve expert guidance and support in various areas, such as policy selection, risk assessment, claims management, and regulatory compliance. By leveraging their knowledge and experience, insurance management professionals help clients navigate the complexities of insurance, ensuring they have the right coverage to protect their assets and manage risks effectively. This can include advising on the most suitable insurance products, assisting with policy renewals, and providing valuable insights to minimize potential losses.

What You'll Learn

- Risk Assessment: Identifying and evaluating potential risks to determine insurance coverage needs

- Policy Administration: Managing and maintaining insurance policies, including premium payments and claims processing

- Claims Management: Handling and resolving insurance claims, ensuring fair and timely settlements

- Regulatory Compliance: Adhering to insurance regulations and laws to ensure ethical and legal practices

- Customer Service: Providing support and assistance to policyholders, addressing inquiries and concerns

Risk Assessment: Identifying and evaluating potential risks to determine insurance coverage needs

Risk assessment is a critical component of insurance management services, as it involves a systematic process of identifying, analyzing, and evaluating potential risks that could impact an individual, business, or organization. This process is essential to ensure that appropriate insurance coverage is in place to mitigate financial losses and provide protection against unforeseen events. Here's a detailed breakdown of how risk assessment contributes to determining insurance coverage needs:

Identifying Risks: The first step is to identify potential risks that could lead to financial losses. This requires a comprehensive understanding of the environment and operations of the insured entity. Risks can be categorized into various types, including financial, operational, legal, environmental, and strategic risks. For instance, a business might face financial risks like market volatility, operational risks such as equipment failure, legal risks associated with lawsuits, environmental risks from natural disasters, and strategic risks related to business decisions. During this phase, insurance professionals collaborate with clients to gather information, conduct interviews, and review existing data to create a comprehensive risk profile.

Risk Analysis and Evaluation: Once risks are identified, the next step is to analyze and evaluate their potential impact. This involves assessing the likelihood and severity of each risk. For example, a natural disaster like a hurricane might have a high likelihood of occurrence in a specific region but a low impact on a small business. In contrast, a data breach could have a lower likelihood but a severe impact on a financial institution. Insurance experts use various tools and techniques, such as risk matrices, to prioritize risks based on their potential consequences. This evaluation helps in understanding the exposure and vulnerability of the insured party.

Determining Insurance Coverage: Based on the risk assessment, insurance management services professionals can recommend appropriate insurance coverage. This involves selecting the right insurance policies, such as property insurance, liability coverage, business interruption insurance, or professional indemnity insurance, to address the identified risks. For instance, a company might need comprehensive general liability insurance to cover potential lawsuits, or they might require cyber insurance to protect against data breaches. The insurance advisor will propose coverage limits and exclusions tailored to the assessed risks, ensuring that the policy provides adequate protection without unnecessary expenses.

Risk Mitigation and Management: Risk assessment also plays a vital role in developing strategies to mitigate and manage risks. This could include implementing safety protocols, regular maintenance, employee training, or purchasing specific equipment to reduce the likelihood or impact of certain risks. For example, a restaurant might improve kitchen safety measures to reduce the risk of fire, thus lowering the insurance premium for fire insurance. Insurance management services can provide guidance on risk management practices, helping clients make informed decisions to minimize potential losses.

By conducting thorough risk assessments, insurance management services professionals can offer tailored solutions, ensuring that clients are adequately protected. This process is an essential part of the insurance management lifecycle, allowing for proactive risk management and the provision of appropriate insurance coverage. It empowers individuals and businesses to make informed choices, ultimately leading to better financial security and resilience.

Young Drivers: Discounted Insurance Options

You may want to see also

Policy Administration: Managing and maintaining insurance policies, including premium payments and claims processing

Insurance management services encompass a range of administrative tasks that ensure the smooth operation of insurance policies. At its core, policy administration involves the meticulous management and maintenance of insurance contracts, encompassing various critical aspects. One of the primary responsibilities is premium collection, which entails processing payments, ensuring timely and accurate billing, and managing payment methods to guarantee a steady revenue stream for the insurance provider. This process requires a robust system to handle premium payments, including online, phone, and mail options, and often involves automated reminders to policyholders to prevent lapses in coverage.

Claims processing is another vital component of policy administration. When a policyholder files a claim, the insurance management team must efficiently manage the process to ensure timely settlements. This includes verifying the validity of the claim, gathering necessary documentation, and coordinating with adjusters or investigators to assess the damage or loss. Effective claims management requires a structured approach to streamline the process, reduce potential fraud, and provide fair and prompt resolutions to policyholders.

Maintaining accurate and up-to-date policy records is essential for effective administration. This involves updating policy details, such as coverage amounts, deductibles, and policyholder information, to ensure that the insurance provider has the most current data. Additionally, policy administration includes the management of policy changes, such as adding or removing coverage, updating personal information, and addressing any policy endorsements or riders. This requires a meticulous eye for detail to ensure compliance with regulatory requirements and the specific terms of each policy.

Furthermore, insurance management services often involve the development and implementation of policies and procedures to standardize and improve administrative processes. This includes creating guidelines for premium calculation, claim handling, and policy documentation. Standardization ensures consistency and efficiency, reducing potential errors and delays. It also enables better training and knowledge transfer among staff, fostering a more cohesive and responsive insurance management team.

In summary, policy administration is a critical function within insurance management services, focusing on the day-to-day management and maintenance of insurance policies. It involves premium collection, efficient claims processing, accurate record-keeping, and the implementation of standardized procedures. Effective policy administration ensures that insurance providers can deliver on their commitments to policyholders, maintain a positive reputation, and operate with financial stability.

Navigating Insurance Billing: What to Do When Your Doctor's Office Refuses to Bill Your Insurer

You may want to see also

Claims Management: Handling and resolving insurance claims, ensuring fair and timely settlements

Claims management is a critical component of insurance management services, focusing on the efficient and equitable handling of insurance claims. This process involves several key steps to ensure that policyholders receive fair and timely settlements, which is essential for maintaining customer satisfaction and trust in the insurance industry.

The first step in claims management is the initial claim reporting. When an insured individual or entity files a claim, it is typically done through a designated channel, such as a phone call, online portal, or email. The claims adjuster, who is often the first point of contact, gathers relevant information, including the nature of the loss, the policy details, and any supporting documentation. This initial assessment helps to categorize the claim and determine the appropriate course of action.

Once the claim is assessed, the adjuster investigates the incident to verify the facts and circumstances. This may involve site visits, interviews with involved parties, and the collection of additional evidence. The adjuster's role is to make a fair and impartial determination of the claim's validity and the extent of the loss. This step is crucial to ensure that the settlement is appropriate and in line with the insurance policy's terms and conditions.

After the investigation, the adjuster prepares a detailed report outlining the findings and recommendations for the claim settlement. This report is then reviewed by the claims manager or supervisor, who ensures that all relevant policies and regulations are followed. The manager also checks for any discrepancies or potential issues that may require further clarification or investigation. Once approved, the settlement offer is made to the policyholder, detailing the amount, the reasons for the decision, and the process for accepting or appealing the offer.

Timely and fair settlements are essential to maintain the reputation of insurance companies and to foster a positive relationship with their customers. Efficient claims management also involves providing regular updates to policyholders throughout the process, ensuring transparency and reducing potential disputes. Additionally, insurance management services may offer additional support, such as providing assistance with repairs or replacements, to help policyholders recover from the loss promptly.

Insurance: A Commodity or Not?

You may want to see also

Regulatory Compliance: Adhering to insurance regulations and laws to ensure ethical and legal practices

Insurance management services encompass a wide range of activities aimed at ensuring the smooth operation of insurance companies and the protection of policyholders. One critical aspect of this field is regulatory compliance, which involves adhering to a complex web of insurance regulations and laws designed to maintain ethical and legal standards within the industry. These regulations are in place to safeguard consumers, promote fair competition, and prevent fraudulent activities.

Regulatory compliance in insurance management is a multifaceted process. It requires insurance companies to navigate through various legal requirements, including those related to licensing, underwriting, claims handling, and customer service. For instance, insurance providers must obtain the necessary licenses to operate in specific jurisdictions, ensuring they meet the regulatory standards set by the relevant authorities. Underwriting practices are also closely scrutinized to ensure that policies are issued fairly and in compliance with the law, considering factors such as risk assessment and premium calculation.

The claims process is another area where regulatory compliance is crucial. Insurance companies must adhere to regulations governing how and when claims are processed, including timely responses, accurate documentation, and fair settlement practices. This ensures that policyholders receive the benefits they are entitled to while also protecting the insurer from potential fraud. Additionally, insurance management services must maintain transparency in their operations, providing clear and accessible information to policyholders and regulatory bodies.

To ensure compliance, insurance companies often employ dedicated compliance departments or teams. These professionals are responsible for monitoring and interpreting regulatory changes, implementing compliance programs, and conducting internal audits. They also play a vital role in educating employees about regulatory requirements and ethical conduct. Regular training sessions and workshops can help employees understand their responsibilities and the potential consequences of non-compliance.

In summary, regulatory compliance is a cornerstone of insurance management services, ensuring that insurance companies operate within the boundaries of the law and ethical standards. It involves a comprehensive approach to licensing, underwriting, claims handling, and customer service, all aimed at protecting consumers and maintaining the integrity of the insurance industry. By adhering to these regulations, insurance providers can build trust with their customers and contribute to a stable and fair market environment.

Expanding Insurance: Improving Healthcare Access

You may want to see also

Customer Service: Providing support and assistance to policyholders, addressing inquiries and concerns

Insurance management services encompass a wide range of activities aimed at ensuring smooth operations and efficient management of insurance policies. One critical aspect of this field is customer service, which involves providing support and assistance to policyholders throughout their insurance journey. Effective customer service is essential for building trust, fostering long-term relationships, and ensuring customer satisfaction.

The primary role of customer service in insurance management is to address inquiries and concerns promptly and efficiently. Policyholders often have questions about their policies, coverage details, claim processes, and other related matters. Customer service representatives are trained to handle these inquiries, providing accurate and timely information. They should possess a comprehensive understanding of insurance products, policies, and procedures to offer suitable solutions. For instance, they might explain the coverage limits and exclusions of a policy, guide a policyholder through the claims filing process, or provide updates on the status of a claim.

In addition to addressing inquiries, customer service representatives play a vital role in resolving concerns. Policyholders may encounter issues such as policy discrepancies, billing problems, or delays in claim settlements. These representatives should be equipped with the skills to handle complaints, demonstrate empathy, and offer appropriate remedies. They might need to escalate complex issues to specialized teams or departments within the insurance company to ensure a thorough investigation and resolution.

To excel in customer service, insurance management professionals should focus on several key areas. Firstly, they should ensure that all interactions are personalized and tailored to the specific needs of each policyholder. This might involve using the policyholder's name, understanding their unique circumstances, and offering customized solutions. Secondly, quick response times are crucial. Policyholders appreciate prompt attention to their inquiries and concerns, so efficient handling of requests is essential.

Furthermore, customer service representatives should strive to provide accurate and consistent information. They should stay updated on policy changes, new products, and industry developments to offer the most relevant and reliable advice. Regular training and knowledge-sharing sessions can help ensure that the team is well-equipped to handle a wide range of customer interactions. By prioritizing customer service, insurance management companies can enhance their reputation, build customer loyalty, and ultimately contribute to the overall success of the business.

Insurance Obsession: Why the Safety Net Craze?

You may want to see also

Frequently asked questions

Insurance Management Services refers to the specialized services provided by professionals who help individuals and businesses manage their insurance policies and claims. These services are designed to ensure that clients have the right coverage, understand their policies, and can navigate the complex world of insurance efficiently.

These services offer numerous advantages. They provide personalized advice to help you choose the best insurance plans based on your specific needs. They also assist in filing and managing insurance claims, ensuring a smoother process and potentially faster compensation. Additionally, they can help you stay compliant with insurance regulations and keep your policies up-to-date.

Insurance management services can be offered by various professionals, including independent insurance agents, brokers, and consultants. These individuals often have expertise in different insurance fields and can provide tailored solutions. Many insurance companies also have dedicated management services departments to assist their policyholders.

Their key responsibilities include assessing clients' insurance needs, recommending appropriate coverage, assisting with policy purchases, and providing guidance on insurance-related matters. They also help clients understand their rights and obligations under the policy, manage premium payments, and offer support during the claims process.

You might consider using these services when you need expert advice on insurance matters, especially if you have complex coverage needs or want to ensure you're getting the best value for your premiums. It's also beneficial when you need assistance with claims, as they can help streamline the process and provide support during what can be a stressful time.