Transferring ownership of a life insurance policy is known as a life settlement. There are several ways to do this, including absolute assignment, which involves transferring all rights and ownership of the policy to another person or entity. It's important to be aware of the tax implications of transferring ownership, as outlined in the transfer-for-value rule.

| Characteristics | Values |

|---|---|

| Name of process | Life settlement |

| Other names | Absolute assignment, transfer-for-value rule |

| Who can transfer ownership? | Policyholder, assignor |

| Who can ownership be transferred to? | Another person, trust, corporation, business entity, assignee |

| Is it permanent? | Yes |

| Is it revocable? | No |

| What are the benefits? | Estate planning, management and distribution of policy proceeds, key person insurance, executive benefits, estate tax savings |

| What are the drawbacks? | If transferred improperly, the policy proceeds may constitute taxable income to policy beneficiaries |

What You'll Learn

Change of beneficiary

Transferring ownership of a life insurance policy is known as a life settlement. This typically occurs when the policyholder no longer needs the coverage or wishes to liquidate the policy's value. There are several ways to transfer ownership, including absolute assignment, which involves transferring all rights and ownership of a life insurance policy to another person or entity. This transfer is usually permanent and irrevocable.

However, instead of transferring ownership, the policyholder can change the beneficiary designation on the policy. This is known as a change of beneficiary. By changing the beneficiary, the policy proceeds will be paid directly to the new beneficiary upon the insured's death, effectively redirecting the benefits to someone else. This option may be preferable in certain situations, such as when the policyholder wishes to maintain some control over the policy or wants to avoid the tax implications of transferring ownership.

The change of beneficiary process can vary depending on the insurance company and the specific policy. In general, the policyholder will need to contact the insurance company and request a change of beneficiary form. This form will require the policyholder to provide information about the new beneficiary, including their name, address, and relationship to the policyholder. Once the form is completed and submitted, the insurance company will update the policy to reflect the new beneficiary designation.

It is important to note that changing the beneficiary of a life insurance policy can have significant financial and legal implications. Therefore, it is always advisable to seek professional advice before making any changes to ensure that the policyholder's intentions are correctly carried out and that the beneficiary receives the intended benefits. Additionally, it is worth considering the potential tax consequences of changing beneficiaries, as there may be rules and regulations that apply, such as the "transfer-for-value" rule, which can impact the taxation of policy proceeds.

Thyroid Cancer Survivors: Getting Life Insurance After Treatment

You may want to see also

Sale or gift

Transferring ownership of a life insurance policy is called a 'transfer for value'. If the policy is transferred within three years of the insured's death, the proceeds may be taxable. This is known as the '3-year rule'.

If the policyholder no longer needs the coverage or wishes to liquidate the policy's value, they may choose to sell the policy to another person or entity for a negotiated price. This is known as a life settlement. Alternatively, the policyholder can change the beneficiary designation on the policy. By changing the beneficiary, the policy proceeds will be paid directly to the new beneficiary upon the insured's death.

Life Insurance IRAs: A Smart Investment Strategy?

You may want to see also

Tax implications

Transferring ownership of a life insurance policy is known as a life settlement. This typically occurs when the policyholder no longer needs the coverage or wishes to liquidate the policy's value. There are several ways to transfer ownership, including absolute assignment, which involves transferring all rights and ownership of the policy to another person or entity. This transfer is usually permanent and irrevocable. Another method is to change the beneficiary designation on the policy, which will redirect the benefits to the new beneficiary upon the insured's death.

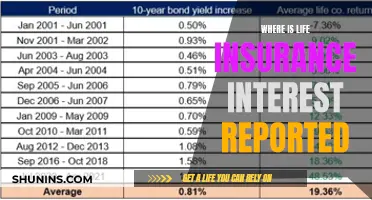

There are serious tax implications to be aware of when transferring ownership of a life insurance policy. If the transfer is not done properly, the policy proceeds may be subject to the "transfer for value" rule, which can result in taxable income for policy beneficiaries. This rule, outlined in Internal Revenue Code Section 101(a)(2), applies when the ownership of a life insurance policy changes hands for valuable consideration. It is important for policyholders, potential buyers, and financial professionals to understand this rule to make informed decisions regarding life insurance.

Fidelity & Guaranty Life Insurance: Same or Different?

You may want to see also

'Transfer for value' rule

Transferring ownership of a life insurance policy is known as a life settlement. This typically occurs when the policyholder no longer needs the coverage or wishes to liquidate the policy's value. There are several ways to transfer ownership, including absolute assignment, changing the beneficiary, and transferring the policy to a trust.

Absolute assignment involves transferring all rights and ownership of a life insurance policy from the policyholder (assignor) to another person or entity (assignee). This transfer is usually permanent and irrevocable. Another way to transfer ownership is to change the beneficiary designation on the policy. By doing so, the policy proceeds will be paid directly to the new beneficiary upon the insured's death, effectively redirecting the benefits to someone else.

A life insurance policy can also be transferred to a trust, where the trust becomes the new policy owner. This can provide various estate planning benefits, such as facilitating the management and distribution of policy proceeds according to the trust's terms. In some cases, a life insurance policy may be owned by a corporation or business entity for purposes like key person insurance or executive benefits.

It is important to note that there is a serious tax trap associated with transferring ownership of a life insurance policy. This is known as the "transfer for value" rule. Outlined in Internal Revenue Code Section 101(a)(2), this rule comes into play when the ownership of a life insurance policy changes hands for valuable consideration. It is important for policyholders, potential buyers, and financial professionals to understand the implications of this rule for the taxation of life insurance proceeds.

Life Insurance: Mitigation and Its Complex Requirements

You may want to see also

'3-year rule'

Transferring ownership of a life insurance policy is called an absolute assignment. This involves transferring all rights and ownership of a life insurance policy from yourself to someone else or a legal entity.

There is also a 'transfer-for-value' rule, which is a tax trap. If the ownership of a life insurance policy changes hands for valuable consideration, the proceeds may constitute taxable income to policy beneficiaries.

The 3-year rule is a tax regulation in the U.S. Internal Revenue Code that can impact the tax treatment of life insurance proceeds when the policy is transferred within three years of the insured's death. If an insured person transfers an insurance policy to an Irrevocable Life Insurance Trust (ILIT) and dies within three years of the transfer, the entire policy proceeds will be included in the insured's gross estate. This is known as the IRS's three-year look-back policy.

The 3-year rule poses a significant challenge for those looking to transfer existing life insurance policies to an ILIT. While establishing a trust with a new policy circumvents this issue, it may not always be feasible if there is an existing policy. One way to avoid estate inclusion under the 3-year rule is to gift an existing life insurance policy to an ILIT and give up any level of control over the policy and the trust. However, even under the most ideal circumstances, if the insured dies within three years of gifting the policy to the trust, all or most of the life insurance policy proceeds will be added to the decedent's gross estate and become subject to estate taxation.

Suicide and Life Insurance: Are Benefits Paid Out?

You may want to see also

Frequently asked questions

This is known as a life settlement.

There are several ways to transfer ownership of a life insurance policy, including absolute assignment, which involves transferring all rights and ownership of a life insurance policy to another person or entity. Another option is to change the beneficiary designation on the policy, which will redirect the benefits to the new beneficiary upon the insured's death.

Yes, if the ownership of a life insurance policy is transferred improperly, the policy proceeds may constitute taxable income to policy beneficiaries. This is known as the "transfer for value" rule.