J.D. Power is a global leader in consumer insights, advisory services, and data analytics. It provides valuable information to consumers who are making decisions about insurance, vehicles, travel, and other purchases. J.D. Power's studies are considered objective because they are based on a wide range of responses from consumers and often include analysis of multiple companies for comparison. The company's insurance studies cover the automotive, home, and life insurance fields. J.D. Power's annual U.S. Auto Claims Satisfaction Study, for example, examines the car insurance claim experience of policyholders from start to finish. The company's 2023 U.S. Auto Insurance Study found that satisfaction with auto insurance had dropped significantly, largely due to surging rates. J.D. Power's home insurance studies also provide insights into customer satisfaction with homeowners and renters insurance. For instance, the company's 2022 U.S. Home Insurance Study revealed that rising auto insurance premiums were leading customers to break up their home and auto insurance bundles.

What You'll Learn

J.D. Power's 2024 Property Claims Study

J.D. Power is a global leader in consumer insights, advisory services, and data and analytics. It has been providing detailed, objective studies on a variety of industries since 1968. The company's services first gained editorial acclaim in the 1970s when The Wall Street Journal referenced one of its first independently funded surveys. J.D. Power's studies are considered objective because they are based on a wide range of responses from consumers and often include analysis of multiple companies for comparison.

The J.D. Power 2024 Property Claims Study focuses on customer satisfaction with home insurance companies. The study found that Amica, AIG, and Erie Insurance are the top three companies for claims satisfaction. Chubb ranked highest for overall customer satisfaction with a score of 688/1000, followed by AIG with 680/1000. The study also revealed that customer satisfaction with home insurance companies was at a seven-year low, largely due to severe weather events causing longer claim times.

The study further highlighted the importance of consistency in service, with customer satisfaction dropping by 200 points when insurers failed to provide consistent service. Additionally, the use of digital tools for submitting claims did not always result in higher satisfaction, as digital claims took longer than expected. The cost was another factor impacting overall satisfaction, with rising premiums and deductibles affecting customer satisfaction.

The J.D. Power 2024 Property Claims Study provides valuable insights into the performance of home insurance companies and their ability to meet customer needs. The study's findings can help insurers identify areas for improvement and enhance their customer satisfaction levels.

Best Auto Insurance: Fair and Affordable

You may want to see also

Auto Insurance Customer Satisfaction

The J.D. Power U.S. Auto Insurance Study is an annual report that examines customer satisfaction with auto insurance providers in 11 geographic regions across the United States. The study evaluates providers based on five key factors: billing process and policy information, claims, interaction, policy offerings, and price. In recent years, the industry has faced challenges due to rising costs and increasing customer dissatisfaction.

Key Findings

One of the key findings of the 2023 study was the significant drop in overall customer satisfaction with auto insurance providers. Satisfaction levels fell by 12 points on a 1,000-point scale compared to the previous year, the largest decline in the past 20 years. This decrease was primarily driven by lower satisfaction with the price of insurance, which saw a 25-point drop. The study also found that nearly one-third of customers experienced a rate increase, with insurers raising rates by an average of 15.5%.

Impact of Rate Increases

The rate increases implemented by auto insurers had a notable impact on customer satisfaction. Customers who received a bill in the mail and paid in full by credit card were more likely to be aware of the price increase, with nearly half of them reporting a higher rate. On the other hand, those who received a digital bill and made automatic recurring payments were less likely to notice the increase, with only about one-fourth reporting a change.

Usage-Based Insurance

The study also highlighted the growing adoption of usage-based insurance (UBI) programs, which base policy costs on a driver's behaviour using telematics data. Participation in UBI programs has more than doubled since 2016, and customers who participate tend to have much higher price satisfaction than those who don't. However, there are still concerns over the accuracy of data collected by UBI technologies.

Regional Variations

The J.D. Power study identified the highest-ranking auto insurers in different regions of the U.S. For example, in California, Wawanesa was ranked highest for the fourth consecutive year, while in the Central region, Shelter was ranked first for the third year in a row. State Farm took the top spot in Florida, and Erie Insurance was ranked highest in the Mid-Atlantic region for the second consecutive year.

Strategies for Insurers

Mark Garrett, director of insurance intelligence at J.D. Power, emphasized the importance of proactively offering UBI alternatives, clearly communicating rate increases, and consistently delivering on brand promises to mitigate the negative impact of rising costs on customer satisfaction.

Understanding Arizona's Auto Insurance Grace Period: Avoiding a Lapse

You may want to see also

Customer Retention

J.D. Power is a consumer data and analytics company that has been providing detailed, objective studies on a variety of industries since 1968. The company is known for its unbiased evaluation of services and products, which has earned it a solid reputation. Its studies are considered trustworthy because they are based on a large number of responses from consumers across the country and often include analysis of multiple companies for comparison.

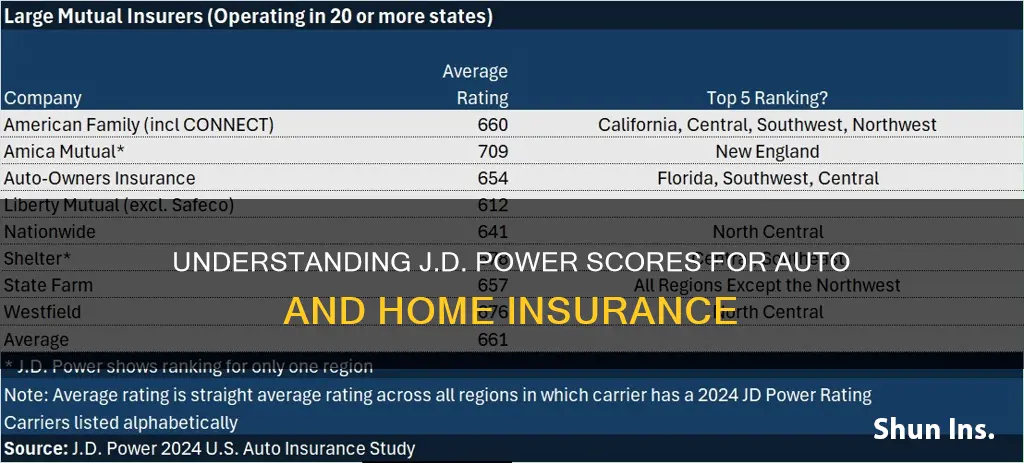

The J.D. Power insurance rankings strongly indicate how well a company performs and can be a useful tool for customer retention. In the case of auto insurance, the J.D. Power Auto Insurance Study groups customer satisfaction for different carriers into regions such as New England, Southwest, Texas, California, and Florida. This allows for a more accurate analysis since a national company may perform better in one area than another.

The study measures customer satisfaction with auto insurance in 11 geographic regions and examines five factors: billing process and policy information, claims, interaction, policy offerings, and price. The 2023 study found that overall customer satisfaction with auto insurance providers had dropped 12 points on a 1,000-point scale, the largest decline in 20 years. This was largely driven by lower satisfaction with the price of insurance, with a 25-point decrease in this category.

For home insurance, the J.D. Power Home Insurance Study examines overall customer satisfaction with two distinct personal insurance product lines: homeowners and renters. Satisfaction in these segments is measured by examining five factors: interaction, policy offerings, price, billing process and policy information, and claims. The 2023 study found that overall homeowner satisfaction was flat compared to 2022, while renter satisfaction increased by one point. However, average filed rate increases for home insurance have been in the double digits each month since February 2023, and nearly half of homeowners insurance customers affected by a rate filing received a rate increase of 5% or more in 2022.

To improve customer retention, insurance companies can focus on providing consistent service, as higher customer satisfaction occurs when there is consistency. Additionally, notifying customers in advance of price increases and offering alternatives such as usage-based insurance (UBI) programs can help blunt the negative effects of rising costs.

Maximizing Your Auto Insurance Adjuster: Tips and Strategies

You may want to see also

Customer Satisfaction Surveys

J.D. Power is a global leader in consumer insights, advisory services, and data and analytics. The company has been providing detailed and objective studies on a variety of industries since 1968. J.D. Power's studies are considered credible because they are based on a large number of responses from consumers across the nation and often include analysis of multiple companies for comparison. The company's mission statement emphasizes its commitment to unbiased data and findings, with a focus on ethical and professional standards.

J.D. Power conducts customer satisfaction surveys for the auto and home insurance industries. These surveys provide valuable insights into how customers feel about their insurance carriers and help insurance companies understand where they can improve. The J.D. Power Auto Insurance Study, for example, examines customer satisfaction in five factors: billing process and policy information, claims, interaction, policy offerings, and price. The study found that overall customer satisfaction with auto insurance providers decreased in 2023, largely due to surging rates.

The J.D. Power Home Insurance Study also examines customer satisfaction in the same five factors as the auto insurance study. The study found that overall satisfaction among homeowners and renters remained flat in 2023, while rates started to increase. Additionally, the study highlighted the impact of insurer-initiated auto premium increases on customer retention and satisfaction with bundled home and auto policies.

The results of these customer satisfaction surveys are used to rank insurance carriers. For example, in the 2024 U.S. Home Insurance Study, Chubb ranked highest in overall customer satisfaction, followed by AIG. Similarly, the J.D. Power 2022 U.S. Auto Insurance Study found that Wawanesa ranked highest in California, while Shelter ranked highest in the Central region.

By conducting these surveys and publishing the results, J.D. Power provides valuable information for consumers and insurance companies alike. Consumers can use the rankings to make informed decisions about their insurance choices, while insurance companies can identify areas for improvement to enhance customer satisfaction.

Remove Your Wife from Your Auto Insurance Policy

You may want to see also

J.D. Power's Home Insurance Study

The J.D. Power Home Insurance Study examines customer satisfaction with two distinct personal insurance product lines: homeowners and renters. The study is based on responses from thousands of homeowners and renters via online interviews. The study measures satisfaction across several factors, including interaction, policy offerings, price, billing process, policy information, and claims.

The 2022 study found that overall satisfaction among homeowners and renters decreased, largely due to rising auto insurance premiums and price dissatisfaction. The retention rates for customers who bundle their home and auto policies were significantly higher than for those who do not bundle. The study also highlighted the potential risk to bundled home policies when customers switch their auto insurer due to premium increases.

The 2023 study revealed that overall homeowner satisfaction remained flat while renter satisfaction increased slightly. It was noted that rising rates and insurers exiting certain states could impact customer satisfaction and trust. The study also found that price sensitivity was a key factor in customers switching carriers, and that bundling of home and auto policies was less prevalent in states experiencing carrier exits and rising rates.

The 2024 study focused on property claims satisfaction and found that customer satisfaction had declined to a seven-year low due to a high number of catastrophic weather events and slower repair times. The average claims cycle time had increased to 23.9 days, and customers who used digital tools for claims reporting experienced faster cycle times but not necessarily higher satisfaction. The study also highlighted the impact of rising insurance premiums and higher costs on overall satisfaction.

The J.D. Power Home Insurance Study provides valuable insights into customer satisfaction and emerging trends in the home insurance market, helping insurers identify areas for improvement and enhance their brand image.

Luxury Cars: Higher Insurance Costs?

You may want to see also

Frequently asked questions

Overall customer satisfaction with auto insurance providers is 822 (on a 1,000-point scale).

Overall customer satisfaction with auto insurance providers is 834 (on a 1,000-point scale).

Overall customer satisfaction with auto insurance providers is 835 (on a 1,000-point scale).

Chubb ranked highest overall in customer satisfaction with a score of 688/1,000.

Erie Insurance ranks highest in the homeowners insurance segment, with a score of 856.