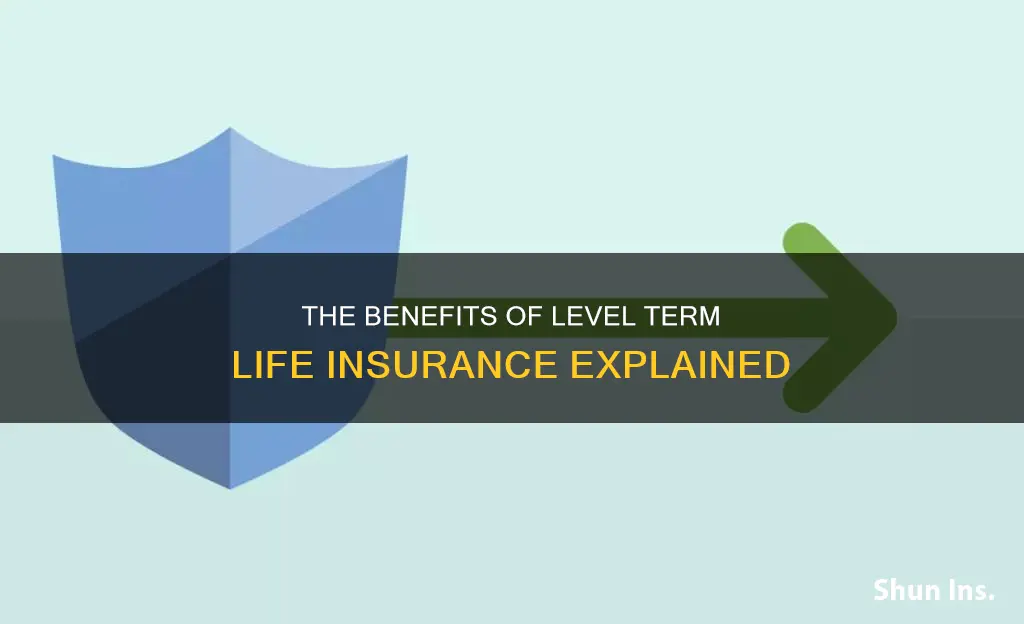

Level term life insurance is a type of life insurance that provides coverage for a specified period, typically between 10 and 30 years. It is one of the most popular types of life insurance available, and is also known as level benefit term life insurance. This is because the death benefit stays the same throughout the policy's life and does not decrease over time. Level term life insurance policies are ideal for people with defined financial obligations like a mortgage, educational expenses or family support needs.

| Characteristics | Values |

|---|---|

| Type of insurance | Term life insurance |

| Policy | Level death benefit for the entire time the policy is in effect |

| Premium | Fixed |

| Death benefit | Fixed |

| Term | Typically between 10 and 30 years |

What You'll Learn

- Level term life insurance is a policy that has a level death benefit for the entire time the policy is in effect

- Level term life insurance policies are the most common type of term life insurance policies

- Level term life insurance is a type of term life insurance that provides coverage for a specified period, typically between 10 and 30 years

- Level term life insurance is a type of term life insurance that helps pay debts, replace income and cover costs for your family and dependents if you pass away

- Level term life insurance is one of the most popular types of life insurance available

Level term life insurance is a policy that has a level death benefit for the entire time the policy is in effect

Level term life insurance policies are the most common type of term life insurance policies. With this policy type, both the death benefit and the premium remain the same over the policy's term. It is often more affordable than other policy types in the long run while providing a stable amount of coverage throughout the life of the policy. The term "level" indicates that the premium payments and the death benefit both remain constant throughout the duration of the policy.

Level term life insurance is a type of term life insurance that provides coverage for a specified period, typically between 10 and 30 years. The length of your coverage period may depend on your age, where you are in your career and if you have any dependents. Level term life insurance is ideal for people seeking straightforward protection, particularly those with defined financial obligations like a mortgage, educational expenses or family support needs.

Level term life insurance is also sometimes called level benefit term life insurance because the death benefit stays the same throughout the policy’s life and does not decrease over time. It is a policy with fixed premiums and death benefits and is ideal for people with dependents.

Life Insurance: Who's Missing Out and Where?

You may want to see also

Level term life insurance policies are the most common type of term life insurance policies

Level term life insurance is also sometimes called level benefit term life insurance because the death benefit stays the same throughout the policy's life and does not decrease over time. The term 'level' indicates that the premium payments and the death benefit both remain constant throughout the duration of the policy. This makes it ideal for people seeking straightforward protection, particularly those with defined financial obligations like a mortgage, educational expenses or family support needs.

Level term life insurance policies have fixed premiums and death benefits and are ideal for people with dependents. The term lengths are typically fixed periods of 10, 15, 20 or 30 years. The length of your coverage period may depend on your age, where you are in your career and if you have any dependents.

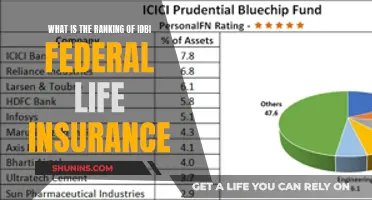

HDFC Life Insurance: Check Your Fund Value

You may want to see also

Level term life insurance is a type of term life insurance that provides coverage for a specified period, typically between 10 and 30 years

The term 'level' indicates that the premium payments and the death benefit will remain the same over the policy's term. This is in contrast to other types of insurance where the premium may increase over time. With a level term life insurance policy, your beneficiaries will get paid the same amount regardless of when you die.

Level term life insurance is often more affordable than other policy types in the long run while providing a stable amount of coverage throughout the life of the policy. It is well-suited to those with dependents as it can help to pay debts, replace income and cover costs for your family if you pass away. The length of your coverage period may depend on your age, career stage and whether you have any dependents.

Level term life insurance is sometimes referred to as level benefit term life insurance, highlighting the death benefit as the unchanging part of the policy. However, it can also be confused with level premium term life insurance, where the premium remains the same but the death benefit may change.

Life Insurance: Adding a Backup Payee, Simplified

You may want to see also

Level term life insurance is a type of term life insurance that helps pay debts, replace income and cover costs for your family and dependents if you pass away

Level term life insurance is also known as level benefit term life insurance because the death benefit stays the same throughout the policy's life and does not decrease over time. Your beneficiaries will get paid the same amount regardless of whether you die in the third year or last year of your policy. The term lengths are typically fixed periods of 10, 20 or 30 years, although some policies offer 15-year terms. The length of your coverage period may depend on your age, where you are in your career and if you have any dependents.

Level term life insurance is often more affordable than other policy types in the long run while providing a stable amount of coverage throughout the life of the policy. It is ideal for people seeking straightforward protection.

Whole Life Insurance: Benefits and Security for Life

You may want to see also

Level term life insurance is one of the most popular types of life insurance available

The term "level" indicates that the premium payments and the death benefit both remain constant throughout the duration of the policy. This makes it ideal for people seeking straightforward protection, particularly those with defined financial obligations like a mortgage, educational expenses or family support needs. Level term life insurance is also well-suited for those with dependents as it can help pay debts, replace income and cover costs for your family if you pass away.

Level term life insurance is often more affordable than other policy types in the long run while providing a stable amount of coverage throughout the life of the policy. It is important to note that the length of your coverage period may depend on your age, career stage and whether you have any dependents.

Whole Life Insurance Options for Seniors Over 60

You may want to see also

Frequently asked questions

Level benefit life insurance is a type of term life insurance where the premium and death benefit remain the same for the duration of the policy. This means that your beneficiaries will receive the same payout whether you die in the third year or the last year of your policy.

Level benefit life insurance policies typically last for a fixed period of 10, 15, 20 or 30 years.

Level benefit life insurance is ideal for people with defined financial obligations, such as a mortgage, educational expenses or family support needs. It is also a good option for those seeking straightforward protection.