The average cost of car insurance varies depending on factors such as age, gender, location, and driving history. In the US, the monthly average cost of a full-coverage car insurance policy is $158, while a state minimum policy costs $42 per month. The national average cost of car insurance is $2,026 per year or $169 per month for full coverage, and $638 per year or $53 per month for state minimum coverage.

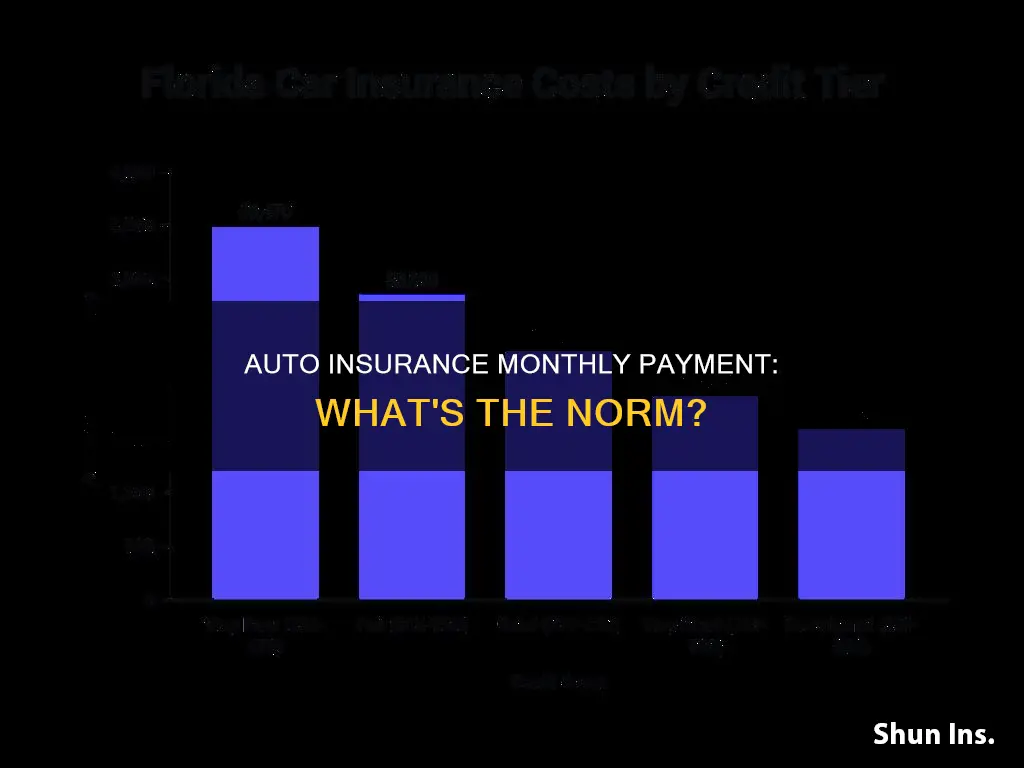

The cost of car insurance also differs by state, with Vermont being the cheapest state for full coverage car insurance, and Florida being the most expensive. The average cost of car insurance for an 18-year-old driver is $6,045 a year, while a 30-year-old pays $2,204 a year and a 60-year-old pays $1,847 a year for full coverage.

Additionally, car insurance rates can vary depending on the company, with USAA, Nationwide, and Travelers offering some of the cheapest rates for full coverage.

| Characteristics | Values |

|---|---|

| Average monthly cost of car insurance in the U.S. | $158 |

| Average monthly cost of car insurance in the U.S. (full coverage) | $196 |

| Average monthly cost of car insurance in the U.S. (minimum coverage) | $53 |

| Average monthly cost of car insurance in the U.S. (state minimum) | $42 |

| Average annual cost of car insurance in the U.S. | $1,638 |

| Average annual cost of car insurance in the U.S. (full coverage) | $2,348 |

| Average annual cost of car insurance in the U.S. (minimum coverage) | $639 |

What You'll Learn

Average monthly cost of car insurance in the U.S

The average monthly cost of car insurance in the U.S. varies depending on several factors, including the type of coverage, age, gender, driving history, and location. Here is an overview of the average monthly costs for different categories:

Average Monthly Cost by Coverage Type:

The national average cost of car insurance for full coverage is around $196, while minimum coverage averages at about $53 per month. Full coverage includes comprehensive and collision insurance, providing more protection in the event of an accident or damage to your vehicle.

Average Monthly Cost by Age and Gender:

Age and gender also play a significant role in determining insurance rates. Younger drivers, especially teens, tend to pay higher premiums due to their lack of driving experience. On average, car insurance for an 18-year-old male is approximately $461 per month, while it costs around $412 per month for an 18-year-old female. As drivers reach their mid-20s, the rates start to level out between genders.

Average Monthly Cost by Driving History:

A clean driving record can result in lower insurance rates. On the other hand, violations such as speeding tickets and DUIs can significantly increase your monthly costs. For example, the average monthly rate for a driver with a speeding ticket can increase by $751 per year, while a DUI can raise the rate by around $1,467 per year.

Average Monthly Cost by State:

The cost of car insurance also varies by state, with Florida being the most expensive, averaging $3,090 per year. In contrast, Ohio is the cheapest state, with an average annual cost of $1,008, or about $84 per month.

It's important to note that these averages may not reflect your specific situation, as insurance rates are highly personalized and depend on various factors. It's always a good idea to shop around and compare quotes from different insurance providers to find the best rates for your needs.

Zander Insurance: Unlocking Home and Auto Protection

You may want to see also

Average cost of car insurance by state

The cost of car insurance varies from state to state, with several factors influencing the price. The national average annual cost for a full-coverage policy is $1,895, but this can be as low as $970 in Wyoming and as high as $3,090 in Florida.

Factors Affecting Car Insurance Rates

An insurer might consider road conditions, the number of licensed drivers, traffic density, the cost of living, weather conditions, local claims history, and state laws when calculating your rate. For example, states with higher populations and more licensed drivers tend to have higher insurance rates, as do states with higher instances of car accidents and insurance claims.

The Most and Least Expensive States for Car Insurance

- Florida

- Louisiana

- Texas

- Michigan

- Kentucky

And the five cheapest states for car insurance:

- Wyoming

- Vermont

- New Hampshire

- Idaho

- Ohio

Understanding Comprehensive Deductibles in Auto Insurance

You may want to see also

Average cost of car insurance by company

The average cost of car insurance varies depending on the company you choose. Here is a table of average annual car insurance costs from some of the largest auto insurance companies, for full and minimum coverage:

| Company | Average Annual Cost (Full Coverage) | Average Annual Cost (Minimum Coverage) |

|---|---|---|

| USAA* | $1,300 | N/A |

| Auto-Owners | $1,300 | N/A |

| Erie | $1,300 | N/A |

| Geico | $1,300 | N/A |

| State Farm | $1,600 | N/A |

| Progressive | $1,700 | N/A |

| Farmers | $2,000 | N/A |

| Allstate | $2,000 | N/A |

| Nationwide | $2,000 | N/A |

| Travelers | $2,000 | N/A |

| American Family | $2,100 | N/A |

| Liberty Mutual | $2,400 | N/A |

USAA is only available to military, veterans and their families.

These rates are based on a 40-year-old driver with a clean driving record and good credit. The cost of car insurance will vary depending on factors such as age, gender, marital status, driving record, and credit score.

Auto Insurance for Fishing Guides: Navigating the Right Coverage

You may want to see also

Average cost of car insurance by age

The cost of car insurance is highest for teens and young adults due to their increased likelihood of accidents and filing claims. The average cost of car insurance is $6,045 a year for an 18-year-old driver, $2,204 a year for a 30-year-old, and $1,847 a year for a 60-year-old. For 16-year-old drivers, the average rate is $8,420 a year, while 17-year-olds pay around $6,736 a year.

Car insurance costs start to decrease as individuals get older and gain more driving experience. By the time drivers reach their early 20s, the cost of auto insurance coverage generally begins to drop. Throughout adulthood, provided that drivers maintain a clean driving record and have no insurance claims, premiums tend to continue decreasing as drivers gain experience.

Around the age of 70, car insurance rates start to increase again. Senior drivers have experience on their side, but reaction times may decrease, and car insurance companies consider those in their 70s and older to have a higher likelihood of getting into accidents.

It's worth noting that age is not the only factor influencing car insurance rates. Location, vehicle type, gender, driving record, and credit score can also impact the cost of car insurance.

Pennsylvania Auto Insurance Cancellation Policies: Understanding Your Rights

You may want to see also

Average cost of car insurance by gender

The cost of car insurance varies depending on a variety of factors, including age, gender, location, and driving history. While gender may not be the most significant factor in determining insurance rates, it can still have a small impact on premiums, particularly for young drivers.

On average, male drivers tend to pay slightly more for car insurance than female drivers, especially at younger ages. This is because data shows that men are more likely to engage in riskier driving behaviours and are more prone to accidents and severe injuries. However, the difference in insurance rates between genders decreases with age, and after 25, the rates for male and female drivers become almost equal.

It is worth noting that some states in the US, such as California, Hawaii, Massachusetts, Michigan, North Carolina, and Pennsylvania, have banned the use of gender as a factor in determining insurance rates. In these states, insurance companies are not allowed to consider gender when calculating premiums.

Average Cost of Car Insurance for Male Drivers:

- According to Bankrate, the average annual cost of car insurance for male drivers is $1,898.

- Insure.com reports that male drivers aged 16 to 24 pay around $140 to $784 more per year than female drivers in the same age group.

- Policygenius found that male drivers pay, on average, $735 for a six-month policy.

- The Zebra states that male drivers under 20 pay approximately 14% more per year than female drivers in the same age bracket.

Average Cost of Car Insurance for Female Drivers:

- Bankrate estimates the average annual cost of car insurance for female drivers to be $1,896.

- Insure.com reports that female drivers aged 16 to 24 pay around $1,052 to $1,768 per year.

- Policygenius determined that female drivers pay an average of $740 for a six-month policy.

- The Zebra found that female drivers under 20 pay approximately 14% less per year than their male counterparts.

Auto Liability Insurance: Is It Mandatory in Oklahoma?

You may want to see also

Frequently asked questions

The average monthly payment for car insurance in the US is $196 for full coverage and $53 for minimum coverage.

The cost of car insurance varies by state. For example, in Florida, the average monthly cost of car insurance is $258, while in Ohio, it is $102.

The cost of car insurance varies by age. For example, for an 18-year-old driver, the average monthly cost is $461, while for a 60-year-old driver, it is $1847.