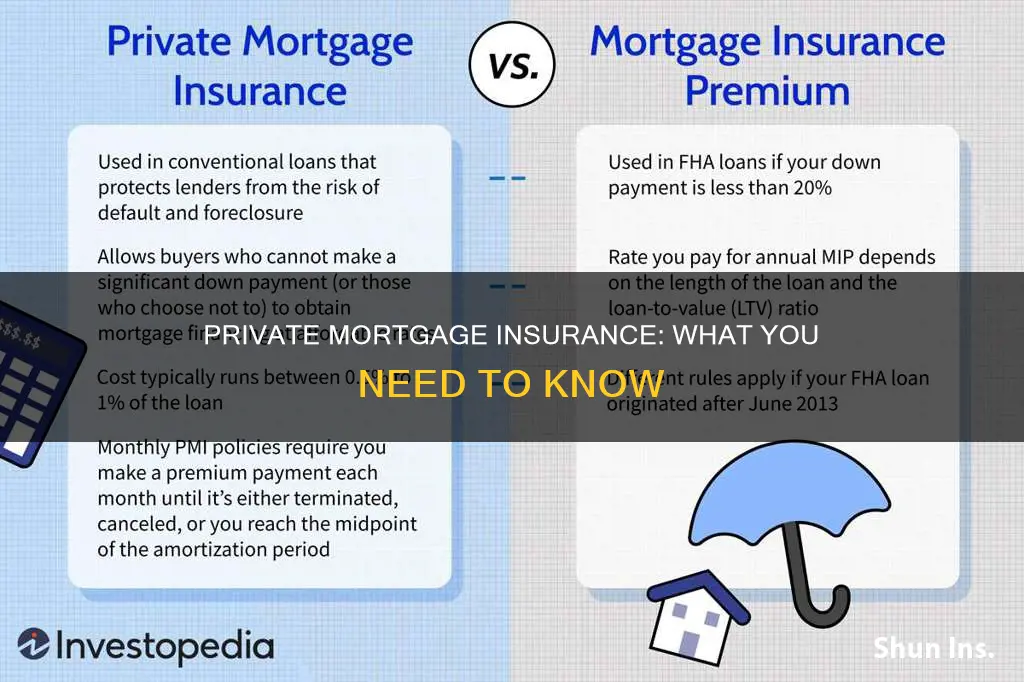

Private mortgage insurance (PMI) is a type of insurance that you might be required to purchase if you take out a conventional loan with a down payment of less than 20% of the purchase price. PMI is designed to protect the lender, not the borrower, in the event of a default on the loan. The insurance is arranged by the lender and provided by private insurance companies, and can be paid for in monthly instalments or a one-off upfront payment.

| Characteristics | Values |

|---|---|

| Name | Private Mortgage Insurance (PMI) |

| Who does it protect? | The lender, not the borrower |

| Who provides it? | Private insurance companies |

| Who pays for it? | The borrower |

| When is it required? | When the down payment is less than 20% of the home's cost |

| How is it paid? | Monthly premium, upfront premium, or a combination of both |

| How much does it cost? | Between 0.46% and 1.5% of the loan amount, depending on credit score and other factors |

| Can it be cancelled? | Yes, once the borrower has 20% equity in the home |

What You'll Learn

Private mortgage insurance (PMI) is required when a down payment is less than 20%

Private mortgage insurance (PMI) is a type of insurance that you may be required to purchase if you take out a conventional loan with a down payment of less than 20% of the purchase price. PMI is designed to protect the lender, not the borrower, in case the borrower stops making payments on their loan.

When a borrower makes a down payment of less than 20% of the property's loan-to-value (LTV) ratio, the mortgage exceeds 80%. This means that the lender is assuming additional risk by accepting a lower amount of upfront money toward the purchase. PMI helps to reduce this risk by compensating the lender in the event of a borrower defaulting on their loan.

The cost of PMI typically ranges from 0.5% to 2% of the loan balance per year but can be as high as 6%, depending on several factors such as the borrower's credit score, the size of the down payment, the loan type, and the loan term. The average monthly cost of PMI is between 0.46% and 1.5% of the loan amount.

PMI is usually paid as a monthly premium, added to the borrower's mortgage payment. However, it can also be paid as a one-time upfront premium at closing or a combination of upfront and monthly payments.

While PMI can help borrowers qualify for a loan they may not otherwise be able to obtain, it increases the cost of the loan. It is important to consider the additional cost of PMI when deciding whether to take out a conventional loan with a down payment of less than 20%.

In summary, PMI is required when a down payment is less than 20% to protect the lender and can impact the overall cost of the loan for the borrower.

Flood Insurance: Private Policies and Bank Acceptance

You may want to see also

PMI is an extra monthly fee

Private mortgage insurance (PMI) is an extra monthly fee that you pay on a conventional mortgage if you put less than 20% down. It is an added insurance policy for homeowners that protects the lender if you are unable to pay your mortgage. It is not the same as homeowner's insurance. It's a monthly fee, rolled into your mortgage payment, that’s required if you make a down payment of less than 20%.

The amount you pay for PMI can vary, but you can expect to pay approximately between $30 and $70 per month for every $100,000 borrowed. The cost of PMI typically ranges from 0.5% to 2% of the loan balance per year but can run as high as 6%. The cost can depend on several factors, including the borrower's credit score, the size of the down payment, the loan type, and the loan term.

PMI must be terminated at a certain point in your loan term or when your mortgage balance drops to a certain percentage of your home’s worth. According to the Consumer Finance Protection Bureau, lenders must cancel it on the date your mortgage balance drops to 78% of your home’s original value, or when you are halfway through your loan term. Even before this scheduled date, once you pay down your mortgage balance to 80% of your home’s original value, you can request your lender to remove your PMI.

PMI can be a nominal price to pay for being able to secure a home loan with today's mortgage rates. It enables you to buy a home without waiting until you can afford a 20% down payment. Home prices remain high, at a median of $384,500 nationally as of Feb. 2024, according to the National Association of Realtors. Homeownership is generally an effective long-term and generational wealth-building tool. Buying a property sooner rather than later allows you to acquire an important asset and start building equity.

PMI is arranged by the lender and provided by private insurance companies. Before agreeing to a mortgage, ask lenders what PMI choices they offer. The most common way to pay for PMI is a monthly premium. Sometimes you pay for PMI with a one-time upfront premium paid at closing. Lenders might offer you more than one option. Ask the loan officer to help you calculate the total costs over a few different timeframes that are realistic for you.

HealthNet: Private Insurance, Comprehensive Coverage and Care

You may want to see also

PMI protects the lender, not the borrower

Private mortgage insurance (PMI) is an extra expense that conventional mortgage holders pay to lenders each month. It typically applies to borrowers whose down payment on a home is less than 20% of the purchase price. Although the borrower pays for it, PMI protects the lender, not the borrower. It compensates the lender for the extra risk they take on by extending a larger loan and demanding less cash upfront from the borrower.

PMI is designed to protect the lender against potential losses. If the borrower defaults on the loan and their house isn't worth enough to repay the debt in full through a foreclosure sale, PMI reimburses the mortgage lender. The insurance policy ensures that the lender gets their money back in the event of a default.

PMI is arranged by the lender and provided by private insurance companies. It is important to note that PMI does not protect the borrower. If a borrower falls behind on their mortgage payments, PMI will not protect them, and they can still lose their home through foreclosure.

While PMI provides no direct benefit to the borrower, it does allow them to buy a home with a smaller down payment, which can be helpful for those who cannot afford a 20% down payment. PMI enables borrowers to become homeowners sooner, but it increases the cost of the loan.

Tricare Select: Better Than Private Insurance?

You may want to see also

PMI can be cancelled once the borrower has built 20% equity in the home

Private mortgage insurance (PMI) is an extra expense that borrowers of a conventional mortgage have to pay each month if their down payment on a home is less than 20% of the purchase price. It is arranged by the lender and provided by private insurance companies, protecting them against loss in the event of borrower delinquency.

PMI can be cancelled once the borrower has built 20% equity in their home. This can be done by submitting a request in writing to the lender or loan servicer. To be eligible for cancellation, the borrower must also be current on their payments, with no record of delinquency, and have no other liens on the home. In some cases, the lender may require an appraisal to confirm that the property value has not declined.

If the borrower chooses not to request PMI cancellation, it will be terminated automatically by the lender once the loan-to-value (LTV) ratio reaches 78%, or when the midpoint of the amortization period is reached (for example, after 15 years on a 30-year mortgage).

It is important to note that PMI cancellation rules may vary depending on the lender, and there are other ways to get rid of PMI ahead of schedule, such as refinancing, getting the home re-appraised, or paying down the principal faster.

UHC: Private or Public Insurance?

You may want to see also

PMI is not the same as homeowner's insurance

Private Mortgage Insurance (PMI) is not the same as homeowners insurance. PMI is an added insurance policy for homeowners that protects the lender if you are unable to pay your mortgage. It is a monthly fee, rolled into your mortgage payment, that's required if you make a down payment of less than 20%. While PMI is an initial added cost, it enables you to buy now and begin building equity versus waiting five to ten years to build enough savings for a 20% down payment.

Homeowners insurance, on the other hand, is a coverage that is required by all mortgage lenders for all borrowers. It is tied to the value of your home and property, not the amount of the down payment. Homeowners insurance protects your home and its contents, and it also protects you from liability in case of lawsuits. It covers the structure of your home and your possessions, and can help cover your lodging if your home becomes temporarily unlivable.

PMI is not to be confused with a mortgage insurance premium (MIP), which is a type of mortgage insurance that comes with a Federal Housing Administration (FHA) insured mortgage. This includes an upfront premium, typically paid at closing, as well as annual premiums.

UnitedHealthcare: Understanding Private Insurance Coverage and Options

You may want to see also

Frequently asked questions

Private Mortgage Insurance is an insurance policy that a lender may require you to purchase if your down payment is less than 20% of the property's value. It protects the lender if you default on your mortgage payments.

PMI only benefits the lender, not the borrower. It compensates the lender for the extra risk they take on by lending to someone who hasn't paid a 20% down payment.

The cost of PMI depends on factors such as the loan amount, the down payment amount, the type of mortgage, and your credit score. It typically ranges from 0.46% to 1.5% of the loan amount.

PMI is usually paid as a monthly premium, added to your mortgage payment. Sometimes, you can pay with a one-time upfront premium, or a combination of upfront and monthly payments.

Yes, you can avoid PMI by making a 20% down payment. You can also look into alternative loan options, such as VA loans or FHA loans, which have different requirements.