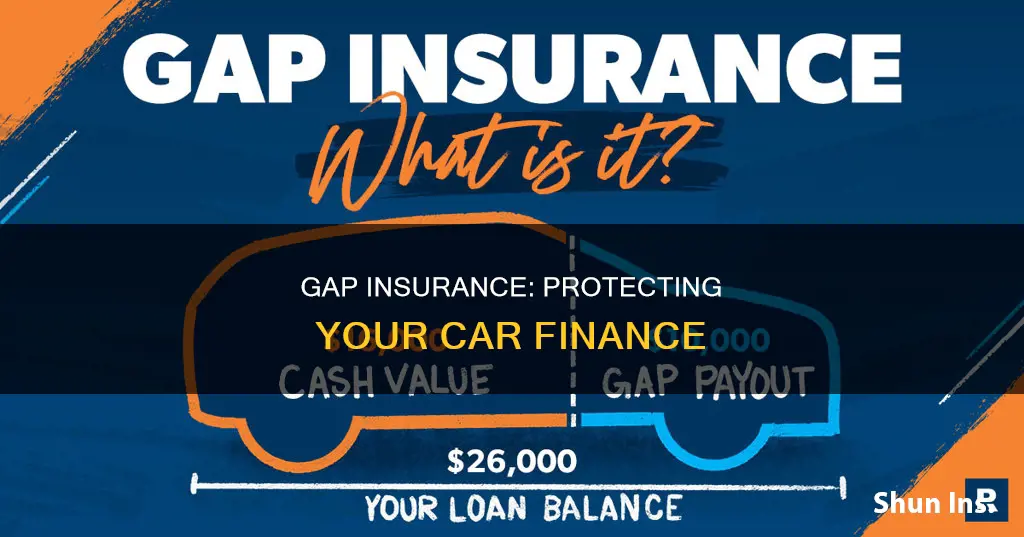

Gap insurance, or guaranteed asset protection, is an optional form of insurance that covers the difference between the amount owed on a car loan and the car's actual value in the event of theft or a total loss. This type of insurance is particularly useful for drivers who owe more on their car loan than the car is worth, as it can help bridge the financial gap and protect them from financial loss. Gap insurance is typically purchased in addition to collision and comprehensive insurance, which covers damage to the car but only pays out up to the car's current market value. While not required by law, gap insurance can provide valuable peace of mind and financial protection for drivers who are upside down on their car loan.

What You'll Learn

- Gap insurance covers the difference between the compensation received and the loan amount owed on a car

- It is optional and covers theft or a total loss

- It is worth considering if you owe more than your car is worth

- It is available from insurers and dealers, with insurers typically being cheaper

- It can be added to comprehensive auto insurance for as little as $20 a year

Gap insurance covers the difference between the compensation received and the loan amount owed on a car

Gap insurance is an optional type of auto insurance that covers the difference between the compensation received and the loan amount owed on a car. It is designed to protect drivers from financial loss in the event that their car is stolen or deemed a total loss. When a car is declared a total loss, the driver's insurance company will pay out the current value of the car, which may be significantly less than what the driver paid for it or the amount they still owe on their loan or lease. This is where gap insurance comes in—it covers the "gap" between the compensation received and the remaining loan amount.

For example, let's say you bought a car for $30,000 and have been making all your payments. However, due to depreciation, your car is now only worth $20,000, but you still owe $25,000 on your loan. If your car is stolen or totaled, your insurance company will pay you the current value of the car, minus your deductible. Without gap insurance, you would only receive $20,000, leaving you with a $5,000 gap. With gap insurance, however, the insurance company would cover that $5,000 gap, ensuring that you can pay off your loan in full.

It's important to note that gap insurance does not cover your insurance deductible, and it also doesn't cover other property damage, injuries, engine failure, or other repairs. Additionally, gap insurance is not required by law, but it may be required by your leasing company or lender. The cost of gap insurance varies depending on the insurer, the state you live in, your driving record, and other factors. It is generally recommended for drivers who owe more on their car loan than the car is worth, have a long-term loan, or have made a small down payment on a new car.

Gap Insurance: Lease Necessity?

You may want to see also

It is optional and covers theft or a total loss

Guaranteed Asset Protection (GAP) insurance is an optional form of coverage that can be added to your car insurance policy. It covers the difference between the amount you owe on your car and its actual cash value (ACV) in the event of theft or total loss. This type of insurance is particularly useful if you owe more on your car loan than the car is worth.

GAP insurance is designed to protect you financially in the event of a total loss of your vehicle, such as theft or a covered accident that renders your car a "total loss". It bridges the gap between the amount you still owe on your car loan and the ACV of the vehicle. This is important because standard auto insurance policies only cover the depreciated value of a car, paying out up to the vehicle's current market value at the time of a claim.

For example, if your new car is stolen or written off in an accident and is worth $25,000 at the time, your comprehensive insurance will pay out that amount to your lender, minus your deductible. However, if you still owe $30,000 on the car loan, you will be responsible for paying the remaining $5,000, as well as your deductible, unless you have GAP insurance. In this case, GAP insurance would cover the $5,000 difference, so you wouldn't have to find the money to pay off the remaining loan balance.

GAP insurance is typically offered by car dealers, lenders, and insurance companies. It can be purchased at a flat rate from lenders and dealerships, but it tends to be more expensive than buying it through an insurance company. It's important to note that GAP insurance does not cover your deductible, and it will not pay out if your vehicle is damaged but repairable.

RV Insurance: What You Need to Know

You may want to see also

It is worth considering if you owe more than your car is worth

If you owe more on your car than it's worth, gap insurance is worth considering. This type of insurance can help bridge the financial gap if your car is stolen or written off and you owe more on your loan than the car's value.

Gap insurance is an optional, additional coverage that covers the "gap" between the amount you still owe on your car loan and the car's actual cash value (ACV) in the event of a total loss. It's important to note that gap insurance doesn't mean your insurance provider will pay you the full amount you originally paid for your car. Instead, it covers the financed amount you currently owe on your car at the time of a covered incident, minus your deductible.

For example, let's say you have a car worth $20,000, but you still owe $25,000 in payments. If your car is stolen or written off, gap insurance will cover the $5,000 difference between the car's value and the amount you owe, minus your deductible.

When deciding whether to purchase gap insurance, it's essential to consider your specific circumstances. If you owe more on your car loan than the car is worth, gap insurance can provide valuable financial protection. On the other hand, if you own your car outright or owe less than its current value, gap insurance may not be necessary.

Additionally, factors such as the length of your loan period, the size of your down payment, and the rate of depreciation of your vehicle can influence the need for gap insurance. If you have a long loan period, a small down payment, or a vehicle that depreciates quickly, gap insurance may be worth considering.

In summary, gap insurance is worth considering if you owe more on your car than it's worth. It can provide financial protection in the event of a total loss, ensuring you don't have to pay the difference between the car's value and the amount you still owe. However, it's important to weigh your individual circumstances and carefully review the terms and conditions of the policy before making a decision.

When to Drop Collision Insurance

You may want to see also

It is available from insurers and dealers, with insurers typically being cheaper

Gap insurance is available from insurers and dealers, with insurers typically being the cheaper option.

While gap insurance is available from both insurers and dealers, it is usually far more expensive to buy a policy from a dealer. This is because when you buy gap insurance from a dealer, the cost is rolled into your car loan and you pay interest on it. On the other hand, when you buy gap insurance from an insurer, you simply pay a higher premium. This means that gap insurance from an insurer is usually hundreds of dollars cheaper than from a dealer. For example, gap insurance from a dealer might cost $500 to $700, whereas the same coverage from an insurer will only cost around $20 to $40 per year.

However, there are some cases where it might be more convenient to buy gap insurance from a dealer. For instance, if you've already bought a car from a dealership and need to insure it immediately, it might be easier to buy gap insurance from the dealer rather than shop around for an insurer. Additionally, some lease providers may include gap insurance in the price of the lease.

Vehicle Registration: Proof of Insurance?

You may want to see also

It can be added to comprehensive auto insurance for as little as $20 a year

Guaranteed asset protection (GAP) insurance is an optional coverage that can be added to comprehensive auto insurance for as little as $20 a year. It is designed to protect drivers who owe more on their car loan than the car is worth, also known as being "upside down" on a loan. In the event of a total loss of the vehicle, GAP insurance covers the difference between the current market value of the car (which standard insurance covers) and the amount still owed on the loan. This can be especially useful for new cars, which can lose up to 20% of their value within the first year of ownership.

GAP insurance is not necessary for everyone. If you own your car outright or if you owe less on your car loan than the car is currently worth, then you may not need GAP insurance. Additionally, GAP insurance is not required by any state or insurer, and it is not necessary if you have made a substantial down payment on the car or if you are paying off the loan in a short period. However, some lenders or leasing companies may require GAP insurance as a protective measure, and it is often automatically included in lease agreements.

When deciding whether to purchase GAP insurance, it is important to consider your individual circumstances, such as the value of your car, the amount you owe on your loan, and the terms of your lease or loan agreement. GAP insurance can provide valuable financial protection in the event of a total loss, but it is not a requirement for all drivers.

Insuring a New Vehicle: What to Expect

You may want to see also