Secondary medical insurance is a type of health coverage that complements primary insurance, providing additional financial protection and coverage for medical expenses. It is designed to step in when the primary insurance policy has reached its limits or when specific medical services are not fully covered. This secondary layer of insurance ensures that individuals have access to necessary healthcare treatments and can help manage out-of-pocket costs, offering peace of mind and financial security in the event of unexpected medical needs.

What You'll Learn

- Coverage: Secondary insurance provides additional benefits beyond primary coverage

- Cost-Sharing: It helps with copays, deductibles, and out-of-pocket expenses

- Network: Secondary plans often have preferred provider networks

- Coordination: It ensures smooth transition between primary and secondary insurers

- Supplemental: Secondary insurance complements primary coverage, filling gaps in benefits

Coverage: Secondary insurance provides additional benefits beyond primary coverage

Secondary medical insurance is a type of insurance that complements and enhances an individual's primary health coverage. It is designed to provide additional financial protection and benefits that go beyond what the primary insurance plan offers. This secondary layer of insurance is particularly useful for individuals who want to ensure comprehensive coverage for themselves and their families.

When it comes to coverage, secondary insurance can offer a range of valuable benefits. Firstly, it can provide coverage for services that are not fully covered by the primary insurance plan. For example, if a primary insurance policy has a limited coverage for specialist consultations, secondary insurance can step in to cover the remaining costs, ensuring that individuals can access the necessary medical expertise without financial barriers. This is especially important for managing chronic conditions or seeking specialized care.

Additionally, secondary insurance can offer extended coverage for specific medical services. For instance, it might cover alternative therapies like physical therapy, chiropractic care, or acupuncture, which are often not included in standard primary insurance plans. By providing these additional benefits, secondary insurance ensures that individuals have access to a broader range of treatment options and can receive care that aligns with their specific health needs.

Furthermore, secondary medical insurance can also provide coverage for expenses that are not typically covered by primary insurance, such as prescription drugs, dental care, or vision care. These additional benefits can significantly reduce out-of-pocket expenses and ensure that individuals receive comprehensive care without facing financial strain. It is a valuable layer of protection, especially for those with pre-existing conditions or unique healthcare requirements.

In summary, secondary insurance plays a crucial role in expanding the scope of coverage and ensuring individuals have access to a wide array of medical services. It complements primary insurance by offering additional benefits, ensuring that individuals can receive the care they need without compromising on their financial well-being. Understanding the coverage provided by secondary insurance is essential for making informed decisions about healthcare and insurance plans.

Unraveling Insurance Coverage: Medical Massage and Your Policy

You may want to see also

Cost-Sharing: It helps with copays, deductibles, and out-of-pocket expenses

Secondary medical insurance is a type of coverage that provides additional financial protection beyond what is offered by a primary insurance plan. It is designed to complement your primary insurance and ensure that you have comprehensive coverage for medical expenses. One of the key aspects of secondary medical insurance is its role in managing cost-sharing, which refers to the financial responsibilities of the insured individual during a healthcare episode.

Cost-sharing is an essential component of healthcare financing, and it typically includes copays, deductibles, and out-of-pocket expenses. Copays are fixed amounts paid by the insured at the time of service, such as a doctor's visit or a prescription refill. These copays are usually a small percentage of the total cost of the service, making them more manageable for individuals. For example, a copay for a doctor's visit might be $20, while a copay for a specialist visit could be $30.

Deductibles, on the other hand, are the amount of money an individual must pay out of pocket before the insurance coverage kicks in. This means that before the insurance starts covering expenses, the insured person is responsible for a certain amount. For instance, if your annual deductible is $1,000, you will have to pay $1,000 in medical expenses before your insurance starts covering any costs. Deductibles can vary widely, and they are often set at different levels for different types of coverage.

Out-of-pocket expenses refer to the total amount an individual pays for healthcare services, including copays and deductibles, plus any other costs not covered by insurance. These expenses can add up quickly, especially for individuals with multiple medical needs or chronic conditions. Secondary medical insurance helps mitigate these out-of-pocket costs, providing financial relief and ensuring that individuals can access necessary healthcare services without incurring significant financial burdens.

By offering cost-sharing assistance, secondary medical insurance ensures that individuals can manage their healthcare expenses more effectively. It provides a safety net, especially for those with high medical needs, by reducing the financial impact of copays, deductibles, and out-of-pocket costs. This type of insurance is particularly valuable for individuals who require frequent medical attention or have pre-existing conditions that may lead to higher healthcare expenses.

Chen Medical's Insurance Coverage: A Comprehensive Guide

You may want to see also

Network: Secondary plans often have preferred provider networks

Secondary medical insurance is a type of health coverage that provides additional benefits and services to complement a primary insurance plan. It is designed to offer an extra layer of protection and support to individuals who already have health insurance. One of the key features of secondary insurance is its focus on networks, which can significantly impact the coverage and benefits provided.

When it comes to secondary plans, network-based coverage is a common approach. These plans typically include a network of healthcare providers, such as doctors, hospitals, and specialists, who have agreed to provide services to the insured individuals at discounted rates. The primary purpose of this network structure is to ensure that enrollees have access to a wide range of medical services while also receiving cost-effective care.

In the context of secondary insurance, these networks are often referred to as "preferred provider networks" (PPNs). PPNs are carefully curated lists of healthcare providers who have established relationships with the insurance company. By utilizing these networks, secondary insurance plans aim to streamline the healthcare experience for their policyholders. When an individual uses a provider within the network, they are more likely to receive better coverage and potentially lower out-of-pocket costs.

The network aspect of secondary insurance plans is crucial because it influences the level of coverage and the overall cost-effectiveness of the policy. Insured individuals are encouraged to seek medical services from within the preferred provider network to take advantage of the negotiated rates. This approach not only benefits the insurance company by reducing administrative costs but also provides policyholders with more affordable healthcare options.

In summary, secondary medical insurance plans often incorporate preferred provider networks to offer a comprehensive and cost-efficient healthcare experience. By utilizing these networks, individuals can access a wide range of medical services while potentially saving money. Understanding the network structure of secondary insurance plans is essential for individuals to make informed decisions about their healthcare coverage and ensure they receive the most appropriate and affordable care.

Life Insurance Payouts: Medicaid's Complex Relationship

You may want to see also

Coordination: It ensures smooth transition between primary and secondary insurers

Coordination is a critical aspect of secondary medical insurance, ensuring a seamless and efficient healthcare experience for individuals with multiple insurance providers. When an individual has both a primary and a secondary insurance plan, coordination becomes the linchpin that connects these two sources of coverage. The primary insurer is typically the one with the highest level of coverage, while the secondary insurer provides additional benefits or covers specific gaps in the primary plan. Effective coordination ensures that the transition between these two insurers is smooth, allowing for a continuous and uninterrupted healthcare experience.

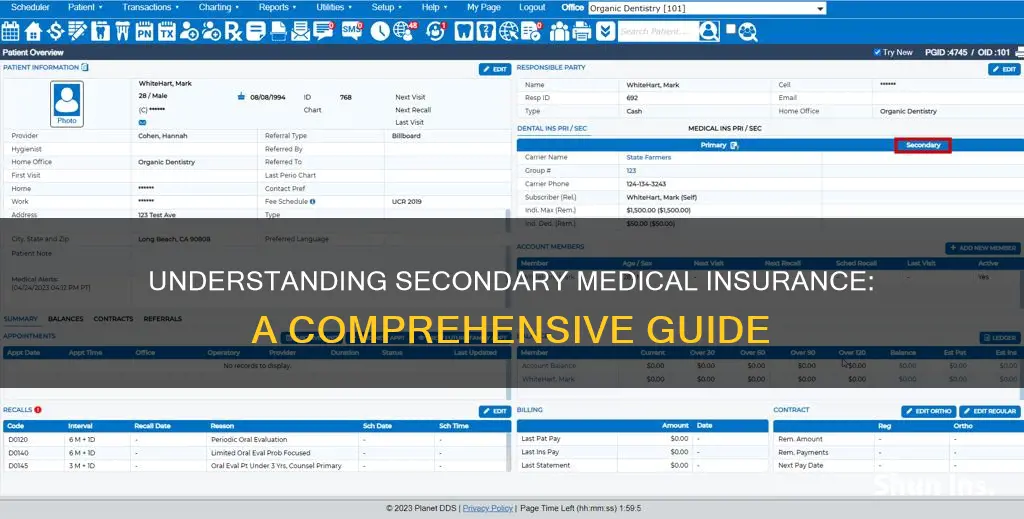

In practice, coordination involves several key steps. Firstly, the primary insurer should be aware of the secondary insurance and its coverage details. This knowledge ensures that the primary insurer can accurately bill the secondary insurer when necessary, without causing confusion or delays. Secondly, the secondary insurer must be informed about the primary insurance's coverage to avoid any overlap or redundancy in benefits. This transparency prevents individuals from receiving duplicate payments or services, which could lead to financial discrepancies.

A well-coordinated system also requires clear communication channels between the primary and secondary insurers. This includes sharing relevant medical records, treatment plans, and any other necessary documentation to ensure that both insurers are aligned regarding the individual's healthcare needs. By maintaining open lines of communication, insurers can collaborate effectively, making informed decisions about coverage and reimbursement.

Furthermore, coordination plays a vital role in preventing gaps in coverage. For instance, if an individual requires specialized treatment, the primary insurer might cover the initial costs, while the secondary insurer steps in to cover the remaining expenses. This ensures that the individual receives the necessary care without financial barriers, especially for critical or complex medical procedures.

In summary, coordination in secondary medical insurance is about creating a harmonious relationship between primary and secondary insurers. It involves knowledge-sharing, transparent communication, and a collaborative approach to ensure that individuals receive the best possible healthcare experience, regardless of the number of insurance providers they have. This coordination is essential for maintaining a fair and efficient healthcare system, especially in complex insurance scenarios.

Healthy Blue Medicaid vs. Medicare: Navigating Healthcare Options

You may want to see also

Supplemental: Secondary insurance complements primary coverage, filling gaps in benefits

Secondary medical insurance, often referred to as supplemental insurance, plays a crucial role in enhancing an individual's healthcare coverage. It acts as a complementary layer to primary insurance, ensuring that policyholders receive comprehensive benefits and financial protection. This type of insurance is designed to fill in the gaps that might exist within a primary insurance plan, providing an additional safety net for medical expenses.

When an individual has primary insurance, it typically covers a range of medical services, including doctor visits, hospital stays, and specific treatments. However, primary insurance plans often have limitations, such as restricted coverage for certain medical procedures, prescription drugs, or long-term care. This is where secondary insurance comes into play. It steps in to provide additional coverage, ensuring that policyholders are not left with unexpected and substantial out-of-pocket expenses. For example, if a primary insurance plan has a limited prescription drug coverage, secondary insurance can step in to cover the remaining costs, making essential medications more affordable.

The primary purpose of secondary insurance is to offer financial protection and peace of mind. It complements the primary insurance policy by addressing specific areas of concern. For instance, it can cover expenses related to specialized medical treatments, high-cost medications, or long-term care facilities. By doing so, it ensures that individuals can access the necessary healthcare services without facing financial barriers. This is particularly important for those with pre-existing conditions or chronic illnesses, as secondary insurance can provide tailored coverage to manage ongoing medical needs.

When considering secondary insurance, it is essential to understand the terms and conditions of both the primary and secondary policies. The secondary insurance provider should work in conjunction with the primary insurance company to ensure seamless coverage and claims processing. This collaboration ensures that policyholders receive the benefits they are entitled to, making the most of their comprehensive insurance package. Additionally, individuals should be aware of any exclusions or limitations in their secondary insurance policy to manage their expectations and healthcare choices effectively.

In summary, secondary medical insurance serves as a valuable addition to primary insurance coverage, providing a safety net for medical expenses. It complements the primary plan by filling gaps in benefits, ensuring individuals have access to comprehensive healthcare. By understanding the role of secondary insurance, individuals can make informed decisions about their healthcare coverage, ensuring they receive the necessary support and financial protection for their medical needs.

Switching Medical Insurance: Understanding Your Options and Benefits

You may want to see also

Frequently asked questions

Secondary medical insurance is a type of health coverage that kicks in when your primary insurance, such as a group plan through your employer or a government-funded program, has reached its maximum coverage limits. It acts as a safety net, ensuring that you have access to further medical benefits and financial protection beyond what your primary insurance provides.

When you have secondary insurance, it typically covers any remaining costs for medical services and treatments after your primary insurance has paid its share. This can include copayments, coinsurance, and deductibles. The secondary insurance provider will often have a network of healthcare providers, and you may need to use in-network services to ensure smooth processing of claims.

Secondary medical insurance can be offered by various entities. It is commonly provided by private insurance companies as an additional layer of coverage in comprehensive health plans. Additionally, some employers may offer secondary insurance as a benefit to their employees, especially for those with high-deductible primary plans. It can also be purchased as a standalone policy by individuals seeking enhanced medical coverage.