Straight life insurance, also known as level term life insurance, is a type of term life insurance that provides a fixed death benefit for a specified period, typically 10, 15, or 20 years. Unlike traditional term life insurance, which has a decreasing death benefit over time, straight life insurance offers a consistent and predictable payout, making it an attractive option for individuals seeking long-term financial protection for their loved ones. This type of insurance is particularly useful for those who want to ensure their family's financial security during a specific period, such as covering mortgage payments, education expenses, or other long-term financial commitments.

What You'll Learn

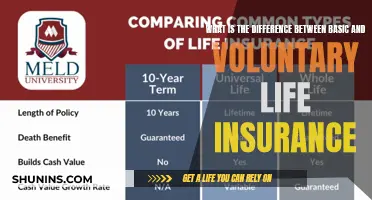

- Definition: Straight life insurance is a permanent policy with a fixed death benefit, paid out upon the insured's death

- Premiums: Premiums are paid regularly, typically monthly or annually, and remain the same throughout the policy's term

- No Lapse: Unlike term life, straight life doesn't lapse if premiums are not paid, ensuring coverage remains in force

- Fixed Costs: The cost of insurance is predictable and doesn't change, making it easier to budget

- Long-Term Coverage: Provides lifelong coverage, ensuring financial security for beneficiaries regardless of future health changes

Definition: Straight life insurance is a permanent policy with a fixed death benefit, paid out upon the insured's death

Straight life insurance, also known as level term life insurance, is a type of permanent life insurance policy that offers a fixed death benefit to the beneficiary upon the insured individual's death. This policy is designed to provide long-term coverage and financial security for the insured's loved ones, ensuring a consistent payout regardless of changes in the insurance market or the insured's health over time.

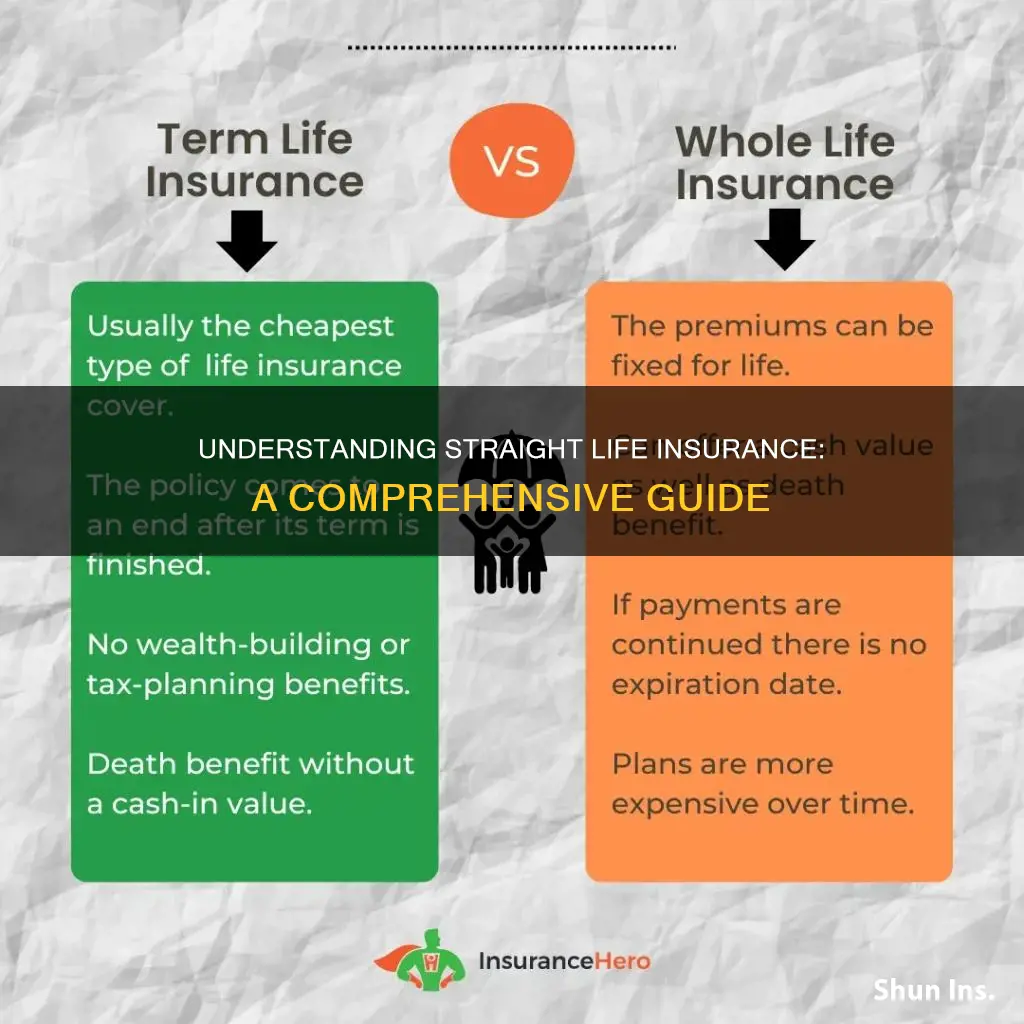

The key characteristic of straight life insurance is its level death benefit, which remains constant throughout the policy's duration. Unlike term life insurance, which has a specific period of coverage, straight life insurance provides coverage for the entire life of the insured. This means that the death benefit is guaranteed to be paid out as long as the policy is in force, providing a sense of financial stability for the insured's family or designated beneficiaries.

When purchasing straight life insurance, policyholders typically choose a fixed premium amount that remains the same annually. This predictability in premium payments allows individuals to plan their finances effectively. The policy's fixed nature also ensures that the death benefit will not decrease or increase over time, providing a reliable source of financial support for the insured's dependents.

One of the advantages of straight life insurance is its simplicity and ease of understanding. The policy is straightforward, with no hidden complexities or variable factors that could impact the death benefit. This clarity is particularly beneficial for individuals who prefer a clear and transparent insurance product. Moreover, straight life insurance can be an excellent tool for estate planning, providing a tax-free inheritance for beneficiaries and helping to ensure that the insured's assets are distributed according to their wishes.

In summary, straight life insurance is a permanent policy with a fixed death benefit, offering long-term financial security and peace of mind. Its level death benefit and predictable premium payments make it an attractive option for individuals seeking a simple and reliable insurance solution to protect their loved ones' financial well-being. Understanding the definition and features of straight life insurance is essential for anyone considering this type of coverage to ensure they make an informed decision regarding their insurance needs.

Oregon Life Insurance Test: How Tough?

You may want to see also

Premiums: Premiums are paid regularly, typically monthly or annually, and remain the same throughout the policy's term

Straight life insurance, also known as level term life insurance, is a type of life insurance policy that offers a fixed amount of coverage for a specified term, typically 10, 15, 20, or 30 years. One of the key features of this policy is its level premiums, which remain consistent throughout the entire duration of the policy. This means that the policyholder pays the same amount of premium each month or year, providing a sense of financial stability and predictability.

When you purchase a straight life insurance policy, you agree to pay a regular premium in exchange for a death benefit that will be paid out to your beneficiaries upon your passing. The beauty of this policy lies in the stability of the premiums. Unlike some other insurance products, where premiums can increase over time, straight life insurance premiums are locked in for the entire term. This ensures that policyholders can budget accurately and plan their finances without the worry of unexpected premium hikes.

The regularity of premium payments is a significant advantage for policyholders. Typically, premiums are due monthly, semi-annually, or annually, depending on the insurance company's preferences and the policyholder's choice. This consistent payment schedule allows individuals to manage their finances effectively and ensures that the insurance coverage remains active without interruption. For those who prefer a structured approach to their insurance needs, this level of predictability is highly valuable.

Furthermore, the fixed nature of the premiums in straight life insurance policies makes it easier for individuals to plan for the long term. Policyholders can accurately estimate their future insurance costs, which is especially important when considering the financial security of their loved ones. This predictability also enables individuals to make informed decisions about their insurance coverage and adjust their policies as their needs and circumstances change over time.

In summary, the concept of 'premiums: premiums are paid regularly, typically monthly or annually, and remain the same throughout the policy's term' is a fundamental aspect of straight life insurance. This feature provides policyholders with financial stability, predictability, and the ability to plan for the future with confidence. Understanding this aspect of the policy is essential for anyone considering straight life insurance as a means of protecting their loved ones and ensuring financial security.

Umbrella Insurance: Does It Cover Your Life?

You may want to see also

No Lapse: Unlike term life, straight life doesn't lapse if premiums are not paid, ensuring coverage remains in force

Straight life insurance, often referred to as permanent life insurance, is a type of long-term coverage that offers several unique features compared to other forms of life insurance, particularly term life. One of its most significant advantages is the 'no lapse' guarantee, which sets it apart from its term counterpart.

When it comes to term life insurance, if the policyholder fails to pay the premiums on time, the coverage can lapse, and the insurance company may offer a grace period before the policy is terminated. However, with straight life insurance, the commitment to provide coverage is unwavering. This means that even if the policyholder stops paying premiums, the insurance remains in force, and the coverage continues to provide financial protection to the beneficiary. This is a crucial aspect for individuals who want to ensure that their loved ones are protected, regardless of their financial situation.

The 'no lapse' feature of straight life insurance is particularly beneficial for those who want a long-term financial safety net. It provides peace of mind, knowing that the insurance will not be canceled due to missed payments. This is especially important for those who have already invested in the policy and want to maintain the coverage without the risk of it being terminated.

In contrast to term life, which is designed for a specific period, straight life insurance is a permanent solution. It builds cash value over time, which can be borrowed against or withdrawn, providing additional financial flexibility. This feature, combined with the 'no lapse' guarantee, makes straight life insurance an attractive option for those seeking long-term financial security.

Understanding the 'no lapse' aspect of straight life insurance is essential for anyone considering this type of coverage. It ensures that the insurance remains a reliable and consistent part of a financial plan, providing coverage for a lifetime, even if the policyholder's financial circumstances change. This feature is a significant advantage for those who want to ensure their loved ones are protected without the worry of potential policy lapses.

Xanax and Life Insurance: What You Need to Know

You may want to see also

Fixed Costs: The cost of insurance is predictable and doesn't change, making it easier to budget

Straight life insurance, also known as level term life insurance, is a type of term life insurance that offers a constant death benefit and premium rate throughout the policy's term. This predictability in cost is one of its key advantages, making it an attractive option for those seeking financial security and peace of mind.

In the context of fixed costs, the cost of insurance under straight life insurance is a significant factor. Unlike some other insurance products, where premiums can vary based on various factors, straight life insurance premiums remain stable over the policy's duration. This predictability allows individuals to plan and budget effectively for the future. For example, if you purchase a $100,000 straight life insurance policy with a 10-year term and a premium of $50 per month, you can accurately calculate and allocate your monthly expenses without the worry of increasing costs. This level of financial planning is particularly beneficial for long-term goals and can provide a sense of security, knowing that your insurance coverage remains consistent.

The predictability of straight life insurance premiums is a result of the policy's structure. The insurance company sets a fixed rate based on the term length and the death benefit amount. This rate is determined by various factors, including the individual's age, health, and lifestyle, but once the policy is in force, the premium remains the same. This stability is in contrast to other insurance types, such as variable life insurance, where premiums can fluctuate based on market performance and investment returns.

With straight life insurance, individuals can make more accurate financial decisions. For instance, if you are planning to take out a mortgage or make significant financial commitments, knowing that your insurance costs will remain constant can provide reassurance. It allows you to allocate funds more efficiently and ensures that your insurance coverage is a consistent part of your budget without unexpected increases.

In summary, the predictability of insurance costs is a significant advantage of straight life insurance. This type of policy provides a fixed death benefit and stable premiums, making it easier for individuals to budget and plan for the future. By understanding and utilizing this predictability, people can make informed financial decisions and ensure that their insurance coverage remains a reliable and consistent part of their overall financial strategy.

Simplified Whole Life Insurance: Worth the Investment?

You may want to see also

Long-Term Coverage: Provides lifelong coverage, ensuring financial security for beneficiaries regardless of future health changes

Straight life insurance, also known as level term life insurance, offers a unique and valuable feature in the realm of life insurance: long-term coverage. This type of policy provides a fixed amount of coverage for the entire duration of the policy, ensuring that beneficiaries are protected for the long term. Unlike other life insurance products, straight life insurance does not change in value or coverage over time, making it a reliable and consistent choice for individuals seeking financial security.

The primary advantage of long-term coverage is the peace of mind it offers. With straight life insurance, beneficiaries can rest assured that their financial needs will be met, regardless of any future health changes or developments. This is particularly important as health conditions can vary and evolve over time, and having a policy that adapts to these changes is crucial. For example, if an individual's health deteriorates, the policy will still provide the promised coverage, ensuring that beneficiaries are not left vulnerable financially.

In the context of long-term coverage, straight life insurance is designed to provide a constant and reliable source of financial support. This is especially beneficial for those who want to secure their family's future or provide for specific long-term goals. For instance, it can be used to cover mortgage payments, fund children's education, or provide a financial safety net for a spouse or partner. The fixed nature of the policy ensures that these financial commitments are met consistently, without the worry of increasing premiums or reduced coverage.

When considering straight life insurance, it is essential to understand the implications of long-term coverage. This type of policy is typically more affordable compared to term life insurance with shorter durations, as the coverage is guaranteed for the entire policy term. However, it is important to note that the premiums may increase over time, especially if the policy is renewed for an extended period. Nonetheless, the long-term security it provides can be a worthwhile investment for many individuals and families.

In summary, straight life insurance with long-term coverage is a powerful tool for ensuring financial security and peace of mind. By providing lifelong protection, this type of policy adapts to the ever-changing circumstances of individuals, offering a consistent and reliable financial safety net for beneficiaries. Understanding the benefits and considerations of straight life insurance can help individuals make informed decisions about their long-term financial planning and protection.

Stryker's Life Insurance Benefits for Employees Explained

You may want to see also

Frequently asked questions

Straight Life Insurance, also known as Level Term Life Insurance, is a type of term life insurance that provides a fixed death benefit for a specified period, typically 10, 20, or 30 years. It offers a straightforward and cost-effective way to secure financial protection for your loved ones during a defined term.

This insurance policy provides a death benefit if the insured person passes away during the term. The benefit is paid out to the designated beneficiaries, and the policy ends at the end of the term. Premiums remain level throughout the policy term, ensuring predictable costs.

Advantages include simplicity, affordability, and predictability. It offers a high death benefit-to-premium ratio, making it an excellent choice for those seeking coverage without the complexities of permanent life insurance. Straight Life Insurance is ideal for individuals who want to provide financial security for a specific period, such as covering mortgage payments or children's education.

Yes, many term life insurance companies offer conversion options. You can typically convert your Straight Life Insurance policy to a permanent life insurance policy, such as whole life or universal life, before the end of the term. This allows you to build cash value and have lifelong coverage.

One potential drawback is that the coverage is limited to the specified term. If you outlive the term, the policy ends, and you may need to reconsider your insurance needs. Additionally, the death benefit is not invested, so there is no accumulation of cash value, which is a feature of permanent life insurance policies.