Taxable gain on life insurance refers to the profit made from selling a life insurance policy, which may be subject to taxation. When an individual sells a life insurance policy, they may realize a gain if the sale price exceeds the original purchase price. This gain is typically calculated as the difference between the sale price and the original cost basis of the policy. Understanding the tax implications of such gains is essential for policyholders to ensure compliance with tax laws and to make informed financial decisions regarding their life insurance investments.

What You'll Learn

- Taxable Proceeds: Amount received after deducting death benefits and premiums

- Exclusion Limits: Annual exclusion for tax-free death benefits varies by country

- Policy Value: Gain is taxable if death benefit exceeds policy cash value

- Income Tax: Taxable gain is subject to income tax rates

- Estate Tax: Life insurance proceeds may be taxable for estate tax purposes

Taxable Proceeds: Amount received after deducting death benefits and premiums

When it comes to life insurance, understanding the tax implications of the proceeds can be crucial for financial planning. The term "taxable gain" in this context refers to the amount of money received by the beneficiary or the policyholder after certain deductions. Specifically, the taxable proceeds are calculated by subtracting the death benefits and any premiums paid from the total amount received.

To illustrate, let's consider a scenario. Imagine a life insurance policy with a death benefit of $200,000. The insured individual pays annual premiums of $5,000. Upon the insured's passing, the beneficiary receives the full death benefit. However, to determine the taxable proceeds, we need to account for the premiums paid over the policy's lifetime. If the policy has been in effect for 10 years, the total premiums paid would be $50,000. So, the taxable proceeds would be calculated as $200,000 (death benefit) minus $50,000 (total premiums), resulting in $150,000.

This calculation is essential for several reasons. Firstly, it helps individuals understand the actual value of the insurance payout after considering the costs associated with the policy. Secondly, it enables beneficiaries to plan their finances effectively, especially if they intend to use the proceeds for significant expenses or investments. By knowing the taxable amount, they can make informed decisions regarding tax strategies and potential tax liabilities.

It's important to note that tax laws and regulations regarding life insurance proceeds can vary by jurisdiction. Therefore, consulting with a tax professional or financial advisor is advisable to ensure compliance with local tax authorities' requirements. They can provide personalized guidance based on an individual's specific circumstances and help optimize the tax treatment of life insurance benefits.

In summary, taxable proceeds from life insurance are the amount received after deducting death benefits and premiums. This calculation ensures that individuals and beneficiaries have a clear understanding of the financial value they can utilize, while also being aware of potential tax obligations associated with these proceeds.

Life Insurance Licenses: Felony Impact Explained

You may want to see also

Exclusion Limits: Annual exclusion for tax-free death benefits varies by country

The concept of life insurance and its tax implications can vary significantly across different countries, and understanding these nuances is essential for individuals and their financial advisors. When it comes to life insurance, the tax treatment of death benefits can be complex, and the annual exclusion limits play a crucial role in determining what is taxable.

In many countries, life insurance policies provide tax-free death benefits to beneficiaries, which can be a valuable financial safety net. However, there are often limits to the amount that can be excluded from taxation. These exclusion limits are set by the respective governments and can vary widely. For instance, in the United States, the annual exclusion amount for life insurance proceeds is typically $1 million per beneficiary per year. This means that any death benefits received in excess of this amount may be subject to taxation. It is important to note that this limit is adjusted annually for inflation, ensuring that it keeps pace with the rising cost of living.

On the other hand, some countries have different approaches to these exclusion limits. For example, in certain European nations, the annual exclusion for life insurance death benefits might be lower, ranging from a few thousand to tens of thousands of euros. These lower limits can significantly impact the tax treatment of large insurance payouts. Additionally, some countries may have specific rules and regulations regarding the taxation of life insurance, including the requirement to report and pay taxes on any proceeds exceeding the exclusion threshold.

Understanding these exclusion limits is crucial for individuals and their families to ensure proper planning and compliance with tax laws. For high-net-worth individuals or those with substantial life insurance policies, exceeding these limits can result in significant tax liabilities. Therefore, it is advisable to consult with tax professionals and insurance advisors who can provide country-specific guidance and help navigate the complexities of international tax laws related to life insurance.

In summary, the annual exclusion for tax-free death benefits from life insurance varies significantly across countries, ranging from substantial amounts in some jurisdictions to lower thresholds in others. Being aware of these limits is essential for effective financial planning and ensuring that life insurance proceeds are managed efficiently within the context of local tax regulations.

Life Insurance: Is It Legally Compulsory?

You may want to see also

Policy Value: Gain is taxable if death benefit exceeds policy cash value

When it comes to life insurance, understanding the tax implications of any gains can be crucial for financial planning. One specific scenario that can arise is when the death benefit of a life insurance policy exceeds its cash value. In such cases, any gain or profit from the policy is considered taxable.

The key concept here is the difference between the death benefit and the policy's cash value. The death benefit is the amount paid out to the beneficiary(ies) upon the insured individual's passing. On the other hand, the policy's cash value refers to the accumulated value of the policy, which can be built up over time through regular premium payments and investment returns.

If the death benefit of a life insurance policy surpasses the policy's cash value, it indicates that the policy has gained value over time. This gain is similar to the profit one might make from selling an investment, and as such, it is subject to taxation. The tax treatment of this gain is important to consider, as it can impact the overall financial strategy of an individual or their beneficiaries.

The tax rules surrounding taxable gains on life insurance policies can be complex and may vary depending on the jurisdiction and the specific policy details. Generally, the gain is treated as ordinary income and is subject to income tax. This means that the beneficiary or the policy owner will need to report this gain in their tax returns and pay the applicable tax rate. It is essential to consult with a tax professional or financial advisor to understand the specific tax implications based on one's circumstances.

In summary, when the death benefit of a life insurance policy exceeds its cash value, any gain or profit from the policy is taxable. This scenario highlights the importance of considering the tax consequences of life insurance policies and seeking professional advice to ensure compliance with tax regulations and to make informed financial decisions.

Temporary Employees: Group Life Insurance Eligibility

You may want to see also

Income Tax: Taxable gain is subject to income tax rates

When it comes to life insurance, understanding the concept of taxable gain is crucial for policyholders and financial planners alike. Taxable gain refers to the profit or surplus that arises from the sale or surrender of a life insurance policy, and it is subject to income tax rates. This means that if you decide to cash in your policy or surrender it, the amount you receive may be taxable, depending on various factors.

The tax treatment of taxable gain on life insurance can vary depending on the jurisdiction and the specific circumstances. In many countries, including the United States, taxable gain is generally considered ordinary income. This means that the amount you receive from the policy, in excess of the policy's cash value, is taxed at your regular income tax rate. For example, if you surrender a policy with a cash value of $10,000 and receive a total of $15,000, the $5,000 gain ($15,000 - $10,000) would be subject to income tax.

The tax implications can be significant, especially for high-income individuals. It's important to consider the potential tax liability when deciding whether to keep, surrender, or sell a life insurance policy. In some cases, the tax on taxable gain can be substantial, and it may impact your overall financial planning. Therefore, it is advisable to consult with a tax professional or financial advisor to understand the specific tax rules and strategies related to your life insurance policy.

Additionally, there are certain exceptions and deductions that may apply to taxable gain on life insurance. For instance, in some jurisdictions, the first $500 of taxable gain from the surrender of a life insurance policy may be exempt from taxation. Moreover, if the policy is used to secure a loan, the interest paid on the loan could be deductible, reducing the taxable gain. These considerations highlight the importance of seeking professional advice to navigate the tax complexities associated with life insurance.

In summary, taxable gain on life insurance is a significant aspect of financial planning and taxation. It is essential to recognize that the amount received from a policy surrender or cash-out may be subject to income tax rates. Understanding the tax rules and seeking appropriate guidance can help individuals make informed decisions regarding their life insurance policies and ensure compliance with tax regulations.

Assessing Life Insurance: Coverage Adequacy and Your Needs

You may want to see also

Estate Tax: Life insurance proceeds may be taxable for estate tax purposes

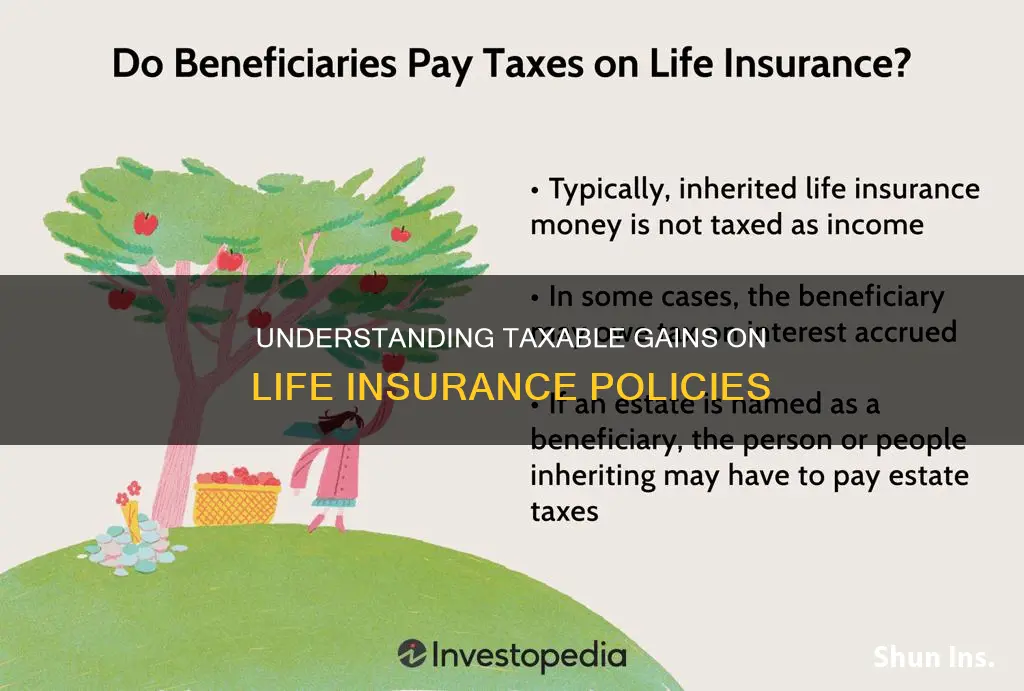

Estate tax is a complex area of taxation, and understanding how life insurance proceeds fit into this can be crucial for effective estate planning. When an individual dies, the value of their estate, including any life insurance policies, is subject to estate tax. The proceeds from a life insurance policy can be a significant asset within an estate, and their treatment under estate tax laws is an important consideration.

In many jurisdictions, life insurance proceeds are generally not included in the taxable estate of the deceased. This means that the death benefit paid out to the beneficiaries is often exempt from estate tax. However, there are exceptions and nuances to this rule. For instance, if the life insurance policy was owned by the estate or if the policy was a modified or interest-bearing policy, the proceeds may be subject to taxation.

The key factor in determining the taxability of life insurance proceeds is the ownership of the policy. If the policy was owned by the insured individual, the proceeds typically pass to the beneficiaries free of estate tax. This is because the insured has effectively transferred the ownership and risk of the policy to the beneficiaries during their lifetime. However, if the policy was owned by the estate or if there are specific provisions in the policy that create a modified ownership interest, the proceeds may be considered part of the taxable estate.

In some cases, life insurance policies can be structured in ways that minimize estate tax implications. For example, an individual can take out a policy on their life and name a trust as the owner and beneficiary. This trust can then pay premiums and accumulate cash value, providing financial security for the beneficiaries without directly impacting the taxable estate. Additionally, certain types of life insurance policies, such as permanent life insurance, may offer tax advantages due to their accumulation of cash value over time.

It is essential for individuals and their estate planners to carefully review the tax laws and seek professional advice to ensure proper compliance. Understanding the specific rules regarding life insurance proceeds and estate tax can help in making informed decisions about policy ownership, beneficiary designations, and overall estate planning strategies.

Life Insurance Cash Value: An Investment Asset?

You may want to see also

Frequently asked questions

Taxable gain on life insurance refers to the profit or gain realized when you surrender a life insurance policy for a cash value that exceeds your original investment. This gain is considered taxable income by the IRS and must be reported on your tax return.

The taxable gain is calculated by subtracting the total premiums paid from the cash surrender value of the policy. If the cash surrender value is less than the premiums paid, the gain is zero. The formula is: Taxable Gain = Cash Surrender Value - Total Premiums Paid.

You are generally required to pay taxes on the taxable gain when you surrender the policy or when the insurance company pays out the cash surrender value. It's important to note that the tax rules can vary depending on the type of life insurance policy and the jurisdiction.

Yes, there are some exceptions and deductions that may apply. For instance, if you have held the policy for a certain period (often 10 years or more) and meet specific criteria, you may be eligible for a tax-free distribution of the cash surrender value. Additionally, certain state laws might offer deductions or exclusions for life insurance gains, so it's advisable to consult tax professionals for personalized advice.