Essential life insurance is a type of coverage that provides financial protection for individuals and their families. It is designed to offer a safety net in the event of the insured's death, ensuring that loved ones are financially secure and can maintain their standard of living. This insurance policy typically pays out a lump sum or regular payments to beneficiaries, covering essential expenses such as mortgage payments, children's education, and daily living costs. The term essential refers to the core benefits and coverage provided, making it a fundamental part of financial planning for many individuals and families.

What You'll Learn

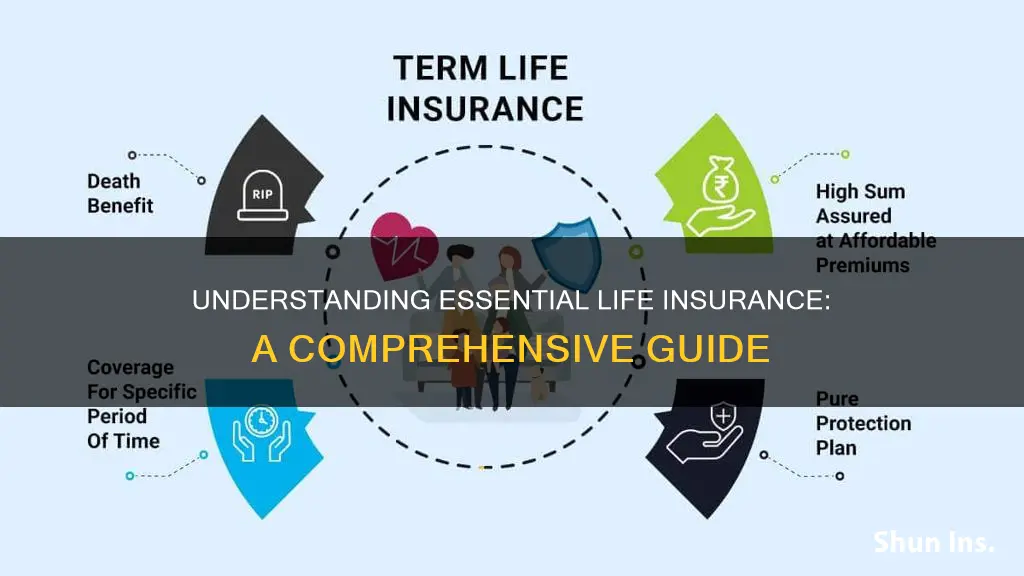

- Definition: Essential life insurance is a basic coverage policy that provides financial protection for beneficiaries in the event of the insured's death

- Coverage Amount: The policy's death benefit is typically a multiple of the insured's annual income or a predetermined amount

- Term Duration: Essential life insurance is valid for a specific period, often 10, 20, or 30 years, and does not accumulate cash value

- Affordable Premiums: This type of insurance offers lower premiums compared to permanent life insurance due to its temporary nature

- No Investment Component: Unlike permanent policies, essential life insurance does not include an investment component, focusing solely on death benefit coverage

Definition: Essential life insurance is a basic coverage policy that provides financial protection for beneficiaries in the event of the insured's death

Essential life insurance is a fundamental type of coverage designed to offer financial security to the beneficiaries in the unfortunate event of the insured's passing. It is a straightforward and essential policy that serves as a safety net for those who rely on the insured's income or support. This insurance is particularly crucial for individuals who have financial responsibilities, such as mortgage payments, children's education, or other dependents, as it ensures that these obligations are met even if the primary breadwinner is no longer present.

The primary purpose of essential life insurance is to provide a lump sum payment or income replacement to the designated beneficiaries when the insured individual dies. This financial support can help cover immediate expenses, such as funeral costs and outstanding debts, and also provide long-term financial stability for the family. The policy typically offers a fixed amount of coverage for a specified period, known as the 'term' of the policy, during which the insured's beneficiaries are protected.

What sets essential life insurance apart is its simplicity and affordability. It is a no-frills policy, focusing solely on providing financial protection during the specified term. Unlike permanent life insurance, which offers lifelong coverage and a cash value component, term life insurance is designed to be a temporary solution, often chosen for its cost-effectiveness and ease of understanding. This type of insurance is ideal for individuals who need coverage for a specific period, such as until a child's education is completed or a mortgage is paid off.

When considering essential life insurance, it is essential to understand the term length. The policy term can vary, typically ranging from 10 to 30 years, and sometimes even longer. During this period, the insured's beneficiaries are protected, and the policy's benefits are in effect. After the term ends, the policy may lapse unless renewed or converted to a permanent policy. This flexibility allows individuals to choose a term that aligns with their financial obligations and future goals.

In summary, essential life insurance is a critical tool for individuals seeking to provide financial security for their loved ones. It offers a straightforward and affordable way to ensure that beneficiaries are protected in the event of the insured's death, covering essential expenses and providing peace of mind. With its simple structure and customizable term lengths, essential life insurance is a valuable consideration for anyone looking to safeguard their family's financial future.

Life Insurance: Gaining Value Through Protection

You may want to see also

Coverage Amount: The policy's death benefit is typically a multiple of the insured's annual income or a predetermined amount

When considering Term Essential Life Insurance, understanding the coverage amount is crucial. The death benefit, or the amount paid out upon the insured's passing, is a key feature of this type of policy. Typically, this benefit is calculated as a multiple of the insured's annual income. For instance, if the insured earns $60,000 annually, the policy might offer a death benefit of $100,000, which is a common multiple, often two or three times the annual income. This approach ensures that the beneficiaries receive a substantial sum to cover essential expenses and maintain their standard of living in the event of the insured's death.

The coverage amount is not just a random figure but is carefully determined based on various factors. Insurers often use guidelines such as the insured's age, health, and lifestyle to set this amount. Younger individuals with healthier lifestyles may qualify for higher coverage multiples, while older individuals or those with pre-existing health conditions might have lower multiples. It's essential to understand that the coverage amount should be sufficient to provide financial security for the beneficiaries, especially in the short term, as term life insurance is designed to cover a specific period, often 10, 15, or 20 years.

Another aspect to consider is the predetermined amount, which can be a fixed sum regardless of the insured's income. This approach is less common but can be useful in specific situations. For example, if the insured has a substantial savings or investment portfolio, the coverage amount might be set at a predetermined value to ensure that the beneficiaries receive a specific financial cushion. This method provides more flexibility in tailoring the policy to the insured's unique financial circumstances.

In summary, the coverage amount in Term Essential Life Insurance is a critical component that ensures financial security for the insured's loved ones. It is typically calculated as a multiple of the annual income, offering a practical and commonly accepted approach to determining the death benefit. However, the specific coverage amount can vary based on individual factors and may also include a predetermined value in certain cases, allowing for personalized policy design. Understanding these aspects can help individuals make informed decisions when selecting the right life insurance policy for their needs.

CalPERS Life Insurance: What Retirees Need to Know

You may want to see also

Term Duration: Essential life insurance is valid for a specific period, often 10, 20, or 30 years, and does not accumulate cash value

Term essential life insurance is a type of life insurance that provides coverage for a defined period, typically ranging from 10 to 30 years. This form of insurance is designed to offer financial protection during a specific time frame, ensuring that your loved ones are covered when it matters the most. Unlike permanent life insurance, term insurance is not intended to be a long-term financial product. Instead, it focuses on providing coverage for a particular duration, making it an essential tool for managing short-term risks and financial obligations.

The term duration is a critical aspect of this insurance type, as it determines the length of time the policy will remain in force. During this period, the insurance company guarantees a death benefit if the insured individual passes away. This benefit is paid out to the policyholder's designated beneficiaries, providing financial security and peace of mind. Once the term ends, the policy expires, and further coverage may need to be obtained if desired.

One of the key advantages of term essential life insurance is its affordability. Since the coverage is limited to a specific period, the premiums are generally lower compared to permanent life insurance. This makes it an attractive option for individuals who require insurance for a particular period, such as covering mortgage payments, providing for children's education, or ensuring financial stability during a specific life stage.

It's important to note that term insurance does not accumulate cash value, which is a feature found in permanent life insurance policies. Cash value accumulation allows policyholders to build a savings component within the policy, which can be borrowed against or withdrawn. In term essential life insurance, the primary focus is on providing coverage for the specified term, and the premiums are solely used to fund the death benefit.

When considering term essential life insurance, it is crucial to evaluate your specific needs and financial goals. Understanding the term duration options (10, 20, or 30 years) and choosing the one that aligns with your requirements is essential. This type of insurance is particularly useful for those who want a straightforward and cost-effective solution to manage their short-term financial risks.

Life Insurance: Am I Entitled to Benefits?

You may want to see also

Affordable Premiums: This type of insurance offers lower premiums compared to permanent life insurance due to its temporary nature

Term essential life insurance is a type of life insurance that provides coverage for a specific period, known as the "term." This insurance is designed to offer a cost-effective solution for individuals seeking temporary coverage for a defined period, typically 10, 15, 20, or 30 years. One of the key advantages of term essential life insurance is its affordability, which makes it an attractive option for those who want to protect their loved ones without breaking the bank.

The lower premiums associated with term insurance are primarily due to its temporary nature. Unlike permanent life insurance, which provides coverage for the entire life of the insured individual, term insurance is specifically tailored to meet the needs of a particular period. This shorter-term focus allows insurance providers to offer more competitive rates since the risk of paying out a death benefit is lower over a more limited time frame. As a result, individuals can secure higher coverage amounts at more affordable prices, making it an excellent choice for those who want to ensure their family's financial security without incurring significant long-term costs.

During the term period, the insured individual pays regular premiums to maintain the policy's coverage. If a covered event occurs (e.g., the insured's death), the beneficiary receives a death benefit. Once the term expires, the policy may lapse unless the individual chooses to renew it or convert it to a permanent policy. This flexibility is another factor contributing to the affordability of term essential life insurance.

Term essential life insurance is particularly beneficial for young families, recent homeowners, or individuals with significant financial obligations. It allows them to secure their loved ones' financial future without the long-term financial burden that permanent life insurance might entail. With term insurance, individuals can focus on other financial goals and priorities during the coverage period, knowing that their family's essential needs are protected.

In summary, term essential life insurance offers a cost-effective solution by providing lower premiums due to its temporary nature. This type of insurance is ideal for those seeking affordable coverage for a specific period, ensuring that their loved ones are protected without compromising their financial well-being. Understanding the duration and flexibility of term insurance can help individuals make informed decisions about their life insurance needs.

FedEx Employees: Understanding Life Insurance Benefits

You may want to see also

No Investment Component: Unlike permanent policies, essential life insurance does not include an investment component, focusing solely on death benefit coverage

Term essential life insurance is a type of life insurance that provides coverage for a specific period, known as the "term." This term can vary, ranging from a few years to several decades, and it is a straightforward and affordable way to secure financial protection for your loved ones during a defined period. One of the key advantages of term essential life insurance is its simplicity and focus on a single aspect: providing a death benefit.

Unlike permanent life insurance policies, which offer a combination of death benefit coverage and an investment component, term essential insurance does not include any investment features. This means that the primary purpose of this insurance is to provide financial security in the event of the insured's death during the specified term. The death benefit is a fixed amount paid out to the policyholder's beneficiaries when the insured individual passes away within the agreed-upon term. This simplicity ensures that the policyholder's family receives the intended financial support without any additional investment risks or complexities.

The "no investment component" aspect of term essential life insurance is a significant differentiator from other life insurance products. Permanent life insurance policies often include an investment component, allowing policyholders to build cash value over time, which can be borrowed against or withdrawn. In contrast, term insurance focuses exclusively on the death benefit, ensuring that the coverage is pure and straightforward. This approach makes term essential life insurance an attractive option for those seeking a clear and cost-effective way to protect their loved ones without the added complexity of investment features.

When considering term essential life insurance, it is essential to understand the duration of the term and the associated costs. The term length determines the period during which the death benefit is guaranteed, and shorter terms typically result in lower premiums. Policyholders can choose from various term lengths, allowing them to align the coverage with their specific needs and financial goals. Additionally, the premiums for term essential life insurance are generally lower compared to permanent policies, making it an affordable option for individuals seeking comprehensive coverage without the investment aspect.

In summary, term essential life insurance is a pure and focused form of life insurance that provides death benefit coverage for a specified term. Its lack of investment components ensures that the policy is straightforward and cost-effective, making it an ideal choice for those seeking financial protection for their loved ones during a defined period. By understanding the term length and associated costs, individuals can make informed decisions about their life insurance needs, ensuring they have the necessary coverage without unnecessary complexities.

Borrowing Against Your Guardian Life Insurance: Is it Possible?

You may want to see also