Term life insurance to age 95 is a type of life insurance that provides coverage for a specific period, typically from age 20 to 95. It offers a straightforward and cost-effective way to protect your loved ones financially during a defined term. This insurance policy guarantees a death benefit if the insured individual passes away within the specified period, ensuring financial security for beneficiaries. It is a popular choice for those seeking temporary coverage, often used to cover expenses like mortgage payments, education costs, or other financial obligations that may extend into the later years of life. Understanding the features and benefits of this insurance can help individuals make informed decisions about their long-term financial planning.

What You'll Learn

- Definition: Term life insurance to age 95 is a policy that provides coverage for a specific period, up to age 95

- Coverage: It offers financial protection for a set duration, ensuring beneficiaries receive a payout upon the insured's death

- Cost: Premiums are typically lower than permanent life insurance due to the limited coverage period

- Flexibility: Policies can be tailored to individual needs, offering various coverage amounts and term lengths

- Benefits: Provides peace of mind and financial security for loved ones during a defined period

Definition: Term life insurance to age 95 is a policy that provides coverage for a specific period, up to age 95

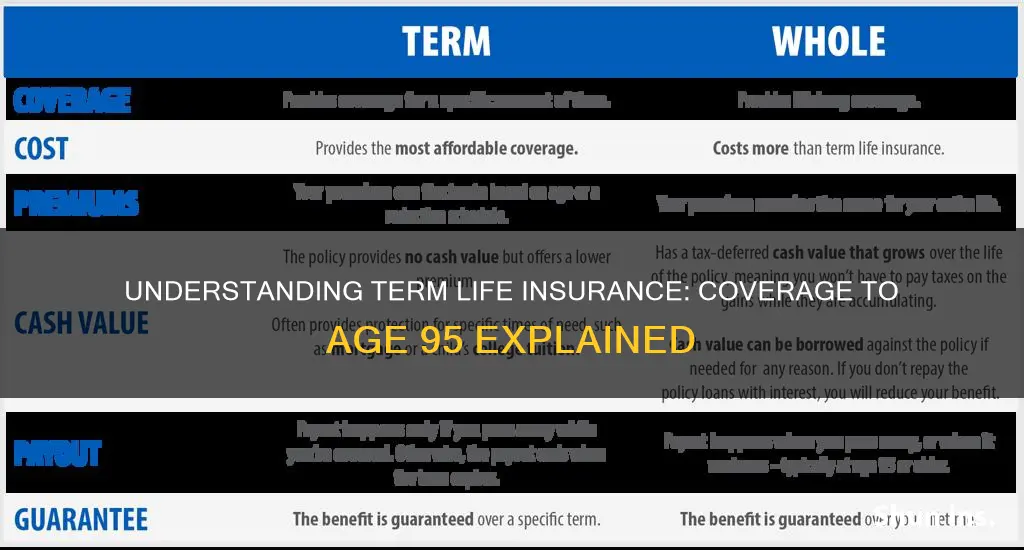

Term life insurance to age 95 is a specific type of life insurance policy designed to offer financial protection for a predetermined period, typically until the insured individual reaches the age of 95. This policy is a form of temporary coverage, providing a clear and defined timeframe for the insurance protection. Unlike permanent life insurance, which offers coverage for the entire life of the insured, term life insurance is a more affordable and straightforward option for those seeking coverage for a particular period.

The key feature of this insurance is its fixed duration, ensuring that the policyholder is protected financially during a specific stage of life. For example, a person might choose term life insurance to age 95 to cover their mortgage payments, provide financial security for their family in the event of their passing, or ensure their children's education costs are covered. The policy will pay out a death benefit if the insured individual passes away during the specified term, offering peace of mind and financial stability.

When purchasing this type of insurance, the policyholder agrees to pay a premium for a set period, often 10, 15, or 20 years. The premium is typically lower compared to permanent life insurance because the coverage is limited to the agreed-upon term. Once the term ends, the policy may continue as a permanent policy, or the coverage can be extended, providing long-term financial protection.

It is essential to understand that term life insurance to age 95 is not suitable for everyone. The policy is ideal for individuals who want coverage for a specific financial responsibility or risk, such as covering a mortgage or providing for a family's future. Those seeking long-term financial planning might consider other insurance options, such as permanent life insurance or whole life insurance, which offer lifelong coverage.

In summary, term life insurance to age 95 is a temporary life insurance policy providing coverage until age 95. It is a cost-effective solution for specific financial needs, offering peace of mind and financial security during a defined period. This type of insurance is a valuable tool for individuals seeking targeted protection for their loved ones or specific financial obligations.

Adding Senior Mom to Your Life Insurance Policy

You may want to see also

Coverage: It offers financial protection for a set duration, ensuring beneficiaries receive a payout upon the insured's death

Term life insurance to age 95 is a specific type of life insurance policy that provides coverage for a predetermined period, in this case, until the age of 95. It is a straightforward and cost-effective way to secure financial protection for your loved ones during a specific time frame. When you purchase this type of policy, you agree to pay a fixed premium for a set period, typically 10, 15, or 20 years, and in return, the insurance company promises to pay out a lump sum benefit to your designated beneficiaries if you pass away during the term.

The beauty of term life insurance lies in its simplicity and focus on providing coverage for a defined period. Unlike permanent life insurance, which offers coverage for the entire lifetime of the insured, term life insurance is designed to address specific financial needs that may arise during a particular stage of life. For example, it can be an excellent choice for individuals who want to ensure their children's education is funded or to cover mortgage payments until the loan is fully repaid.

The coverage provided by term life insurance to age 95 is comprehensive and reliable. Once the policy is in force, the insurance company has a legal obligation to honor the death benefit if the insured individual passes away during the specified term. This means that your beneficiaries will receive the agreed-upon payout, providing them with the financial support they need during a challenging time. The payout can be used to cover various expenses, such as funeral costs, outstanding debts, or even daily living expenses, ensuring that your loved ones are financially secure.

One of the advantages of this type of policy is its affordability. Since the coverage is limited to a specific duration, the premiums are generally lower compared to permanent life insurance. This makes it an attractive option for individuals who require substantial coverage but may have budget constraints. Additionally, term life insurance is often more accessible to those with health conditions or lifestyles that might make obtaining permanent coverage challenging or expensive.

In summary, term life insurance to age 95 is a powerful tool for providing financial security and peace of mind. It offers a straightforward approach to life insurance, focusing on coverage for a set duration. By ensuring beneficiaries receive a payout upon the insured's death, this policy empowers individuals to protect their loved ones and address specific financial obligations during a critical period of their lives.

Canceling Life Insurance: Understanding Your Time Limit

You may want to see also

Cost: Premiums are typically lower than permanent life insurance due to the limited coverage period

Term life insurance to age 95 is a type of life insurance that provides coverage for a specific period, typically from age 20 to 95. One of the key advantages of this policy is its cost-effectiveness compared to permanent life insurance. The lower premiums are primarily attributed to the limited coverage period, which is designed to match the duration of a specific financial obligation or goal.

When considering the cost, it's essential to understand that term life insurance is a pure risk transfer tool. It offers coverage for a defined period, ensuring financial security during that time. This type of insurance is particularly attractive to individuals who want to protect their loved ones or secure their family's financial future without the long-term commitment of permanent life insurance. By keeping the coverage period limited, the insurance company assumes a lower risk, which results in more affordable premiums.

The limited coverage period of term life insurance to age 95 means that the insurance company is not obligated to pay out a death benefit for an extended duration. This reduced risk allows for lower premiums, making it an economically viable option for many individuals. As a result, those seeking affordable life insurance coverage can benefit from this type of policy, especially when their primary goal is to provide financial protection for a specific period.

In contrast, permanent life insurance, such as whole life or universal life, offers lifelong coverage. While it provides more comprehensive protection, the extended coverage period comes at a higher cost. The premiums for permanent life insurance are typically higher because the insurance company needs to account for the long-term risk and the potential for the policy to accumulate cash value over time.

By choosing term life insurance to age 95, individuals can take advantage of lower premiums without sacrificing the essential protection that life insurance provides. This option is particularly suitable for those who want to secure their family's financial future during a specific phase of life, such as raising children or paying off a mortgage, without the long-term financial commitment of permanent insurance. It offers a practical and cost-effective solution for managing financial risks.

Steroid Testing: Life Insurance's Dark Secret

You may want to see also

Flexibility: Policies can be tailored to individual needs, offering various coverage amounts and term lengths

Term life insurance to age 95 is a flexible and customizable financial product designed to provide coverage for a specific period, ensuring individuals and their families are protected during the years when they may need it the most. This type of insurance offers a unique advantage by allowing policyholders to choose the coverage amount and the duration of the policy, making it adaptable to individual circumstances and preferences.

One of the key benefits of term life insurance is its ability to cater to diverse needs. Policyholders can select the coverage amount based on their financial goals and the level of protection required. For instance, someone with a large family and significant financial responsibilities might opt for a higher coverage amount to ensure their loved ones are financially secure in the event of their passing. Conversely, a younger individual with fewer dependents may choose a lower coverage amount, keeping costs manageable while still providing a safety net.

The flexibility extends to the term length as well. Term life insurance to age 95 allows individuals to choose the duration of coverage, typically ranging from 10 to 30 years. This option is particularly useful for those who want coverage for a specific period, such as until a child's education is funded or a mortgage is paid off. For example, a policyholder might opt for a 20-year term, ensuring that their family is protected during the years when the financial burden of raising children is often at its highest.

Furthermore, this type of insurance can be adjusted over time as an individual's life circumstances change. If a policyholder's financial situation improves, they can increase the coverage amount to better reflect their current needs. Conversely, if their financial obligations decrease, they can opt for a shorter term or a lower coverage amount, thus reducing the overall cost of the policy. This adaptability ensures that the insurance remains relevant and effective throughout the policyholder's life.

In summary, term life insurance to age 95 offers a high level of flexibility, allowing individuals to customize their coverage based on personal circumstances. By providing various coverage amounts and term lengths, this insurance product empowers policyholders to make informed decisions about their financial security, ensuring they are protected during the years that matter most. This flexibility is a significant advantage, making term life insurance an attractive option for those seeking tailored and adaptable insurance solutions.

Borrowing from Your Unum Life Insurance: Is It Possible?

You may want to see also

Benefits: Provides peace of mind and financial security for loved ones during a defined period

Term life insurance to age 95 is a specific type of life insurance policy that offers coverage for a predetermined period, typically from age 0 to 95. This type of insurance is designed to provide financial protection and peace of mind to individuals and their loved ones during a defined period. Here's how it can benefit you and your family:

Financial Security: One of the primary advantages of term life insurance to age 95 is the financial security it provides. During the policy term, if something happens to the insured individual, the policy pays out a death benefit to the designated beneficiaries. This financial support can help cover various expenses, such as mortgage payments, children's education, or daily living costs, ensuring that your loved ones are financially protected even in your absence. The death benefit can be a significant financial cushion, allowing your family to maintain their standard of living and cover any outstanding debts or financial obligations.

Peace of Mind: Knowing that your family is financially secure in the event of your untimely passing can provide immense peace of mind. This type of insurance takes the worry out of providing for your loved ones, especially during critical life stages. With term life insurance, you can focus on enjoying your life and creating memories, confident that your family's financial future is protected. It allows you to rest assured that your beneficiaries will have the necessary financial resources to make important decisions and manage their lives effectively.

Affordability: Term life insurance to age 95 is often more affordable compared to permanent life insurance. The coverage is limited to a specific period, and the premiums are typically lower because the risk is reduced. This affordability makes it an attractive option for individuals who want to provide financial protection for a defined period without incurring significant long-term costs. You can choose the coverage amount and term length that best suits your needs and budget, ensuring that you get the most value for your money.

Flexibility: This insurance policy offers flexibility in terms of coverage and beneficiaries. You can customize the policy to fit your specific requirements, such as selecting the desired death benefit amount and choosing beneficiaries. Additionally, you can adjust the policy as your life circumstances change, such as getting married, having children, or purchasing a home, ensuring that your coverage remains relevant and appropriate.

By providing financial security and peace of mind, term life insurance to age 95 ensures that your loved ones can focus on honoring your memory and building their future, knowing they have the necessary support in place. It is a valuable tool for anyone seeking to protect their family's financial well-being during a defined period.

Globe Life Insurance and Colonial Penn: What's the Difference?

You may want to see also

Frequently asked questions

Term life insurance to age 95 is a type of life insurance policy that provides coverage for a specific period, typically 10, 15, or 20 years, up to the age of 95. It offers financial protection to your beneficiaries if you pass away during the term period.

Term life insurance is a more straightforward and affordable option compared to permanent life insurance. It focuses solely on providing coverage for a defined period, whereas permanent life insurance offers lifelong coverage and includes a savings component. Term insurance is ideal for those who need coverage for a specific period, such as covering mortgage payments or providing for children's education.

Selecting a term life insurance policy that extends up to age 95 can offer several advantages. Firstly, it provides coverage for a longer period, ensuring financial security for your loved ones even in your later years. Secondly, it may be more cost-effective than extending coverage to age 100 or beyond, as the risk of mortality decreases with age.

Yes, many term life insurance companies offer conversion options. If you decide to continue your coverage beyond the initial term period, you can typically convert your term policy to a permanent life insurance policy, ensuring lifelong coverage. This conversion process may require a medical examination and additional underwriting.

Several factors determine the premium cost of term life insurance to age 95. These include your age, gender, health status, lifestyle choices (e.g., smoking, alcohol consumption), occupation, and the amount of coverage you choose. Generally, younger and healthier individuals with no smoking history will qualify for lower premiums.