Term plus life insurance is a type of life insurance that provides coverage for a specific period, known as the term, during which the policyholder pays a fixed premium. This insurance offers a straightforward and cost-effective way to secure financial protection for a defined period, typically 10, 15, or 20 years. It is a popular choice for individuals who want to protect their loved ones from financial hardship in the event of their untimely death during the term. Unlike permanent life insurance, term plus insurance is designed to be a temporary solution, allowing policyholders to focus on other financial goals or transition to more permanent coverage as their needs change.

What You'll Learn

- Definition: Term plus life insurance is a combination of term life and permanent life insurance

- Term Life: Provides coverage for a specific period, offering a fixed premium and death benefit

- Conversion Option: Allows term policyholders to convert to permanent insurance without medical exams

- Death Benefit: Pays a lump sum to beneficiaries upon the insured's death

- Cost: Premiums are typically lower than pure permanent insurance due to term coverage

Definition: Term plus life insurance is a combination of term life and permanent life insurance

Term plus life insurance is a comprehensive insurance policy that offers a unique blend of two distinct life insurance types: term life and permanent life insurance. This innovative product is designed to provide individuals with a tailored solution that meets their specific financial needs and long-term goals. By combining these two insurance types, term plus life insurance offers a flexible and adaptable approach to life coverage.

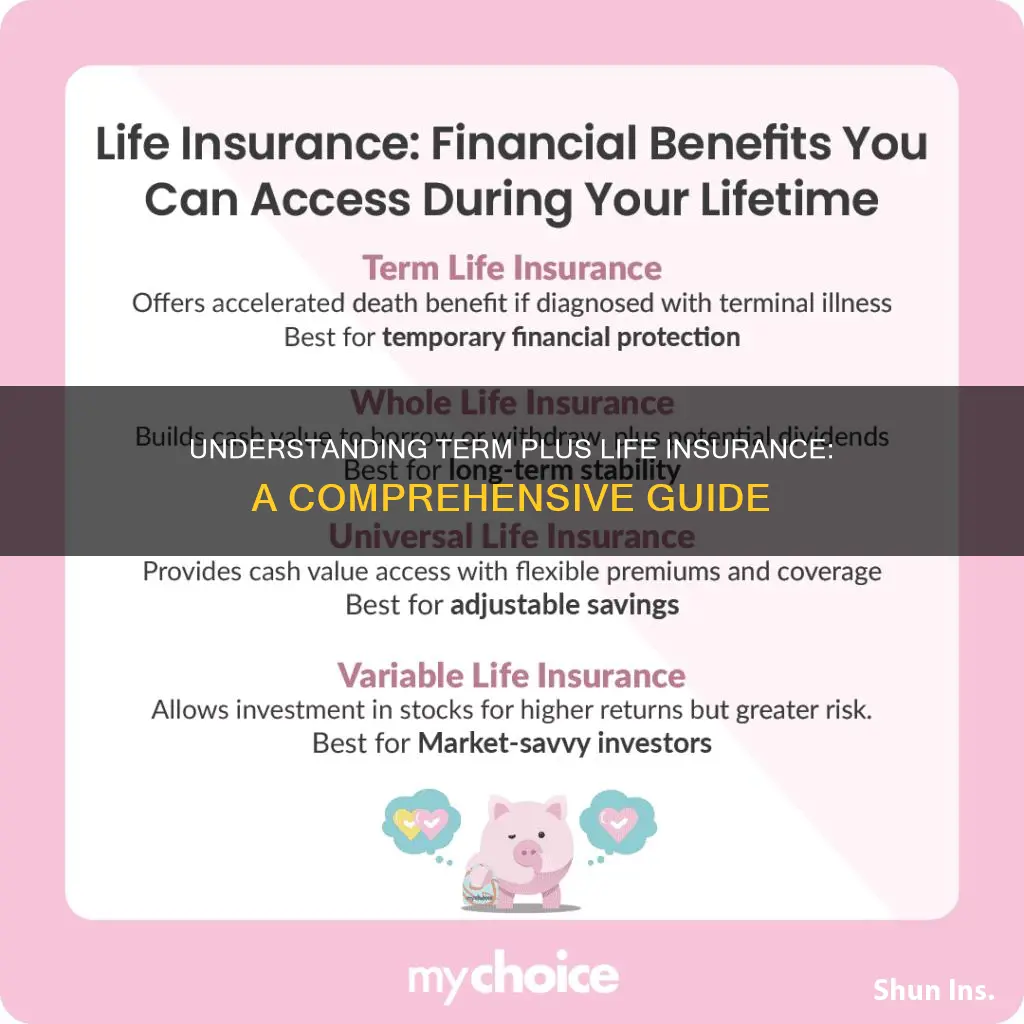

Term life insurance, as the name suggests, provides coverage for a specific term or period, typically ranging from 10 to 30 years. It is a straightforward and cost-effective way to secure financial protection for a defined duration. During this term, the policyholder pays a fixed premium, and in return, the insurance company promises to pay a death benefit to the designated beneficiaries if the insured individual passes away within the specified period. This type of insurance is ideal for covering short-term financial obligations, such as mortgage payments, children's education, or business ventures, where the need for coverage is expected to be temporary.

On the other hand, permanent life insurance, also known as whole life insurance, offers lifelong coverage. It provides a death benefit that remains in force as long as the policyholder pays the premiums. One of the key advantages of permanent life insurance is that it includes an investment component, allowing the policy's cash value to grow over time. This feature can be particularly beneficial for long-term financial planning, as it provides a source of funds that can be borrowed against or withdrawn, offering financial flexibility.

Term plus life insurance combines the best of both worlds. It starts with a term life policy, providing immediate coverage and peace of mind for a specified period. Simultaneously, it incorporates a permanent life insurance component, ensuring that the policyholder's loved ones are protected even after the initial term ends. This combination allows individuals to benefit from the simplicity and affordability of term life while also having the security of permanent coverage. As the term life portion expires, the policy can be converted into a permanent policy, ensuring long-term financial protection without any gaps in coverage.

In summary, term plus life insurance is a strategic financial tool that offers a seamless transition from short-term to long-term life coverage. It provides individuals with the flexibility to manage their financial obligations during specific periods while also securing their loved ones' future. This innovative insurance product is an excellent choice for those seeking a comprehensive solution that adapts to their changing needs over time.

Unlocking Life Insurance: Withdrawing Money from Your Policy

You may want to see also

Term Life: Provides coverage for a specific period, offering a fixed premium and death benefit

Term life insurance is a type of coverage that provides financial protection for a defined period, typically ranging from 10 to 30 years. It is a straightforward and affordable way to secure a death benefit for your loved ones during a specific time frame. With term life insurance, you pay a fixed premium, which remains consistent throughout the policy's duration. This predictability is one of the key advantages, as it allows you to plan and budget effectively. The primary purpose of term life insurance is to offer financial security to your family or beneficiaries in the event of your untimely passing during the specified term.

When you purchase a term life insurance policy, you select a coverage amount, often referred to as the death benefit. This benefit is the monetary amount that will be paid out to your designated beneficiaries if you pass away during the policy's term. The premium you pay is calculated based on various factors, including your age, health, lifestyle, and the coverage amount you choose. Younger individuals often benefit from lower premiums due to the reduced risk associated with a longer life expectancy.

One of the critical aspects of term life insurance is its simplicity and ease of understanding. Unlike permanent life insurance, which provides coverage for the entire life of the insured, term life insurance is designed for a specific period. This means that if you outlive the term, the policy expires, and the coverage ends. However, this simplicity also means that term life insurance is generally more affordable, making it an attractive option for those seeking cost-effective coverage.

During the term, if a covered event occurs (i.e., your death), the insurance company pays out the death benefit to your beneficiaries. This financial support can help cover various expenses, such as mortgage payments, children's education, or daily living costs, ensuring that your loved ones are financially secure even in your absence. It's essential to choose a term length that aligns with your current and future financial obligations to ensure adequate coverage.

In summary, term life insurance provides a focused and cost-effective solution for those seeking coverage for a specific period. With its fixed premiums and death benefits, it offers peace of mind and financial security to individuals and their families. Understanding the duration and coverage options available can help you make an informed decision when selecting the right term life insurance policy to suit your needs.

Life Insurance and High Blood Pressure: What's the Verdict?

You may want to see also

Conversion Option: Allows term policyholders to convert to permanent insurance without medical exams

The term plus life insurance policy offers a unique feature known as the conversion option, which provides policyholders with the flexibility to transition from a term life insurance policy to a permanent life insurance policy without undergoing a medical examination. This option is particularly valuable for those who initially opt for term life insurance due to its affordability and simplicity but later realize the need for long-term coverage and financial security.

When you purchase a term plus life insurance policy, you typically select a specific term duration, such as 10, 20, or 30 years. During this term, the policy provides a death benefit if the insured individual passes away. After the term expires, the policy may automatically convert to a permanent life insurance policy, or the policyholder may have the option to do so. The conversion option ensures that you can continue your coverage without any gaps in protection.

The beauty of this feature lies in its convenience and potential cost savings. By converting to a permanent policy without a medical exam, you can secure lifelong coverage without the typical health assessments and medical questions that are often required for new permanent life insurance policies. This process is especially beneficial for individuals who have experienced health changes or improvements since their initial policy purchase, as it allows them to maintain their coverage without the need for a medical evaluation.

To exercise the conversion option, policyholders usually need to notify their insurance provider before the term's end. The insurance company will then guide the process, which may include a review of the policyholder's credit history and financial information. Once approved, the term policy is converted to a permanent policy, often with the same death benefit and premium structure as the original term policy. This seamless transition ensures that you retain the coverage you need without any disruptions.

In summary, the conversion option in term plus life insurance is a valuable tool for policyholders seeking long-term financial protection. It provides a straightforward way to upgrade from a term policy to a permanent one, ensuring continuous coverage without the hassle of medical exams. This feature is particularly advantageous for those who want to adapt their insurance needs as their health and life circumstances evolve over time.

Navigating Life Insurance: Your Guide to Parent's Policies

You may want to see also

Death Benefit: Pays a lump sum to beneficiaries upon the insured's death

Term plus life insurance is a type of life insurance that combines the benefits of two different policies: term life insurance and whole life insurance. It offers a straightforward and cost-effective way to secure financial protection for your loved ones in the event of your passing. One of the key features of this insurance is the death benefit, which is a crucial aspect to understand.

The death benefit is a guaranteed payout that is paid out to the designated beneficiaries when the insured individual (the person whose life is insured) passes away. This lump sum payment is a critical financial safety net for your family, providing them with the necessary funds to cover various expenses and maintain their standard of living. When purchasing term plus life insurance, you have the flexibility to choose the amount of death benefit that suits your needs. This customization allows you to ensure that your beneficiaries receive the financial support they require during a challenging time.

Upon your death, the insurance company will pay out the death benefit amount to the beneficiaries you have specified. This process is typically straightforward and efficient, providing much-needed financial relief to your loved ones. It is essential to carefully select and inform your beneficiaries to ensure a smooth and timely payout when the time comes.

Term plus life insurance is particularly attractive due to its simplicity and affordability. The policy provides coverage for a specific term, often 10, 20, or 30 years, during which the death benefit is guaranteed. This term-based approach allows individuals to secure coverage for a defined period, making it ideal for those who want temporary financial protection for their families. After the term ends, the policy may continue, offering permanent coverage with an increasing death benefit, or it can be adjusted or canceled.

In summary, the death benefit is a vital component of term plus life insurance, offering financial security and peace of mind. It ensures that your beneficiaries receive a lump sum payment, providing them with the means to cover essential expenses and maintain their financial stability. By understanding and utilizing this feature, individuals can take a proactive approach to protecting their loved ones' financial well-being.

Substance Abuse: Impacting Life Insurance Rates and Coverage

You may want to see also

Cost: Premiums are typically lower than pure permanent insurance due to term coverage

Term plus life insurance is a type of life insurance that offers a combination of coverage and benefits. It is designed to provide a sense of security and financial protection for individuals and their loved ones. One of the key advantages of this insurance is its cost-effectiveness, especially when compared to pure permanent life insurance.

The lower premiums of term plus life insurance can be attributed to the nature of its coverage. Term life insurance is a temporary policy, typically covering a specific period, often 10, 20, or 30 years. During this term, the insurance company guarantees a death benefit if the insured individual passes away. This term coverage is more straightforward and less complex than permanent insurance, which provides coverage for the entire life of the insured.

In permanent life insurance, the policy remains in force for the insured's entire life, and the premiums are often higher due to the long-term commitment and the associated costs. The insurance company invests a portion of the premiums in various financial instruments to generate returns and ensure the policy's long-term viability. This investment aspect adds complexity and cost to permanent insurance.

In contrast, term plus life insurance focuses solely on providing coverage for a defined period. The premiums are calculated based on the term duration and the death benefit amount. Since the coverage is limited to a specific time frame, the insurance company's risk is reduced, and they can offer lower premiums. This makes term plus life insurance an attractive option for those seeking affordable coverage without the long-term financial commitment of permanent insurance.

By choosing term plus life insurance, individuals can obtain the necessary financial protection during a specific period without incurring the higher costs associated with permanent insurance. This type of policy is particularly beneficial for those who want to ensure their family's financial security for a particular duration, such as covering mortgage payments, children's education, or other significant financial obligations. The lower premiums make it accessible to a broader range of individuals, allowing them to secure their loved ones' futures without straining their budgets.

Aflac Life Insurance: Is It Worth the Cost?

You may want to see also

Frequently asked questions

Term Plus Life Insurance is a type of life insurance that provides coverage for a specific period, known as the "term." It is designed to offer a temporary safety net for your loved ones during a particular time in your life, such as when you have a mortgage, children's education expenses, or other financial commitments. The policy typically has a fixed premium and a guaranteed death benefit, ensuring that your beneficiaries receive a lump sum payment if you pass away during the term.

Unlike permanent life insurance, which provides coverage for the entire life of the insured individual, Term Plus Life Insurance is a temporary policy. It is often more affordable and offers a straightforward way to protect your family during a specific period. The key advantage is that you can choose the term length that aligns with your financial obligations, and once the term ends, you can decide whether to renew or switch to another type of coverage.

This type of insurance offers several advantages. Firstly, it provides comprehensive coverage at a potentially lower cost compared to permanent policies. You can customize the term length to match your needs, ensuring that your loved ones are protected when it matters most. Additionally, Term Plus Life Insurance often has no cash value accumulation, allowing for more straightforward and transparent pricing. This policy can be an excellent choice for those seeking a simple and effective way to secure their family's financial future during a defined period.