The average cost of car insurance varies depending on a variety of factors, including age, location, provider, vehicle type, and driving record. In the United States, the average annual cost of car insurance is $869 for minimum coverage and $2,681 for full coverage. However, this cost is based on a 35-year-old driver with good credit and no driving violations. The three most influential factors that affect your car insurance rates are your location, provider, and age.

| Characteristics | Values |

|---|---|

| Average monthly cost of car insurance in the U.S. | $196 for full coverage |

| $53 for minimum coverage | |

| Average annual cost of car insurance in the U.S. | $2,348 for full coverage |

| $639 for minimum coverage | |

| Average cost of car insurance in 2024 | $1,766 for full coverage |

| $497 for minimum coverage | |

| Average cost of car insurance in 2024 | $2,026 for full coverage |

| $638 for state minimum coverage | |

| Average cost of car insurance in the U.S. in 2024 | $2,068 |

| Average monthly cost of car insurance in the U.S. | $172 |

What You'll Learn

Average car insurance costs for different driver profiles

The cost of car insurance varies depending on several factors, including age, gender, driving history, and location. Here is a breakdown of the average car insurance costs for different driver profiles:

Age

The cost of car insurance tends to be higher for younger and older drivers, as they are considered higher-risk. For example, the average annual cost of car insurance for an 18-year-old driver is $6,045, while it is $1,847 for a 60-year-old driver.

Gender

In most states, gender also impacts car insurance rates, with men typically paying more than women due to riskier driving behaviors. However, the difference in rates between genders tends to decrease as age increases.

Driving History

Drivers with a clean driving record benefit from lower insurance rates. On the other hand, those with a history of accidents, speeding tickets, or DUIs will pay significantly more for car insurance. For instance, a driver with a DUI can expect their insurance rates to increase by around 83%.

Location

Car insurance rates vary by state, with Vermont, Idaho, and Maine having some of the lowest average rates, while Florida, Louisiana, and Texas have the highest. The cost of car insurance in a particular state is influenced by factors such as the number of claims, cost of repairs, and vehicle theft frequency.

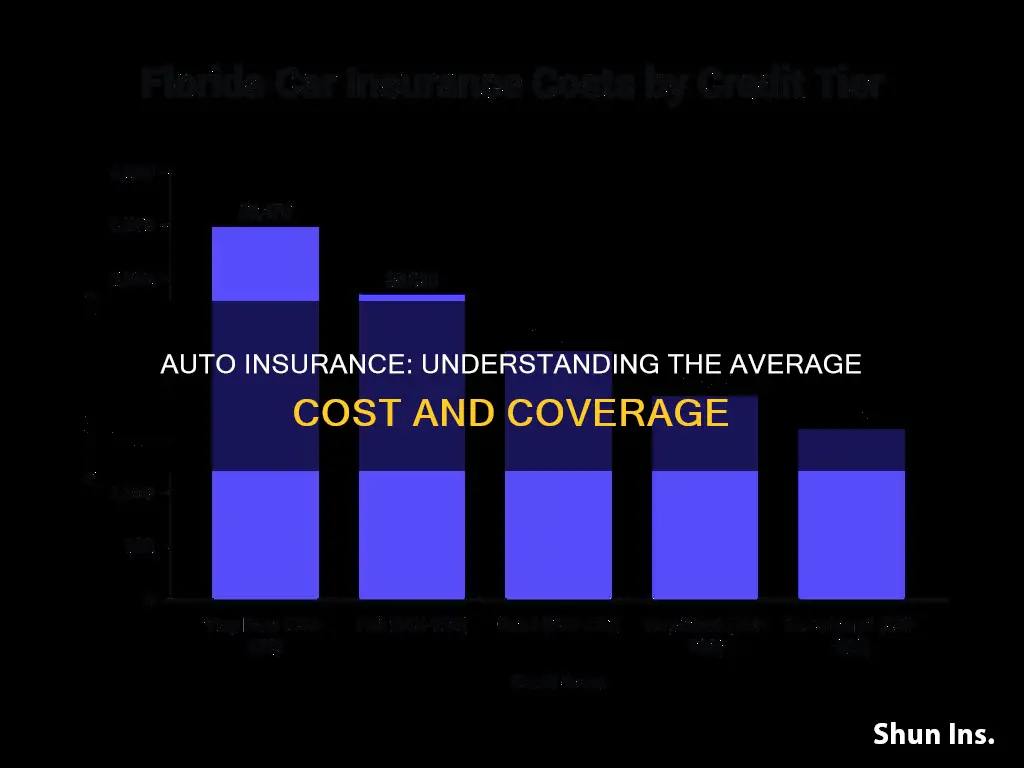

Credit Score

In most states, credit score is also a factor in determining car insurance rates. Drivers with poor credit scores are considered higher-risk and may pay up to 58% more for car insurance than those with good credit.

Vehicle Type

The type of vehicle you drive also impacts your insurance rates. Sports cars, luxury cars, and electric vehicles tend to have higher insurance rates due to higher repair costs and the increased likelihood of accidents.

Marital Status

Married individuals often benefit from lower car insurance rates compared to single drivers, as insurers associate marriage with safer and more stable driving behaviors.

Coverage Level

The level of coverage you choose will also affect your insurance costs. Full coverage insurance, which includes collision and comprehensive coverage, is significantly more expensive than minimum coverage. However, it is important to note that minimum coverage may not provide sufficient protection in the event of an accident.

Transferring Vehicle Ownership: IAA's Guide to Certificate Title Transfers

You may want to see also

Average car insurance rates by state

The average cost of car insurance varies across the United States, ranging from $29 per month in South Dakota to $154 per month in Michigan for minimum coverage. The national average for full coverage is $1,895 per year, but this can differ drastically depending on the state.

Louisiana, Florida, California, Michigan and Colorado

Louisiana has the most expensive car insurance in the US, with an average annual premium of $2,883 for full coverage. Florida, California, Michigan and Colorado are also among the most expensive states for car insurance. High insurance costs in these states can be attributed to severe weather, uninsured motorists, high population density, crime rates, costly lawsuits, and poor road conditions.

Maine, New Hampshire, Vermont, Ohio and Idaho

Maine has the cheapest car insurance rates in the US, with an average annual premium of $1,175 for full coverage. New Hampshire, Vermont, Ohio and Idaho also offer cheap car insurance. Low insurance costs in these states can be attributed to low population density, mild weather, and a competitive insurance market.

Other Factors Affecting Car Insurance Rates

Other factors that influence car insurance rates include driving record, age, marital status, location, state insurance minimums, gender, and vehicle type.

Redlining Practice: Auto Insurance Policy Discrimination

You may want to see also

Average car insurance cost by company

The average cost of car insurance varies depending on the company, the driver's age, gender, driving record, and credit score. Here is a breakdown of the average cost of car insurance by company:

USAA:

USAA is an insurance company that offers some of the cheapest full coverage car insurance rates, but it is only available to military personnel, veterans, and their families. Their rates are highly competitive, and they are known for providing excellent customer service.

Auto-Owners:

Auto-Owners Insurance is another company that offers affordable full coverage car insurance. Their rates are generally lower than many of their competitors, and they have a strong reputation for financial stability and customer satisfaction.

Geico:

Geico is a well-known insurance company that provides some of the lowest full coverage rates in the industry. They are known for their extensive coverage options, discounts, and reliable customer service.

Erie:

Erie Insurance is a regional insurance provider that offers highly competitive rates for full coverage. They are known for their exceptional customer service and have a strong presence in the states where they operate.

Other Companies:

Other insurance companies, such as State Farm, Progressive, Allstate, and Nationwide, also offer competitive rates. It is always a good idea to shop around and compare quotes from multiple companies to find the best rates and coverage options for your specific needs.

It is important to note that the cost of car insurance can vary significantly depending on personal factors such as age, driving record, credit score, and the type of vehicle being insured. Additionally, the cost of car insurance can vary by state, with some states having significantly higher or lower average rates than others.

UTV Auto Insurance: Understanding the Requirements

You may want to see also

How your driving record impacts your car insurance cost

A driving record is a record with the department of motor vehicles (DMV) that stores your personal identification, license information, and any tickets or other infractions. It follows you from the day you get your license until you stop driving.

Your driving record is one of the most important factors that determine your car insurance cost. It gives insurance companies a good indicator of how you drive and how responsible you are behind the wheel. It helps them assess how much risk you carry for them.

- Traffic violations and accidents: Every accident, speeding ticket, or moving violation adds up and increases your risk level with car insurance companies. A serious offense such as a DUI or reckless driving charge can label you as a high-risk driver and push your insurance premiums up by 30% to 300%. Even a speeding ticket can bump your rates by 20%.

- License suspensions: A serious driving infraction, such as a DUI or reckless driving, can lead to a suspended license, making it illegal for you to drive. Driving with a suspended license can lead to criminal charges and further increase your insurance rates.

- Insurance claims: If you have a history of making insurance claims, insurance companies will consider you a higher risk and may increase your premiums.

- Credit rating: If you choose not to pay a traffic ticket, your credit rating will likely take a hit. Most states will add fees, and if left unpaid, your credit rating could drop significantly. A weaker credit record may further increase your car insurance rates.

- Career impact: A serious driving infraction or a series of small ones may put your job at risk, especially if driving is a significant part of your job. A suspended license or an increase in insurance costs due to your driving record may be a deal-breaker for your employer.

Remember that your driving record is not the only factor that determines your car insurance cost. Other factors, such as your age, gender, location, vehicle type, and credit score, also play a role in calculating your insurance premiums.

Fleet Auto Insurance: Understanding Commercial Vehicle Coverage

You may want to see also

Auto insurance costs for drivers with good and poor credit

Auto insurance costs vary depending on factors such as age, gender, driving history, and credit score. Drivers with poor credit pay nearly 85% more for full coverage car insurance than those with good credit. Poor credit is seen as an indicator of higher risk, with more frequent insurance claims, and thus a larger financial risk to insurers.

In the US, the average cost of car insurance is $2,348 per year, or $196 per month, for full coverage, and $639 per year, or $53 per month, for minimum coverage. However, these costs can vary significantly depending on individual circumstances. For example, in some states, such as Florida, Louisiana, and Texas, the average cost of full coverage car insurance is significantly higher than the national average, due to factors such as frequent claims and higher vehicle repair costs. On the other hand, states like Idaho, Vermont, and Ohio have cheaper annual full coverage rates, thanks to lower living costs and less congested traffic.

Canceling Kemper Auto Insurance: A Step-by-Step Guide

You may want to see also

Frequently asked questions

The average cost of car insurance in the U.S. is $2,348 per year or $196 per month for full coverage and $639 per year or $53 per month for minimum coverage.

The average cost of car insurance varies by state. For example, in Vermont, the average annual cost of car insurance is $1,396, whereas in Florida, it is $3,450.

The average cost of car insurance varies by age. For instance, for an 18-year-old driver, the average annual cost is $5,669, whereas for a 35-year-old driver, it is $2,387.

In states where gender is used as a factor in determining car insurance rates, males tend to pay more than females, especially at younger ages. For example, at age 20, males pay on average $626 more per year than females.