Navigating the world of life insurance in New York can be complex, with numerous options available. The best life insurance policy for an individual in New York depends on various factors, including their age, health, financial goals, and the level of coverage they require. This article aims to provide an overview of the different types of life insurance available, helping New Yorkers make informed decisions to ensure they and their loved ones are protected.

What You'll Learn

- Cost Comparison: Explore New York's best life insurance rates and coverage options

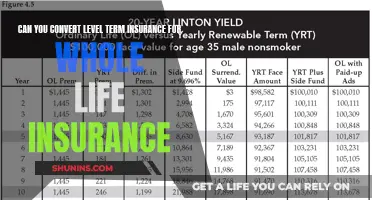

- Term vs. Permanent: Understand the differences and benefits of term and permanent life insurance

- Provider Reviews: Research top-rated life insurance companies in New York

- Coverage Needs: Assess your financial needs and choose appropriate coverage amounts

- Medical Underwriting: Learn about the underwriting process and its impact on policy approval

Cost Comparison: Explore New York's best life insurance rates and coverage options

When considering life insurance in New York, it's essential to understand that the cost and coverage options can vary significantly based on several factors. These factors include age, health, lifestyle, and the amount of coverage you choose. New York has a range of life insurance providers, each offering different policies with varying premiums. Here's a detailed breakdown of how to explore and compare the best rates and coverage options in the state.

Age and Health Impact on Premiums:

Age is a critical factor in determining life insurance rates. Younger individuals typically pay lower premiums as they are considered less risky. As you age, especially after a certain threshold, premiums tend to increase. Additionally, health plays a significant role. Insurers often consider medical history and current health status when quoting premiums. For instance, a non-smoker with no significant health issues may secure more affordable rates compared to a smoker or someone with pre-existing conditions.

Coverage Options and Their Costs:

Life insurance policies in New York offer various coverage options, including term life, whole life, and universal life insurance. Term life insurance provides coverage for a specified period, often 10, 20, or 30 years, and is generally more affordable. Whole life insurance offers lifelong coverage and includes an investment component, making it more expensive. Universal life insurance provides flexibility in premium payments and death benefit amounts, with rates varying based on individual circumstances. When comparing costs, consider the coverage period and the death benefit amount to find a balance that suits your needs without breaking the bank.

Shopping Around for the Best Rates:

To get the best rates, it's crucial to shop around and obtain quotes from multiple insurers. New York residents can request quotes from various life insurance companies, both traditional and online providers. Online platforms often provide quick quotes, allowing you to compare prices and coverage options easily. However, for more personalized advice, consulting with independent insurance agents who understand New York's market can be beneficial. They can help you navigate the options and find policies that offer the best value for your specific situation.

Additional Factors to Consider:

Apart from age and health, other factors influence life insurance costs. These include lifestyle choices, such as smoking or excessive alcohol consumption, which can impact your premium. Marital status and the number of dependents may also play a role. Furthermore, the amount of coverage you require will directly affect the cost. Higher coverage amounts mean higher premiums. It's essential to assess your financial situation and long-term goals to determine the appropriate coverage level.

In summary, exploring New York's best life insurance rates involves understanding the impact of age, health, and coverage options on premiums. Shopping around, comparing quotes, and considering additional factors will help you make an informed decision. Remember, the goal is to find a policy that provides adequate coverage at a cost you can afford, ensuring financial security for your loved ones.

Chicago Police Life Insurance: What's Covered?

You may want to see also

Term vs. Permanent: Understand the differences and benefits of term and permanent life insurance

When considering life insurance in New York, it's essential to understand the two primary types: term and permanent life insurance. Each offers unique advantages and serves different financial needs. This guide will help you navigate these options to make an informed decision.

Term Life Insurance:

Term life insurance provides coverage for a specified period, typically 10, 20, or 30 years. It is a more affordable and straightforward option, offering a death benefit if the insured person passes away during the term. The key advantage of term life is its simplicity and cost-effectiveness. It is ideal for individuals who want coverage for a specific period, such as until a child's education is funded or a mortgage is paid off. During the term, premiums are usually lower compared to permanent life insurance, making it a budget-friendly choice. However, it's important to note that term life insurance does not accumulate cash value, and the policy ends when the term is over, unless you choose to renew it.

Permanent Life Insurance:

In contrast, permanent life insurance, also known as whole life or universal life, offers lifelong coverage. This type of policy builds cash value over time, which can be borrowed against or withdrawn. Permanent life insurance provides a death benefit and a guaranteed return on the premiums paid. The cash value can grow tax-deferred, and it can be used to pay for long-term care or even serve as an inheritance for beneficiaries. One of the significant benefits is the ability to build equity, which can be a valuable asset. Permanent life insurance is more expensive than term life, but it offers long-term financial security and the peace of mind of knowing you have coverage for your entire life.

Choosing Between Term and Permanent:

The decision between term and permanent life insurance depends on your specific circumstances and financial goals. If you need coverage for a limited time and want a more affordable option, term life is the way to go. It provides a safety net during the years when your family's financial needs are most critical. On the other hand, permanent life insurance is suitable for those seeking long-term financial security and the potential for wealth accumulation. It is a more comprehensive solution, ensuring that your loved ones are protected even in your absence.

In New York, as in many other states, understanding the differences between term and permanent life insurance is crucial to making the right choice. Term life offers temporary coverage with lower premiums, while permanent life provides lifelong protection and the potential for cash value growth. Assessing your financial situation, long-term goals, and the level of coverage needed will help you decide which type of life insurance is best suited to your needs.

Geico Life Insurance: Legit or a Scam?

You may want to see also

Provider Reviews: Research top-rated life insurance companies in New York

When it comes to finding the best life insurance in New York, provider reviews are an essential step in the decision-making process. With numerous insurance companies offering a wide range of policies, it can be challenging to determine which provider is the most suitable for your needs. Here's a guide to help you navigate this important research:

Understanding Provider Reviews:

Provider reviews offer valuable insights into the experiences of current and past customers. These reviews often highlight the strengths and weaknesses of different insurance companies, allowing you to make an informed choice. Look for reviews that provide detailed information about the claims process, customer service, policy coverage, and overall satisfaction. Websites like Insurance Journal, NerdWallet, and J.D. Power offer comprehensive reviews and ratings for life insurance providers in New York.

Research Top-Rated Companies:

Start by identifying the top-rated life insurance companies in New York based on various factors. These factors may include financial stability, customer satisfaction ratings, and the range of policies offered. Some highly regarded insurance providers in the state include New York Life, MetLife, and Prudential. Research their websites and explore the different policy options they provide. Compare their offerings, such as term life, whole life, and universal life insurance, to find the best fit for your requirements.

Evaluate Policy Options:

Each insurance company will have its own set of policy features and benefits. Carefully review the terms and conditions of different policies. Consider factors like coverage amount, term length, premium payments, and any additional benefits or riders offered. For example, some companies may provide an accidental death benefit or a waiver of premium option. Ensure that the policy aligns with your financial goals and provides adequate coverage for your loved ones.

Check Financial Strength and Ratings:

Assess the financial stability of the insurance companies you are considering. Look for providers with strong financial ratings from reputable agencies like A.M. Best, Moody's, or Standard & Poor's. These ratings indicate the company's ability to fulfill its financial obligations to policyholders. A higher financial rating often signifies a more reliable and trustworthy insurance provider.

Read Customer Testimonials:

In addition to professional reviews, read customer testimonials and feedback. Personal experiences can provide valuable insights into the quality of service and support offered by different companies. Websites and forums dedicated to insurance reviews often feature customer stories, allowing you to gauge the overall satisfaction and reliability of a particular provider.

By thoroughly researching and comparing top-rated life insurance companies in New York, you can make a well-informed decision. Remember, the best policy is the one that meets your specific needs, offers competitive pricing, and provides excellent customer support.

Term Life Insurance: Building Equity or Not?

You may want to see also

Coverage Needs: Assess your financial needs and choose appropriate coverage amounts

When it comes to life insurance in New York, understanding your coverage needs is crucial. The primary purpose of life insurance is to provide financial protection and peace of mind for your loved ones in the event of your passing. Here's a guide to help you assess your financial requirements and select the right coverage amount:

Evaluate Your Financial Situation: Start by taking an honest look at your current financial obligations and future goals. Consider your income, expenses, debts, and any ongoing financial commitments. For instance, if you have a mortgage, children's education expenses, or a spouse and family who rely on your income, you'll need a substantial amount of coverage to ensure their financial security. Calculate the potential financial impact of your death on your family, including any immediate expenses and long-term needs.

Determine the Coverage Amount: The coverage amount you choose should be sufficient to cover your family's financial obligations and provide for their future. A common rule of thumb is to aim for a coverage amount that is 10 to 15 times your annual income. This can be a starting point, but it's essential to customize it based on your unique circumstances. For example, if you have a high-income job, you might need more coverage to ensure your family can maintain their standard of living. Conversely, if you have a lower income but significant debt, a higher coverage amount might be necessary to pay off debts and provide for your family.

Consider Long-Term Needs: Life insurance should also account for long-term financial goals. For instance, if you want to ensure your children's education is funded, you'll need to calculate the total cost of their education and choose a coverage amount that will cover this expense. Additionally, consider any future financial goals, such as retirement plans or business succession, and factor these into your coverage decision.

Review and Adjust Regularly: Life circumstances change over time, and so should your insurance coverage. Regularly review your policy to ensure it remains appropriate. Life events like marriage, the birth of a child, or a significant career change can impact your coverage needs. Adjust your policy accordingly to reflect any changes in your financial situation or family structure.

Remember, the goal is to provide financial security and peace of mind for your loved ones. By carefully assessing your financial needs and choosing the right coverage amount, you can ensure that your family is protected, even in the face of adversity. It's always advisable to consult with a financial advisor or insurance professional who can provide personalized guidance based on your specific circumstances.

Life Insurance: Necessary Without Kids?

You may want to see also

Medical Underwriting: Learn about the underwriting process and its impact on policy approval

The process of medical underwriting is a critical aspect of obtaining life insurance, especially in New York, where insurance companies must adhere to strict regulations. This process involves a thorough evaluation of an individual's health and medical history to determine their insurability and the terms of their policy. It is a detailed and often complex procedure, but it plays a vital role in ensuring that insurance companies can provide coverage that is fair and sustainable for all policyholders.

When applying for life insurance, the underwriting process typically begins with a series of health questions and a medical examination. Insurers will ask about pre-existing conditions, lifestyle factors such as smoking or excessive alcohol consumption, and any recent or past medical treatments. This information is crucial as it helps underwriters assess the risk associated with insuring the individual. For instance, a person with a history of heart disease or diabetes may be considered a higher risk, which could impact the terms of their policy.

During the medical examination, various health indicators are considered, including blood pressure, cholesterol levels, and body mass index (BMI). These physical assessments provide a more comprehensive understanding of an individual's health status. For example, high blood pressure might indicate a need for further investigation or a potential adjustment in the policy terms. The underwriting team will also review lab results, medical records, and sometimes even consult with healthcare professionals to make an informed decision.

The impact of medical underwriting on policy approval is significant. Based on the information gathered, insurance companies can determine the type of policy offered, the coverage amount, and the premium rate. A favorable underwriting outcome often results in better policy terms, including lower premiums and higher coverage limits. Conversely, individuals with adverse health factors may face challenges in obtaining full coverage or might be required to pay higher premiums to offset the increased risk.

In New York, the state's insurance department regulates the underwriting process to protect consumers. This regulation ensures that underwriters consider all relevant health information and provide fair treatment to applicants. It also encourages insurance companies to offer a range of policies to cater to diverse health profiles, ensuring that individuals can find suitable coverage options. Understanding the medical underwriting process is essential for anyone seeking life insurance, as it empowers individuals to make informed decisions and potentially secure more favorable policy terms.

Canceling Thrivent's Permanent Life Insurance: A Step-by-Step Guide

You may want to see also

Frequently asked questions

The best type of life insurance depends on your individual needs and financial goals. Term life insurance is a popular choice for many New Yorkers as it provides coverage for a specific period, offering a higher death benefit at a lower cost compared to permanent life insurance. Permanent life insurance, such as whole life or universal life, offers lifelong coverage and includes an investment component, which can be beneficial for long-term financial planning.

When selecting a life insurance company, consider factors such as financial strength, customer service, and policy options. Research the company's ratings and reviews, and ensure they are licensed to operate in New York. Look for companies with a strong financial position to ensure they can fulfill their obligations to policyholders. Additionally, check for any complaints or disputes with the New York State Department of Financial Services.

Obtaining a life insurance quote is a straightforward process. You can start by providing basic personal and health information to insurance companies or their authorized representatives. They will then assess your risk factors and offer quotes for different coverage amounts and policy types. You can compare quotes based on your preferences and choose a policy that suits your needs.

New York has certain regulations and requirements for life insurance policies. The state mandates that life insurance companies provide a minimum level of coverage, and they must disclose specific information in policy documents. Additionally, New York residents may have access to state-specific programs or incentives for purchasing life insurance, so it's essential to understand the local insurance market and any potential benefits.

Yes, it is possible to obtain life insurance with pre-existing health conditions, but the process and terms may vary. Insurance companies in New York consider factors like your health history, age, and lifestyle when determining eligibility and premiums. Some companies offer guaranteed issue policies, which do not require a medical exam, while others may provide coverage with specific conditions or higher premiums. It's advisable to compare offers from multiple insurers to find the best option for your circumstances.