Choosing the best life insurance policy can be a complex decision, as it depends on various factors such as your age, health, financial goals, and the level of coverage you require. The market offers a wide range of options, including term life, whole life, and universal life insurance, each with its own advantages and disadvantages. This article aims to provide an overview of these types of policies, helping you understand the key differences and considerations to make an informed decision that aligns with your specific needs and circumstances.

What You'll Learn

- Assess Needs: Evaluate financial obligations, health, and family needs to determine coverage type

- Policy Types: Understand term, whole life, and universal life policies and their benefits

- Cost Considerations: Compare premiums, coverage amounts, and policy terms to find the best value

- Provider Reputation: Research insurance company ratings, financial strength, and customer service

- Review and Adjust: Periodically assess policy adequacy and adjust as life circumstances change

Assess Needs: Evaluate financial obligations, health, and family needs to determine coverage type

Assessing your needs is a crucial step in determining the best life insurance policy for your situation. This process involves a comprehensive evaluation of various factors that will influence the type and amount of coverage you require. Here's a detailed guide to help you navigate this assessment:

Financial Obligations: Start by identifying your financial responsibilities. This includes any existing debts, such as mortgages, car loans, student loans, or personal debts. Consider the duration and potential impact of these obligations on your family. For instance, if you have a large mortgage, ensuring that your life insurance policy can cover the remaining balance in the event of your passing is essential. Additionally, think about future financial commitments. Are you planning to start a business, fund your child's education, or contribute to a retirement fund? These future expenses should also be factored into your coverage decision.

Health and Lifestyle: Your health and lifestyle choices play a significant role in determining the type of life insurance you should consider. Firstly, evaluate your overall health. Do you have any pre-existing medical conditions or chronic illnesses? These factors can impact the cost and availability of certain life insurance policies. For instance, individuals with health issues might be advised to opt for term life insurance, which provides coverage for a specific period, or they may be encouraged to improve their health before applying for a policy. Lifestyle choices, such as smoking, excessive drinking, or engaging in extreme sports, can also affect your insurance rates.

Family Needs: The needs of your family are a critical aspect of this assessment. Consider the financial impact of your death on your loved ones. Can your family afford to maintain their current standard of living without your income? Calculate the potential loss of income and ensure that your life insurance policy can provide sufficient financial support to cover daily expenses, mortgage or rent payments, and any other regular costs. Additionally, think about long-term family goals. Are there any upcoming large expenses or milestones, such as weddings or college tuition, that your family should be prepared for?

Determining Coverage Type: Based on your evaluation, you can now decide on the type of life insurance policy. Term life insurance is often a popular choice for those seeking affordable coverage for a specific period, typically 10, 20, or 30 years. It provides a death benefit if the insured passes away during the term. Permanent life insurance, on the other hand, offers lifelong coverage and includes a savings component, allowing your beneficiaries to receive a cash value upon your passing. Universal life insurance provides flexible coverage and potential investment opportunities. The choice depends on your financial goals, risk tolerance, and the duration of coverage needed.

By thoroughly assessing your financial obligations, health status, and family needs, you can make an informed decision about the appropriate life insurance coverage. This process ensures that you select a policy that provides adequate financial protection for your loved ones and aligns with your long-term goals. Remember, life insurance is a personal decision, and consulting with a financial advisor or insurance professional can provide valuable guidance tailored to your unique circumstances.

Life Insurance and Taxes: What's the Deal?

You may want to see also

Policy Types: Understand term, whole life, and universal life policies and their benefits

When considering life insurance, it's essential to understand the different policy types available to ensure you choose the best coverage for your needs. The three primary types of life insurance policies are term life, whole life, and universal life, each with its own unique features and advantages.

Term Life Insurance: This is a straightforward and cost-effective policy that provides coverage for a specified term, typically 10, 20, or 30 years. It is ideal for individuals who want temporary coverage to protect their loved ones during a specific period, such as when they are young and have a large family or when they are paying off a mortgage. Term life insurance offers a fixed death benefit and premiums, making it easy to budget. The main advantage is its affordability, especially for younger and healthier individuals. Once the term ends, policyholders can choose to renew the policy or opt for a different type of coverage.

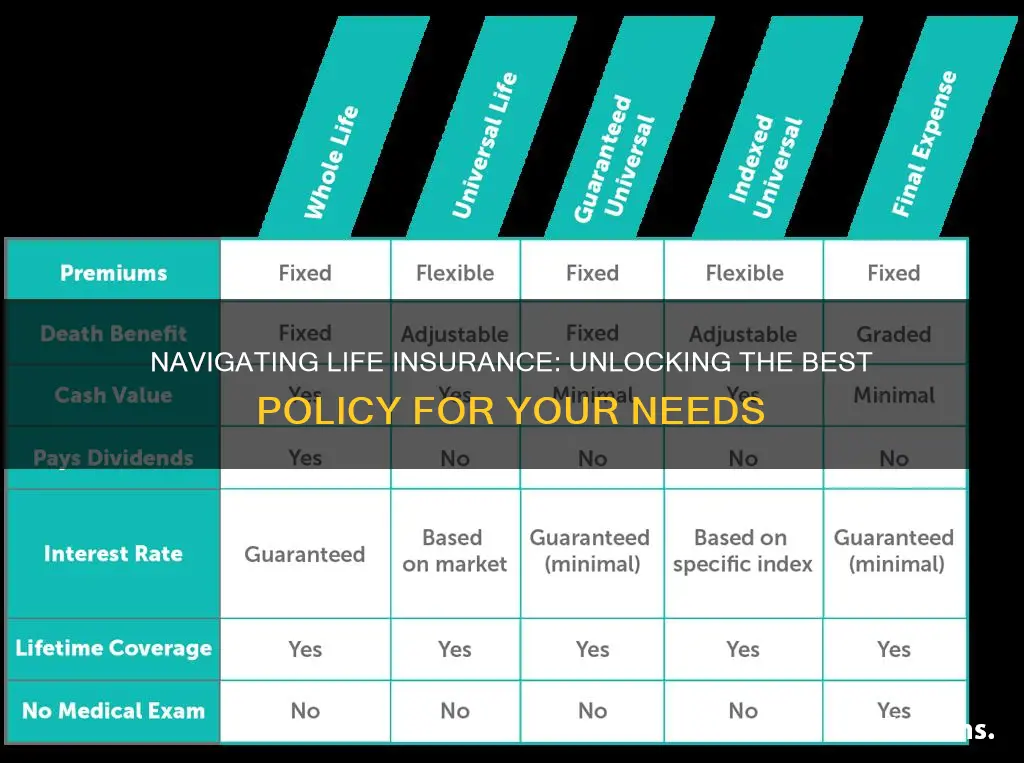

Whole Life Insurance: In contrast, whole life insurance offers permanent coverage for the entire lifetime of the insured individual. It provides a guaranteed death benefit and a fixed premium that remains the same throughout the policy's duration. This type of policy builds cash value over time, which can be borrowed against or withdrawn. Whole life insurance is suitable for those seeking long-term financial security and a consistent premium payment. It offers stability and the potential for tax-deferred growth. However, it is generally more expensive than term life, especially for older individuals or those with health concerns.

Universal Life Insurance: This policy offers flexibility and adaptability, allowing policyholders to adjust their death benefit and premium payments over time. Universal life insurance provides permanent coverage and also accumulates cash value, similar to whole life. The premiums are typically higher than term life, but they can be adjusted based on the policyholder's needs. One of the key benefits is the ability to increase the death benefit or make extra payments to build more cash value. This policy is suitable for individuals who want a long-term financial plan and the option to customize their coverage.

Understanding these policy types is crucial in making an informed decision. Term life is excellent for temporary needs, whole life provides permanent coverage with cash value, and universal life offers flexibility and customization. Assessing your financial goals, family responsibilities, and long-term plans will help determine the most appropriate policy type. It is always advisable to consult with a financial advisor or insurance professional to ensure you select the best life insurance policy that aligns with your specific requirements.

General vs Life Insurance: What's the Real Difference?

You may want to see also

Cost Considerations: Compare premiums, coverage amounts, and policy terms to find the best value

When evaluating life insurance policies, cost is a critical factor that can significantly impact your financial well-being. The best policy for you should offer a balance between coverage and affordability. Here's a detailed breakdown of how to consider costs and make an informed decision:

Compare Premiums: The premium is the amount you pay regularly (monthly, quarterly, or annually) to maintain your life insurance policy. It's essential to compare premiums across different insurance providers. A lower premium might seem attractive, but it could indicate reduced coverage or a less stable company. Conversely, a higher premium might offer more comprehensive coverage and better financial stability. Look for policies that provide a good coverage-to-premium ratio. Online comparison tools can help you quickly assess premiums for various policies, making it easier to identify the most cost-effective options.

Understand Coverage Amounts: The coverage amount is the financial benefit paid to your beneficiaries when you pass away. It's crucial to ensure that this amount aligns with your financial goals and obligations. For instance, if you have a large mortgage, dependants, or specific funeral expenses, you might need a higher coverage amount. When comparing policies, consider your current and future financial needs. A higher coverage amount will typically result in higher premiums, so finding the right balance is key. Some policies offer flexible coverage options, allowing you to adjust the amount as your circumstances change.

Policy Terms: Life insurance policies can have varying terms, typically ranging from 10 to 30 years, with some offering longer-term coverage. The term length impacts the overall cost. Longer-term policies often have lower annual premiums but may be more expensive in the long run. Shorter-term policies provide immediate coverage and can be more affordable upfront. When comparing terms, consider your long-term financial goals and the likelihood of needing insurance coverage for an extended period. For instance, if you're planning to take out a mortgage in the next few years, a shorter-term policy might be more suitable.

Review Policy Fees: In addition to premiums, be mindful of other policy fees. These can include surrender charges, which are penalties for canceling a policy early, and administrative fees. These fees can vary between insurers and can significantly impact the overall cost of your policy. Understanding these fees is essential to ensure you're not paying more than necessary. Some insurers offer no-surrender-charge policies, providing more flexibility without the associated penalty.

Consider Your Health and Lifestyle: Insurance providers often consider your health and lifestyle factors when determining premiums. Non-smokers, for example, may qualify for lower rates. Similarly, individuals with a healthy weight and no significant medical conditions might also benefit from reduced premiums. If you have a history of smoking, diabetes, or other health issues, be prepared for potentially higher costs. Some insurers offer incentives for healthy habits, such as fitness tracking or non-smoking programs, which can help lower your premiums over time.

By carefully comparing premiums, coverage amounts, policy terms, and fees, you can make an informed decision about the best life insurance policy for your needs and budget. It's a crucial step in ensuring that you and your loved ones are protected financially.

Life Insurance Blood Tests: HIV Testing Included?

You may want to see also

Provider Reputation: Research insurance company ratings, financial strength, and customer service

When considering the best life insurance policy, provider reputation is a critical factor that can significantly impact your experience and the value you receive. Researching and understanding the reputation of insurance companies is essential to ensure you make an informed decision. Here's a detailed guide on how to evaluate provider reputation:

Insurance Company Ratings: Start by examining the ratings assigned to insurance providers by independent agencies. These ratings provide an unbiased assessment of the company's financial stability, customer service, and overall performance. Well-known rating agencies like A.M. Best, Moody's, and Standard & Poor's offer comprehensive ratings for insurance companies. Look for companies with higher ratings, as this indicates a stronger financial position and a lower risk of insolvency. For instance, a 'A' or 'A+' rating from A.M. Best signifies a company with superior financial strength and a very low probability of default.

Financial Strength: Financial strength is a key indicator of an insurance company's ability to fulfill its obligations to policyholders. It reflects the company's financial resources and its capacity to pay out claims and meet other financial commitments. Research the financial strength ratings provided by these agencies, which often categorize companies based on their financial stability. A higher financial strength rating means the company is more likely to have the resources to handle large-scale claims and provide long-term financial security to its customers.

Customer Service: A reputable insurance provider should offer excellent customer service, ensuring that policyholders receive prompt and efficient assistance. Evaluate the company's customer service reputation by reading reviews and testimonials from current and past customers. Online forums, consumer websites, and social media platforms can provide valuable insights into the quality of customer service. Look for companies that have a history of addressing customer concerns, providing clear communication, and offering timely support.

Independent Reviews and Awards: Keep an eye out for independent reviews and awards that recognize insurance companies for their exceptional performance. These awards often highlight companies that excel in areas such as customer satisfaction, innovation, and financial stability. While awards should not be the sole criterion for decision-making, they can provide additional reassurance about a company's reputation and commitment to its customers.

Longevity and Market Presence: Consider the age and market presence of the insurance company. Established companies with a long history in the industry often have a proven track record of serving customers effectively. They may have more resources to invest in customer service, research and development, and innovative products. However, newer companies can also bring fresh ideas and improved customer-centric approaches to the market.

By thoroughly researching insurance company ratings, financial strength, and customer service, you can make a well-informed decision when choosing a life insurance provider. This due diligence ensures that you select a reputable company that can provide reliable coverage and support throughout the life of your policy. Remember, a strong provider reputation often translates to better customer experiences and more favorable policy terms.

Lincoln Life Insurance: Suicide Coverage and Exclusions

You may want to see also

Review and Adjust: Periodically assess policy adequacy and adjust as life circumstances change

Reviewing and adjusting your life insurance policy is a crucial aspect of ensuring that you and your loved ones are adequately protected throughout your life's journey. Life is dynamic, and various events can significantly impact your insurance needs. Therefore, it's essential to periodically assess the adequacy of your policy and make adjustments as your life circumstances evolve. Here's a detailed guide on how to approach this process:

Understand Your Current Policy: Begin by thoroughly understanding the life insurance policy you currently hold. Familiarize yourself with the coverage amount, policy term, beneficiaries, and any unique features or riders included. Knowing the specifics of your policy is the first step towards making informed decisions about its review and adjustment.

Life Event Triggers: Life events often serve as catalysts for re-evaluating your insurance needs. Common triggers include marriage or divorce, the birth of a child, the purchase of a home, or significant career advancements. For instance, starting a family may require increasing your coverage to ensure financial security for your spouse and children. Similarly, buying a house could necessitate a higher insurance amount to cover potential mortgage payments and other associated expenses.

Review and Assess Regularly: It is recommended to review your life insurance policy at least once a year or whenever there are substantial changes in your life. Regular reviews allow you to stay proactive in managing your insurance needs. During these assessments, consider the following:

- Income and Expenses: Evaluate your current income, expenses, and financial obligations. Have your expenses increased or decreased? Are there any new financial commitments or goals? Adjusting your policy to reflect these changes can ensure that your insurance coverage aligns with your current financial situation.

- Health and Lifestyle: Take note of any significant health changes, such as new medical conditions, surgeries, or lifestyle modifications. These factors can impact your insurance premiums and coverage options. For instance, improving your health through exercise and diet might lead to lower premiums, while a change in occupation could require a policy adjustment.

- Family and Dependency: As your family structure evolves, so should your insurance coverage. Review the number of dependents and their ages. If you have children, consider the potential long-term financial impact of their education and future needs. Adjusting the policy to provide adequate financial support for your family's well-being is essential.

Consultation and Professional Advice: When reviewing your policy, consider seeking professional advice from insurance brokers or financial advisors. They can provide valuable insights tailored to your specific circumstances. These experts can help you navigate the complexities of policy adjustments, ensuring that you make informed decisions. Additionally, they can assist in finding the right coverage options and riders to suit your changing needs.

Policy Adjustments: Based on your reviews and assessments, make the necessary adjustments to your policy. This might include increasing or decreasing the coverage amount, extending or shortening the policy term, or adding or removing specific riders. For example, you might opt for a longer term policy to provide coverage for an extended period or choose a rider that offers additional benefits, such as accelerated death benefits or long-term care insurance.

By regularly reviewing and adjusting your life insurance policy, you can ensure that it remains relevant and effective as your life progresses. This proactive approach allows you to adapt to changing circumstances, providing the necessary financial protection for yourself and your loved ones. Remember, life insurance is a long-term commitment, and staying informed and proactive is key to making the best choices for your future.

Trusts and Life Insurance: Who Gets the Payout?

You may want to see also

Frequently asked questions

The best life insurance policy depends on your individual needs and circumstances. It's essential to consider factors such as your age, health, financial goals, and the level of coverage you require. Term life insurance is a popular choice for those seeking affordable coverage for a specific period, while whole life insurance offers permanent coverage and a cash value component. It's recommended to assess your situation, including your family's financial obligations and your own financial resources, to determine the appropriate coverage amount and type of policy.

Choosing the right insurance company is crucial for a positive experience. Research and compare different insurers based on their financial strength, customer service reputation, and policy offerings. Look for companies with a strong financial rating from reputable agencies, as this indicates their ability to fulfill their financial obligations. Read reviews and testimonials to gauge customer satisfaction. Additionally, consider the company's claims process, accessibility of customer support, and their overall reputation in the industry.

There are primarily three types of life insurance policies: Term Life, Whole Life, and Universal Life. Term life insurance provides coverage for a specified term, such as 10, 20, or 30 years, and is generally more affordable. Whole life insurance offers lifelong coverage with fixed premiums and a cash value accumulation. Universal life insurance provides flexible premiums and allows policyholders to adjust the death benefit and premium payments. Each type has its advantages, and the choice depends on your long-term financial goals and preferences.

Yes, comparing quotes from multiple insurance providers is an excellent way to find competitive rates and the best coverage for your needs. Online comparison tools allow you to input your personal and financial information, and they provide quotes from various insurers. This process helps you understand the price range for different policies and coverage options. However, it's important to remember that the cheapest option might not always be the best. Consider the policy's features, coverage terms, and the insurer's reputation to make an informed decision.