When it comes to no-exam life insurance, finding the best option can be a game-changer for those seeking coverage without the hassle of a medical exam. This type of insurance is designed to provide quick and convenient coverage, often with faster approval processes and potentially lower premiums. The best no-exam life insurance policies are tailored to meet the needs of individuals who may have health concerns or prefer a streamlined application process. These policies typically involve a simplified underwriting process, where the insurance company relies on health and lifestyle questions rather than a full medical examination. Understanding the benefits and potential drawbacks of no-exam life insurance is essential for making an informed decision.

What You'll Learn

- Affordability: Compare premiums and coverage limits for no-exam policies

- Speed: Understand the quick application and approval process

- Medical History: No-exam policies bypass detailed medical questions and exams

- Benefits: Explore the advantages of simplified underwriting for quick coverage

- Alternatives: Compare no-exam options with traditional exam-based life insurance

Affordability: Compare premiums and coverage limits for no-exam policies

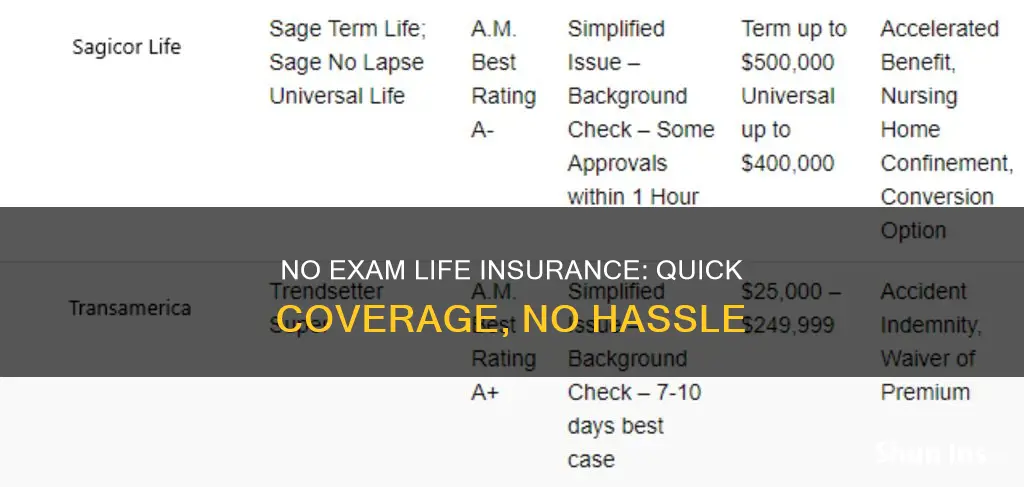

When considering no-exam life insurance, affordability is a critical factor to evaluate. These policies, often referred to as simplified issue or no-medical-exam life insurance, offer convenience and speed but may come with trade-offs in terms of cost. Here's a detailed look at how to assess the affordability of no-exam life insurance policies:

Understanding Premiums:

The premium is the amount you pay for your life insurance policy. For no-exam policies, premiums are typically calculated based on simplified underwriting, which means less detailed health information is required. This can result in lower premiums compared to traditional life insurance, especially for those with pre-existing conditions or a history of health issues. However, it's essential to remember that the premium is not just about the health factors; it also depends on the coverage amount, age, and other personal details.

Coverage Limits:

No-exam life insurance policies usually offer lower coverage amounts compared to traditional policies. This is because the insurer takes on more risk by waiving the medical exam. As a result, the coverage limit may be a significant factor in determining affordability. If you require a substantial amount of coverage, you might need to consider the trade-off between coverage and cost. Some insurers provide options to increase coverage limits, but these may come with additional health questions or a medical exam.

Comparing Quotes:

To find the most affordable option, it's crucial to obtain quotes from multiple insurers. Request quotes for the same coverage amount and term length to make a direct comparison. Online platforms and insurance brokers can facilitate this process by providing quotes from various providers. When comparing quotes, pay attention to the fine print, as different insurers may have varying terms and conditions, including any exclusions or limitations.

Age and Gender:

Age and gender are significant factors influencing the cost of life insurance. Generally, younger individuals and men pay lower premiums for life insurance. No-exam policies might still offer competitive rates for younger individuals, but as you age, the premiums can increase significantly. It's essential to consider your age when evaluating the affordability of a no-exam policy, especially if you plan to keep the coverage for a long term.

Additional Benefits and Costs:

No-exam life insurance policies may include additional benefits or costs that can impact affordability. For instance, some policies offer an accelerated death benefit, allowing you to receive a portion of the death benefit if you are diagnosed with a terminal illness. While this can provide financial security, it may also increase the overall cost. Understanding these additional features and their associated costs is essential when assessing the true affordability of a no-exam life insurance policy.

By carefully comparing premiums, coverage limits, and additional benefits, you can make an informed decision about the affordability of no-exam life insurance. It's a balance between convenience, speed, and cost, ensuring you get the right coverage at a price that fits your budget.

Whole or Term Life Insurance: Which Mix Works?

You may want to see also

Speed: Understand the quick application and approval process

The appeal of no-exam life insurance lies in its efficiency and convenience. This type of policy is designed to streamline the application process, allowing you to secure coverage quickly without the need for a medical examination. Here's how the speed and ease of this process work:

When you opt for no-exam life insurance, the insurer bypasses the traditional medical underwriting process. This means you won't have to undergo a physical examination or provide extensive medical records. Instead, the insurer relies on the information you provide in your application. This simplified approach significantly reduces the time required to get approved for a policy. Typically, the entire process, from application to approval, can be completed within a few days or even just a few hours in some cases. This speed is particularly advantageous for those seeking immediate coverage or who have time constraints.

The application process is often straightforward and user-friendly. You'll be asked to provide basic personal information, such as your name, date of birth, and contact details. Additionally, you'll need to disclose any pre-existing medical conditions or lifestyle factors that could impact your health. This information is crucial for the insurer to assess your risk profile accurately. The insurer will then use this data to determine the policy terms and rates, ensuring a quick and efficient decision-making process.

One of the key advantages of this process is the immediate feedback you receive. Once your application is submitted, the insurer will quickly review the information and provide a decision. This rapid assessment allows you to know your coverage status in a short time. If approved, you can proceed to finalize the policy and make the necessary payments. This speed is especially beneficial for individuals who need insurance coverage promptly, such as those with a recent diagnosis or a time-sensitive situation.

Furthermore, the no-exam policy's efficiency extends to the approval process itself. Unlike traditional life insurance, where waiting periods for medical exams and assessments can delay coverage, this process ensures that you can start benefiting from your policy almost immediately. This is particularly important for those who want to protect their loved ones or secure financial coverage without delays. The quick approval process also means you can make the most of any time-sensitive opportunities or life events that may require insurance coverage.

In summary, no-exam life insurance offers a swift and efficient way to secure coverage. The streamlined application and approval process, which relies on your provided information, ensures that you can obtain life insurance quickly without the typical lengthy procedures. This speed is a significant advantage for those seeking immediate protection and a convenient solution for various life circumstances.

Life Insurance: Monumental's Comprehensive Coverage Benefits

You may want to see also

Medical History: No-exam policies bypass detailed medical questions and exams

No-exam life insurance policies have gained popularity for their convenience and speed, especially for those seeking quick coverage without the hassle of a medical examination. These policies are designed to provide an efficient way to obtain life insurance, often with less paperwork and a faster approval process. One of the key advantages of no-exam policies is that they bypass the traditional, lengthy application process that involves detailed medical questions and exams.

When you opt for a no-exam life insurance policy, the insurer will still require you to provide your medical history, but it will be a simplified process. Instead of a thorough medical examination, you'll typically be asked to answer a series of health-related questions, which are usually less intrusive and cover basic health information. This approach allows the insurer to assess your health risks and determine the policy terms without the need for a physical exam. The questions may include inquiries about your age, smoking status, alcohol consumption, occupation, and any pre-existing medical conditions.

The process of obtaining a no-exam policy is straightforward. You'll receive a questionnaire or application form that asks about your medical history and lifestyle choices. It's important to provide accurate and honest information to ensure the policy is tailored to your needs and to avoid any potential issues during the claims process. The insurer will then use this information to calculate the premium and determine the coverage amount. This streamlined approach can be particularly beneficial for individuals who may have a busy schedule or those who prefer a quicker and more convenient way to secure life insurance.

By bypassing detailed medical questions and exams, no-exam policies offer a faster and more accessible option for life insurance. This type of policy is often preferred by individuals who want immediate coverage, especially those with pre-existing health conditions or busy lifestyles, as it eliminates the potential delays caused by traditional medical exams. Additionally, no-exam policies can be an attractive choice for those who may be hesitant to undergo a medical examination or provide extensive medical records.

In summary, no-exam life insurance policies provide a convenient and efficient way to secure coverage without the need for a detailed medical examination. This approach simplifies the application process, making it more accessible and appealing to a wide range of individuals. It is a valuable option for those seeking quick and hassle-free life insurance, ensuring that they can protect their loved ones without extensive medical interventions.

Haven Life: Quick Insurance Payouts for Peace of Mind

You may want to see also

Benefits: Explore the advantages of simplified underwriting for quick coverage

Simplified underwriting, a key feature of no-exam life insurance, offers several advantages that make it an attractive option for those seeking quick coverage. This process streamlines the traditional underwriting methods, allowing for a faster and more efficient application experience. Here's an exploration of the benefits:

Speed and Convenience: One of the primary advantages is the significant reduction in time required for obtaining a policy. With traditional life insurance, the underwriting process can be lengthy, involving extensive medical exams and extensive paperwork. Simplified underwriting bypasses these steps, enabling applicants to secure coverage within a matter of days or even hours. This speed is particularly beneficial for individuals who need immediate protection, such as those facing a family emergency or a sudden life event.

Accessibility for All: Simplified underwriting makes life insurance more accessible to a broader range of individuals. Many people with pre-existing health conditions or those who are considered high-risk by traditional insurers can still qualify for coverage. This approach considers alternative methods to assess risk, such as reviewing medical records, lifestyle factors, and other relevant data, rather than relying solely on in-person medical exams. As a result, more people can find affordable and suitable life insurance options.

Cost-Effectiveness: The process often leads to lower premiums for applicants. By eliminating the need for extensive medical exams and reducing the time spent on underwriting, insurance companies can offer competitive rates. This cost-effectiveness is especially appealing to those on a tight budget or with limited time, as it provides an efficient way to secure financial protection without incurring high expenses.

Peace of Mind: Knowing that you have coverage quickly can provide immense peace of mind. Simplified underwriting allows individuals to protect their loved ones' financial future without the usual delays and complexities. This is crucial for those facing life's uncertainties, ensuring that their families are taken care of should the unexpected happen.

In summary, simplified underwriting in no-exam life insurance offers a swift, accessible, and cost-effective way to obtain coverage. It empowers individuals to make quick decisions regarding their financial security, providing a valuable safety net for various life circumstances. This approach has revolutionized the life insurance industry, making it more adaptable and responsive to the needs of modern consumers.

Life Insurance: Gift Tax Implications Explained

You may want to see also

Alternatives: Compare no-exam options with traditional exam-based life insurance

When considering life insurance, the traditional route often involves a medical examination, which can be a lengthy and sometimes stressful process. However, the rise of no-exam life insurance has provided an alternative that is both convenient and efficient. This type of policy is designed to offer coverage without the need for a medical assessment, making it an attractive option for those seeking a quicker and potentially more straightforward approach to securing their loved ones' financial future.

No-exam life insurance, as the name suggests, bypasses the traditional medical exam requirement. Instead, it relies on other methods to assess the insured's health and determine the policy's terms. This can include reviewing medical records, answering health-related questions, and sometimes even a simple phone interview. The process is streamlined, allowing for a faster application and approval time, which is particularly beneficial for individuals who need immediate coverage or those with busy schedules who may not have the time for a lengthy medical examination.

One of the key advantages of no-exam life insurance is the speed at which it can be obtained. With traditional life insurance, the waiting period after a medical exam can be several weeks or even months, during which time the policy may not be in effect. No-exam policies, on the other hand, can often be approved and active within a few days, providing immediate peace of mind and financial security. This is especially crucial for individuals facing time-sensitive situations, such as those with pre-existing health conditions who may be concerned about finding suitable coverage.

Another benefit is the potential for better rates. Since no-exam policies skip the medical assessment, they may offer more competitive premiums compared to traditional life insurance. This is because the absence of a medical exam reduces the risk for the insurer, and they can base the policy's terms on other health-related factors. For healthy individuals, this can result in significant savings over the life of the policy. However, it's important to note that the underwriting process may still consider factors like age, gender, and lifestyle, which can influence the final premium.

While no-exam life insurance provides a convenient and efficient option, it's essential to understand the trade-offs. These policies typically have certain limitations, such as reduced coverage amounts or higher premiums for individuals with pre-existing health conditions. Additionally, the underwriting process may still require a more thorough investigation into the applicant's health history through other means. Despite these considerations, no-exam life insurance remains a valuable alternative, offering a quick and accessible way to secure life insurance coverage without the traditional medical exam.

Life Insurance Benefits: Interest Accrual After Death?

You may want to see also

Frequently asked questions

No-exam life insurance, also known as simplified issue life insurance, is a type of life insurance policy that requires minimal medical underwriting. Instead of a traditional medical exam, the insurer relies on a simplified questionnaire and sometimes a phone interview to assess the applicant's health and determine the policy terms and premiums. This process is designed to be quicker and more accessible, making it an attractive option for those who may not have the time or the desire to undergo a full medical examination.

Qualification for no-exam life insurance typically involves answering a series of health-related questions on an application form. These questions may include inquiries about your smoking status, alcohol consumption, medical history, and current medications. The insurer will use this information to assess your risk profile and determine the policy's coverage and cost. In some cases, you may also be asked to provide basic personal details and financial information. It's important to provide accurate and honest answers to ensure a smooth application process and to avoid any potential issues with claim settlements in the future.

While no-exam life insurance offers convenience and faster approval, there are a few potential drawbacks to consider. One disadvantage is that the coverage options and policy terms may be more limited compared to traditional life insurance. The insurer might offer fewer death benefit amounts and policy riders, and the overall coverage may be more restricted. Additionally, the premiums for no-exam policies can sometimes be higher due to the simplified underwriting process. It's essential to carefully review the policy details and compare different providers to ensure you are getting the best coverage and value for your needs.