Finding affordable auto insurance in New Jersey can be challenging. The average cost of car insurance in the state is $1,706 per year, with some cities like Newark and Irvington having average rates as high as $249 per month. However, there are ways to find cheaper insurance plans.

According to recent studies, Geico offers the cheapest car insurance in New Jersey, with an average rate of $58 per month for minimum coverage and $138 per month for full coverage. Other affordable options in the state include Plymouth Rock, NJM Insurance, Selective Insurance, and Farmers.

To get the cheapest car insurance in New Jersey, it is recommended to compare quotes from multiple providers, apply for car insurance discounts, raise your deductible, and consider a telematics program. Additionally, New Jersey is a no-fault state, which means that drivers are required to carry personal injury protection (PIP) in addition to liability insurance. This unique requirement contributes to higher insurance premiums in the state.

| Characteristics | Values |

|---|---|

| Cheapest car insurance in New Jersey | Geico |

| Average cost of car insurance in New Jersey | $1,706 per year |

| Cheapest car insurance in New Jersey for minimum coverage | Geico |

| Cheapest car insurance in New Jersey for full coverage | Geico |

| Cheapest car insurance in New Jersey for drivers with prior incidents | Selective |

| Cheapest car insurance for young drivers in New Jersey | Geico |

What You'll Learn

Cheapest car insurance for young drivers in New Jersey

Car insurance rates for young drivers in New Jersey are typically higher than for older, more experienced drivers. However, there are still some affordable options available.

Cheapest Car Insurance for Teen Drivers in New Jersey

According to US News, the average annual rates for teen drivers in New Jersey are $6,240 for 17-year-old female drivers and $7,008 for 17-year-old male drivers. The cheapest company for teens is Geico, with an average annual rate of $2,264 for females and $2,281 for males.

Cheapest Car Insurance for Young Adult Drivers in New Jersey

For 25-year-old drivers, the average auto insurance rate in New Jersey is $1,863 per year for females and $1,967 per year for males. Geico is the cheapest option for both groups, with average annual rates of $1,279 and $1,258, respectively.

Cheapest Car Insurance for Young Drivers with a Ticket in New Jersey

For 18-year-old drivers with a speeding ticket, Geico offers the cheapest rates in New Jersey, with a minimum coverage policy costing around $96 per month.

Cheapest Car Insurance for Young Drivers with an Accident in New Jersey

For young drivers with an at-fault accident, Geico again offers the cheapest rates, with a minimum coverage policy costing around $109 per month.

Cheapest Car Insurance for Young Drivers with a DUI in New Jersey

For young drivers with a DUI, Geico is still the cheapest option, with a minimum coverage policy costing around $109 per month.

Auto Insurance Liability: Understanding Cleanup Costs

You may want to see also

Cheapest car insurance for teens with a ticket

Car insurance rates for teens in New Jersey are already high, and a speeding ticket on their record will further increase their insurance costs. Here are some of the cheapest options for teens with a ticket:

Geico

Geico is the cheapest option for teens with a speeding ticket in New Jersey, with rates starting at $96 per month for a minimum coverage policy and $206 per month for full coverage. Geico is also one of the few companies that does not raise rates for some drivers after their first traffic violation.

State Farm

State Farm is another option for teens with a ticket, although their rates are higher than Geico. Their rates for teens with a speeding ticket start at $135 per month for full coverage.

Plymouth Rock

Plymouth Rock is a good choice for teens with a ticket, with rates starting at $140 per month for full coverage. They are also one of the cheapest options for teens in general in New Jersey.

Teens in New Jersey should also consider staying on their parent's car insurance policy, as this can save them a significant amount on their insurance costs. Adding a teen to a parent's policy is much cheaper than purchasing a separate policy for the teen.

Strategies for Negotiating a Fair Auto Insurance Claim

You may want to see also

Cheapest car insurance for teens with an at-fault accident

New Jersey is a no-fault state, meaning that drivers are required to file claims with their insurance companies following a collision, regardless of who caused the accident. This is one of the reasons why car insurance in New Jersey is more expensive than in other states.

According to Bankrate, GEICO offers the cheapest car insurance for teens with an at-fault accident in New Jersey, with an average annual premium of $1,059 for full coverage. Foremost is the most expensive option, with policies starting at $5,088 per year.

The average cost of car insurance for teens in New Jersey is $6,240 per year for 17-year-old female drivers and $7,008 per year for 17-year-old male drivers. The cheapest option for teens is GEICO, with an average annual rate of $2,264 for females and $2,281 for males.

Tips for Finding Cheap Car Insurance in New Jersey

- Compare quotes from multiple insurance companies.

- Ask about discounts, such as those for bundling policies, good grades, or paperless billing.

- Choose a higher deductible.

- Improve your credit score.

- Opt for a limited right to sue.

Auto Insurance: Debt or Necessary Evil?

You may want to see also

Cheapest car insurance for young drivers with a DUI

Car insurance rates for young drivers with a DUI history are significantly higher than the rates for drivers with clean records. A DUI record can remain on file for up to 10 years and cause insurance rates to double.

In New Jersey, the cheapest car insurance companies for young drivers with a DUI include:

- Geico

- NJM Insurance

- Progressive

- Plymouth Rock

- Travelers

- State Farm

- Allstate

The average cost of car insurance in New Jersey for drivers with a DUI is $535 per month. However, rates vary depending on age, gender, location, credit score, and driving history.

Young drivers with a DUI charge can expect to pay higher rates than older drivers. Additionally, male drivers typically pay more for car insurance than female drivers.

To find the cheapest car insurance rates, it is recommended to compare quotes from multiple insurance providers and to take advantage of any available discounts. It is also worth considering a higher deductible to lower the cost of car insurance.

- Geico - $210

- NJM Insurance - $188

- Progressive - $350

- Plymouth Rock - $138

- Travelers - $458

- State Farm - $354

- Allstate - $582

Auto Insurance: Prepaid or Postpaid?

You may want to see also

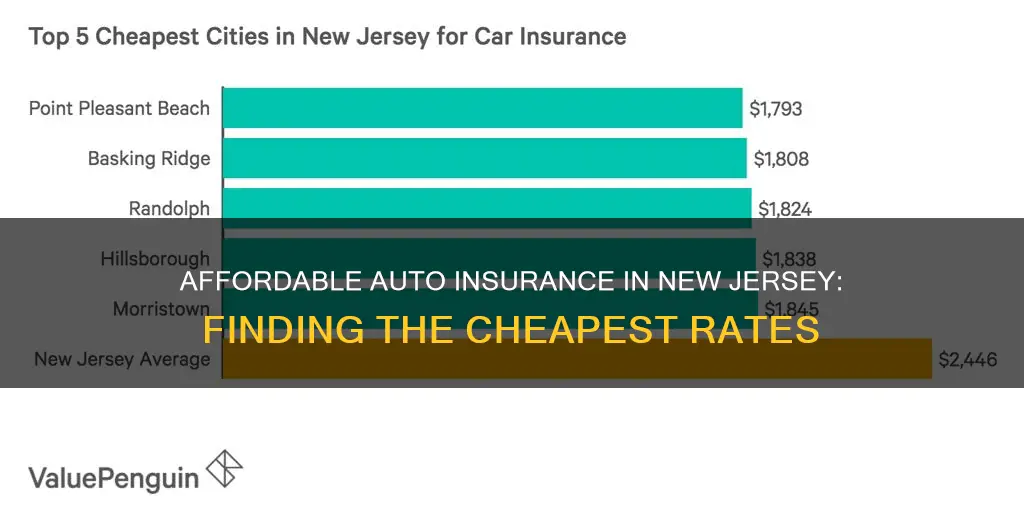

Cheapest car insurance rates by city in New Jersey

The cost of car insurance varies depending on where you live. In New Jersey, the average cost of car insurance is $1,706 per year, which is more expensive than the national average of $1,543. The cheapest car insurance company in New Jersey is Geico, with an average annual rate of $1,163.

- Trenton: $2,004

- Bayonne: $2,035

- Newark: $2,480

- Passaic: $2,423

The cost of car insurance also depends on the type of coverage you choose. The average annual cost for low coverage in New Jersey is $1,567, with Geico being the cheapest option at $972. For high coverage, the average annual rate is $1,814, with Geico again being the cheapest option at $1,274.

To get the cheapest car insurance rates in New Jersey, it is recommended to keep a clean driving record, maintain a high credit score, review your coverage regularly, choose a car model that is cheap to insure, select higher deductibles, and shop around for quotes from different insurance companies.

Effective Strategies for Selling Auto Insurance

You may want to see also

Frequently asked questions

According to various sources, Geico offers the cheapest car insurance in New Jersey, with an average rate of $58 per month for minimum coverage and $97 per month for full coverage.

The average cost of car insurance in New Jersey is $117 per month for minimum coverage and $253 per month for full coverage.

Some factors that affect car insurance premiums in New Jersey include driver age, driving record, coverage selections, credit history, and vehicle make and model.