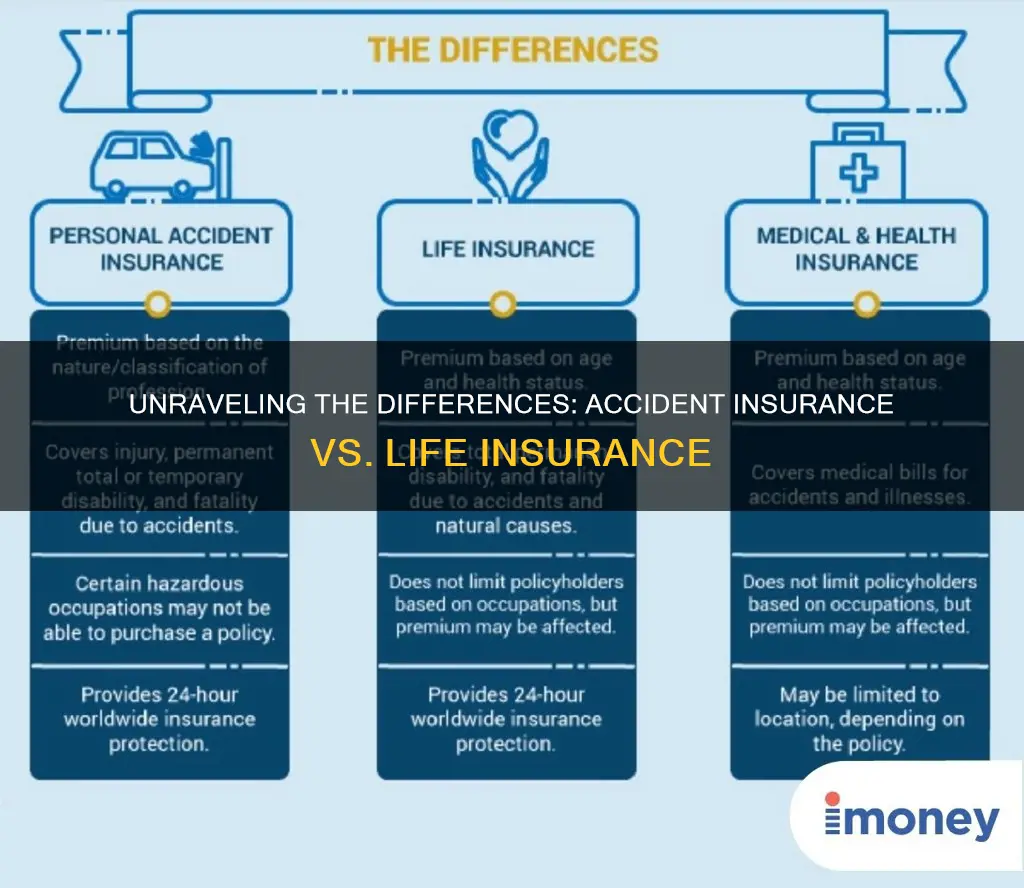

Accident insurance and life insurance are two distinct types of coverage that provide financial protection. Accident insurance, also known as disability insurance, covers medical expenses and lost income due to accidental injuries or illnesses. It ensures that individuals can manage the financial impact of unexpected accidents or health issues. On the other hand, life insurance is a financial safety net for the beneficiaries in the event of the insured person's death. It provides a lump sum payment or regular income to the designated recipients, offering peace of mind and financial security for their future. Understanding the differences between these two insurance types is essential for individuals to choose the right coverage based on their specific needs and circumstances.

Accident Insurance vs. Life Insurance: Key Differences

| Characteristics | Values |

|---|---|

| Definition | Accident insurance provides financial protection against accidental injuries or death. Life insurance offers coverage for the loss of a life. |

| Focus | Accident insurance primarily covers medical expenses, disability, and accidental death. Life insurance focuses on providing financial support to beneficiaries in the event of the insured's death. |

| Coverage | Typically covers accidents like falls, collisions, poisoning, etc. Life insurance covers death caused by accidents, natural causes, or other specified events. |

| Benefits | Pays for medical bills, rehabilitation, lost wages, and other accident-related expenses. Life insurance provides a lump sum or regular payments to beneficiaries. |

| Eligibility | Generally requires a medical examination and may have age and health restrictions. Life insurance eligibility is often based on age, health, and lifestyle factors. |

| Cost | Premiums are usually lower compared to life insurance. Life insurance premiums vary based on age, health, and coverage amount. |

| Term | Often short-term or for a specific period. Life insurance can be term or permanent, offering coverage for a set period or indefinitely. |

| Tax Implications | Accidental death benefits may be tax-free. Life insurance proceeds are generally tax-free if received by beneficiaries. |

| Purpose | Designed to cover unexpected medical costs and provide financial security. Life insurance aims to secure the financial future of dependents in the event of the insured's death. |

What You'll Learn

- Coverage Scope: Accident insurance covers specific injuries, while life insurance provides financial protection for dependents

- Claim Process: Claims for accident insurance are often simpler and faster than those for life insurance

- Premiums: Accident insurance premiums are typically lower than life insurance premiums

- Benefits: Life insurance offers a lump sum or regular payments, whereas accident insurance provides medical coverage

- Eligibility: Life insurance is available to most people, whereas accident insurance may have stricter eligibility criteria

Coverage Scope: Accident insurance covers specific injuries, while life insurance provides financial protection for dependents

Accident insurance and life insurance are two distinct types of coverage that offer different benefits and serve unique purposes. Understanding the coverage scope of each can help individuals make informed decisions about their insurance needs.

Accident insurance, as the name suggests, is designed to provide financial assistance in the event of accidental injuries. This type of insurance typically covers a range of accidents, including those that occur during everyday activities, sports, or even at work. For example, if an individual sustains a broken bone, a concussion, or a burn injury, accident insurance can offer financial relief for medical expenses, hospitalization costs, and even rehabilitation. The coverage is often limited to specific injuries and may not include illnesses or chronic conditions. This insurance is particularly useful for individuals who want to protect themselves against the financial burden of unexpected accidents, ensuring they have the necessary funds to cover medical treatments without straining their savings or health insurance.

On the other hand, life insurance is a more comprehensive financial protection tool. It is designed to provide financial security for the beneficiaries or dependents of the insured individual. Life insurance policies offer coverage for various life events, such as the insured person's death, disability, or critical illness. When an insured individual passes away, the life insurance policy pays out a death benefit to the designated beneficiaries, ensuring their financial stability and providing for their long-term needs. This coverage is especially crucial for families with dependents, as it can help cover expenses like mortgage payments, education costs, or daily living expenses, ensuring the family's financial well-being even in the absence of the primary income earner.

The key difference lies in the scope of coverage. Accident insurance focuses on providing financial assistance for specific injuries, ensuring individuals can access necessary medical care without financial barriers. In contrast, life insurance offers a broader financial safety net, protecting dependents and beneficiaries from the financial impact of the insured individual's death or critical illnesses. Both types of insurance are valuable, and understanding their unique coverage scopes can help individuals choose the right insurance policies to safeguard their health, finances, and loved ones.

Life Insurance Agent Exam: How Many Questions to Expect?

You may want to see also

Claim Process: Claims for accident insurance are often simpler and faster than those for life insurance

The claim process for accident insurance is generally more straightforward and efficient compared to life insurance claims. When an individual purchases accident insurance, they are typically covered for specific incidents, such as injuries sustained in accidents, medical expenses, and potential income loss due to the inability to work. In the event of an accident, the policyholder can file a claim by providing relevant documentation, such as medical reports, accident reports, and any other evidence supporting the claim. The insurance company will then review the information and, if approved, process the claim, often resulting in a faster payout. This simplicity in the claim process is one of the key advantages of accident insurance, making it an attractive option for those seeking quick financial relief in the event of an accident.

On the other hand, life insurance claims can be more complex and time-consuming. When a life insurance policyholder passes away, the beneficiary must initiate the claim by providing the necessary documentation, including proof of death, the policy document, and any additional requirements specified by the insurance company. The insurance provider will then conduct a thorough investigation, which may involve verifying the cause of death, reviewing medical records, and assessing the policyholder's lifestyle and health history. This process can be lengthy, especially in cases where the cause of death is uncertain or requires further medical analysis.

The difference in claim complexity can be attributed to the nature of the coverage. Accident insurance is designed to provide financial protection against unforeseen events, and the claim process reflects this by focusing on the immediate consequences of the accident. In contrast, life insurance policies often have more intricate terms and conditions, especially those with higher coverage amounts or specific policy riders. The insurance company needs to ensure that the claim is legitimate and adheres to the policy's guidelines, which can lead to a more thorough and time-consuming verification process.

Additionally, the speed of the claim process can impact the policyholder's financial situation. Accident insurance claims, being simpler, can provide quick financial assistance, allowing individuals to cover immediate expenses and manage their financial obligations without significant delays. This prompt financial support can be crucial in helping individuals and their families during challenging times. In contrast, life insurance claims may take longer to process, and the payout might not be as immediately available, especially if the investigation requires extensive documentation and verification.

In summary, the claim process for accident insurance is often more straightforward and rapid due to the specific nature of the coverage and the incidents it protects against. This simplicity in the claim process is a significant advantage for policyholders, ensuring they can access the financial support they need in the event of an accident. Understanding these differences in claim procedures can help individuals make informed decisions when choosing between accident insurance and life insurance, depending on their specific needs and preferences.

Becoming a Life Insurance Agent: Getting Accredited

You may want to see also

Premiums: Accident insurance premiums are typically lower than life insurance premiums

When comparing accident insurance and life insurance, one of the key differences lies in their cost structures, particularly in terms of premiums. Accident insurance premiums are generally more affordable compared to life insurance premiums. This is primarily due to the nature of the coverage provided by these two types of insurance.

Accident insurance is designed to provide financial protection in the event of accidental injuries or illnesses. The primary focus is on covering medical expenses, rehabilitation costs, and sometimes even income replacement during the recovery period. Since the risk of accidents is relatively common and often covered by various health insurance plans, the insurance company can offer accident insurance at a lower premium. The coverage is usually straightforward, and the payouts are typically for a specific period, making it a more cost-effective option.

On the other hand, life insurance is a more comprehensive and complex product. It provides financial security to the beneficiaries in the event of the insured individual's death. Life insurance policies can be term-based or permanent, with various riders and add-ons available. The premiums for life insurance are higher because the insurance company needs to account for the long-term risk of the insured individual's death, which can occur at any time. Additionally, life insurance policies often include a cash value component, which grows over time and can be borrowed against or withdrawn, further increasing the overall cost.

The lower premiums of accident insurance make it an attractive option for individuals seeking additional financial protection without a significant financial burden. It is particularly useful for those who want to cover unexpected medical expenses or have a specific need for income replacement during a short-term disability. When choosing between the two, it is essential to consider one's specific needs, risk factors, and financial goals to determine the most suitable insurance coverage.

In summary, the difference in premiums between accident insurance and life insurance is a result of the varying levels of risk and coverage provided by each type of policy. Accident insurance offers more affordable protection for accidental injuries, while life insurance provides comprehensive coverage for a longer period, hence the higher costs. Understanding these premium differences can help individuals make informed decisions when selecting insurance products that align with their unique circumstances.

Understanding Insurance Cancellation: Qualifying Life Event?

You may want to see also

Benefits: Life insurance offers a lump sum or regular payments, whereas accident insurance provides medical coverage

When considering insurance options, it's essential to understand the distinct advantages of life insurance and accident insurance. Life insurance provides financial security for your loved ones in the event of your passing. It offers a lump sum payment or regular installments, ensuring that your family can maintain their standard of living and cover essential expenses during a challenging time. This financial support can help cover funeral costs, outstanding debts, mortgage payments, or even provide a financial cushion for daily living expenses.

On the other hand, accident insurance focuses on medical coverage. When you purchase accident insurance, you're primarily protecting yourself against the financial burden of medical expenses resulting from accidental injuries. This type of insurance typically covers emergency room visits, surgeries, hospital stays, and rehabilitation. It provides a safety net, ensuring that you or your loved ones don't face financial strain due to unforeseen accidents, which can be a significant relief during a traumatic experience.

The key benefit of life insurance is its ability to provide long-term financial stability and peace of mind. It allows you to plan for the future, knowing that your family will be taken care of even if you're no longer around. Life insurance policies often come with various riders and options to customize the coverage according to your specific needs.

Accident insurance, while not a replacement for comprehensive health insurance, offers a specialized form of coverage. It is particularly useful for individuals who engage in high-risk activities or sports, as it provides additional protection against the financial consequences of accidents. This insurance can be a valuable addition to your overall financial plan, especially if you want to ensure that medical expenses related to accidents are covered promptly.

In summary, life insurance and accident insurance serve different purposes. Life insurance offers financial security and peace of mind, ensuring your family's well-being in the long term. Accident insurance, on the other hand, provides medical coverage and financial protection specifically for accidental injuries, offering a safety net during challenging times. Understanding these differences can help you make informed decisions when choosing the right insurance coverage for your situation.

Stop AAA Life Insurance Mailers: Opt-Out Options Explained

You may want to see also

Eligibility: Life insurance is available to most people, whereas accident insurance may have stricter eligibility criteria

Life insurance is a financial product designed to provide financial protection and peace of mind to individuals and their families. It is a contract between an individual and an insurance company, where the insurer agrees to pay out a specified amount of money (the death benefit) to the policyholder's beneficiaries upon the insured individual's death. This type of insurance is widely accessible and available to a broad range of people, making it a popular choice for those seeking financial security for their loved ones. The primary purpose of life insurance is to ensure that the financial obligations and goals of the insured person are met, even in the event of their untimely passing.

On the other hand, accident insurance, also known as accidental death and dismemberment (AD&D) insurance, focuses on providing coverage specifically for accidents. This type of insurance is typically more specialized and may have more stringent eligibility requirements compared to life insurance. Accident insurance policies often require the insured individual to meet certain health and lifestyle criteria, such as being in good health, not engaging in high-risk activities, or having a specific age range. For instance, some policies may exclude coverage for pre-existing conditions, extreme sports enthusiasts, or individuals with certain medical histories, making it less accessible to a broader population.

The eligibility criteria for accident insurance can vary widely depending on the insurance provider and the specific policy. Some insurers may offer coverage to individuals with pre-existing conditions, while others may have strict exclusions. Additionally, factors like age, occupation, and lifestyle choices can influence eligibility. For example, a policy might exclude coverage for accidents resulting from high-risk occupations or extreme sports, ensuring that the insurance remains relevant and beneficial to the majority of the population.

In contrast, life insurance is generally more inclusive and less dependent on specific health conditions or lifestyle choices. It is designed to provide coverage to a wide range of individuals, ensuring that families and dependents receive financial support in the event of the insured person's death. Life insurance policies often consider factors like age, health, occupation, and lifestyle, but the primary focus is on providing financial protection to the policyholder's beneficiaries. This accessibility makes life insurance an essential tool for many individuals and families to secure their financial future.

Understanding the eligibility differences between accident insurance and life insurance is crucial for individuals seeking appropriate coverage. While life insurance offers broad accessibility, accident insurance may require more careful consideration of personal circumstances. It is advisable to review the specific eligibility criteria of different insurance providers to make an informed decision and ensure that the chosen insurance plan aligns with one's needs and health status.

Understanding Supplemental AD&D Life Insurance: A Comprehensive Guide

You may want to see also

Frequently asked questions

Accident insurance provides coverage for medical expenses and potential income loss due to accidental injuries, while life insurance offers financial protection to beneficiaries in the event of the insured person's death.

These policies usually cover accidents that occur during the policy term, providing benefits for medical treatments, surgeries, and sometimes rehabilitation. The coverage amount can vary based on the severity of the injury and the policy's terms.

Life insurance ensures financial security for the insured's family or designated beneficiaries. It provides a lump-sum payment or regular income to cover expenses like mortgage payments, education costs, or daily living expenses, ensuring the family's financial stability after the insured's passing.

Yes, many insurance providers offer combined policies that include both accident and life insurance benefits. These policies can provide comprehensive coverage, offering financial protection against accidents and the peace of mind of knowing your loved ones are financially secure in the event of your passing.