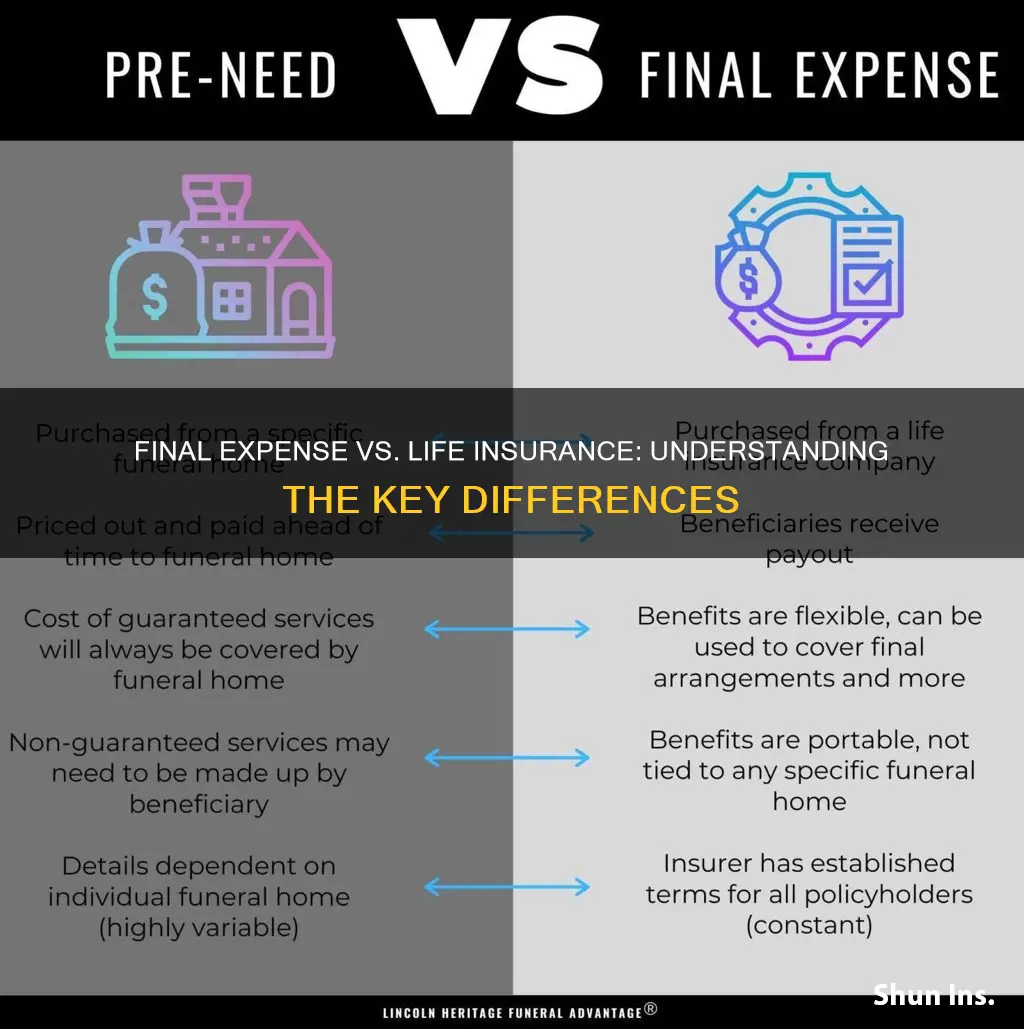

Final expense insurance and life insurance are two distinct types of coverage with different purposes. Life insurance provides financial protection to beneficiaries in the event of the insured's death, offering a lump sum payment or regular income to cover expenses like funeral costs, outstanding debts, and living expenses. On the other hand, final expense insurance is specifically designed to cover the costs associated with final arrangements, such as funeral and burial expenses, and is tailored for older individuals who may have limited options for traditional life insurance due to age or health factors. This type of insurance ensures that the insured's loved ones are financially supported during a difficult time without the burden of additional financial stress.

What You'll Learn

- Coverage: Final expense insurance covers specific, predictable costs, while life insurance provides a lump sum benefit for various purposes

- Duration: Final expense policies are typically term, lasting until a specific age, whereas life insurance can be permanent

- Payout: Final expense pays for funeral expenses, while life insurance can be used for any purpose, including debt repayment and legacy

- Cost: Premiums for final expense are generally lower due to predictable costs, compared to life insurance, which varies based on health

- Flexibility: Life insurance offers more flexibility in benefit selection, whereas final expense is more standardized, focusing on funeral needs

Coverage: Final expense insurance covers specific, predictable costs, while life insurance provides a lump sum benefit for various purposes

When it comes to insurance, understanding the differences between various types of coverage is essential to making informed decisions about your financial security. Two common types of insurance that often cause confusion are final expense insurance and life insurance. While both serve important purposes, they have distinct features and benefits that cater to different needs.

Final expense insurance, as the name suggests, is designed to cover the specific and often predictable costs associated with final arrangements. These expenses typically include funeral costs, burial or cremation services, and any outstanding debts or final wishes that need to be honored. The primary purpose of this insurance is to provide peace of mind, ensuring that your loved ones are not burdened with the financial responsibility of arranging your final affairs. It is a way to secure your wishes and provide financial relief during a difficult time.

On the other hand, life insurance offers a more comprehensive benefit. It provides a lump sum payment, known as a death benefit, upon the insured individual's passing. This benefit can be utilized for various purposes, such as paying off debts, covering living expenses for dependents, funding education, or even starting a business. Life insurance is a versatile financial tool that can provide financial security and support for the beneficiaries, ensuring that their financial goals and obligations are met even after the insured person's passing.

The key difference in coverage lies in the specific and limited scope of final expense insurance. It focuses on a particular set of expenses, ensuring that these predictable costs are covered. In contrast, life insurance offers a broader range of benefits, providing financial support for a wide array of purposes. While final expense insurance is crucial for covering immediate and specific costs, life insurance provides a safety net for the long-term financial well-being of the insured and their loved ones.

Understanding these differences is vital for individuals to choose the right insurance coverage based on their unique needs and circumstances. Both types of insurance play significant roles in financial planning, offering protection and peace of mind in different ways.

Whole Life Insurance: Halal or Haram?

You may want to see also

Duration: Final expense policies are typically term, lasting until a specific age, whereas life insurance can be permanent

The primary distinction between final expense insurance and traditional life insurance lies in their duration and coverage. Final expense policies are designed to provide financial protection for specific, often anticipated, expenses related to end-of-life matters. These expenses typically include funeral costs, burial or cremation fees, and any outstanding debts or final wishes that a policyholder may have. As the name suggests, these policies are intended to cover the final costs, hence the term "final expense."

In contrast, life insurance is a more comprehensive financial tool that offers coverage for a broader range of purposes. It is typically categorized into two main types: term life insurance and permanent life insurance. Term life insurance provides coverage for a specified period, often 10, 20, or 30 years, and it pays out a death benefit if the insured individual passes away during that term. This type of insurance is ideal for those who want coverage for a specific period, such as when they have young children or a mortgage to pay off.

On the other hand, permanent life insurance, also known as whole life or universal life, offers coverage for the entire lifetime of the insured individual. This type of policy builds cash value over time, which can be borrowed against or withdrawn, providing financial flexibility. Permanent life insurance is suitable for those seeking long-term financial security and the potential for tax-advantaged savings.

The key difference in duration is that final expense policies are generally term policies, meaning they are in force for a specific period until a predetermined age, often 90 or 100. After this age, the policy may lapse, and further coverage may not be available. In contrast, life insurance, especially permanent policies, provides coverage for life, ensuring financial protection for the long term. This longevity of life insurance allows individuals to build a financial safety net that can adapt to changing circumstances over time.

Understanding the duration of these policies is crucial for individuals to make informed decisions about their insurance needs. While final expense policies are tailored for specific end-of-life expenses, life insurance offers more comprehensive coverage, providing financial security for various life events and long-term goals.

Heart Disease and Afib: Impact on Life Insurance

You may want to see also

Payout: Final expense pays for funeral expenses, while life insurance can be used for any purpose, including debt repayment and legacy

When it comes to insurance, understanding the differences between various types can be crucial in making the right choice for your needs. Two common types of insurance that often cause confusion are final expense insurance and life insurance. While both serve the purpose of providing financial security, they have distinct features and uses.

Final expense insurance, as the name suggests, is designed to cover the costs associated with final arrangements and funeral expenses. This type of policy is tailored to provide a specific benefit, which is typically the coverage of funeral and burial costs. These costs can be substantial and often include expenses like casket, burial plot, transportation, and other related services. The payout from a final expense policy is straightforward and directly addresses the immediate financial burden that families may face during a difficult time.

On the other hand, life insurance offers a more flexible approach to financial security. It provides a death benefit that can be used for various purposes, making it a versatile tool for individuals and their families. Life insurance policies can be customized to suit specific needs, and the payout can be utilized for a wide range of expenses, including debt repayment, mortgage payments, education costs, or even as a legacy for beneficiaries. This flexibility allows policyholders to ensure that their loved ones are financially protected and that their wishes are honored.

The key difference lies in the purpose and flexibility of the payout. Final expense insurance is specifically tailored to cover funeral and burial costs, providing immediate relief to the family. In contrast, life insurance offers a broader range of options, allowing the policyholder to decide how the death benefit is utilized, whether it's for immediate family needs or long-term financial goals. This distinction is essential for individuals to consider when evaluating their insurance options and ensuring that their coverage aligns with their specific requirements and preferences.

In summary, while both final expense and life insurance provide financial security, the former is dedicated to covering funeral expenses, offering a direct and immediate benefit. Life insurance, however, provides a more comprehensive approach, allowing policyholders to use the death benefit for various purposes, ensuring a more personalized and adaptable financial safety net. Understanding these differences can help individuals make informed decisions when choosing the right insurance coverage for themselves and their loved ones.

Aviva Life Insurance: What You Need to Know

You may want to see also

Cost: Premiums for final expense are generally lower due to predictable costs, compared to life insurance, which varies based on health

When considering the financial aspects of insurance, understanding the cost structure is crucial. Final expense insurance and life insurance are two distinct types of coverage, each with its own pricing dynamics. One of the key differences lies in the cost of premiums.

Final expense insurance, as the name suggests, is designed to cover the final costs associated with an individual's passing, such as funeral expenses, burial costs, and outstanding debts. The beauty of this type of insurance is that the expenses are relatively predictable and consistent. Since the primary purpose is to cover specific, known costs, the insurance company can offer more competitive rates. Premiums for final expense insurance are generally lower because the risk and uncertainty associated with the payout are reduced. This predictability allows insurers to set prices that are more affordable for policyholders, especially those with pre-determined final expenses.

On the other hand, life insurance operates on a different cost model. It provides financial protection to the beneficiaries in the event of the insured individual's death. The cost of life insurance premiums can vary significantly, primarily due to health factors. Insurers consider the health and medical history of the applicant when determining the premium amount. Factors such as age, smoking status, medical conditions, and overall health can influence the price. As a result, life insurance premiums are often higher compared to final expense insurance, especially for individuals with pre-existing health conditions or those who are older. The variability in health-related factors makes it challenging to predict the exact cost, leading to a more dynamic pricing structure.

In summary, the cost aspect is a critical differentiator between final expense and life insurance. Final expense insurance offers more affordable premiums due to the predictable nature of the covered expenses, making it an attractive option for those seeking cost-effective coverage for specific financial needs. In contrast, life insurance premiums are influenced by health-related factors, resulting in a more varied pricing range. Understanding these cost differences is essential for individuals to make informed decisions when choosing the right insurance coverage for their unique circumstances.

Does Life Insurance Blood Test Check for Marijuana?

You may want to see also

Flexibility: Life insurance offers more flexibility in benefit selection, whereas final expense is more standardized, focusing on funeral needs

When it comes to insurance, understanding the differences between various types of policies is crucial for making informed decisions. Two common types of insurance that often cause confusion are life insurance and final expense insurance. While both serve important purposes, they differ significantly in their structure, benefits, and overall flexibility.

Life insurance is a broad term that encompasses various types of policies, each offering different levels of coverage and flexibility. It provides financial protection to the policyholder's beneficiaries in the event of their death. One of the key advantages of life insurance is the flexibility it offers in terms of benefit selection. Policyholders can choose from a wide range of coverage options, including term life, whole life, and universal life. Term life insurance, for instance, provides coverage for a specified period, allowing individuals to tailor the duration of protection to their specific needs. Whole life insurance offers lifelong coverage with a guaranteed death benefit, while universal life insurance provides flexibility in premium payments and death benefit amounts. This flexibility ensures that individuals can select a policy that aligns with their financial goals, risk tolerance, and long-term plans.

On the other hand, final expense insurance, also known as burial insurance, is designed specifically to cover the costs associated with funeral and burial expenses. This type of insurance is more standardized and often provides a set amount of coverage for these specific needs. Final expense policies typically have a fixed premium and a guaranteed death benefit, which means the coverage remains the same throughout the policy's duration. While this standardization ensures that the insurance is straightforward and easy to understand, it also limits the flexibility that policyholders have in customizing the policy to their unique circumstances.

The key difference in flexibility lies in the way these policies are structured. Life insurance policies are designed to provide a comprehensive financial safety net, allowing individuals to choose the level of coverage and benefits that best suit their needs. This flexibility is particularly important for those who want to ensure their loved ones are financially protected in various life stages and situations. In contrast, final expense insurance focuses solely on funeral and burial costs, providing a fixed amount of coverage that may not be adjustable. This standardization can be beneficial for individuals who want a simple and predictable insurance solution for their final expenses.

In summary, life insurance offers a wide range of options and flexibility in benefit selection, allowing individuals to customize their coverage based on their unique circumstances. It provides a comprehensive financial safety net that can adapt to changing needs over time. In contrast, final expense insurance is more standardized, focusing solely on funeral and burial expenses, which may not offer the same level of customization but provides a straightforward and predictable solution for specific needs. Understanding these differences is essential for individuals to choose the right insurance policy that aligns with their financial goals and requirements.

Reporting Life Insurance: Tax Implications and Guidelines

You may want to see also

Frequently asked questions

The main distinction lies in their purpose and coverage. Final expense insurance, also known as burial insurance, is designed to cover the costs associated with final arrangements, such as funeral expenses, burial or cremation, and any outstanding debts. It provides a one-time payout to the policyholder's beneficiaries or estate. On the other hand, life insurance offers financial protection to the policyholder's loved ones by providing a death benefit upon the insured individual's passing. This benefit can be used for various purposes, including mortgage payments, children's education, or family expenses.

Premiums for final expense insurance are typically fixed and guaranteed, meaning they remain the same over the life of the policy. This predictability is attractive to those seeking long-term financial planning. In contrast, life insurance premiums can vary depending on factors like the insured's age, health, and the amount of coverage chosen. Term life insurance, for instance, may have lower premiums for a specific period but can increase over time.

Yes, many final expense insurance policies offer the option to convert them into a traditional life insurance policy. This conversion allows policyholders to increase their coverage amount or change the policy's terms as their needs evolve. It provides flexibility, ensuring that the insurance remains relevant and suitable for the policyholder's changing circumstances.

Life insurance policies, including term and permanent life insurance, offer tax-deferred growth of cash value (in the case of permanent policies). This means the policy's cash value can accumulate tax-free until it is withdrawn. Final expense insurance, being a form of whole life insurance, also provides tax-advantaged growth. However, the primary tax benefit of life insurance is the death benefit received by beneficiaries, which is generally tax-free.