Life insurance is a crucial financial tool that provides security and peace of mind for individuals and their loved ones. While the concept of life insurance can seem complex, there are straightforward methods to make the process more accessible and understandable. This paragraph will explore an easy approach to life insurance, highlighting the benefits of simplified policies and how they can offer essential coverage without the usual complications. By breaking down the key aspects, we'll demonstrate how anyone can navigate the world of life insurance with confidence and make informed decisions about their future.

What You'll Learn

- Understanding Basics: Learn the fundamentals of life insurance, coverage options, and benefits

- Term vs. Permanent: Compare term life and permanent life insurance to choose the right fit

- Affordability: Explore cost-effective methods to obtain life insurance without breaking the bank

- Online Comparison: Utilize online tools to compare policies and find the best deal

- Consult an Advisor: Seek professional guidance to navigate the complexities of life insurance

Understanding Basics: Learn the fundamentals of life insurance, coverage options, and benefits

Life insurance is a financial tool that provides a safety net for individuals and their loved ones. It is a contract between an individual (the policyholder) and an insurance company, where the insurer promises to pay a designated beneficiary a sum of money upon the policyholder's death. This fundamental concept offers financial security and peace of mind, ensuring that your family's financial obligations are met even if the primary breadwinner is no longer around.

The primary purpose of life insurance is to provide financial protection and support to your loved ones during challenging times. It can help cover various expenses, such as mortgage payments, children's education, funeral costs, and daily living expenses. By having a life insurance policy, you can ensure that your family's financial stability is maintained, even in the event of your untimely passing.

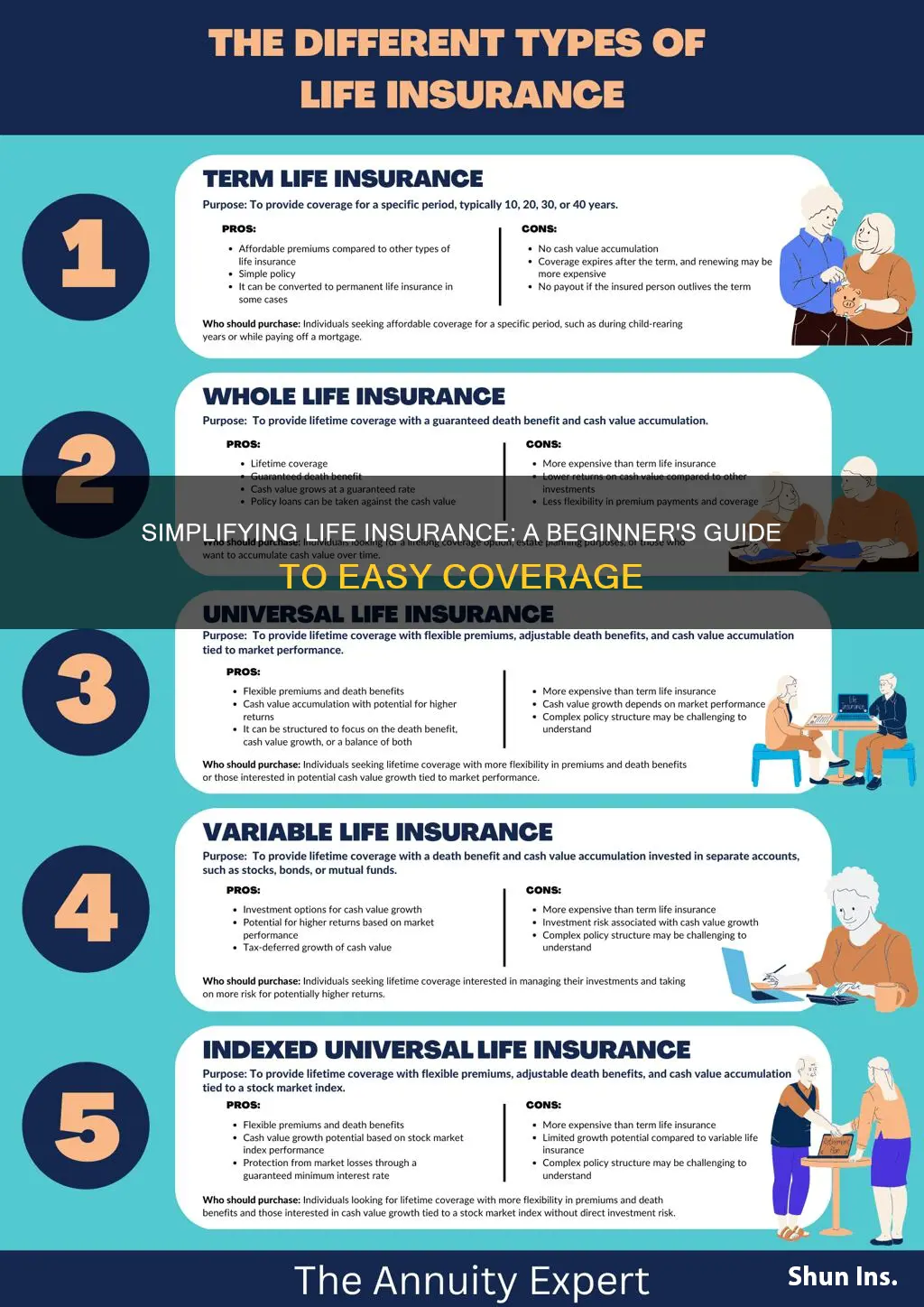

There are several types of life insurance policies available, each offering different coverage options and benefits. The most common types include Term Life Insurance, Whole Life Insurance, and Universal Life Insurance. Term life insurance provides coverage for a specified period, such as 10, 20, or 30 years, and is often chosen for its affordability and simplicity. Whole life insurance offers lifelong coverage and includes an investment component, allowing the policy to accumulate cash value over time. Universal life insurance provides flexible coverage and allows policyholders to adjust their premiums and death benefits as needed.

When considering life insurance, it's essential to understand the concept of coverage. The coverage amount, or death benefit, is the sum the insurance company will pay to your beneficiaries upon your death. This amount should ideally cover your family's financial needs and obligations. Factors such as your age, health, lifestyle, and the number of dependents you have will influence the cost and coverage options available to you.

Additionally, life insurance policies often come with various benefits and riders that can enhance your coverage. For instance, some policies offer an accelerated death benefit, allowing you to access a portion of your death benefit if you are diagnosed with a terminal illness. Other riders might include waiver of premium, which ensures your premiums are waived if you become disabled, or a critical illness rider, providing additional benefits if you are diagnosed with a critical illness. Understanding these additional features can help you make informed decisions and tailor your policy to your specific needs.

Life Insurance Contracts: Signature Requirements and Beneficiaries

You may want to see also

Term vs. Permanent: Compare term life and permanent life insurance to choose the right fit

When it comes to life insurance, understanding the different types of coverage can be crucial in making the right choice for your needs. The two primary categories are term life and permanent life insurance, each with its own advantages and considerations. Here's a breakdown to help you decide which one aligns better with your goals.

Term Life Insurance:

Term life insurance provides coverage for a specific period, typically 10, 20, or 30 years. It is a straightforward and often more affordable option, making it an excellent choice for those seeking temporary protection. During the term, the policy offers a death benefit if the insured individual passes away. This type of insurance is ideal for individuals who want coverage to secure their family's financial future during a particular life stage, such as when they have young children or a mortgage. The beauty of term life is its simplicity; it provides peace of mind without the complexity of permanent policies.

Permanent Life Insurance:

In contrast, permanent life insurance offers lifelong coverage, providing a death benefit for the entire duration of the policy. This type of insurance is more complex and typically comes with higher premiums. Permanent life insurance includes an investment component, allowing the policyholder to build cash value over time. This feature can be advantageous for those seeking long-term financial planning and investment opportunities. With permanent insurance, you have the flexibility to borrow against the cash value or withdraw funds, providing financial security and potential tax advantages.

Choosing Between Term and Permanent:

The decision between term and permanent life insurance depends on your specific circumstances and financial goals. If you require coverage for a limited time to support your family during a critical period, term life is the way to go. It offers a cost-effective solution without the long-term commitment. On the other hand, permanent life insurance is suitable for those seeking a lifelong financial safety net, especially if you want to build wealth and have the means to afford higher premiums.

In summary, term life insurance is a simple, short-term solution, while permanent life insurance provides long-term coverage with additional investment benefits. Consider your financial situation, the duration of coverage needed, and your long-term financial objectives when making your decision. Consulting with a financial advisor can also provide valuable insights tailored to your unique circumstances.

IndiaFirst Life Insurance: Check Your Fund Value

You may want to see also

Affordability: Explore cost-effective methods to obtain life insurance without breaking the bank

Life insurance is a crucial financial tool that provides peace of mind and financial security for your loved ones. However, it can often be associated with high costs, leaving many individuals hesitant to explore their options. The good news is that there are several cost-effective methods to obtain life insurance without compromising on coverage. Here's a guide to help you navigate the process and find affordable life insurance:

- Term Life Insurance: One of the most straightforward and affordable ways to get life insurance is by opting for term life insurance. This type of policy provides coverage for a specific period, typically 10, 20, or 30 years. During this term, the policy offers a death benefit if the insured individual passes away. The beauty of term life insurance is its simplicity and lower cost compared to permanent life insurance. It is ideal for those who want coverage for a defined period, such as until a child's education is funded or a mortgage is paid off. When the term ends, you can choose to renew the policy or explore other options, ensuring that you only pay for the coverage you need.

- Shop Around and Compare Quotes: Affordability is key when it comes to life insurance. The best way to ensure you get the most competitive rates is by shopping around and comparing quotes from multiple insurance providers. Start by gathering information about your health, age, and lifestyle, as these factors influence premium costs. Then, request quotes from various insurance companies, including both traditional and online insurers. Compare the coverage options, premiums, and terms offered. Many online platforms and insurance brokers allow you to compare policies side by side, making it easier to identify the most cost-effective options.

- Consider Your Health and Lifestyle: Insurance companies often use health and lifestyle factors to determine premium rates. A healthy lifestyle can lead to lower insurance costs. If you are a non-smoker, maintain a healthy weight, and engage in regular physical activity, you may qualify for preferred rates. Additionally, avoiding risky activities like skydiving or extreme sports can also result in more affordable premiums. It's essential to be transparent about your health history during the application process, as misrepresenting information can lead to denied claims.

- Utilize Online Resources and Brokers: The digital age has made it easier to access life insurance information and services. Online platforms and insurance brokers can provide valuable assistance in finding affordable options. These resources often allow you to compare policies, calculate premiums, and even apply for insurance online. They may also offer guidance on choosing the right coverage and understanding the fine print of different policies. Some online insurers specialize in providing cost-effective term life insurance, making it convenient to explore various options from the comfort of your home.

- Review and Adjust Regularly: Life insurance needs can change over time, and so should your policy. Regularly reviewing your life insurance coverage is essential to ensure it remains affordable and relevant. As you age, your health may change, and you might have different financial obligations. Adjusting your policy accordingly can help you avoid overpaying for unnecessary coverage. Additionally, life events like getting married, having children, or purchasing a home may prompt you to increase your coverage, but it's essential to do so within your budget.

By exploring these cost-effective methods, you can obtain the necessary life insurance coverage without straining your finances. Remember, the goal is to find a balance between coverage and affordability, ensuring that your loved ones are protected while keeping your insurance expenses manageable.

Marijuana Use and Life Insurance: What's the Impact?

You may want to see also

Online Comparison: Utilize online tools to compare policies and find the best deal

In today's digital age, comparing life insurance policies online has become an efficient and convenient way to find the best coverage for your needs. With numerous insurance providers offering a wide range of plans, utilizing online comparison tools can be a game-changer for those seeking an easy and effective method to secure their loved ones' financial future. This approach allows you to gather and analyze various options without the hassle of visiting multiple offices or dealing with extensive paperwork.

Online comparison platforms provide a comprehensive overview of different life insurance policies, presenting key features, benefits, and costs in a structured manner. These tools often allow you to input specific criteria, such as age, health status, desired coverage amount, and preferred payment options. By doing so, the comparison engine generates tailored results, ensuring you only see relevant policies that match your requirements. This personalized approach saves time and effort, as you can quickly narrow down the options and focus on the most suitable ones.

When using online comparison sites, you gain access to a vast array of insurance providers and their offerings. These platforms often aggregate policies from various companies, giving you a 360-degree view of the market. You can compare premiums, coverage terms, rider options, and other essential details side by side. This comprehensive comparison empowers you to make an informed decision, ensuring you choose a policy that aligns with your financial goals and provides adequate protection.

Moreover, online comparison tools often include customer reviews and ratings, offering valuable insights into the experiences of other policyholders. Reading these reviews can help you gauge the reliability and customer satisfaction associated with different insurance providers. This additional layer of information contributes to a more well-rounded decision-making process, allowing you to select a company known for its excellent service and financial stability.

In summary, leveraging online comparison tools is an efficient and user-friendly approach to finding the right life insurance policy. It streamlines the process, providing a comprehensive overview of available options, and empowers you to make a confident choice. With the ability to compare policies from multiple providers, you can secure the best deal that meets your specific needs and ensures the financial security of your loved ones.

Maximizing Life Insurance: Strategies to Boost Cash Surrender Value

You may want to see also

Consult an Advisor: Seek professional guidance to navigate the complexities of life insurance

When it comes to life insurance, seeking professional guidance can be an invaluable step towards making informed decisions and finding the right coverage for your needs. While online resources and self-education can provide a good foundation, consulting an advisor is a strategic move that can simplify the process and ensure you make the best choices. Here's why considering this approach is beneficial:

Comprehensive Understanding: Life insurance policies can be intricate and varied. An advisor specializes in this field and can offer a comprehensive understanding of the various types of policies available, such as term life, whole life, and universal life insurance. They will explain the differences, benefits, and potential drawbacks of each, helping you grasp the nuances that might be challenging to comprehend through self-study.

Personalized Advice: Every individual has unique financial goals, health conditions, and life circumstances. A professional advisor takes the time to assess your personal situation, including your age, health, income, and family status. This personalized approach ensures that the recommended insurance plans are tailored to your specific needs, providing adequate coverage for your loved ones while also considering your financial capabilities.

Navigating Complexities: The process of choosing and purchasing life insurance can be complex, with various factors to consider, including premium costs, policy terms, and rider options. An advisor will guide you through these complexities, ensuring you understand the implications of different choices. They can also help you avoid potential pitfalls and make decisions that align with your long-term financial goals.

Long-Term Financial Planning: Life insurance is not just about providing financial security for your family; it's also a crucial component of long-term financial planning. Advisors can help you integrate life insurance into your overall financial strategy, considering factors like retirement planning, estate planning, and tax efficiency. This holistic approach ensures that your insurance decisions contribute to your financial well-being in the long run.

Peace of Mind: Perhaps the most significant benefit of consulting an advisor is the peace of mind it provides. Understanding your life insurance options and making informed decisions can reduce stress and anxiety. Knowing that you have a professional guiding you through the process can be reassuring, especially when dealing with significant financial commitments.

In summary, while exploring online resources is a good starting point, consulting a life insurance advisor is a strategic move that can simplify the process, provide personalized advice, and ensure you make the best decisions for your loved ones and your financial future. It is an investment in your peace of mind and long-term financial security.

Understanding Family Unit Life Insurance: A Comprehensive Guide

You may want to see also

Frequently asked questions

The easiest way to obtain life insurance is by comparing different policies and providers online. Many insurance companies offer straightforward online applications, allowing you to quickly compare quotes, customize your policy, and purchase coverage without the need for in-person meetings. This method is convenient, especially for those who prefer a quick and efficient process.

Yes, many life insurance companies now offer no-exam or simplified life insurance policies. These policies are designed for individuals who may have health concerns or are considered high-risk by traditional insurance standards. Simplified applications focus on basic health questions and may not require a medical exam, making the process faster and more accessible.

Choosing the right life insurance plan involves considering several factors. Start by evaluating your financial goals and the amount of coverage you need. Term life insurance is a popular choice for temporary coverage, while permanent life insurance provides long-term protection. Research and compare different types of policies, such as whole life, universal life, and variable life insurance, to find the best fit for your requirements and budget.