The guarantee issue on term life insurance is a crucial aspect to consider when purchasing this type of insurance policy. This feature ensures that the insurance company will provide coverage, regardless of the insured's health status or any changes in their medical history, as long as the initial premium is paid. It guarantees that the policyholder will receive the agreed-upon death benefit if they pass away during the term of the policy, providing financial security for beneficiaries. This provision is particularly attractive to those with pre-existing conditions or those who may face higher insurance rates due to health risks, as it offers a level of certainty and protection that can be invaluable for individuals and their families.

What You'll Learn

- Definition: Guarantee Issue Term Life is a policy with no medical exam, offering coverage for a set period

- No Medical Exam: Applicants are approved regardless of health, ensuring coverage without a health assessment

- Fixed Premiums: Premiums remain constant throughout the term, providing predictable costs for the insured

- Death Benefit: The policy guarantees a payout to beneficiaries if the insured dies during the term

- Renewal Options: Some policies offer the ability to renew at the end of the term without a new medical exam

Definition: Guarantee Issue Term Life is a policy with no medical exam, offering coverage for a set period

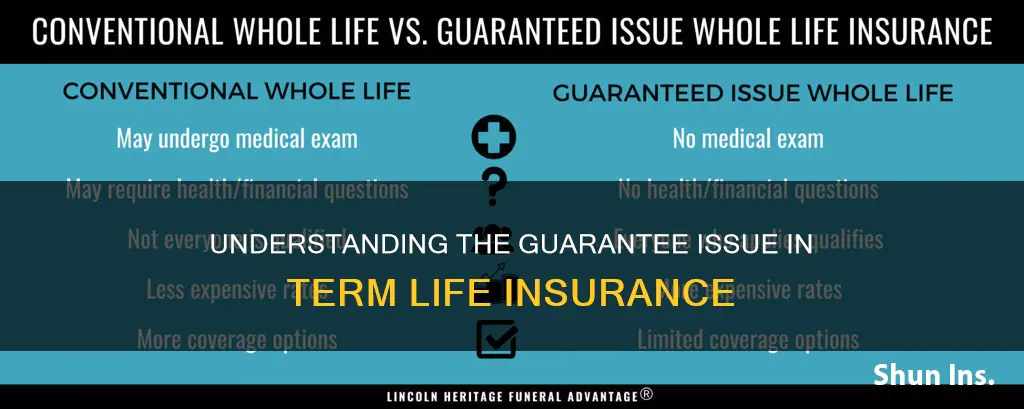

Guarantee Issue Term Life Insurance is a type of term life insurance policy that provides coverage without the need for a medical examination. This means that, regardless of an individual's health status or medical history, they can be approved for coverage with no health questions or medical tests required. The term "guarantee issue" refers to the insurer's commitment to provide coverage without any conditions or exceptions, making it an attractive option for those who may have health issues or are considered high-risk by traditional insurance companies.

The primary advantage of Guarantee Issue Term Life is its simplicity and accessibility. Since there is no medical exam, the application process is often quicker and less invasive. This type of policy is typically designed for individuals who want coverage for a specific period, such as 10, 15, or 20 years, and it is especially beneficial for those who may not qualify for standard term life insurance due to health concerns. By eliminating the need for a medical exam, the insurer takes on a higher risk, which is why the premiums for Guarantee Issue Term Life can be more expensive compared to standard term life insurance.

When purchasing Guarantee Issue Term Life, policyholders can expect a streamlined process. The insurer will still review the applicant's information, including age, gender, and any relevant health details, but the absence of a medical exam simplifies the underwriting process. This type of policy is ideal for individuals who want immediate coverage without the hassle of a lengthy medical examination, especially those with pre-existing health conditions or chronic illnesses that might typically disqualify them from standard life insurance.

It's important to note that while Guarantee Issue Term Life offers coverage without a medical exam, the policy terms and conditions may vary. The coverage amount, duration, and premiums will depend on the insurer's guidelines and the applicant's specific circumstances. Policyholders should carefully review the policy details to understand the coverage provided and any limitations or exclusions.

In summary, Guarantee Issue Term Life Insurance is a valuable option for individuals seeking term life coverage without the typical medical exam requirements. It provides a convenient and accessible way to obtain insurance, especially for those with health concerns, by offering a guaranteed acceptance process. However, understanding the policy's terms and potential limitations is essential to ensure that the coverage meets one's specific needs.

Life Insurance Awareness: September's Financial Focus

You may want to see also

No Medical Exam: Applicants are approved regardless of health, ensuring coverage without a health assessment

The 'No Medical Exam' guarantee issue on term life insurance is a feature that provides an easy and convenient way to secure life insurance coverage without the hassle and potential drawbacks of a medical examination. This option is particularly appealing to those who may have health concerns or simply prefer a more straightforward application process. Here's a detailed breakdown of how it works and its benefits:

When you opt for the 'No Medical Exam' option, the insurance company bypasses the traditional medical assessment process. Typically, standard term life insurance policies require applicants to undergo a medical exam, which includes a physical check-up and blood tests, to evaluate their health and assess the risk of insuring them. However, with this guarantee issue, you can skip this step and still receive coverage. This is especially advantageous for individuals with pre-existing health conditions or those who are generally considered high-risk by traditional insurance standards.

The approval process for 'No Medical Exam' term life insurance is straightforward and quick. Applicants simply need to provide basic health information, such as current medications, recent medical procedures, and any chronic conditions. This information is used to determine the appropriate coverage amount and premium, ensuring that the insurance company can accurately assess the risk associated with insuring the applicant. The absence of a medical exam means that individuals with health issues or those who are unable to undergo a physical examination due to various reasons can still access life insurance coverage.

One of the key advantages of this guarantee issue is the speed and convenience it offers. Without the need for a medical exam, the application process is often faster, allowing applicants to receive coverage more quickly. This is particularly beneficial for those seeking immediate protection or those in urgent need of life insurance due to personal or family circumstances. Moreover, it eliminates the potential embarrassment or discomfort associated with a medical examination, making the process more accessible and less stressful for applicants.

It's important to note that while 'No Medical Exam' term life insurance provides an efficient way to obtain coverage, it may come with certain limitations. The insurance company might offer lower coverage amounts compared to traditional policies, and premiums could be higher due to the increased risk associated with bypassing a medical assessment. However, for individuals who prioritize convenience and speed over maximum coverage, this option can be an excellent solution.

In summary, the 'No Medical Exam' guarantee issue on term life insurance is a convenient and efficient way to secure coverage without the traditional medical assessment. It caters to a wide range of applicants, especially those with health concerns or time constraints, ensuring that life insurance is accessible to more people. Understanding this feature can help individuals make informed decisions about their insurance needs and find the right coverage for their specific circumstances.

Bharti AXA Life Insurance: Your Trusted Partner

You may want to see also

Fixed Premiums: Premiums remain constant throughout the term, providing predictable costs for the insured

The concept of 'Guarantee Issue' in term life insurance is a crucial aspect to understand when considering life insurance policies. It refers to the insurance company's commitment to provide coverage without the need for additional medical exams or health questions, especially for a specific period, known as the 'term'. This term can vary, typically ranging from 10 to 30 years, and during this period, the insurance company guarantees acceptance of the policy, provided the insured individual meets the initial eligibility criteria.

One of the most appealing features of guarantee issue term life insurance is the predictability it offers. When you purchase a policy with this guarantee, you can be assured that your premiums will remain fixed and consistent throughout the entire term. This is in contrast to other types of life insurance, where premiums might increase or decrease based on various factors, including changes in the insured's health or age.

With fixed premiums, the insured individual can plan their finances more effectively. Knowing exactly how much they will pay annually, semi-annually, or monthly allows for better budgeting and financial management. This predictability is especially beneficial for long-term financial planning, such as saving for a child's education or planning for retirement.

The guarantee issue also ensures that the insured person's acceptance into the policy is secure, provided they meet the initial requirements. This is particularly advantageous for individuals who may have health issues or a family history of certain medical conditions, as they can still obtain coverage without the fear of being declined or having to undergo a medical examination.

In summary, the guarantee issue on term life insurance provides a sense of security and predictability. It ensures that the insured individual can secure a policy with fixed premiums, making it an excellent choice for those seeking long-term financial protection without the worry of premium fluctuations or potential policy rejection. This feature is especially valuable for individuals who want a straightforward and reliable life insurance solution.

Best Life Insurance in Sri Lanka: Top Choices Revealed

You may want to see also

Death Benefit: The policy guarantees a payout to beneficiaries if the insured dies during the term

The 'guarantee issue' on term life insurance refers to a specific feature that provides a level of security and certainty for policyholders. When you purchase a term life insurance policy with a guarantee issue, you are essentially locking in a specific death benefit amount for the duration of the policy term. This means that if the insured individual (the person whose life is insured) passes away during the term of the policy, the insurance company is legally obligated to pay out the predetermined death benefit to the designated beneficiaries.

The death benefit is a crucial aspect of term life insurance, as it ensures financial security for the loved ones left behind. It provides a lump sum payment or an income stream to cover various expenses, such as funeral costs, outstanding debts, mortgage payments, or the daily living expenses of the beneficiaries. Knowing that there is a guaranteed payout in the event of the insured's death can offer peace of mind and financial protection for the policyholder and their family.

With a guarantee issue, the insurance company takes on the risk of paying out the death benefit, which is typically higher than the standard rates for term life insurance. This is because the policy is designed to provide a fixed benefit during a specific period, and the insurance provider calculates the premiums accordingly. The guarantee ensures that the policyholder and their beneficiaries are protected, even if the insured's health or age changes during the term.

When considering term life insurance with a guarantee issue, it's essential to understand the terms and conditions of the policy. These may include the specific death benefit amount, the duration of the term, and any exclusions or limitations. Policyholders should carefully review the policy documents to ensure they comprehend the coverage and any potential restrictions. Additionally, comparing different insurance providers and their offerings can help individuals find the best fit for their needs and ensure they receive the guaranteed benefits they require.

In summary, the guarantee issue on term life insurance provides a secure and predictable death benefit, ensuring that beneficiaries receive the intended financial support in the event of the insured's passing. This feature offers peace of mind and financial protection, making it an attractive option for those seeking reliable coverage during a specific period.

Life Insurance: A Safety Net for Disability Income Loss

You may want to see also

Renewal Options: Some policies offer the ability to renew at the end of the term without a new medical exam

When considering term life insurance, it's important to understand the concept of guarantee issue and how it relates to renewal options. Guarantee issue is a term used to describe the insurance company's commitment to provide coverage at a specified rate, regardless of any changes in the insured's health or lifestyle during the initial term. This is particularly beneficial for individuals who may have health concerns or who want to ensure they have coverage without the risk of being declined or having to undergo a medical exam.

Renewal options are a feature offered by some term life insurance policies, providing policyholders with the convenience and security of extending their coverage without the typical medical underwriting process. This means that at the end of the initial term, the policyholder can renew their insurance without having to undergo a new medical exam, which could be a significant advantage for those who have developed health issues or want to avoid the potential stress of a medical assessment. The renewal process often involves a simple application and a review of the insured's health history, allowing for a seamless continuation of coverage.

The key advantage of this renewal option is the peace of mind it provides. Policyholders can ensure their loved ones are protected without the worry of potential health changes affecting their ability to renew. This is especially valuable for those with pre-existing conditions or those who have experienced significant life changes, such as a major surgery or a chronic illness, which might typically lead to higher insurance premiums or even denial of coverage.

However, it's essential to review the terms and conditions of the policy carefully. Some insurance companies may have specific criteria or limitations for renewal, such as age restrictions or a maximum age limit for the insured. Additionally, the renewal process might require the payment of a higher premium, reflecting the increased risk associated with the extended coverage. Understanding these details is crucial to making an informed decision about the policy's renewal.

In summary, the guarantee issue on term life insurance, combined with renewal options, offers a valuable tool for individuals seeking long-term protection. It provides a safety net for those who want to ensure their loved ones are financially secure, even if their health status changes over time. By carefully considering the policy's terms and the insurance company's renewal criteria, individuals can make an informed choice that best suits their needs and provides the necessary coverage.

Life Insurance: Job Loss and Your Policy Explained

You may want to see also

Frequently asked questions

The guarantee issue is a feature of term life insurance that ensures the insurance company will provide coverage as promised, regardless of any changes in the insured's health or medical history. When you purchase a term life insurance policy with a guarantee issue, the insurance company guarantees that they will not decline your claim if you die during the term of the policy, as long as you meet the initial underwriting criteria at the time of application. This is particularly beneficial for individuals with pre-existing health conditions or those who may be considered high-risk by other insurance providers.

When you apply for a term life insurance policy with a guarantee issue, the insurance company will assess your health and medical history at the time of application. If approved, they will offer you a policy with a guaranteed death benefit, meaning the amount of coverage will be the same as what you initially applied for, without any future medical exams or health questions. This provides individuals with a sense of security, knowing that their coverage is locked in and cannot be revoked due to changes in health.

While the guarantee issue provides valuable protection, it's important to understand that there may be certain limitations or exceptions. For instance, some insurance companies might have specific age limits for the guarantee issue, typically offering it for individuals up to a certain age, often 65 or 70. Additionally, there could be exclusions or limitations on pre-existing conditions or certain types of health issues. It's advisable to review the policy details and consult with an insurance professional to fully understand the terms and conditions of the guarantee issue.