When it comes to life insurance, finding the ideal coverage can be a complex task. The ideal life insurance policy is one that provides financial protection for your loved ones in the event of your passing, ensuring they have the necessary support to maintain their standard of living and achieve their financial goals. It's crucial to consider various factors such as your age, health, lifestyle, income, and family responsibilities to determine the appropriate amount of coverage. This personalized approach ensures that the policy adequately addresses the unique needs of the individual and their beneficiaries, offering peace of mind and a safety net for the future.

What You'll Learn

- Assess Your Needs: Evaluate financial obligations, family income, and long-term goals

- Age and Health: Younger, healthier individuals may qualify for lower-cost policies

- Policy Types: Term, whole life, and universal life offer different benefits and costs

- Coverage Amount: Determine the financial impact of loss based on income and expenses

- Review Regularly: Adjust coverage as life changes to ensure adequate protection

Assess Your Needs: Evaluate financial obligations, family income, and long-term goals

When assessing your ideal life insurance coverage, it's crucial to evaluate your financial obligations, family income, and long-term goals. This comprehensive approach ensures that you choose a policy that adequately protects your loved ones and aligns with your future plans. Here's a detailed breakdown of how to approach this evaluation:

- Financial Obligations: Start by making a comprehensive list of all your financial commitments. This includes regular expenses such as mortgage or rent payments, car loans, student loans, credit card debts, and any other recurring financial obligations. Consider the duration of these commitments and the potential impact of your death on these debts. For instance, if you have a substantial mortgage, life insurance can ensure that your family doesn't have to worry about the remaining payments. Similarly, if you have ongoing loans, the insurance can provide the necessary financial support to settle them.

- Family Income: Assess the income your family relies on. This includes your own income and that of your spouse or partner. Calculate the total annual income and consider any potential changes in the future, such as planned career advancements or the possibility of one partner staying at home to care for children. It's essential to ensure that your life insurance policy can provide a steady income replacement for your family in the event of your passing. The policy should ideally cover a significant portion of your family's annual income to maintain their standard of living.

- Long-Term Goals: Think about your long-term financial goals and how they might be impacted by your death. This includes considerations such as your children's education expenses, future retirement plans, or any specific savings goals. For example, if you've set aside funds for your child's college education, life insurance can ensure that this money is available for its intended purpose. Additionally, if you have retirement plans that rely on a steady income stream, the insurance can provide the necessary financial support to keep those plans on track.

- Combining the Elements: When evaluating your needs, it's essential to consider how these various factors interact. For instance, a high-income earner with a large mortgage and young children might require a more substantial life insurance policy to cover both the mortgage and the family's living expenses. In contrast, someone with fewer financial obligations and a more secure financial future might opt for a lower coverage amount. The key is to find a balance that ensures your family's financial stability and peace of mind.

Remember, the ideal life insurance coverage is one that is tailored to your unique circumstances. It should provide financial security for your loved ones, cover your financial obligations, and support your long-term goals. By carefully assessing these aspects, you can make an informed decision about the appropriate level of coverage for your situation.

Life Insurance and Debt Collection in New York

You may want to see also

Age and Health: Younger, healthier individuals may qualify for lower-cost policies

When it comes to life insurance, age and health play a significant role in determining the cost and availability of policies. Younger, healthier individuals often find themselves in a favorable position when it comes to securing life insurance coverage at more affordable rates. This is primarily due to the statistical advantage associated with younger age and better health conditions.

As we age, the risk of developing health issues or facing critical illnesses increases. Insurance providers often consider age as a major factor in assessing risk. Younger individuals typically have a longer life expectancy, reducing the likelihood of claiming on a policy in the near future. This lower risk translates to more competitive pricing for life insurance. Additionally, younger people are generally less likely to have pre-existing health conditions or chronic diseases, which can significantly impact insurance premiums.

Health status is another critical aspect. Insurance companies often require medical examinations or health assessments to determine the risk associated with insuring an individual. Younger, healthier individuals are more likely to pass these assessments with fewer health concerns, resulting in lower-cost policies. Maintaining a healthy lifestyle, including regular exercise, a balanced diet, and avoiding harmful habits like smoking, can significantly improve one's chances of securing favorable life insurance rates.

For those who are younger and in good health, it is advisable to start considering life insurance options early. This allows for a more comprehensive understanding of personal and family needs and enables individuals to make informed decisions. By taking out a policy at a younger age, individuals can lock in lower rates for the long term, ensuring that their loved ones are protected even as they age.

In summary, younger and healthier individuals have an advantage when it comes to obtaining ideal life insurance coverage. Their age and health status contribute to lower risk assessments, making it easier to qualify for more affordable policies. Taking proactive steps to maintain a healthy lifestyle can further enhance these benefits, ensuring that individuals can secure the necessary coverage for their long-term financial security and the well-being of their loved ones.

Maximize VA Life Insurance: Strategies to Boost Your Coverage

You may want to see also

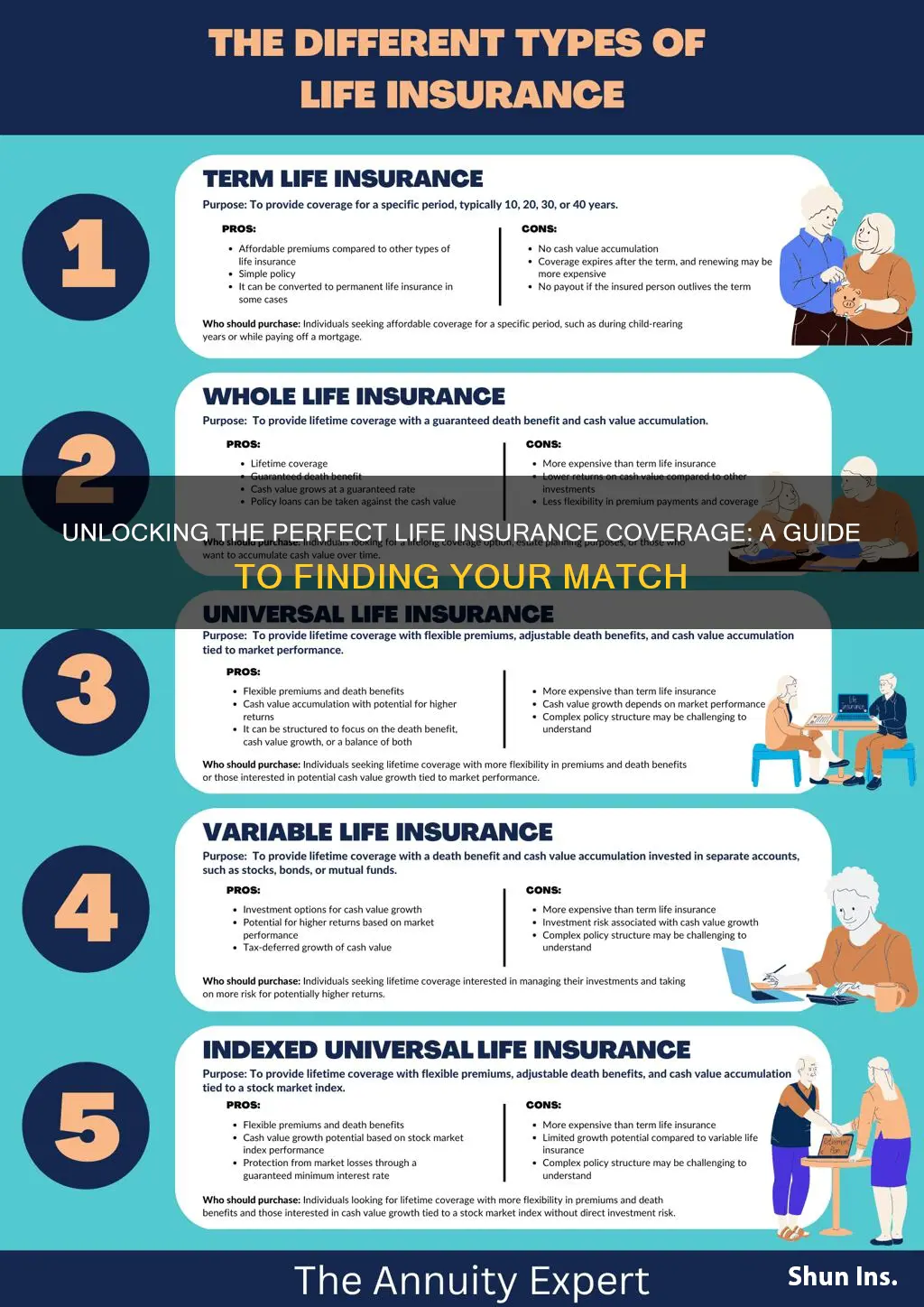

Policy Types: Term, whole life, and universal life offer different benefits and costs

When considering life insurance, it's essential to understand the different policy types available, each with its own set of advantages and trade-offs. The three primary types of life insurance are term life, whole life, and universal life, each catering to various financial needs and goals.

Term Life Insurance: This is a straightforward and cost-effective option, providing coverage for a specified period, typically 10, 20, or 30 years. It is ideal for individuals seeking temporary protection, especially those with short-term financial goals or those who want to cover specific liabilities, such as a mortgage or children's education. Term life insurance offers a fixed premium, making it budget-friendly, and the policyholder receives a death benefit if they pass away during the term. However, it does not accumulate cash value, and the coverage ends when the term expires, requiring the purchase of a new policy if desired.

Whole Life Insurance: In contrast, whole life insurance provides lifelong coverage, ensuring protection throughout the policyholder's entire life. It combines a death benefit with a savings component, known as cash value, which grows tax-deferred. This type of policy offers a fixed premium, similar to term life, but with the added benefit of a guaranteed death benefit and a cash value that increases over time. The cash value can be borrowed against or withdrawn, providing financial flexibility. While whole life insurance is more expensive than term life, it offers long-term financial security and a consistent premium, making it suitable for those seeking permanent coverage and a savings component.

Universal Life Insurance: This policy offers flexibility and adaptability, providing permanent coverage with a focus on long-term savings. Universal life insurance allows policyholders to adjust their premiums and death benefits, making it customizable. It also accumulates cash value, which can be invested and grow, offering potential tax advantages. The flexibility of universal life insurance allows for higher death benefits and the ability to increase coverage as needed. However, it typically has higher costs and complex features, making it more suitable for those who want a long-term financial strategy and the option to adjust their policy as their circumstances change.

In summary, the choice between term, whole life, and universal life insurance depends on individual financial goals, risk tolerance, and long-term plans. Term life is ideal for short-term needs, whole life offers lifelong coverage and savings, while universal life provides flexibility and a focus on long-term financial strategies. Understanding these policy types is crucial in making an informed decision about life insurance coverage.

LLC Life Insurance: Ownership and Benefits Explained

You may want to see also

Coverage Amount: Determine the financial impact of loss based on income and expenses

When determining the ideal life insurance coverage, understanding the financial impact of a potential loss is crucial. This involves assessing your current and future financial obligations to ensure that your loved ones are protected in the event of your passing. The primary goal is to provide financial security and peace of mind, knowing that your family can maintain their standard of living and cover essential expenses.

Start by calculating your annual income and expenses. This includes your salary, any additional income sources like investments or side hustles, and fixed expenses such as rent or mortgage payments, utilities, insurance premiums, and minimum loan payments. Variable expenses, such as groceries, transportation, and entertainment, should also be considered, as these costs can fluctuate over time. Summing up these expenses will give you a clear picture of your monthly or annual outgoings.

Next, consider the potential financial impact of your loss. This involves estimating the future income your family would lose if you were no longer there to provide for them. It's essential to factor in the number of dependents, their ages, and any specific financial needs they may have, such as education costs or future marriage expenses. For instance, if you have a young child who requires financial support until they reach adulthood, you'll need to account for that in your coverage amount.

Additionally, think about the time frame over which your family would need financial support. This could be for a few years, until your children finish school, or potentially for the rest of their lives. Longer-term financial commitments, such as a mortgage or business loans, should also be taken into account. By considering these factors, you can determine a coverage amount that adequately addresses the financial impact of your loss.

Remember, the ideal life insurance coverage should provide a financial safety net that covers at least 10-15 years of your family's estimated living expenses. This ensures that your loved ones can maintain their lifestyle and cover essential costs during a challenging period. It's a good practice to regularly review and adjust your coverage as your financial situation and family circumstances evolve.

Life Insurance and Veteran Suicide: What Families Need to Know

You may want to see also

Review Regularly: Adjust coverage as life changes to ensure adequate protection

Reviewing and adjusting your life insurance coverage regularly is a crucial aspect of ensuring that you and your loved ones are adequately protected throughout life's various stages. Life insurance is a dynamic financial tool that should evolve with your personal circumstances, providing the necessary coverage at the right times. Here's a detailed guide on why and how to review and adjust your policy:

Life Changes and Insurance Needs: Life is a journey filled with milestones and transitions, and each significant change can impact your insurance needs. For instance, getting married or having children often increases the desire to protect their future. Similarly, purchasing a home, starting a business, or experiencing career advancements might necessitate higher coverage amounts. As you age, your health and lifestyle choices may also influence the type and cost of insurance you require. Regular reviews ensure that your policy reflects these evolving circumstances.

Policy Reviews and Adjustments: It is recommended to review your life insurance policy at least once a year or whenever there are substantial life changes. During these reviews, consider the following: First, assess your current financial obligations and future goals. Do you need to cover mortgage payments, provide for dependent children's education, or ensure a comfortable retirement for your spouse? These factors will guide the determination of the coverage amount. Second, evaluate your health and lifestyle. Improved health or lifestyle changes might allow for more affordable premiums, while significant health issues could require adjustments to ensure sufficient coverage.

Benefits of Regular Review: Regular reviews offer several advantages. Firstly, they ensure that your policy remains relevant and effective. Life insurance is not a one-time purchase; it's a long-term commitment. By reviewing annually, you can stay on track with your financial goals and adapt to changing priorities. Secondly, it allows you to take advantage of any policy changes or new products that your insurance provider might offer, ensuring you get the best value. Lastly, it provides an opportunity to identify any gaps in coverage and make necessary adjustments promptly.

Steps to Review and Adjust: When reviewing your policy, start by understanding the current coverage and its terms. Contact your insurance provider or broker to request a comprehensive breakdown of your policy. Ask about any changes or updates that might be beneficial. Consider the following questions: Are there any riders or add-ons that can enhance coverage? Can you increase or decrease the death benefit based on your current financial needs? Are there any premium savings options available? By actively engaging with your policy, you can make informed decisions.

In summary, life insurance is a powerful tool to safeguard your loved ones' future, and its effectiveness relies on regular reviews and adjustments. By staying proactive and adapting your policy to life's changes, you can ensure that your insurance remains a reliable source of financial protection when it's needed most. Remember, life insurance is not a one-size-fits-all product; it should be tailored to your unique circumstances.

Life and Health Insurance: Continuing Ed for Career Growth

You may want to see also

Frequently asked questions

Life insurance is a financial safety net designed to provide financial security to your loved ones in the event of your death. It ensures that your family can maintain their standard of living, cover expenses, and achieve their financial goals even if you are no longer there to provide.

The ideal amount of coverage depends on various factors, including your personal circumstances, financial obligations, and the number of dependents you have. A common rule of thumb is to ensure that your life insurance policy covers at least 10 times your annual income and can cover expenses like mortgage, education costs, funeral expenses, and outstanding debts. It's essential to regularly review and adjust your coverage as your life changes.

The choice between term life insurance and permanent life insurance depends on your specific needs and financial goals. Term life insurance provides coverage for a specified period, typically 10, 20, or 30 years, and is often more affordable. It's suitable for covering temporary financial obligations. Permanent life insurance, on the other hand, offers lifelong coverage and includes a savings component, making it ideal for long-term financial planning and leaving a legacy.

Yes, it is possible to obtain life insurance even with pre-existing health conditions. However, the process may be more complex, and the terms and rates can vary. Insurers often consider factors like the severity of the condition, recent medical history, and lifestyle choices when determining eligibility and premium costs. It's recommended to disclose all relevant health information to get an accurate assessment from multiple insurance providers.

Life insurance needs can change over time due to various life events such as marriage, the birth of a child, purchasing a home, or significant career advancements. It is advisable to review your life insurance policy annually or whenever there are substantial changes in your life. Regular reviews ensure that your coverage remains adequate and aligned with your current circumstances.